Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

I often discuss the economic pattern that repeats itself throughout history: the cycle of inflation followed by deflation.

This cycle I unnoticed by many due to its length. The cycle can take anywhere from 60 to 100 years to complete. Historically speaking, it typically culminates with debt defaults, bank failures, and deflation.

Ever since the Federal Reserve began the policy of increasing interest rates and tightening in the name of controlling inflation, I have been adamant in my belief that it wouldn’t take long and the Fed would reverse course to attempt to stave off a deflationary crash like occurred during the 1930’s.

I haven’t changed my mind despite the fact that the Fed is now stating that interest rate cuts may now not happen until May of this year.

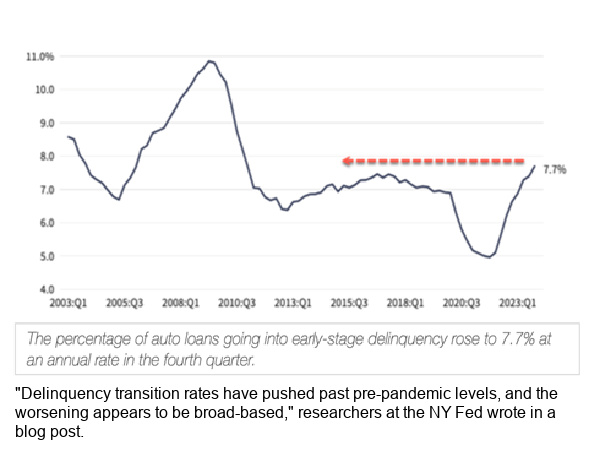

One of the main reasons for my steadfast belief in a Fed ‘pivot’ is the debt facts of the United States Government. We are all aware that the government of the United States has more than $34 trillion in debt. Less well-known, however, is the fact that the US Government will need to finance about $10 trillion in debt this year (2024) alone.

From where I sit, that’s going to be very difficult to accomplish without the Federal Reserve becoming the buyer of last resort for this government debt.

I shared this article excerpt with you last week (Source: https://apolloacademy.com/10-trillion-in-us-treasuries-coming-to-the-market-in-2024/) s)

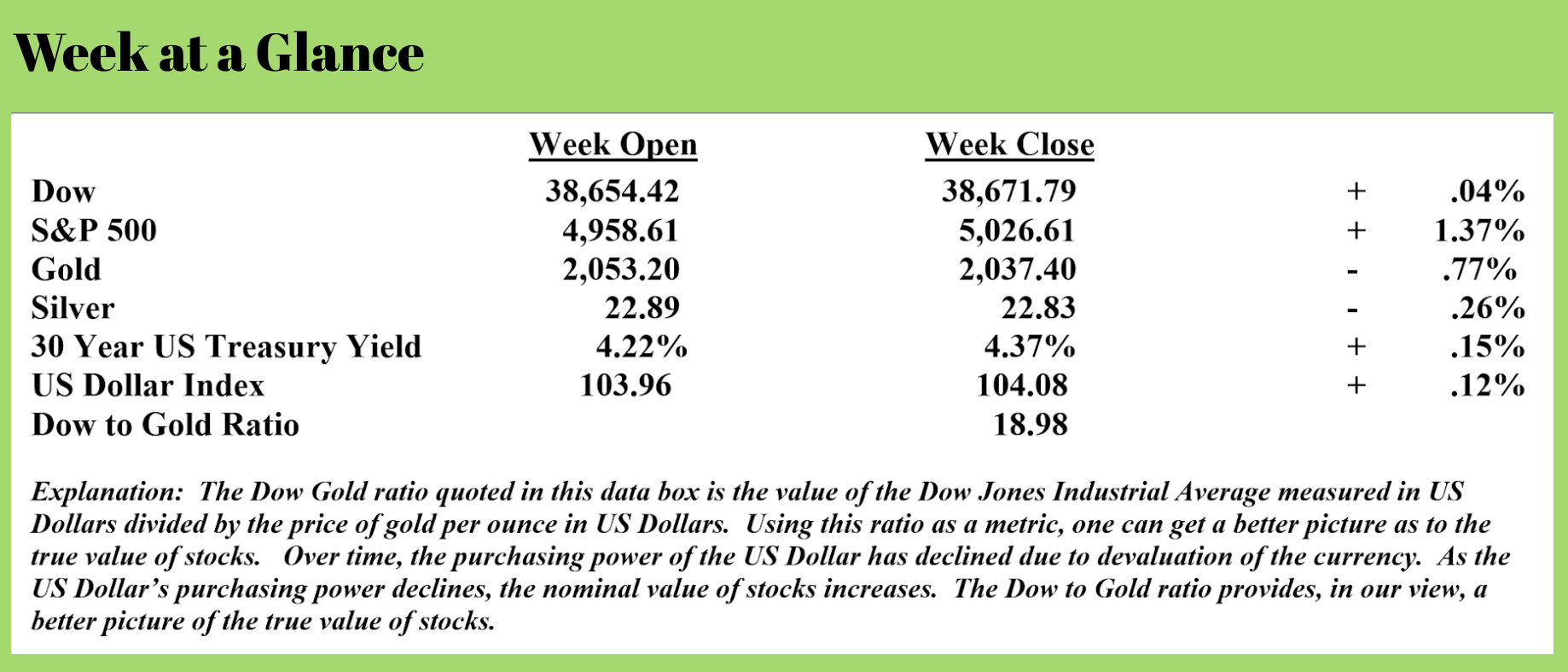

A record $8.9 trillion of government debt will mature over the next year; see the first chart below. The government budget deficit in 2024 will be $1.4 trillion, according to the CBO, and the Fed has been running down its balance sheet by $60 billion per month.

