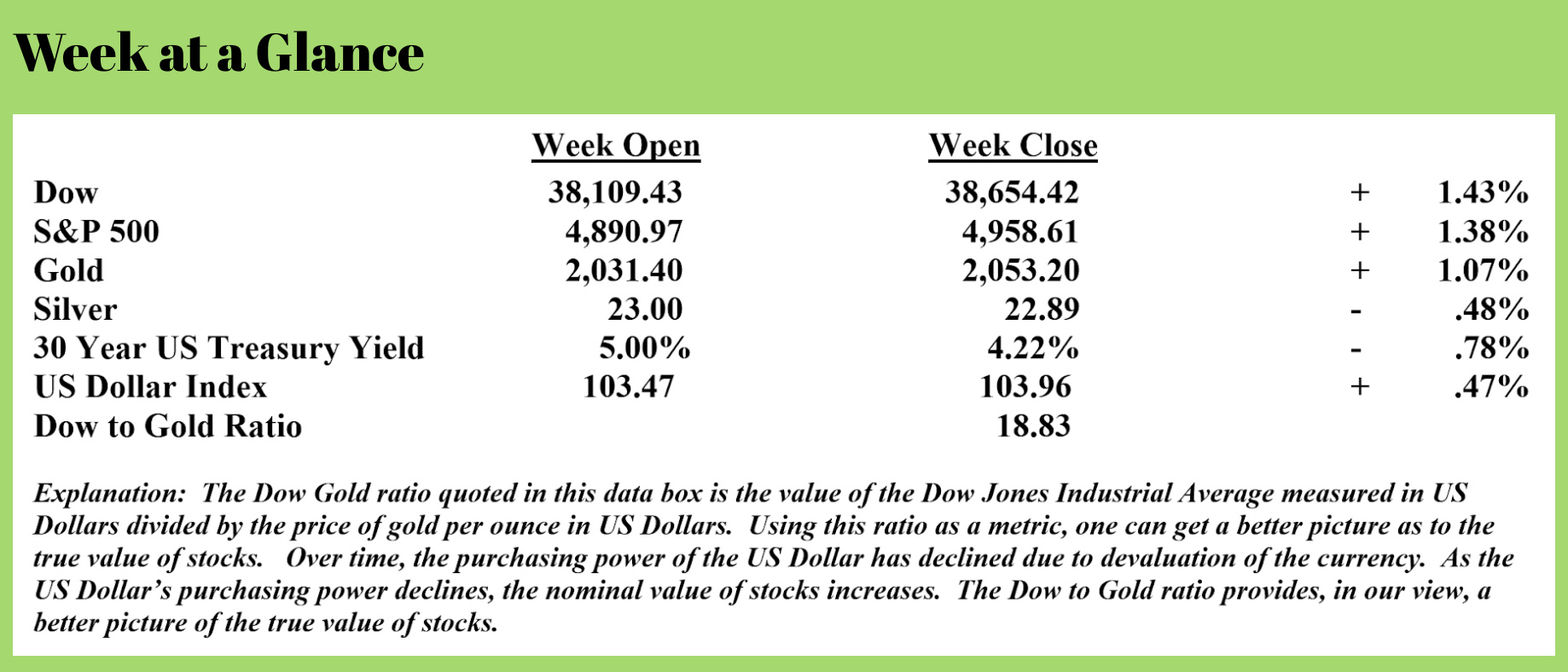

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Last week, I discussed the inflation followed by deflation cycle that has repeated itself throughout history.

While the fact that we have witnessed inflation over the past several years is indisputable, the annual rate of inflation is perhaps a bit unclear.

The ‘official’ inflation rate is reported as the Consumer Price Index. While space limits this discussion, it’s fair to say that the actual annual price inflation rate is greater than the rate reported by the Consumer Price Index.

The Consumer Price Index is calculated using adjustments that are somewhat subjective, including hedonic (pleasure) adjustments, substitution, and adjustments to weightings.

The official inflation rate reported as of December was higher than anticipated by most analysts, coming in at 3.4%. (Source: https://www.msn.com/en-us/money/markets/inflation-picked-up-in-december-cpi-report-shows-what-will-it-mean-for-fed-rate-cuts/ar-AA1mOh86)

Of course, if you’ve been to the grocery store, the hardware store or the doctor’s office, you are keenly aware that this number is not reflective of your price experience.

The Chapwood Index is a private inflation index that examines the prices of 500 consumer items year over year in 50 metropolitan areas across the United States. The Chapwood Index suggests the annual price inflation rate is more like 10% to 12% annually depending on the part of the country in which one lives.

The chart below is taken from The Chapwood Index (Source: https://chapwoodindex.com/).

Notice from the chart that New York City has experienced average annual price inflation over the past five years of more than 13%, while Houston comes in at a little over 10%.

It’s impossible to dispute that the inflation part of the cycle arrived a few years ago and is continuing.

But signs of deflation are also beginning to appear.

Technically defined, deflation is a contraction of the currency supply. Since currency is loaned into existence, currency is at its most fundamental level – debt.

When debt goes unpaid, currency disappears from the financial system and results in deflation.

With that as background, I want to draw your attention to two deflationary red flags that are now emerging.

