Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Dow Hits 50,000

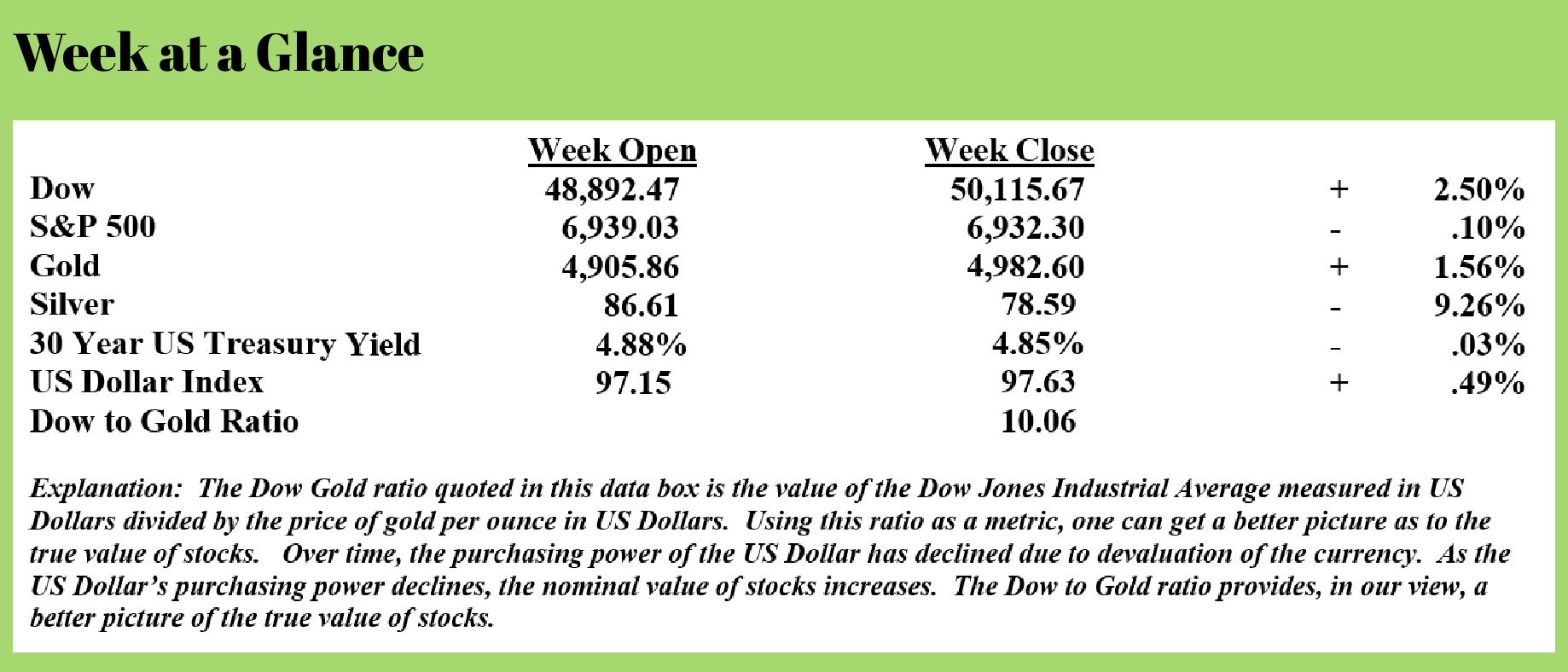

Stocks were mixed last week as the Dow Jones Industrial Average hit an all-time high, eclipsing the 50,000 mark for the first time, while the Standard and Poor’s 500 fell slightly.

Does this mean that stocks will continue to rise and make more new highs?

Maybe, but probably not for the right reason.

Much of the appreciation in stocks can be attributed to a weaker US Dollar. As I’ve pointed out many times previously, stocks are higher when priced in US Dollars that have been notably devalued, but stock prices are lower when priced in gold, which has been ‘real money’ for most of history.

The metrics of stock valuations simply don’t support higher stock prices.

