Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

California Considering Billionaire Tax

The State of California is now considering the “2026 Billionaires’ Tax Act”. If this act becomes law, any taxpayer in California would pay a one-time 5% tax on assets over $1 billion. The tax would be based on the taxpayer's net worth numbers in 2026, but would be imposed on any billionaire living in California in 2025, ensuring that billionaires wouldn’t be able to flee the state to avoid the tax. (Source: https://www.zerohedge.com/political/giant-sucking-sound-exodus-california-continues-taxpayers-businesses)

While California may get some revenue from billionaires because of this tax, the actions of the state’s ruling politicians are once again fueling a mass exodus from the state.

Google founders Larry Page and Sergey Brin are beginning to move at least some of their business entities out of the State of California. (Source: https://www.zerohedge.com/markets/even-googles-founders-have-had-enough-california-and-are-saying-adios)

“The New York Times” reported that in the ten days leading up to the Christmas holiday, Brin terminated or moved 15 California LLCs. Seven of Brin’s companies, including those that manage his yachts and his interest in a private air terminal at San Jose’s International Airport, were converted to Nevada business entities.

Mr. Page is taking similar action. More than 45 California LLCs associated with Page filed documents in December to either become inactive or move out of state. Additionally, a trust with ties to Mr. Page also recently purchased a $71.9 million mansion in Coconut Grove, FL, a suburb of Miami.

But it’s not just the billionaires leaving California. According to data from U-Haul, California is the hardest state in which to find a U-Haul. While California has more U-Hauls leaving the state than any other, it’s not surprising to me that the next four most active states for U-Haul rentals leaving the state are Massachusetts, New York, Illinois, and New Jersey. All are high-tax states.

As the exodus from high-tax states intensifies, tone-deaf politicians are continuing to spend more, hoping to fund their reckless spending by taxing the wealthy. Seems the wealthy are voting with their feet.

Reminds me of the quote by Margaret Thatcher, who noted that socialism fails every time because sooner or later you run out of other people’s money.

Are We Repeating the Failed Continental Experiment?

Growing up, I occasionally heard my grandfather (who was born in 1900) use the term “not worth a Continental” when referring to something that was virtually worthless.

The saying “not worth a Continental”, not used anymore, was referencing the failed Continental Dollar currency issued by the United States at the time of the Revolutionary War.

The Continental Dollar, like the US Dollar today, was paper money. The colonies, needing to fund the war effort, elected to go into temporary debt to finance the war.

Once it became clear that the debt was too large to be paid, the ruling class made the choice that is almost always made by politicians when studying history – they decided to print more of the currency. The predictable result was massive inflation. It didn’t take too long, and confidence in the currency was lost, and the Continental became worthless for purchases and for debt repayment.

This fiat currency failure greatly influenced the authors of the US Constitution, who wanted to ensure that the failed currency experiment would never be repeated. Article 1, Section 10 of the US Constitution states that states were not allowed to “coin money, emit bills of credit or make anything but gold and silver coin a tender in payment of debts.”

It’s obvious that the US has not just slightly deviated from the Constitution – the country has simply disregarded it.

Jeff Thomas, writing for “International Man,” recently wrote a terrific piece (Source: https://internationalman.com/articles/not-worth-a-continental/) on the five ‘common denominator’ policy errors that have existed in every historical hyperinflationary collapse. They are war or military conflict, depletion of precious metals reserves, excessive debt that is too large to ever be repaid, devaluation of currency (typically to pay debt), and loss of control of inflation.

Thomas points out that we are living in a time where much of the world has committed three to four of the five policy errors already.

There are smaller wars and geopolitical tensions worldwide. The US has (purportedly) 30% to 40% of the gold reserves it had 70 years ago. The current US national debt is pushing $40 trillion, and the Social Security trust fund is gone in 6-7 years. The US Dollar has already experienced massive devaluation, as evidenced by precious metals’ prices in US Dollars.

Thomas makes another point in his piece, one that I’ve made previously. Hyperinflations happen quickly and unexpectedly– like a lightning bolt from the sky on a clear day. Once confidence is lost, the collapse follows quickly.

