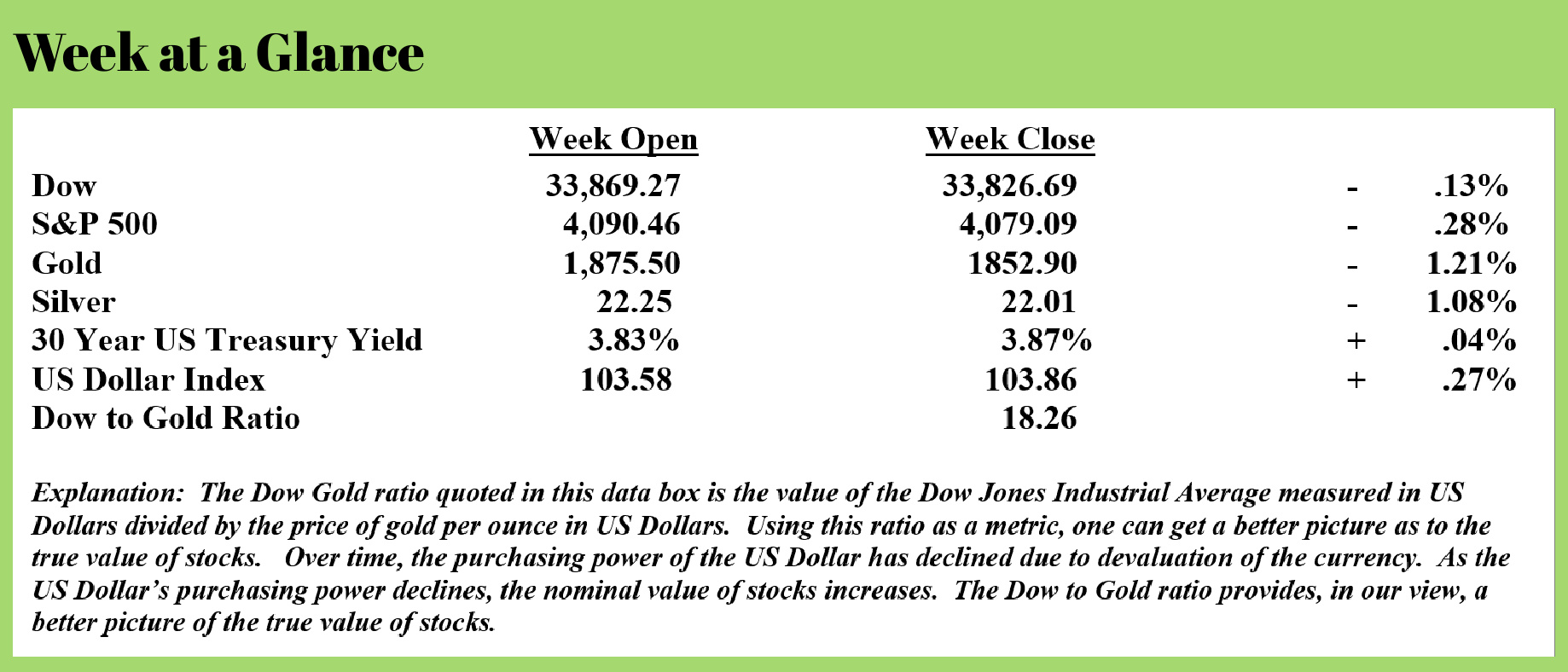

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

A seldom-discussed topic that has a significant economic impact is private sector debt levels.

Ever since 1971, when the US Dollar became a fiat currency, and new currency has been created by loaning it into existence.

If banks have a 10% reserve requirement, a $100,000 deposit into a bank can be transformed into $1,000,000 if the velocity of money is high enough.

For example, say you deposit $100,000 into your bank. Your banker reserves 10% or $10,000 and loans out the other $90,000. Say the borrower of the $90,000 buys an expensive car and borrows the $90,000 now available from your bank to do so. The car dealer deposits the $90,000 into her bank. That banker reserves 10% or $9,000 and loans out the other $81,000. That process continues up to a maximum of new currency created of $1,000,000.

Historically, when the Federal Reserve wanted to jump-start the economy by increasing the currency supply, the central bank would reduce interest rates to increase the velocity of money, thereby creating more currency.

That worked until the time of the financial crisis when interest rates were reduced to zero, but lending did not follow due to the fact that, collectively speaking, the American public was already deeply in debt.

It was at that point the Federal Reserve made the decision to ‘temporarily’ pursue a program of quantitative easing or currency creation. As we all now know, the program continued long past the time that a reasonable person would say it was temporary.

As I have often stated, it is my belief that this program will once again be revived in earnest, although it will likely be called something other than quantitative easing.

Since the time of the financial crisis, this policy of currency creation has caused debt levels to increase immensely. At the time of the financial crisis, worldwide debt was about $100 trillion. It now stands at $300 trillion – a truly remarkable number.

