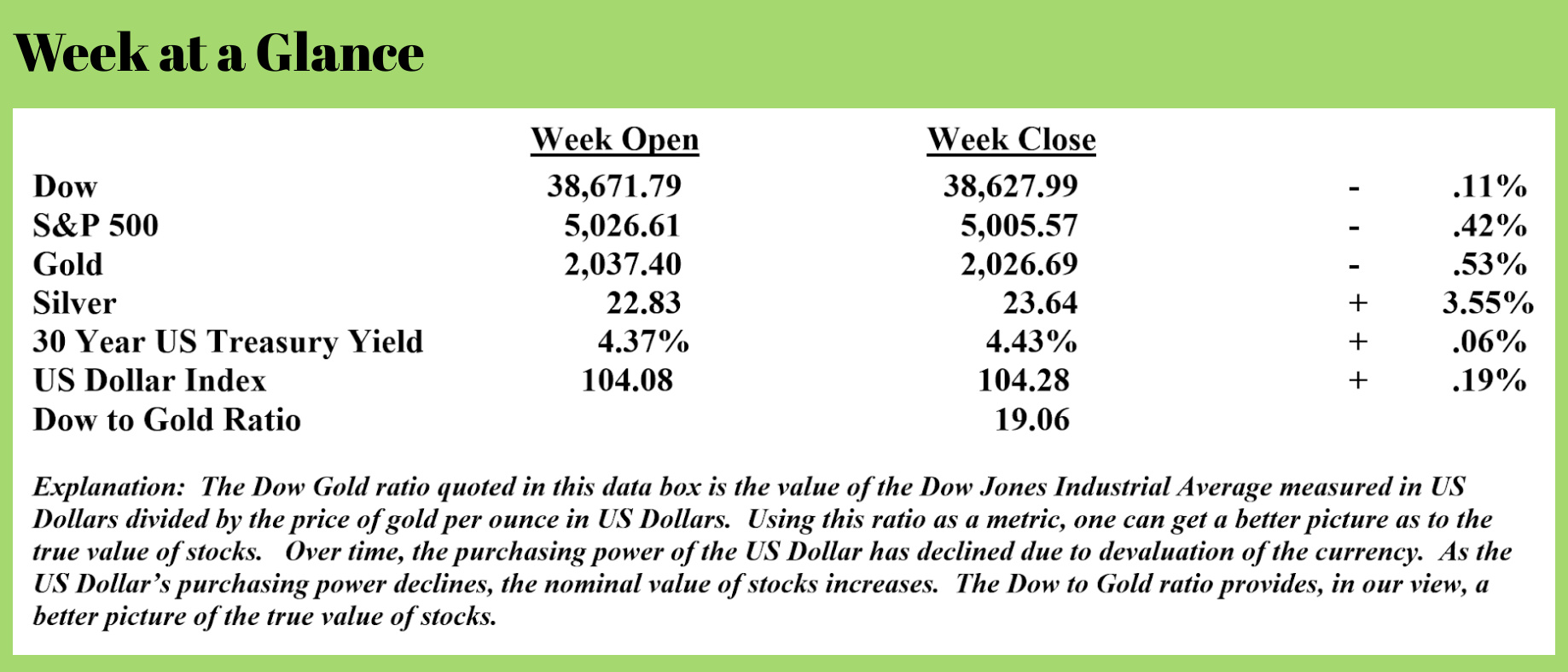

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Maybe some of you are old enough to remember the Bill Clinton campaign mantra of 1992; “it’s the economy, stupid.” It was a phrase coined by Clinton political strategist James Carville, who is still kicking around today.

It was a wildly successful phrase and one to which enough Americans could relate that Clinton defeated the incumbent President, George H.W. Bush, in an electoral college landslide.

While it may not be this election cycle, I’m sure that when the consequences of massive levels of government and private sector debt become reality, some future politician might adapt this phrase to “it’s the debt stupid”.

Debt levels at the present time are at record levels, with no hope of all of the debt being paid with ‘honest’ currency. It’s only a matter of time before the debt hangover kicks in, and as far as hangovers go, this one will be especially painful.

Let’s begin with government debt.

Officially, the debt of the US Government stands at $34.24 trillion.

According to “Bloomberg,” interest costs on US Government debt crossed $1 trillion annually as of the last quarter of 2023. (Source: https://markets.businessinsider.com/news/bonds/us-debt-interest-payments-federal-deficit-treasury-bonds-fed-hikes-2023-11?op=10)

Conservative estimates have the US Government’s official debt at between $50 trillion and $60 trillion within a decade. (Source: https://www.msn.com/en-us/money/markets/the-cost-of-interest-on-us-debt-is-soaring/ar-BB1hZKsL)

That level of debt will push interest on the debt to nearly $2 trillion annually IF interest rates don’t move from these levels, which, given the diminishing status of the US Dollar globally, is a huge IF.

That ‘official’ debt doesn’t count the unfunded liabilities of the United States federal government. Those unfunded liabilities include Social Security and Medicare. All told, the official debt combined with the unfunded liabilities of all federal government programs exceed $200 trillion. According to an article published in “Forbes” by Professor Lawrence Kotlikoff in February of 2023, the unfunded liabilities of Medicare stood at $103.4 trillion, and the unfunded liabilities of Social Security were an equally eye-popping $61.8 trillion. (Source: https://www.forbes.com/sites/kotlikoff/2023/02/24/off-the-table-puts-our-kids-on-the-hook/?sh=4cf005071159)

Here is the trillion-dollar question: can this monster debt problem be solved?

In my view (and in the view of most everyone with a basic understanding of debt levels with access to a calculator), no.