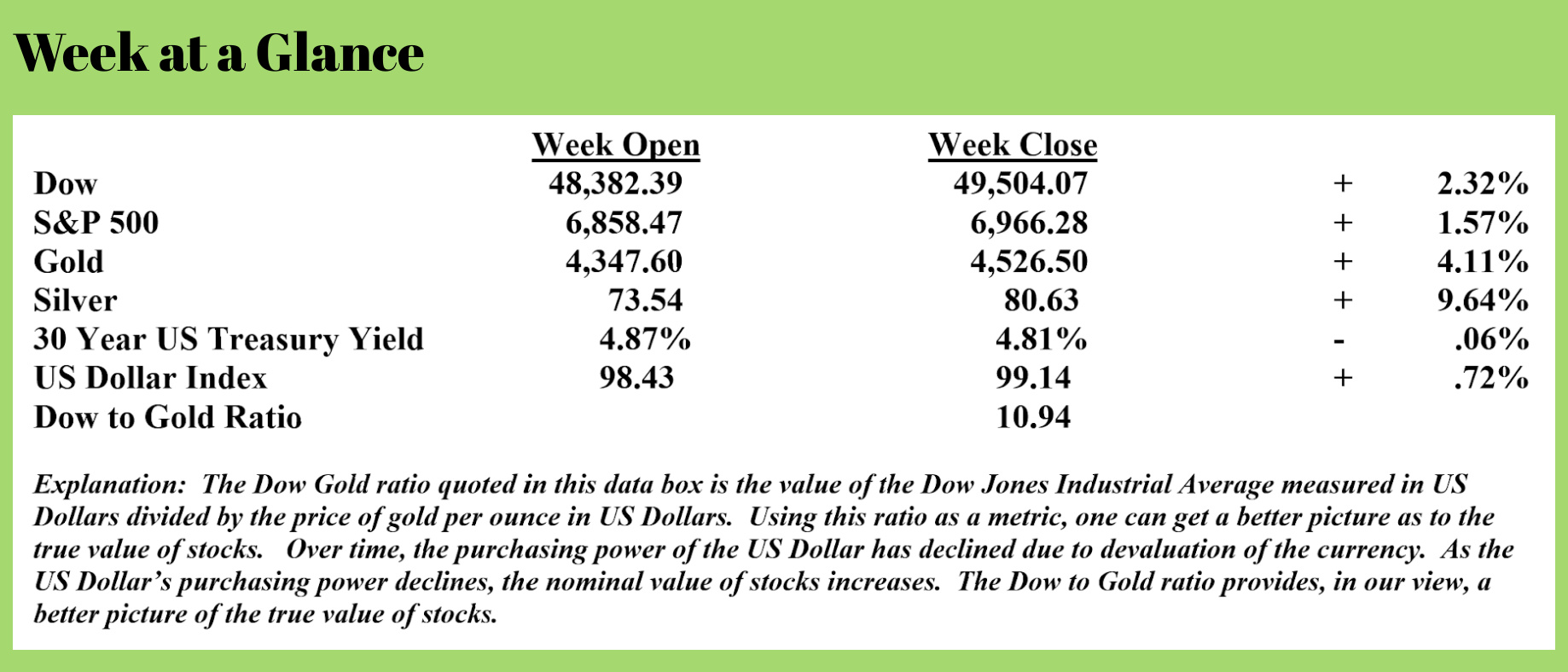

While I expect a potential pullback or consolidation in metals’ prices, longer-term, I believe that holding precious metals will be essential for many investors.

Trump Calls for Maximum Credit Card Interest Rates of 10%

The president called for credit card companies to cap interest rates at 10% for one year. (Source: https://justthenews.com/politics-policy/all-things-trump/trump-calls-limiting-credit-card-interest-rates-10-one-year)

Should a cap of 10% be enforced, it will simply mean that higher-risk credit card borrowers will lose access to credit. Banks charge interest rates on loans that they consider to be commensurate with the risk in making the loan. Faced with a choice of capping interest on higher-risk borrowers at 10% or not offering the borrower credit, banks will make the latter choice every time.

RLA Radio

The RLA radio program this week is a bit of an about-face. David Grubb interviews me about my latest book, “Portfolio Playbook. You can listen to the interview now by clicking on the "Podcast" tab at the top of this page, or find it on your favorite podcast channel.

Quote of the Week

“One man with courage is a majority.”

-Thomas Jefferson

Comments