Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Stocks continue to rally despite economic news that is worsening. It was a good week in financial markets last week, with stocks, US Treasuries, and gold all rallying.

The economic news is however, not as rosy as markets were last week.

Gallup, the polling organization, found that for only the third time in the last twenty years, Americans were “not satisfied” with their own lives. Only 47% of those polled said they were ‘highly satisfied’ with their own lives, which is only one percentage point higher than the all-time low recorded in 2011. (Source: https://news.gallup.com/poll/610133/less-half-americans-satisfied-own-lives.aspx)

Not surprisingly, the link between satisfaction of one’s own life and one’s financial condition is strong. Previous low points in Americans’ personal satisfaction have occurred when the economy was shaky. The 46% reading recorded in 2011 came when the country was muddling through the aftermath of the financial crisis, and the other sub-50% satisfaction reading was during the financial crisis in December of 2008. Interestingly, the percentage of Americans satisfied with their own lives was 47% then as well.

Meanwhile, the US Labor Department reported that the average American family now spends 11% of their income on food. (Source: https://www.msn.com/en-us/money/other/cost-of-food-reaches-highest-its-been-in-30-years-compared-to-income-definitely-making-it-harder/ar-BB1iKezX)

The Labor Department added that food costs have not consumed this high a percentage of household income in 30 years.

Even though official statistics indicate that wage growth has outpaced inflation, this statistic tells us otherwise.

In response, the MSN article referenced above suggested that consumers ‘shift some of their eating habits and budget.’ And “The Wall Street Journal” recently published a piece suggesting that consumers skip breakfast to save money. (Source: https://www.wsj.com/livecoverage/cpi-report-today-january-2023-inflation/card/to-save-money-maybe-you-should-skip-breakfast-fSd6mz0miaAPhUFb2jgy)

I have a thought – how about a solid policy to get inflation under control? As I have previously stated, this can’t be done without the US Government operating with a balanced budget, or at least a much lower budget deficit.

In case you are of the mind that this can’t be done – think again. The newly elected President of Argentina, Javier Milei, after just one month in office, turned a monster budget deficit into a surplus of $589 million. (Source: https://www.zerohedge.com/economics/milei-secures-argentinas-first-budget-surplus-2012-after-only-one-month-office)

Previous administrations in Argentina relied on currency devaluation and socialist policies to attempt to continue business as usual. The result was stagflation; economic contraction with a 250% annual inflation rate.

Milei’s budget surplus didn’t come about pain-free. The newly elected president essentially tore apart many existing social programs, choosing to pull the proverbial band-aid off quickly. While this is painful for many, so is 250% inflation.

I hope U.S. policymakers are looking on and taking notes.

But I digress. Back to the economy.

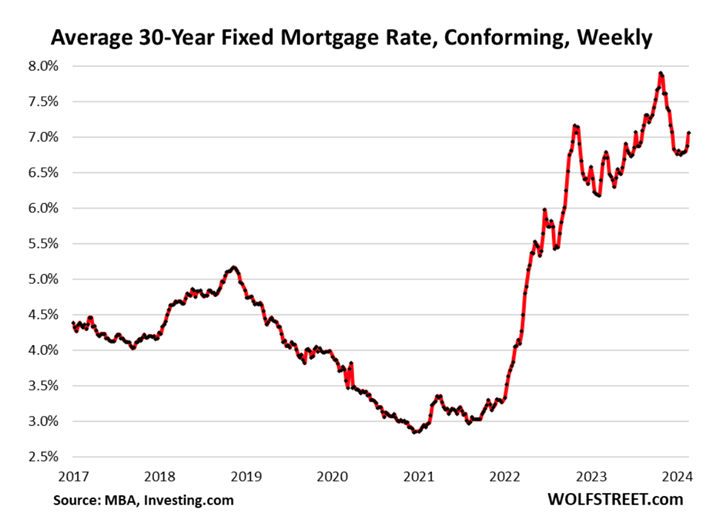

The housing market is once again nearly frozen as interest rates on 30-year mortgages are now back over 7%.

These mortgage rates are now the highest they’ve been in more than two months. (Source: https://wolfstreet.com/2024/02/21/mortgage-rates-rise-back-to-7-housing-market-re-freezes-buyers-strike-continues-prices-are-just-too-high/)

The chart on this page from “Wolf Street” illustrates the average 30-year, conforming mortgage interest rate.