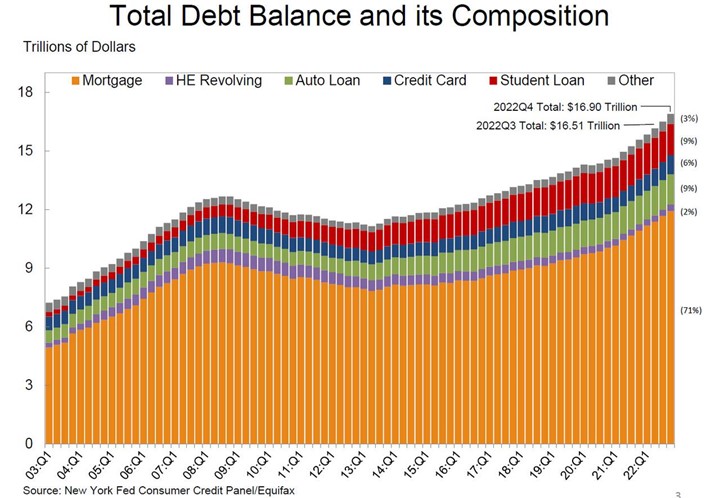

Presently, debt levels are continuing to increase. The data shows that consumers are increasingly taking on new debt to cope with rising living costs. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/consumer-debt-soars-394bn-most-20-years-record-169-trillion-young-borrowers-struggle-repay):

While it won't tell us anything we don't know - since it is two months delayed and we already get monthly updates from the Fed via the G.19 statement - this morning the NY Fed published its quarterly Household Debt and Credit report, which showed that total household debt in the fourth quarter of 2022 rose by 2.4% or $394 billion, the largest nominal quarterly increase in twenty years, to a record $16.90 trillion. Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession.

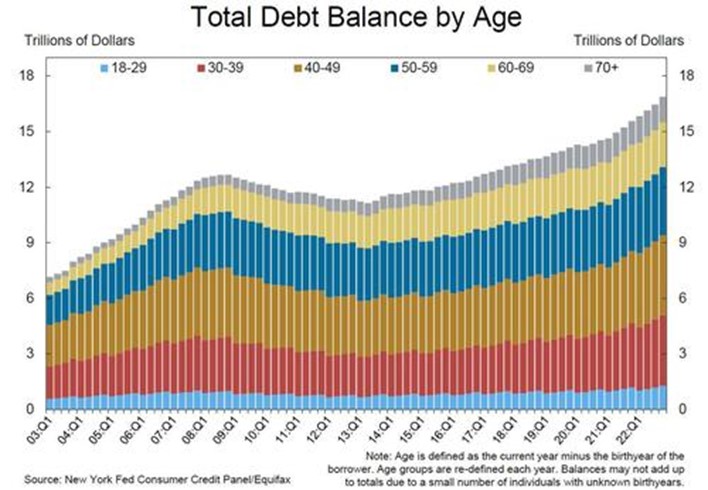

And the same chart broken down by age:

Every type of consumer credit increased in Q4, and here is a detailed breakdown:

- Mortgage balances rose by $254 billion in the fourth quarter of 2022 and stood at $11.92 trillion at the end of December, marking a nearly $1 trillion increase in mortgage balances in 2022.

- Home equity lines of credit rose by $14 billion to $340 billion.

- Student loan balances now stand at $1.60 trillion, up by $21 billion from the previous quarter. In total, non-housing balances grew by $126 billion.

- Auto loan balances increased by $28 billion in the fourth quarter, consistent with the upward trajectory seen since 2011.

- Credit card balances increased $61 billion in the fourth quarter to $986 billion, surpassing the pre-pandemic high of $927 billion.

There is an eternal truth about excessive debt accumulation – if there is too much debt to be paid, it won’t be paid.

This is true regarding private sector debt, and it is true as far as government debt and liabilities are concerned as well.

It is my view, based on simple math, that debt levels are now past the point of no return and are now too high to ever be paid.

The result, at some future point, will be a massive deflationary environment that will, in my view, resemble the 1930’s; or, possibly, worse.

Looking at the first chart above, one can see the combined debt total of mortgage debt, home equity loan debt, auto debt, student loan debt, and credit card debt is now about 1/3rd higher than at the time of the financial crisis.

Alarmingly, debt levels have grown the most among those over age 60. That, at least in my view, indicates that consumers are increasingly relying on debt to make ends meet in what is a very difficult economy.

And, to add insult to injury, the most recent inflation numbers indicate that inflation is not under control. This was not at all surprising to me. As I have been stating, the Fed isn’t doing enough to get inflation under control.

Inflation will not be controlled until we have real, positive interest rates – something we are a long way away from.

In the meantime, the US economy (and the world economy) is heading for a time of painful stagflation.

The radio program this week features an interview with Dr. Chris Martensen, author of the book “The Crash Course.”

I chat with Dr. Martensen about the economy, energy, and ecology – three topics he discusses and analyzes in detail in his updated version of “The Crash Course.”

You can listen to the program now by clicking on the "Podcast" tab at the top of this page.

“Beliefs are what divide people. Doubt unites them.”

-Peter Ustinov

Comments