Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The March “You May Not Know Report” discusses how the current economy (since the time of the Great Financial Crisis) is artificial- the result of easy money policies by the Federal Reserve and government stimulus.

History teaches us that when governments overspend and central banks over print, eventually reality sets in. One of the founding fathers, Thomas Jefferson, told us that we could expect inflation followed by deflation and that is exactly the track on which we now find ourselves.

Inflation has not subsided; the most recent data shows that inflation is accelerating exactly as Jefferson suggested it would. And Americans are suffering as a result. There are now also signs of deflation setting in as well. This from Michael Maharrey writing for Schiff Gold (Source: https://schiffgold.com/commentaries/this-strong-economy-is-a-facade-built-out-of-debt/):

Retail sales surged in January, creating the impression that the economy is humming along nicely. After all, there can’t be a problem if consumers are out there consuming, right?

But a lot of people are ignoring a key question: how are people paying for this shopping spree?

As it turns out, they’re putting a lot of this spending on credit cards.

Even with a big 1.8% decline in retail sales in December, revolving credit, primarily reflecting credit card debt, grew by another $7.2 billion that month, a 7.3% increase.

To put the numbers into perspective, the annual increase in 2019, prior to the pandemic, was 3.6%. It’s pretty clear that Americans are still heavily relying on credit cards to make ends meet.

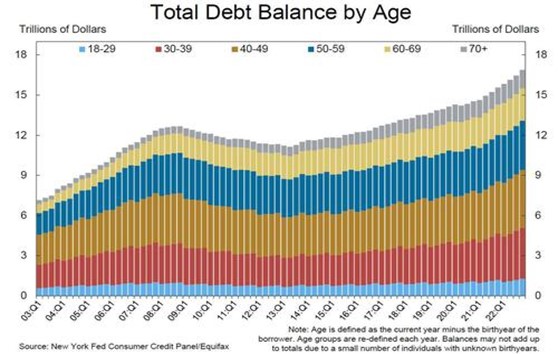

Meanwhile, household debt rose by $394 billion in the fourth quarter of 2022. It was the largest quarter-on-quarter increase in household debt in two decades.

Debt balances have risen $2.7 trillion higher than they were at the beginning of the pandemic.

Clearly, this isn’t a sign of a healthy economy. Americans are spending more on everything thanks to rampant price inflation that doesn’t appear to be waning, and they’re relying on credit cards to do it. Saving has plunged. This isn’t a sound economic foundation, and it isn’t even sustainable. Credit cards have a nasty thing called a limit. And with credit card interest rates at record-high levels, people will reach those limits pretty quickly.

I ran across something the other day that provides an even more striking example of just how reliant the US economy is on debt.

A company called the Wisconsin Cheeseman sells gift packs of cheese, candies and other treats. And you can buy the gifts on their in-house credit plan.

Let this sink in for a moment. A primary pitch from a gift company is that you can buy on credit.

The annual percentage rate will run you a modest 5.75% to a hefty 25.99% depending on the state. (Most states are currently above 20%. But don’t worry. Your payments can be as low as $10 a month.) Just don’t think about the fact that you’ll probably be paying for this cheese for years to come.

There are other companies facilitating borrowing this doesn’t even show up in the official debt figures.

The use of BNLP services such as Affirm, Afterpay and Klarna has exploded in the last couple of years. These services allow consumers to pay off purchases through installment payments, often interest-free. In a December 2021 report, Cardify CEO Derrick Fung said buy now, pay later has rapidly become more mainstream.

“The consumer over the last 12 months has become more compulsive and BNPL products are the result of us being locked up for too long and wanting more instant gratification,” he said.

Buy now, pay later is a convenient way to spread out spending, but there is a dark side. It encourages consumers to spend more. Nearly 46% of those polled said they would spend less if BNPL wasn’t an option.

The rise of buy now pay later (BNPL) is another sign of a deeply dysfunctional economy. Americans are piling up millions of dollars of additional debt using BNPL on top of their credit cards.

So, while the mainstream pundits tell you the economy is strong, they are looking at a facade. It’s a house of cards. And eventually, it will collapse.

American consumers continue to “support the economy” by spending money today despite rising prices. But they’re borrowing to do it. Tomorrow is fast approaching. And with it depleted savings, higher interest rates, and looming credit card limits. This is simply not a sustainable trajectory, no matter how the mainstream press tries to spin it.

Consumers are struggling. That means that the deflation part of the cycle that Jefferson warned us about may be about to emerge in earnest.

As I have stated in the past (and there are many analysts who would disagree with me), I expect that the Federal Reserve will reverse course and begin pursuing easy money policies once again.

Should I be right about this, we will have to wait and see if the Fed can be effective. I have my doubts. Consumers are accumulating too much debt.

The chart below breaks down debt accumulation by age. Alarmingly, those age 60 plus are accumulating more debt on a percentage basis than other age groups. That should serve as a huge red flag and warning sign.

History teaches us that excessive debt levels lead to deflation.

This time will be no different.

Deflation will, at some point, become the prevalent economic force.

That will be more bad news for stocks and real estate.

Stocks are already feeling it, and real estate is now beginning to dramatically unwind in many parts of the country.

The best advice that I can offer is to have some of your assets that will be protected from a prolonged decline in stocks and real estate and other assets that will perform well in an inflationary environment.

The radio program this week features an interview with Karl Denninger, author, and blogger.

I chatted with Karl about the economy and his forecast for real estate based on his demographic studies. It’s a fascinating conversation that you won’t want to miss.

You can listen to the program now by clicking on the "Podcast" tab at the top of this page.

“Energy and persistence conquer all things.”

-Benjamin Franklin

Comments