Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

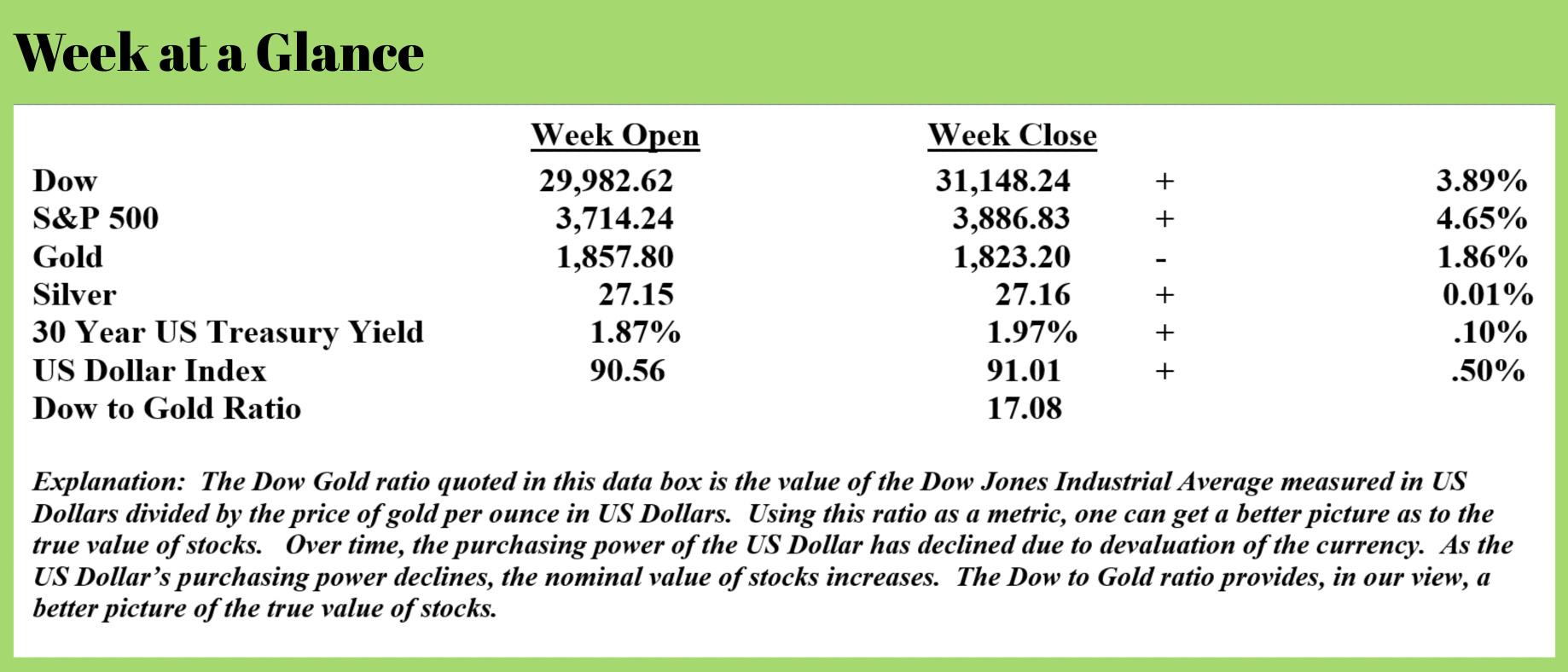

To say there is a lot going on in the world of finance, investing and economics would be a severe understatement.

Seems that enough of the politicians in Washington are now behind a $1.9 trillion stimulus package to get it passed in the next several weeks. The support and opposition to the spending package is, not surprisingly, falling along party lines. According to “US News and World Report” (Source: https://www.usnews.com/news/politics/articles/2021-02-05/biden-digs-in-on-19-trillion-stimulus-amid-new-criticism-of-the-cost), the proposed stimulus package would get another $1400 stimulus check to many Americans, extend unemployment insurance, raise the minimum wage, and include funding for food and housing assistance as well as child care and paid leave.