Well, there is the option of cutting federal spending across the board by more than 40%, but there’s a better chance of me winning The Masters with my ten handicap. The reality is if federal spending were to be cut enough to balance the budget, we’d be immediately experiencing a huge economic contraction, and we’d still have no plan to pay down the debt or fund the underfunded government programs.

So, let’s address the proverbial elephant in the room, shall we?

Like the pachyderm in the room, no one dare acknowledge; we all know what HAS to come next.

More currency creation or devaluation.

History offers us abundant examples of this inevitable outcome. We’ve discussed them in this publication previously (past issues of “Portfolio Watch” are archived at www.RetirementLifestyleAdvocates.com).

The bottom line is this: if a government’s debt problem cannot (or will not) be addressed via cost-cutting (current debt levels and unfunded liabilities are simply too high to be solved through increased taxation), there is only one other solution – currency creation.

It doesn’t matter what the Federal Reserve policymakers say; their talk (rhetoric) cannot change the math.

Get out the aforementioned calculator and perform this simple exercise: $200 trillion (a conservative estimate of government debt and unfunded liabilities) divided by 125 million tax returns filed in the United States, and you discover that each taxpayer would be on the hook for about $1.6 million.

Can it be done?

Not even close.

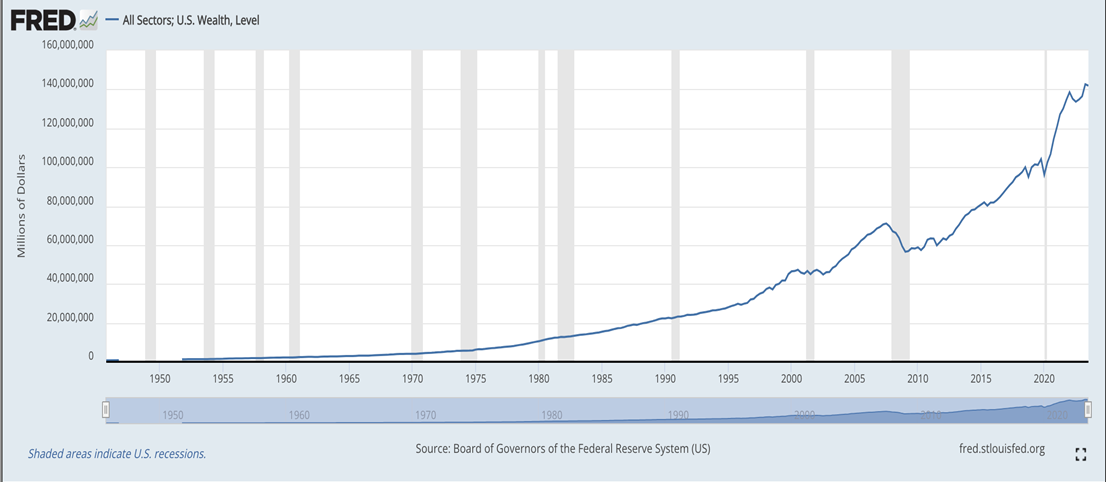

Let me prove it to you using one chart from the Federal Reserve that illustrates total wealth in the United States (Source: https://fred.stlouisfed.org/series/BOGZ1FL892090005Q):

Notice that total wealth stands at about $140 trillion; I rest my case.

Assuming it was possible to collect this total from the populace to make the US solvent, spending would still have to be cut by more than 40% to balance the budget.

Seems clear what will happen, doesn’t it?

But the debt story doesn’t end there.

At least partially due to the Federal Reserve’s easy money policies in the recent past, private sector debt is rising, too.

If your household income doesn’t buy what it used to buy because of inflation, you spend savings if you have it and then resort to borrowing to make ends meet.

There is plenty of evidence that much of the US population is doing just that.

The following excerpts are from the Fed’s most recent Household Debt and Credit Report released this month (Source: https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2023Q4):

Aggregate household debt balances increased by $212 billion in the fourth quarter of 2023, a 1.2% rise from 2023Q3. Balances now stand at $17.50 trillion and have increased by $3.4 trillion since the end of 2019, just before the pandemic recession.

Aggregate delinquency rates increased in the fourth quarter of 2023. As of December, 3.1% of outstanding debt was in some stage of delinquency, up by 0.1 percentage point from the third quarter.

Annualized, approximately 8.5% of credit card balances and 7.7% of auto loan balances transitioned into delinquency. Early delinquency transition rates for mortgages increased by 0.2 percentage point.

Missed federal student loan payments will not be reported to credit bureaus until 2024Q4. Because of these policies, less than 1% of aggregate student debt was reported 90+ days delinquent or in default in 2023Q4 and will remain low until at least 2024Q4.

I find it very interesting that student loan delinquencies will not be reported to credit bureaus until after the election. Probably just a coincidence?

If you’re so inclined, I would suggest that you read the Fed’s own report (link above).

The bottom line is this: nearly all types of household debt increased in the fourth quarter of 2023, and delinquency rates rose.

Between 1 in 11 and 1 in 12 credit card users were delinquent on their payments and about 1 in 13 auto loans were delinquent.

Since we’ve concluded that the only way to attempt to address the federal debt and unfunded liability problem is through more currency creation or devaluation, we can expect debt delinquencies to rise as the inflation fires are once again fueled.

Navigating the economic and investing environment that lies ahead will require a plan prepared in light of these very troubling circumstances. Do you have one?

This week’s RLA Radio program features special guest Mark Jeftovic, publisher of “The Bitcoin Capitalist.” I talk with Mark about his forecast for currencies, including central bank digital currencies.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page.

‘Failure is the condiment that gives success its flavor.”

-Truman Capote

Comments