Marc Faber, past RLA Radio guest and publisher of the “Gloom, Boom and Doom Report,” noted last week that US stocks have NEVER been this expensive. (Source: https://www.gloomboomdoom.com/mm-commentary/public-archive/detail/has-a-great-rotation-begun/)

Faber notes that the price-to-sales ratio is up to 3.47x, which is a historic high. That means a stock investor pays $3.47 for every dollar in revenue generated by S&P 500 companies.

Shockingly, that ratio is now 53% higher than at the time of the tech stock bubble peak in 2000, when the ratio stood at 2.27x. At the market peak in late 2021, prior to the decline of 2022, the ratio was 3.21x.

For perspective, the ratio averaged about 1 during the 1990’s.

Commercial Mortgages Continue Dismal Performance

Wolf Richter reported that the default rate on commercial mortgage-backed securities spiked by more than 1% in January. The delinquency rate on office mortgages is now 12.3%. (Source: https://wolfstreet.com/2026/02/03/office-cmbs-delinquency-rate-spikes-to-record-12-3-much-worse-than-financial-crisis-meltdown-peak/)

That 12.3% delinquency rate is 1.6% higher than the worst number seen during the financial crisis.

The spike in the default rate in January was triggered by two Manhattan office towers.

One of the towers, One Worldwide Plaza, a 49-story, 2 million+ square foot tower on Eighth Avenue in Manhattan, has $1.2 billion in debt. $940 million of the debt is a senior commercial mortgage-backed securities loan, and another $260 million in mezzanine financing,

If you’re not familiar with mezzanine financing, it is financing that is subordinated to senior debt but senior to equity. It’s like a second mortgage on a home. Senior lenders get paid first, then mezzanine lenders and finally owners.

One Worldwide Plaza didn’t have the cash flow to pay the January 2026 tax bill and make the note payment in December.

The property has a vacancy rate of 37% in 2025, up from 10% in 2024 after one tenant left and another downsized.

In 2017, when the building was refinanced, the collateral was appraised at $1.7 billion. The collateral is now re-appraised at $390 million, a 77% reduction from the 2017 appraisal.

As I’ve reported previously, commercial real estate will likely continue to be a drag on the economy.

Expect Monetary Policy to be “Run It Hot”

Jerome Powell is on his way out as Federal Reserve Chair in May. While many analysts are of the opinion that the nominee to replace Powell, Kevin Warsh, will be hawkish on inflation, I’m not so sure.

The most recent appointee to the Federal Reserve Board of Governors, Stephen Miran, in testimony before the Senate Banking Committee, stated that this (Source: https://www.axios.com/2025/09/17/trump-fed-miran-third-mandate):

“Congress wisely tasked the Fed with pursuing price stability, maximum employment, and moderate long-term interest rates.”

That testimony was a bit surprising, given that the Fed is widely regarded as having two mandates – price stability and maximum employment.

By adding the third mandate of moderate long-term interest rates, Miran tipped his hand.

While the Federal Reserve controls short-term interest rates, specifically the overnight lending rate, the market controls long-term interest rates. This is why, as the Fed has been cutting rates, long-term interest rates have been rising.

Lenders will demand an interest rate commensurate with the risk they perceive they are taking in making the loan. Since the Fed began cutting rates in September of 2024, longer-term interest rates on US Treasuries have increased.

If the Fed is now going to control longer-term interest rates, there is only one way to accomplish this: create currency to create demand for longer-term US Treasuries.

It will work for a while, but over time, it will fuel inflation.

It seems clearer that this will be the Fed policy moving ahead. That being the case, owning assets in your portfolio that can’t be printed will be critically important.

RLA Radio

The RLA radio program this week features an interview that I conducted with Peter Schiff, the Chief Market Strategist for Europacific Capital.

I talk with Peter about his forecast for stocks, precious metals, and the US economy.

The program is available here by clicking on the "Podcast" tab at the top of this page, or you can find it on your favorite podcast channel.

Quote of the Week

“Never pick a fight with an ugly person. They’ve got nothing to lose.”

-Robin Williams

Comments