I wrote about this as likely being imminent not long ago and also commented that the only way to fund another stimulus package was via more money creation.

I’ll go on the record again stating that this just gets us a little further down the slippery slope of currency devaluation. It’s also worth noting that the further down the slope we slide, the faster we move.

I am reminded of the analogy that past radio guest Rob Kirby used when describing how hyperinflation progresses. Mr. Kirby stated that if you started to fill up Yankee Stadium with water beginning with one drop from an eyedropper and then one minute later doubling that to two drops and then every minute thereafter you doubled the drops, you’d fill up Yankee Stadium in less than an hour.

Interestingly, five minutes before the stadium was completely full of water, the bases would barely be covered. In other words, all the action happens in the last five minutes. Hyperinflations progress the same way. On last week’s live update webinar (now available at www.RetirementLifestyleAdvocates.com), I shared the time frames of 52 hyperinflations that have occurred around the world since 1923. Each of these examples confirms this progression.

As far as the stimulus is concerned, even some progressive, Keynesian economists are now voicing concerns over the size and scope of the proposed stimulus package. Former Clinton and Obama economic advisor Lawrence Summers recently expressed his concern over the size of the proposed spending package and the likely inflation that will have to follow in an op-ed piece published in “The Washington Post”. (Source: https://www.washingtonpost.com/opinions/2021/02/04/larry-summers-biden-covid-stimulus/). Here is an excerpt:

“…..a comparison of the 2009 stimulus and what is now being proposed is instructive. In 2009, the gap between actual and estimated potential output was about $80 billion a month and increasing. The 2009 stimulus measures provided an incremental $30 billion to $40 billion a month during 2009 — an amount equal to about half the output shortfall.

In contrast, recent Congressional Budget Office estimates suggest that with the already enacted $900 billion package — but without any new stimulus — the gap between actual and potential output will decline from about $50 billion a month at the beginning of the year to $20 billion a month at its end. The proposed stimulus will total in the neighborhood of $150 billion a month, even before consideration of any follow-on measures. That is at least three times the size of the output shortfall.

In other words, whereas the Obama stimulus was about half as large as the output shortfall, the proposed Biden stimulus is three times as large as the projected shortfall. Relative to the size of the gap being addressed, it is six times as large.”

Later in the piece, Mr. Summers notes that while he is in agreement that stimulus is a good idea it needs to be “enacted in a way that neither threatens future inflation and financial stability”.

Of course, you don’t have to be a trained economist to figure out that money printing on this scale will mean that inflation will have to show up at some point.

To this point, the United States has been able to get away with more money creation than any other country could have. There is one reason for this – the US Dollar is still the currency that is used more than any other in international trade. This is known as the US Dollar having reserve currency status.

I noted last week that it is my belief that the United States reached the peak of the credit cycle last year when the traditional purchasers of US Government debt quit buying. Deficit spending last year by the US Government was funded largely through money creation. I believe the only thing standing between the US and massive inflation is the US Dollar’s role as the reserve currency. Once reserve currency status is lost, all the dollars being inventoried overseas for use in international trade will migrate back to the US. That’s when inflation will begin in earnest.

There are signs the rest of the world is moving away from the US Dollar. Bill Campbell of DoubleLine Capital commented (Source: https://www.zerohedge.com/geopolitical/doubleline-warns-events-are-motion-remove-dollar-reserve-currency) (emphasis added):

“….a series of equal and opposite reactions are occurring as nations move to remove the role of the U.S. dollar at the center of global trade and finance. This will have a long-lasting structural impact in ending the dominance of the dollar as the world’s reserve currency.