The chart on this page from “Wolf Street” illustrates the average 30-year, conforming mortgage interest rate.

Wolf Richter of “Wolf Street” had this to say about the current state of the housing market:

That relatively small increase in mortgage rates caused mortgage applications to re-plunge – after they’d barely risen from the record lows going back to 1995 – a sign that the housing market remains frozen because prices are still too high, and potential sellers are still thinking that this too shall pass, and potential buyers have figured it out.

Mortgage applications to purchase a home plunged by 10% in the latest week from the prior week, seasonally adjusted, according to the MBA.

Mortgage applications were down by 9% from the already depressed levels in the same week a year ago. They were just a hair above the late-October record lows in the data going back to 1995. They’re down by:

- 2022: -47%

- 2021: -42%

- 2019: -43%

Year-over-year, mortgage applications are down 9%. Compared to the same week in 2019, 2021, and 2022, mortgage applications are down by nearly half.

At the same time, many corporations are cost-cutting, including cutting jobs. This from Michael Snyder, who outlined some of the more shocking layoffs that have occurred recently: (Source: https://theeconomiccollapseblog.com/all-of-the-elements-are-in-place-for-an-economic-crisis-of-staggering-proportions/)

Twitch 35% of workforce; Roomba 31% of workforce; Hasbro 20% of workforce; LA Times 20% of workforce; Spotify 17% of workforce; Levi’s 15% of workforce; Qualtrics 14% of workforce; Wayfair 13% of workforce; Duolingo 10% of workforce; Washington Post 10% of workforce; Snap 10% of workforce; eBay 9% of workforce; Business Insider 8% of workforce; Paypal 7% of workforce; Okta 7% of workforce; Charles Schwab 6% of workforce; Docusign 6% of workforce; CISCO 5% of workforce; UPS 2% of workforce; Blackrock 3% of workforce; Paramount 3% of workforce; Citigroup 20,000 employees; Pixar 1,300 employees.

Snyder notes that the last time layoffs of this magnitude happened was 2008 and 2009 during the financial crisis and recession.

Many regional banks may also be on the ropes. Kevin O’Leary, star of the television program “Shark Tank,” also known as Mr. Wonderful, had this to say about regional banks: (Source: https://www.dailymail.co.uk/yourmoney/banking/article-13066937/kevin-oleary-regional-banks-bancorp-silicon-valley.html)

Regional banks are doomed.

That's not necessarily a bad thing… if you're prepared for it.

It's been almost a year since Silicon Valley Bank collapsed in March – the victim of idiotic management. But the sobering reality is the small banking crisis is far from over.

In the next three to five years, thousands more regional institutions will fail. That's why I don't have a dime saved or invested in a single one.

Certainly, looking at the exposure that many of these banks have to commercial real estate and the current state of the commercial real estate market, O’Leary may have a point.

“Morningstar” published this on commercial real estate loans recently (Source: https://www.morningstar.com/news/marketwatch/20231230133/no-one-is-throwing-good-money-after-bad-why-2024-looks-like-trouble-for-commercial-real-estate)

Property owners pocketed billions of dollars by refinancing properties when rates were low. They aren't going to throw it away now.

First goes the easy money, then come the defaults, especially when property owners have already cashed out.

Investors are bracing for 2024 to be pretty gloomy in the U.S. commercial real estate market, with more landlords expected to throw in the towel on downtrodden buildings with debt coming due.

There are plenty of potential economic storm clouds on the horizon.

If you aspire to a comfortable, stress-free retirement, you need to plan accordingly.

The day may be fast approaching when traditional planning strategies fail those who use them.

This week’s radio program features an interview with Dr. A Gary Shilling, long-time “Forbes” columnist, money manager, and publisher of the excellent “Insight” newsletter.

Dr. Shilling and I chat about his forecast for the US economy as well as his forecast for various financial markets.

If you haven't yet heard my interview with Dr. Shilling, click on the "Podcast" tab at the top of this page to listen now.

“Instead of getting married again, I’m going to find a woman I don’t like and give her a house.”

-Rod Stewart

Comments