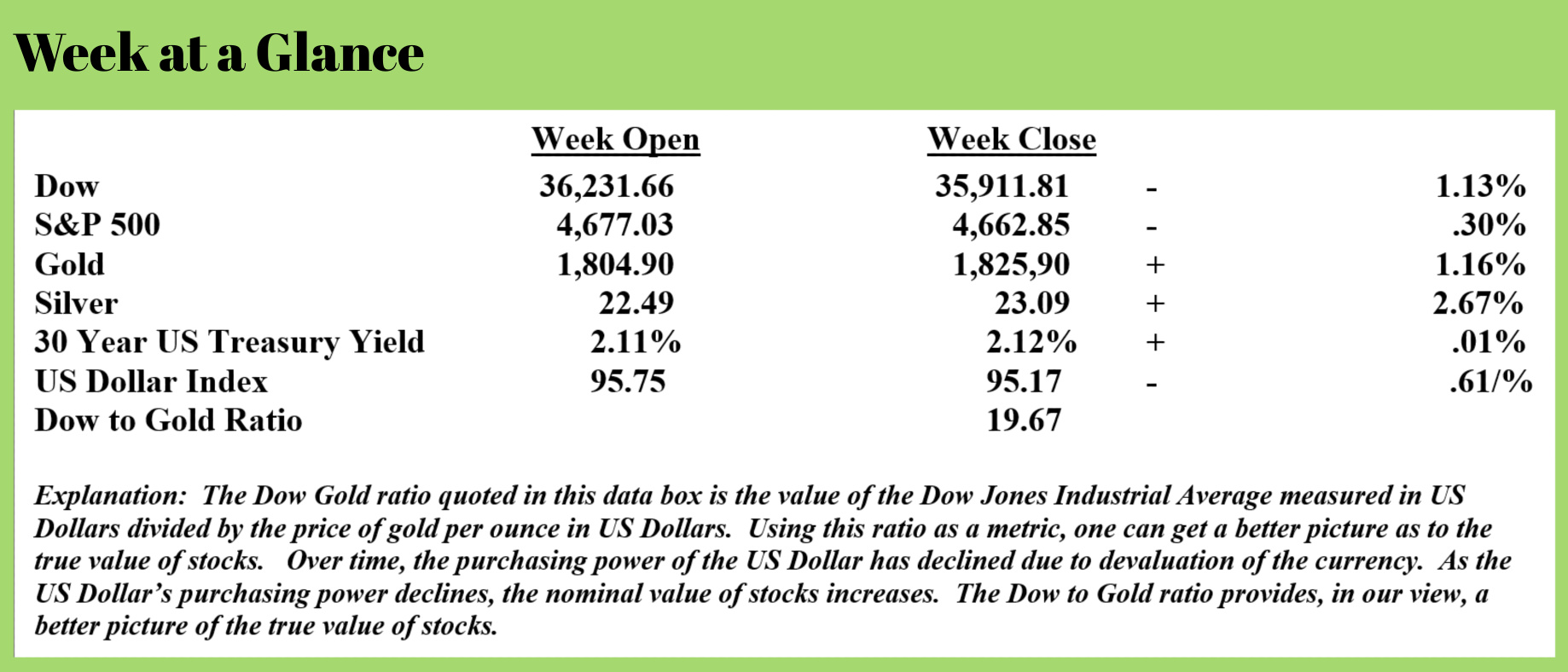

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The potential double top in stocks theory that I put out a couple of weeks ago is still holding after last week’s price action in stocks.

While it remains too early to tell, there are many signs that the stock market may be ready to decline. It is my view that most of the gain in stocks seen since the financial crisis of a dozen years ago is attributable to the artificial market environment created by the easy money policies of the Federal Reserve.

Ironically, since the financial crisis, which was caused by excessive debt, debt worldwide has increased exponentially. A piece published this week by Egon von Greyerz does a nice job of breaking down the numbers (Source: https://goldswitzerland.com/coming-market-madness-could-take-70-years-to-recover/)

The year 2022 will most likely be the culmination of risk. An epic risk moment in history that very few investors will see until it is too late as they expect to be saved yet another time by the Fed and other central banks.

And why should anyone believe that 2022 will be different from any year since 2009 when this bull market started? Few investors are superstitious and therefore won’t see that 13 spectacular years in stocks and other asset markets might signify an end to the epic super-bubble.

The Great Financial Crisis (GFC) in 2006-9 was never repaired. Central bankers and governments patched Humpty up with glue and tape in the form of printed trillions of dollars, euro, yen etc. But poor Humpty Dumpty was fatally injured and the intensive care he received would only give him a temporary reprieve.

When the GFC started in 2006, global debt was $120 trillion. Today we are at $300t, rising to potentially $3 quadrillion when the debt and derivatives bubble finally first explodes and then implodes as I explained in my previous article.

