Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

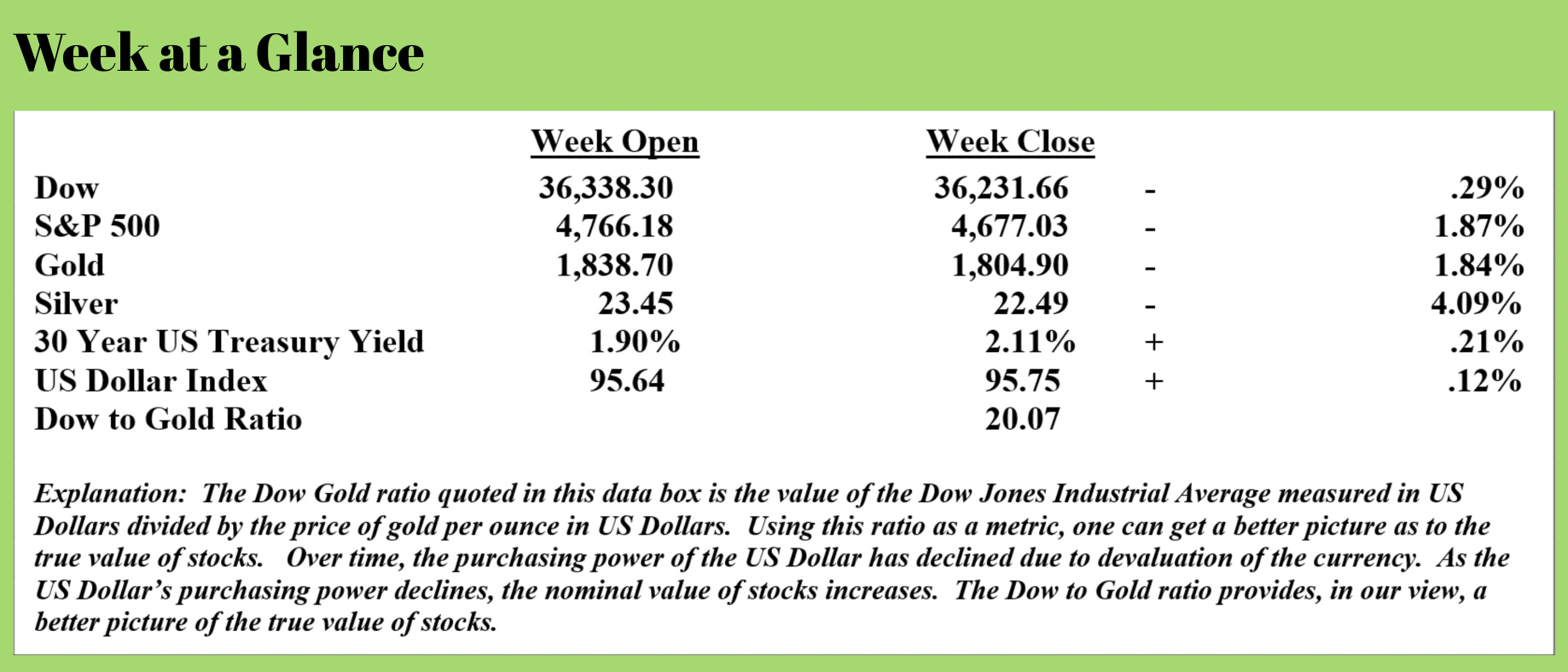

My ‘double top’ theory from last week is holding true so far, but we will wait and see. If you missed last week’s issue of “Portfolio Watch”. A double top is a bearish formation where prior market highs are approximately reached but no new highs are made.

At this point, it’s too early to tell.

Bonds had a simply dismal week last week.

The yield on the 30-Year US Treasury Bond spiked from 1.90% to 2.11% as bond prices fell hard. An article that was reprinted in “The Detroit News” titled “Global Bond Rout Intensifies as Fed Prompts Bets on Faster Hikes” explains: (Source: https://www.detroitnews.us/2022/01/06/global-bond-rout-intensifies-as-fed-prompts-bets-on-faster-hikes/)

The Treasury selloff that started the year is rippling across the globe as investors scramble to price in the risk that the Federal Reserve raises interest rates faster than currently anticipated to contain inflation.

Yields on U.S. 10-year notes climbed to 1.73% on Thursday, just shy of the 2021 high of 1.77%. The yield has spiked 22 basis points this week, set for the steepest increase since June 2020. The jump sparked a sell-off in bonds and equities across Asia and Europe and widened divergences in rate expectations across markets.

“Gone are the days investors bought bonds with their eyes closed, confident in central banks’ eventual support for the market,” wrote Padhraic Garvey, head of global debt and rates strategy at ING Groep. “A key driver is a Federal Reserve on a mission to tighten policy, and the latest minutes show they mean business.”

