Weekly Market Update by Retirement Lifestyle Advocates

Happy New Year!

Here we are again at the beginning of another New Year.

As the calendar turns from December to January, we become reflective about the year just passed and hopeful for the year that lies directly in front of us.

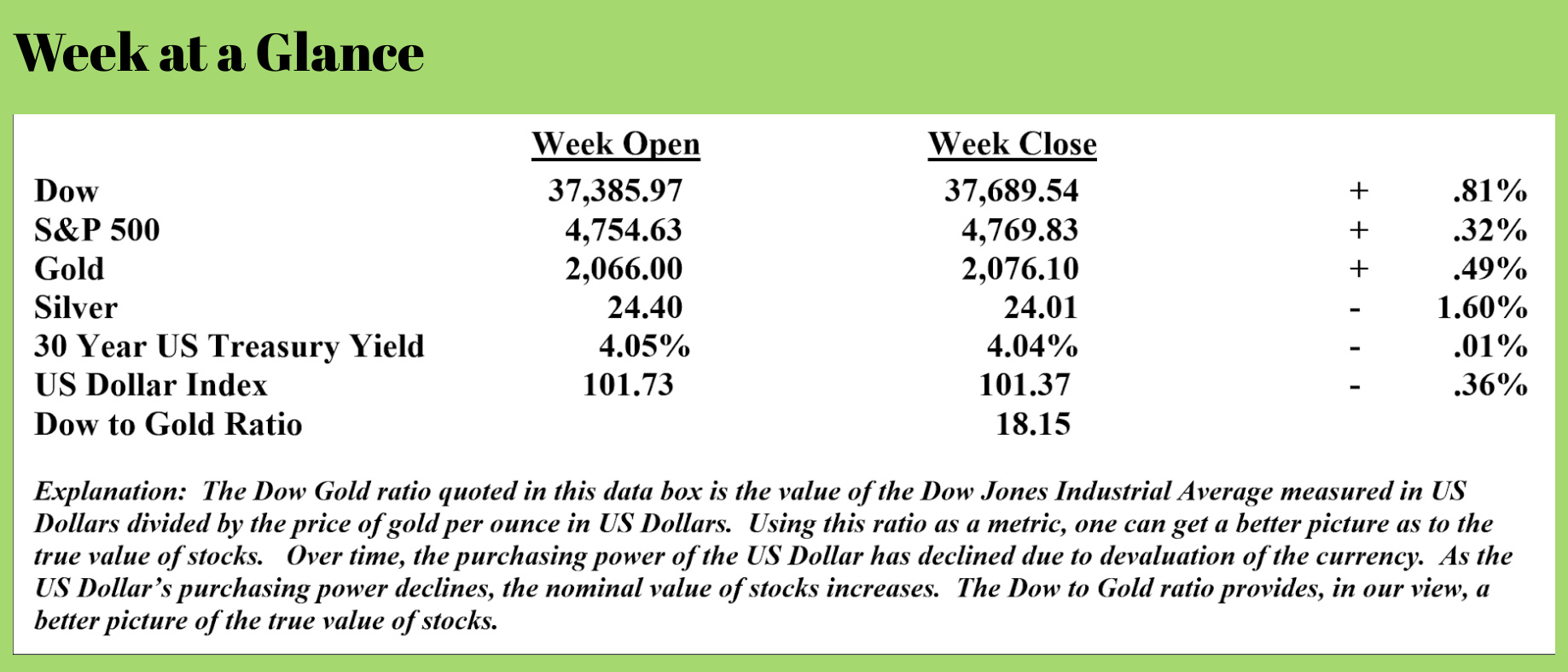

In this, the first “Portfolio Watch” newsletter of 2024, I’ll offer a brief forecast as to where we go this year from an economic and investing standpoint.

While 2023 was a marked improvement over 2022 as far as traditional investments were concerned, as we enter 2024, let me offer you a perspective that I believe will serve you well in the year ahead.

In a sentence, here is the perspective:

The traditional way of investing using a 60/40 portfolio remains broken. Those who aspire to a comfortable, stress-free retirement who also rely on a conventional approach to investing will likely, at least in my view, find themselves severely disappointed in their results.

Let’s take a look.

A 60/40 portfolio, the portfolio allocation most commonly advanced as the best way to invest, is comprised of 60% stocks and 40% bonds.