A record $8.9 trillion of government debt will mature over the next year; see the first chart below. The government budget deficit in 2024 will be $1.4 trillion, according to the CBO, and the Fed has been running down its balance sheet by $60 billion per month.

The bottom line is that someone will need to buy more than $10 trillion in US government bonds in 2024.

Eventually, ultimately, the Federal Reserve won’t be able to reflate the asset bubbles. This will likely result in more consumer price inflation and declining asset prices as stagflation sets in.

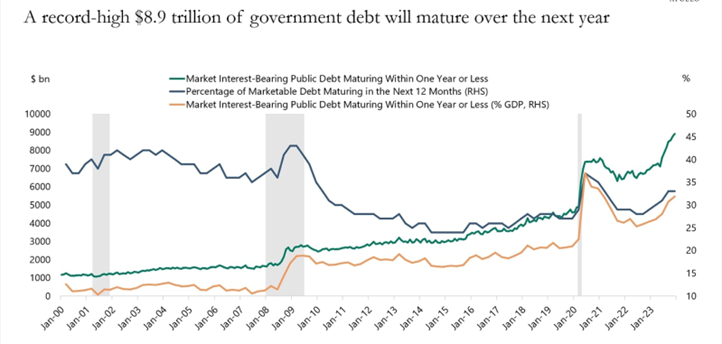

We are already seeing the beginnings of debt defaults. Both auto loan and credit card loan defaults are rising. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/garbage-deals-dealership-puts-customers-cars-3000-monthly-payments):

A New York Fed survey published earlier this week indicated that, in the fourth quarter of 2023, auto loan delinquencies reached levels not seen since right after the Great Recession more than a decade ago.

As a refresher, the data from Tuesday by the Federal Reserve Bank of New York showed the rate at which car owners are behind on their payments hit an annualized rate of 7.7%, the highest level since 2010.

Notice from the chart that illustrates auto loan default levels that delinquencies are now as high as about 14 years ago – and they’re rising.

Notice from the chart that illustrates auto loan default levels that delinquencies are now as high as about 14 years ago – and they’re rising.

To make matters worse, consumers who are buying vehicles presently are paying a lot more for an auto payment. Here is a bit more from the piece:

An Edmunds report from last year showed the percentage of drivers with plus $1,000 monthly payments jumped to an all-time high of 17.1% in the second quarter of 2023 compared to 16.8% in the first quarter. The reason is that the average amount financed for a new vehicle is around $40,000, plus auto loan rates are at a generational high.

"The double whammy of relentlessly high vehicle pricing and daunting borrowing costs is presenting significant challenges for shoppers in today's car market," Edmunds' director of insights Ivan Drury said last year.

This leads us to two posts made by X user Clown World. They shared what appears to be an auto dealer sharing several images online of new customers financing vehicles with payments that are as much as monthly mortgage payments.

One person purchased a 2023 Tahoe with $2,550 monthly payments on an 84-month term!

Another person bought a 2023 Sierra 2500 Denali with $3,000 monthly payments, locked in a 96-month term!

These are more defaults just waiting to happen.

Credit card defaults are also rising. This from “Mish Talk”. (Source: https://mishtalk.com/economics/credit-card-and-auto-delinquencies-soar-especially-age-group-18-to-39/)

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90-day or longer delinquencies.

Please consider the New York Fed Household Credit Report for the Fourth Quarter 2023, released this week.

Consumer Credit Key Points

- Aggregate household debt balances increased by $212 billion in the fourth quarter of 2023, a 1.2% rise from 2023Q3. Balances now stand at $17.50 trillion and have increased by $3.4 trillion since the end of 2019, just before the pandemic recession.

- Mortgage balances shown on consumer credit reports increased by $112 billion during the fourth quarter of 2023 and stood at $12.25 trillion at the end of December.

- Balances on home equity lines of credit (HELOC) increased by $11 billion, the seventh consecutive quarterly increase after 2022Q1, and there is now $360 billion in aggregate outstanding balances.

- Credit card balances, which are now at $1.13 trillion outstanding, increased by $50 billion (4.6%).

- Auto loan balances increased by $12 billion, continuing the upward trajectory that has been in place since 2020Q2, and now stand at $1.61 trillion.

- Other balances, which include retail cards and other consumer loans, grew by $25 billion. Student loan balances were effectively flat, with a $2 billion increase and stand at $1.6 trillion. In total, non-housing balances grew by $89 billion.

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011 at best.

As I have been stating here for a long time, if there is too much debt to be paid, it won’t be paid.

Rising levels of loan delinquencies just make that point.

Deflation is inevitable, but as this past radio show guest, Mark Jeftovic, once stated, just because something is inevitable doesn’t mean it's imminent.

But it’s getting closer by the day.

The radio program this week features a conversation with John Rubino, founder of the website "DollarCollapse.com" and co-author of the book "The Money Bubble." John and I discuss the current state of the economy, the government's manipulation of data, and unsustainable levels of deficit spending.

If you haven't had a chance to listen to the show, click on the "Podcast" tab at the top of the page and listen now.

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

-Ludwig von Mises

Comments