Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Here in “Portfolio Watch,” each week, I look at conditions and events that may affect your retirement.

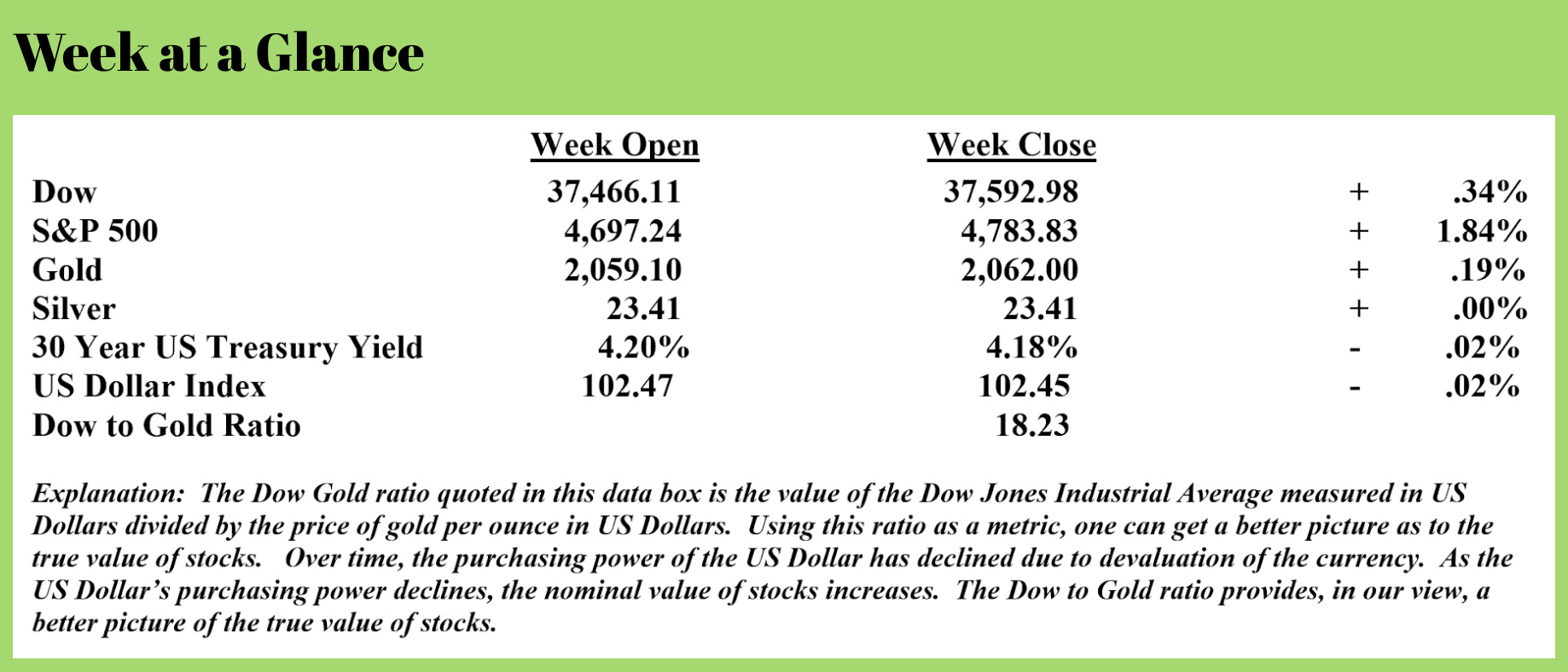

Last week, I discussed the fact that the Federal Reserve, the central bank of the United States, decided that 2024 would be the year of more rate cuts, as I suggested would happen when the Fed began monetary tightening by increasing interest rates nearly two years ago in March of 2022.

The Fed began to increase interest rates ostensibly to get inflation under control after the US experienced its worst inflation in more than four decades.