Federal Open Market Committee members also discussed starting to shrink the central bank’s swollen balance sheet soon after their first hike, the minutes showed. That would be a more aggressive approach than during the previous rate-hike cycle in the 2010s, when the Fed waited almost two years after liftoff to begin trimming the stockpile of assets built up as it injected cash into the economy.

In other words, the Fed is threatening to take away the punch bowl and the markets are reacting. Higher interest rates will be detrimental to an economy that is already fragile. The most recent jobs report is another bit of evidence that the economy remains weak. This from “Yahoo Finance” (Source: https://finance.yahoo.com/news/job-growth-disappoints-biden-says-233412951.html)

Non-farm employment grew by 199,000 in December, the U.S. Labor Department announced Friday, a disappointing result that fell well short of expectations for the month.

Should the Fed stay the course and complete the taper (totally cease currency creation), the financial markets and the economy are sure to suffer. On the other hand, should the Fed change course and continue currency creation, the risk is that already high inflation turns hyperinflationary.

Ironically, at a certain point, rather than helping the financial markets, inflation will hurt them. This from Steve Forbes (Source: https://www.forbes.com/sites/steveforbes/2022/01/07/will-inflation-cause-a-stock-market-crash-in-2022/?sh=36eb67e35a44)

This could well be the year that inflation starts to smack the stock market. The current episode of What’s Ahead explains why.

Investors need to understand that there are two kinds of inflation: monetary and nonmonetary.

Last year most of the increases in prices came from pandemic disruptions, made worse by Biden Administration blunders. This is nonmonetary inflation.

The other type of inflation comes from the Federal Reserve printing too much money. Our central bank has been using a certain gimmick—reverse repurchase agreements—on an unprecedented scale to keep this mountain of money from cascading into the economy. But these kinds of ploys always end badly.

Moreover, the Fed has announced that come spring it will no longer be adding to its holdings in government bonds—which means higher interest rates than even the Fed anticipates.

And that’s bad news for the economy—and the stock market.

The easy money policies that the Fed has been pursuing always end badly. Steve Forbes knows it and past radio show guest, Alasdair Macleod knows it. Here are some excerpts from a piece that he wrote last week. (Source: https://www.goldmoney.com/research/goldmoney-insights/money-supply-and-rising-interest-rates)

The establishment, including the state, central banks, and most investors are thoroughly Keynesian, the latter category having profited greatly in recent decades from their slavish following of the common meme.

That is about to change. The world of continual Keynesian stimulus is coming to its inevitable end with prices rising beyond the authorities’ control. Being blinded by neo-Keynesian beliefs, no one is prepared for it.

This article explains why interest rates are set to rise substantially in this new year. It draws on evidence from the inflation crisis of the 1970s, points out the similarities and the fact that currency debasement today is far greater and more global than fifty years ago. In the UK, half the current rate of monetary inflation for half the time — just for one year — led to gilt coupons of over 15%. And today we have Fed watchers who can only envisage a Fed funds rate climbing to 2% at most…

A key factor will be the discrediting of this Keynesian hopium, likely to be replaced by a belated conversion to the monetarism that propelled Milton Friedman into the public eye when the same thing happened in the mid-seventies. The realization that inflation is always and everywhere a monetary phenomenon will come too late for policymakers to stop it.

The situation is closely examined for America, its debt, and its dollar. But the problems do not stop there: the risks to the global system of fiat currencies and credit from rising interest rates and the debt traps that will be sprung are acute everywhere.

Keynesian hopium, as Mr. Macleod calls it, is the belief that the central bankers will be able to continue to create currency to keep the economy chugging along all while keeping inflation under control.

The smattering of evidence presented so far in this week’s issue pokes holes in this argument. Yet, many in the financial industry are still clinging to this hopium. Mr. Macleod explains:

Clearly, the outlook is for higher dollar interest rates. The Fed is trying to persuade markets that it is a temporary phenomenon requiring only modest action and that while inflation, by which the authorities mean rising prices, is unexpectedly high when things return to normal it will be back down to a little over two per cent. There’s no need to panic, and this view is widely supported by the entire investment industry.