Many advisors and self-proclaimed experts suggest using index funds to manage a 60/40 portfolio so that fees can be kept down.

Don’t get me wrong.

Historically, there have been times when a 60/40 portfolio has worked well to allow the accumulation of retirement assets.

But that time is not now, in my opinion.

And it has not been the case for the past nearly four years.

Take a look at this chart of an exchange-traded fund that tracks the price action of the Standard and Poor’s 500.

Over the past four years, the S&P 500 has returned the following:

Over the past four years, the S&P 500 has returned the following:

2020 15.84%

2021 27.08%

2022 -19.41%

2023 24.35%

Now let’s look at another exchange-traded fund that has the investment objective of tracking the price performance of the long-term US Treasury bond. Over the past four years, long-term US Treasuries have returned the following:

2020 13.67%; 2021 -6.33%; 2022 -32.43%; 2023 -1.00%

Now, let’s combine these returns to see what the traditional 60/40 portfolio would have returned:

2020 14.97%; 2021 13.52%; 2022 -24.62%; 2023 23.95%

Had you started the calendar year 2020 with $100,000 in your 60/40 portfolio, your year-end account balances would have looked like this:

2020 $114,970; 2021 $130,514; 2022 $98,381; 2023 $121,944

A four-year cumulative return of 21.94%.

Taking compounding into account, that is an average annual return of 4.7%.

That, however, is a gross return. The actual net return is far less when taking into account the adversarial impact of inflation.

While we could calculate an inflation-adjusted return using the official inflation rate as reported by the Consumer Price Index, we all know that inflation calculation is severely flawed.

The Consumer Price Index uses ‘adjustments’ (or should I say manipulations?) to arrive at the inflation rate reported as the CPI. These adjustments include weightings, substitution, and hedonic adjustments.

The bottom line is that these ‘adjustments’ that are used to arrive at the officially reported inflation rate act to keep the reported inflation rate much lower than the real inflation rate or the inflation rate that you and I experience in our day-to-day lives.

The Chapwood Index is an inflation metric that uses the actual prices of consumer items in 50 different metropolitan areas in the United States to determine the real inflation rate.

Depending on where you live in the United States, the actual inflation rate over the past five years has ranged from 10.1% to 13.7% annually.

For discussion purposes, let’s use an average of the two ends of the inflation rate calculation. That would give us an average annual inflation rate of 11.9%.

Over the past four years, the traditional 60/40 portfolio has returned an average of 4.7% per year, while the inflation rate has been 11.9% per year.

Here is what that means to the aspiring retiree.

A $1,000,000 portfolio would need an average annual return of 11.9% just to keep pace with inflation. That means the portfolio would need to be worth $1,567,907 today just to have maintained purchasing power!

The 60/40 portfolio would have returned $1,201,674.

That’s more than $365,000 short of where it would have to be to have kept pace with inflation.

Now, as we enter 2024, the Federal Reserve, the central bank of the United States, is ready to once again pursue easy money policies. Mark my words; that will add fuel to an inflation fire that has never been properly brought under control.

Couple the Fed’s pivot to easy money policies with the fact that the move away from the US Dollar internationally is picking up steam, and, in my view, more inflation is a given in 2024.