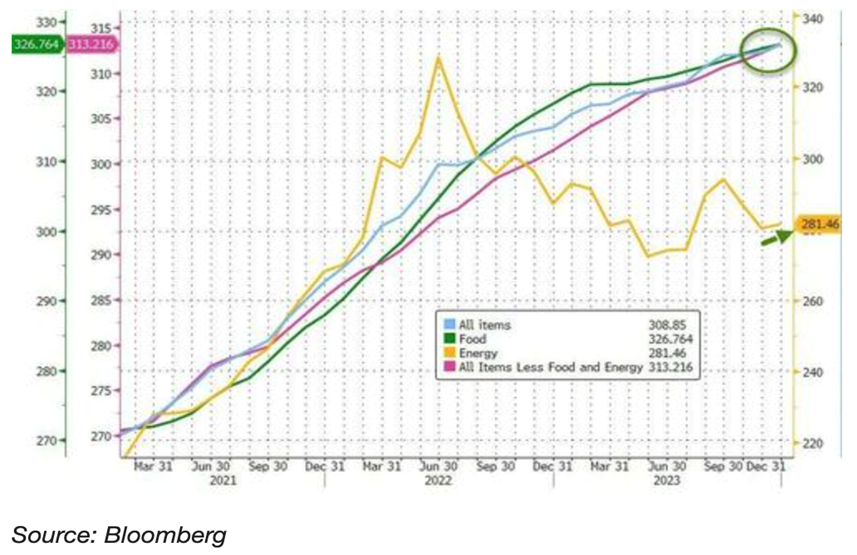

The December inflation data is here. It seems that the Fed may be acting a bit prematurely if getting inflation under control is its primary goal. This from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/headline-cpi-hotter-expected-december-supercore-accelerating):

Headline Consumer Price Inflation printed hotter than expected in December, +0.3% MoM vs +0.2% exp and +0.1% prior, pushing the YoY headline CPI up to +3.4% (from +3.1% prior and hotter than the +3.2% exp)...

Headline Consumer Price Inflation printed hotter than expected in December, +0.3% MoM vs +0.2% exp and +0.1% prior, pushing the YoY headline CPI up to +3.4% (from +3.1% prior and hotter than the +3.2% exp)...

Goods deflation has stalled as the used cars and trucks index rose 0.5 percent over the month, after rising 1.6 percent in November.

This is a category that Fed Chair Jerome Powell and other policymakers have highlighted as a focus.

All the subsectors of SuperCore rose MoM with the shelter index increased 6.2 percent over the last year, accounting for over two thirds of the total increase in the all items less food and energy index.

Notice on the chart taken from the “Zero Hedge” article above that ‘all items’ inflation is at an all-time high, as is food, as are all items excluding food and energy. This is hardly getting inflation under control.