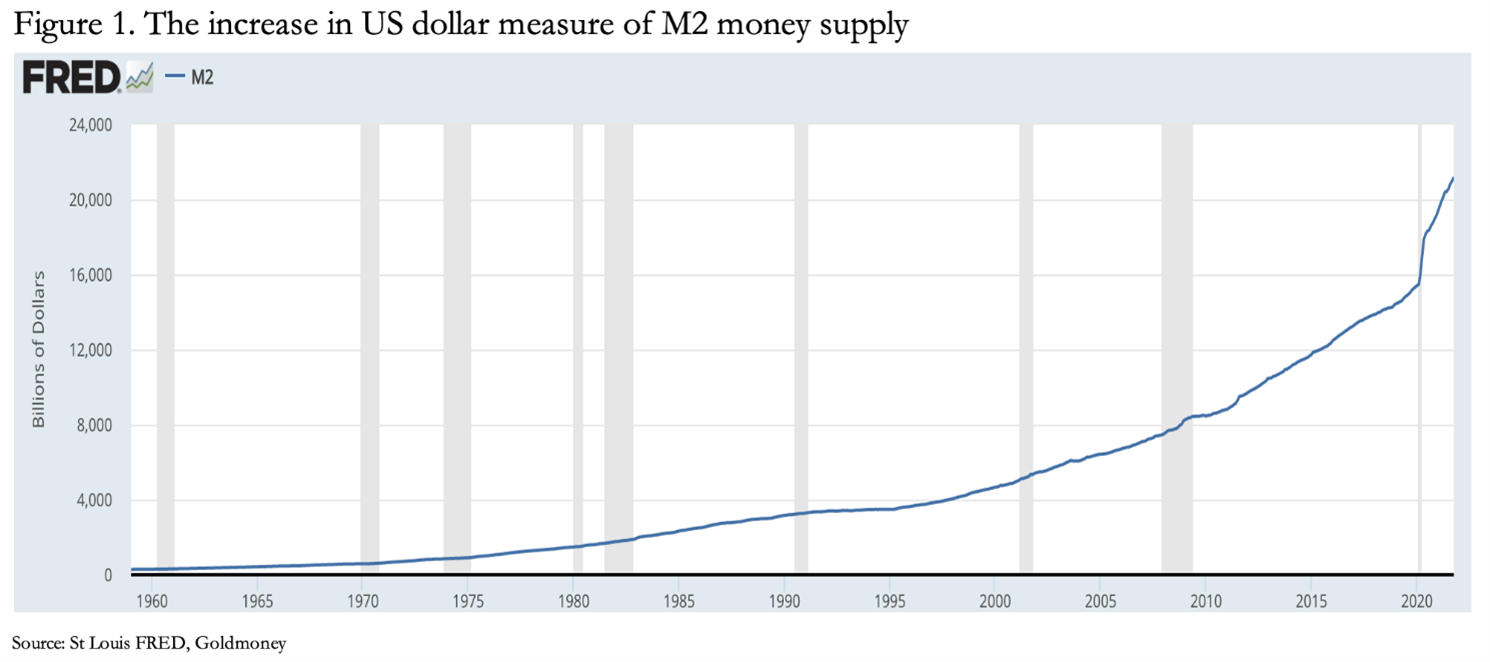

Unfortunately, this narrative is based on wishful thinking rather than reality. The reality is that over the last two years the dollar has been dramatically debased as part of an ongoing process, as the chart in Figure 1 unmistakably shows.

Since February 2020, M2 has increased from $15,470 to $21,437 last November, that’s 38.6% in just twenty months, an average annualized inflation rate of 23.2% for nearly two years on the trot. And that follows unremitting expansion at an accelerated pace since the 2008 Lehman crisis, an inflationary increase of 175% since August 2008 to November 2021. If the CPI is the relevant measure, then its current indicated rate of price inflation at 6.8% is only the beginning of upward pressure on prices.

For now, markets are ignoring this reality, hoping the Fed is still in control and can be believed. But we can be sure that it will soon become apparent that the monetary authorities have a major problem on their hands which will no longer be satisfied by jaw-jaw alone. Interest rates will then be destined for significantly higher levels, not because there is demand for capital against a background of limited savings supply, but because anyone holding dollars will require compensation for retaining them. A similar error is to think that with economic growth slowing from its initial recovery and with concerns that the world may be entering a recession, demand and supply will return to a balance and prices will stop rising.

These errors aside, the 10-year US Treasury, which is currently yielding 1.7% cannot continue for long at these levels with CPI prices rising at 6.8% and more. And in the next few months, with higher producer prices, energy, and raw material costs in the pipeline the pressure for a substantial upwards rerating of bond yields (which is a catastrophic fall in prices) is only going to increase.

I, like Mr. Forbes and Mr. Macleod, am of the firm belief that 2022 will see the proverbial rooster come home to roost as far as Fed policy is concerned.

This week’s radio program features an interview with best-selling author Harry Dent. I get Harry’s stock market forecast and talk to him about his upcoming debate with past RLA Radio guest, Peter Schiff. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“When you go into court you are putting your fate in the hands of 12 people who weren’t smart enough to get out of jury duty.”

-Norm Crosby