The first, and the scariest of these red flags is the level of US Government debt that needs to be financed in 2024. This from Torsten Slok, Chief Economist at Apollo (Source: https://apolloacademy.com/10-trillion-in-us-treasuries-coming-to-the-market-in-2024/) (emphasis added):

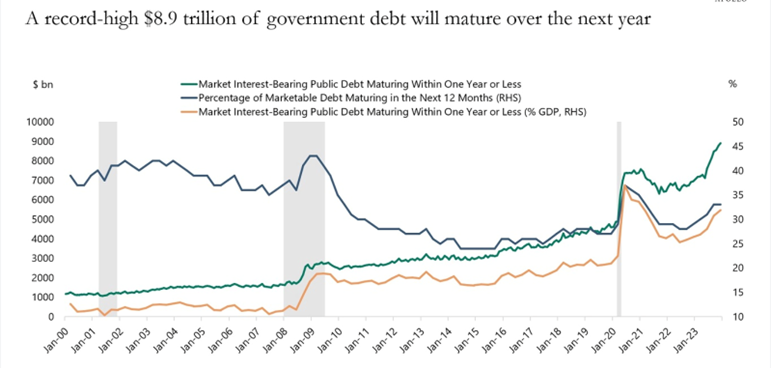

A record $8.9 trillion of government debt will mature over the next year; see the first chart below. The government budget deficit in 2024 will be $1.4 trillion, according to the CBO, and the Fed has been running down its balance sheet by $60 billion per month.

A record $8.9 trillion of government debt will mature over the next year; see the first chart below. The government budget deficit in 2024 will be $1.4 trillion, according to the CBO, and the Fed has been running down its balance sheet by $60 billion per month.

The bottom line is that someone will need to buy more than $10 trillion in US government bonds in 2024. That is more than one-third of US government debt outstanding. And more than one-third of US GDP.

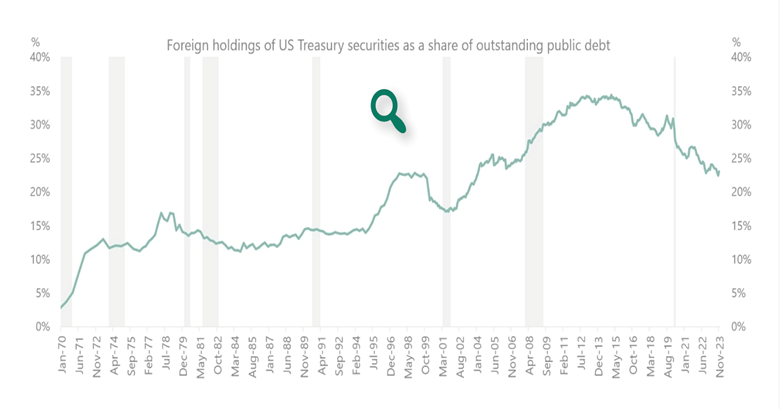

This may be a particular challenge when the biggest holders of US Treasuries, namely foreigners, continue to shrink their share, see the second chart.

More fundamentally, interest rate-sensitive balance sheets such as households, pensions, and insurance have been the biggest buyers of Treasuries in 2023, and the question is whether they will continue to buy once the Fed starts cutting rates.

More fundamentally, interest rate-sensitive balance sheets such as households, pensions, and insurance have been the biggest buyers of Treasuries in 2023, and the question is whether they will continue to buy once the Fed starts cutting rates.

I think the answer to that last question is likely a ‘no’. The increase in interest rates we’ve seen recently has created a better market for US Treasuries but at lower interest rates, but even at current interest rates, it’s difficult to imagine $10 trillion in US Government bond sales.

The second point I would add is that it is extremely unlikely, in my view, that the US Government will have an operating deficit of just $1.4 trillion. When comparing US Government spending in the first quarter with tax receipts, there was an operating deficit of $510 billion. This from MSN (Source: https://www.msn.com/en-us/money/news/federal-deficit-blew-up-89b-more-in-1st-quarter-2024-than-last-year/ar-BB1hiyAk):

The federal government ran a $510 billion budget deficit in the first quarter of fiscal year 2024 – an increase of $89 billion from the same period a year ago, according to data from the Treasury Department and the nonpartisan Congressional Budget Office (CBO).

The CBO noted that the deficit grew in Q1 of FY24 compared to the same period a year ago because federal spending rose at a faster pace than tax receipts in its preliminary analysis of the budget data.

While the government’s tax revenue rose by $83 billion in that period, spending increased by $170 billion, resulting in a $510 billion deficit that was $89 billion larger than last year’s $421 billion deficit in the first quarter, according to the Treasury’s data.

A $510 billion dollar first-quarter operating deficit translates to an annual deficit of more than $2 trillion. Throw in an election year goody bag to influence votes and $3 trillion wouldn’t be out of the realm of possibility.

I believe it will be extremely difficult for the US Government to sell $10 to $12 trillion in debt.

This has the potential to be extremely deflationary in the longer term, while in the shorter term, the Federal Reserve could become the buyer of last resort, further fueling inflation in the near term.

The second deflationary red flag appeared last week. A Hong Kong judge ordered Evergrande, the large Chinese real estate firm to liquidate assets.

Evergrande has approximately $300 billion in outstanding bonds that the company sold all around the world. These bonds are now largely worthless.

There is now more than $300 trillion in debt worldwide, and the math has us irrefutably concluding that not all this debt can be paid. Evergrande is, in my opinion, the first of many stories we will hear on this topic in 2024.

The radio program this week features a conversation that I had with Karl Deninger. Karl and I discuss the outlook for US financial markets and Karl offers some extremely interesting information about electric vehicles.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page.

“What has been will be again, what has been done, will be done again; there is nothing new under the sun.”

-King Solomon

Comments