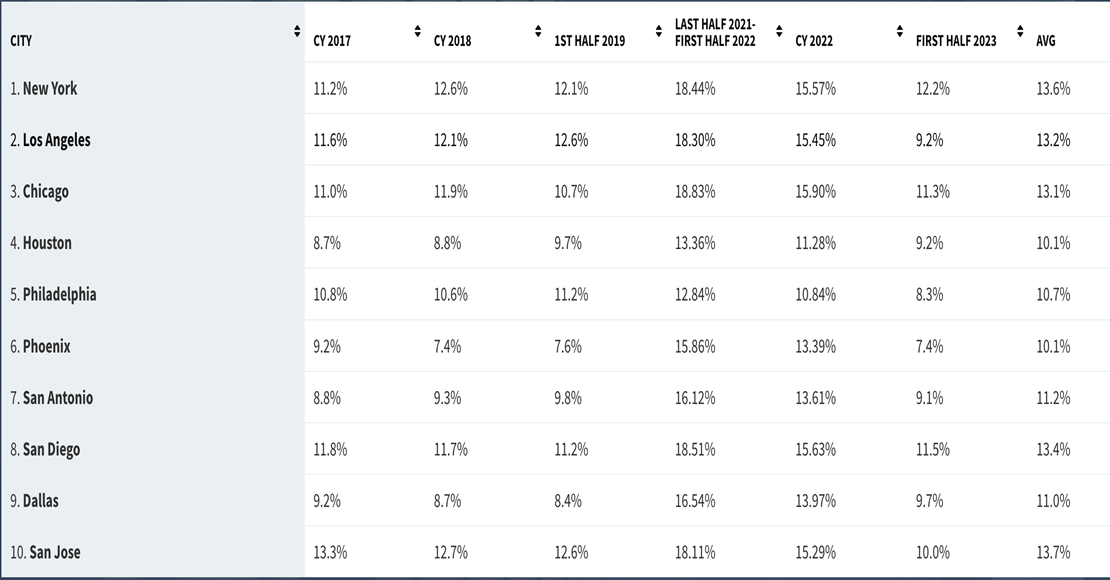

The Chapwood Index is a private index that calculates the inflation rate by examining the cost of 500 different consumer items in 50 different metropolitan areas around the United States. (Source: https://chapwoodindex.com/).

According to the Chapwood Index, the actual annual inflation rate over the past five years has been closer to 12%, as noted by the chart below.

As I noted last week, much of the motivation behind the decision to cut interest rates may be political.

As I noted last week, much of the motivation behind the decision to cut interest rates may be political.

In the meantime, the jobs numbers seem solid, but when you look at them with some scrutiny, they’re suspect as well. This from MN Gordon (Source: https://economicprism.com/yellens-bald-faced-lies/):

Did you see the recent government propaganda from the U.S. Bureau of Labor Statistics?

Not the latest faulty claim that consumer prices increased at an annual rate of just 3.4 percent in December. But rather the claim that 216,000 jobs were added in December.

Upon release, and right on cue, Treasury Secretary Janet Yellen declared that the U.S. economy had achieved a soft landing. She also said that her “hope is that it will continue.”

What Yellen neglected to mention was that October employment was revised down by 45,000 jobs and November was revised down by 26,000 jobs. That’s 71,000 jobs the government recently reported which didn’t exist.

How many of the 216,000 jobs reported for December will wind up being pure fantasy?

Yellen also didn’t mention that 52,000 of the reported jobs are in government, 59,000 are in health care and social assistance, and 22,000 are in food services. These aren’t the kind of jobs that create and spread new wealth and abundance to the economy.

In addition, there are 4.2 million workers that are employed part time for economic reasons. This represents individuals who prefer full-time employment but are working part-time because their hours have been cut or they cannot find full-time work.

There are also 8.5 million multiple job holders. These are people who work more than one job because a single job doesn’t pay the bills.

These low-level service jobs, filled by people with low-level skill sets, are the jobs that Yellen is so excited about. Absolutely, these jobs are important. If they didn’t exist there would be no option to get cheap mall pizza while simultaneously getting insulted. Life would be less abundant.

Nonetheless, these are not the type of jobs that drive the economy forward. They certainly don’t offer opportunities for American workers to get ahead. They don’t provide the cutting-edge skills, or the higher wages needed to propel the American economy above its foreign competitors.

One of Yellen’s key talking points is that wage growth is outpacing inflation. She can even point to the December jobs report for justification.

Based on the government propaganda, hourly earnings rose 4.1 percent in the year through December while consumer price inflation, as measured by the consumer price index (CPI), came in at 3.4 percent for the year. Here’s Yellen:

“Wage increases are running over price increases now. American workers are getting ahead and the progress for the middle-income families is very noticeable.”

Cherry picking data durations to support a false narrative is a longstanding tactic of big government statists. The reality is that on Yellen’s watch American workers have steadily fallen behind.

When you zoom out to show from December 2020 to the present, average hourly wages and CPI tell a much different story. As David Stockman, the former Director of the Office of Management and Budget recently detailed, “the cost of living has risen 25 percent more than the average hourly wage.”

In other words, American workers have taken a significant pay cut over the last three years.

Despite the reported inflation numbers and the reported jobs numbers, the economic reality is that nearly two thirds of American households are living paycheck-to-paycheck.

And there is likely more inflation to come.

The radio program this week features a conversation that I did with Michael Oliver, founder of Momentum Structural Analysis. I get Mr. Oliver’s forecast for the economy and financial markets.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page.

“So, if we lie to the government, it’s a felony. But, if they lie to us, it’s politics.”

-Bill Murray

Comments