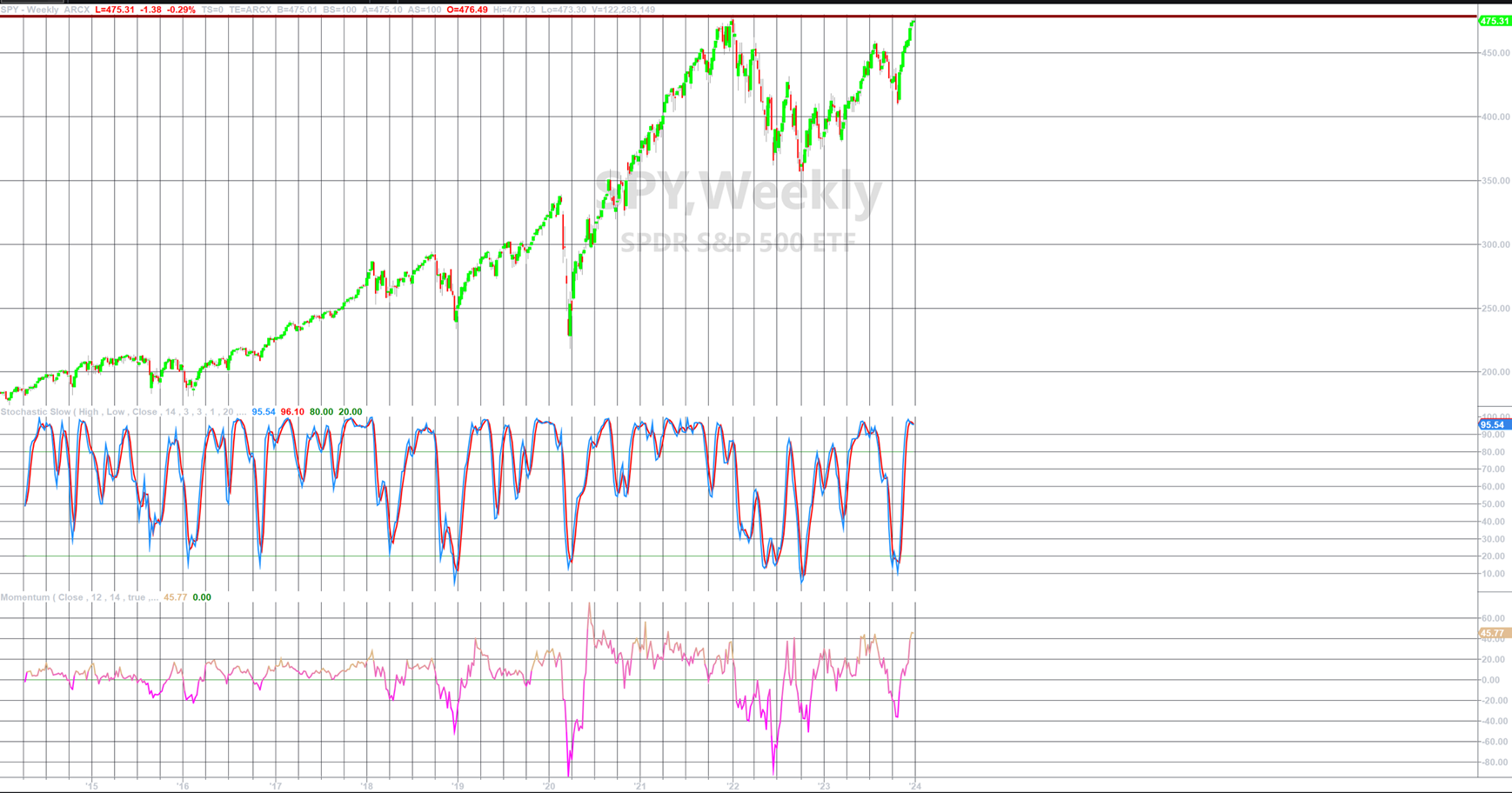

And, as I told “Portfolio Watch Positions” subscribers this week, stocks are at a critical point as we enter 2024 with long-term technical indicators flashing warning signs.

This chart is a weekly price chart of an exchange-traded fund that tracks the price movement of the S&P 500.

The top of the chart shows the price action of the ETF that tracks the index.

Notice the red line drawn horizontally across the top of the chart. That red line

Notice the red line drawn horizontally across the top of the chart. That red line

The middle analysis tool on the chart is a stochastic oscillator. It moves up as a market becomes more overbought (prices likely ready to fall) and moves down as a market becomes more oversold (prices likely ready to rise). Notice that at the present time, the oscillator is suggesting that prices may fall.

The bottom of the chart has the analysis tool momentum graphed. Like the stochastic oscillator, it is suggesting that prices may be ready to fall.

When one combines all these factors, it seems that stocks may be once again ready to correct. Only time will tell if the easy money policies of the Federal Reserve can pump prices up again, but I have my doubts.

If you want to be successful when investing for retirement, I strongly believe that it will be important to hedge against inflation and manage investment drawdown risk.

A drawdown in an investment is a paper loss. The brutal reality of drawdown math is that for every percentage decline an investment experiences, a percentage gain that is exponentially larger must be realized in order to get back to ‘break even’.

The radio program this week features an interview that I did with Selwyn Duke, a defender of the principles of Western civilization.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page, or find it on your favorite podcast channel by searching YourRLA.

“What the New Year brings will depend a great deal on what you bring to the New Year.”

-Vern McLellan

Comments