Over the past years, the U.S. set out to address inequities in the global trade environment by imposing tariffs and sanctions on various countries from China to Mexico and Canada with the rewriting of the North American Free Trade Agreement into the United States-Mexico-Canada Agreement. Even the countries in the European Union were affected. In addition, Washington implemented sanctions against Russia in 2014 in response to Moscow’s annexation of Crimea, and more recently against Iran and Venezuela, effectively using the dollar’s role at the center of global trade and finance to force compliance of other nations. These actions impacted nations beyond those directly targeted by the U.S. action, and today many governments around the world are taking countervailing steps to remove their reliance on the dollar-based global trade and finance system that has reigned since 1944.

In November, 15 Asian countries, comprising 30% of global GDP, signed the Regional Comprehensive Economic Partnership (RCEP), creating a free-trade zone among the signatories. This agreement attempts to provide gains to trading within the regional partnership through reduction of trade and investment barriers, and increased incentives for economic integration. It is noteworthy that RCEP came about without participation of either the U.S. or Europe, and has effectively created the world’s largest trading bloc, according to the Rand Corp. Beyond the obvious benefits for economic growth in the region, a more-subtle byproduct of this agreement is to focus on bilateral settlement of trade, effectively removing the dollar as the standard unit of transaction for regional trade, according to economist and geopolitical analyst Peter Koenig, a veteran of more than 30 years with the World Bank. Liu Xiaochun, deputy dean of the Shanghai New Finance Research Institute, recently furthered this idea, stating, “Under RCEP, currency choices for regional settlement in trade, investment, and financing will increase significantly for the yuan, yen, Singapore dollar and Hong Kong dollar.” Liu’s comments were posted to the China Finance 40 Forum, a think tank comprising senior Chinese regulatory officials and financial experts.

Asia is not the only region taking steps to disentangle itself from the U.S. dollar standard in global trade and payments. The European Commission, the executive branch of the 27-country European Union (EU), released a communication explicitly stating the goal to strengthen the “international role of the euro.” This goal would “help achieve globally shared goals such as the resilience of the international monetary system, a more stable and diversified global currency system, and a broader choice for market operators.” The communication also highlights the use of sanctions by other countries, which hurt domestic EU interests, as an additional reason for taking action to make the EU more autonomous in the global trade-and-payments infrastructure. This document outlines specific action items to help move the EU in this direction of more autonomy from the current dollar-centric system. The implementation of a digital finance strategy will be a key component of this new EU strategy, including work on a retail central bank digital currency available to the general public.

Mr. Campbell notes the year 1944 in his piece. That is the year that the US Dollar was made the world reserve currency as part of The Bretton Woods Agreement. At that time, the US Dollar was directly linked to gold at a rate of $35 per ounce.

I believe that moving ahead, as currencies evolve we will eventually get back to using hard assets or currency backed by hard assets in commerce. While that could be a gold or silver backed digital currency, I think history teaches us that Voltaire was right when he said that currencies always return to their intrinsic value. For paper currency not backed by hard assets and digital currency not backed by hard assets, that intrinsic value is zero or near-zero.

History teaches us that any currency solution not involving hard assets is not a solution, it’s a temporary fix that will also fail.

If you’d like to get more information on owning hard assets, give the office a call and we can schedule a time to get you more information and educate you on the different ways to own hard assets,

Thank you all for your continued support and referrals. If you know of someone who could benefit from our educational materials, please have them visit our website at www.RetirementLifestyleAdvocates.com. Our webinars, podcasts, and newsletters can be found there.

The radio program this week features an interview with prolific author, Jeffrey Tucker. Jeffrey is an entertaining guy to chat with and an unapologetic libertarian and Austrian economist.

If you are not participating in our weekly Monday update webinars, you can get more information on them at www.RetirementLifestyleAdvocates.com or catch the replays there.

As noted above, if you need more information about the webinars or would like to schedule a phone conversation to discuss precious metals, just give the office a call at 1-866-921-3613.

“I didn’t attend the funeral, but I sent a nice letter stating that I approved of it.”

-Mark Twain