It is amazing what fake money made of just air can achieve. Even better of course is that the central banks have manipulated interest rates to ZERO or below which means the debt is issued at zero or even negative cost.

Investors now believe they are in Shangri-La where markets can only go up and they can live in eternal bliss. Few understand that the increase in global debt since 2006 of $180t is what has fueled investment markets.

Just look at these increases in the stock indices since 2008:

Nasdaq up 16X

S&P up 7x

Dow up 6X

And there are of course even more spectacular gains in stocks like:

Tesla up 352X or Apple up 62X.

These types of gains have very little to do with skillful investment, but mainly with a herd that has more money than sense fueled by paper money printed at zero cost.

To call the end of a secular bull market is a mug’s game. And there is nothing that stops this bubble from growing bigger. But we must remember that the bigger it grows, the greater the risk is of it totally wiping out gains not just since 2009 but also since the early 1980s when the current bull market started.

The problem is also that it will be impossible for the majority of investors to get out. Initially they will believe that it is just another correction like in 2020, 2007, 2000, 1987 etc. So greed will stop them from getting out.

But then as the fall continues and fear sets in, investors will set a limit higher up where they intend to get out. And when the market never gets there, the scared investor will continue to set limits that are never reached until the market reaches the bottom at 80-95% from the top.

And thus paper fortunes will be wiped out. We must also remember that it can take a painstakingly long time before the market recovers to the high in real terms.

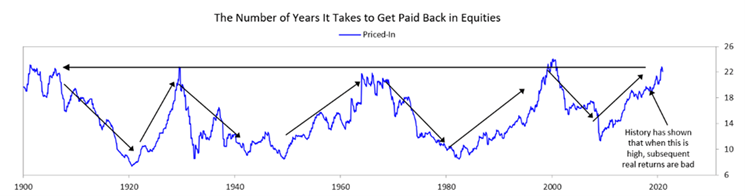

As Ray Dalio shows in the chart below, the 1929 high in the Dow was not even recovered in real terms by the mid-1960s. Finally, it was surpassed in 2000.

This means that it took 70 years to recover in real terms! So investors might have to wait until 2090 to recover the current highs after the coming fall.

So looking at the chart, the market is now at a similar overvalued level it was in 1929, 1972 and 2000.

Thus the risk is as great as at some historical tops in the last 100 years.

The chart below shows that the 1929 top in the Dow was not reached in real terms until 2000.

How many investors are prepared to take the risk of a say 90% fall like in 1929-32 and not recover in real terms until by 2090!

Again, I repeat that this is not a forecast. But it is an epic warning that risk in investment markets are now at a level that investors should avoid.

I fear that sadly very few investors will heed this risk warning.

In his piece, von Greyerz explains that the causes of the financial crisis were excessive debts, huge derivative exposure, and massive unfunded liabilities. In 2009 at the time of the financial crisis, the combined total was about $120 trillion.

Today, thanks to easy money policies that $120 trillion number has risen to $300 trillion – an increase of 250%!

That’s truly remarkable when you consider it.

As von Greyerz notes in his article, this problem has been building for a very long time and may be culminating presently. Here is another excerpt from his article:

As I have pointed out many times, the US has not had a budget surplus since 1930 with the exception of a couple of years in the 1940s and 50s. The Clinton surpluses were fake as debt still increased.

But the money and market Madness started in the 1970s after Nixon couldn’t make ends meet and closed the gold window. The US federal debt in 1971 was $400 billion. Since then, the US debt has grown by an average of 9% per year. This means that the US debt has doubled every 8 years since 1971. We can actually go back 90 years to 1931 and find that US debt since then has doubled every 8.3 years.

What a remarkable record of total mismanagement of the US economy for a century!

The US has not had to build an empire in the conventional way by conquering other countries. Instead, the combination of a reserve currency, money printing, and a strong military power has given the US global power and a global financial empire.

Even worse, since the coup by private bankers in 1913 to take control of the creation of money, the US Federal debt has gone from $1 billion to almost $30 trillion.

As Mayer Amschel Rothschild poignantly stated in 1838:

“Permit me to issue and control the money of a nation and I care not who makes its laws”.

And that is exactly what some powerful bankers and a senator decided on Jekyll Island in 1910 when they conspired to take over the US money system through the creation of the Fed which was founded in 1913.

It was this takeover of the creation of money by the private bankers that has landed us where we now find ourselves- on a path of inflation to be followed by deflation as I have been discussing.

While my crystal ball doesn’t work any better than anyone else’s does, it seems we are nearing the inevitable end of the cycle.

Are you prepared?

This week’s radio program features an interview with Market Analyst, Dr. Charles Nenner. I get Dr. Nenner’s forecast for all markets as well as cryptocurrencies moving through 2022.

Dr. Nenner has a terrific track record when it comes to predicting the movements of financial markets using his cycle analysis. You can listen to this terrific interview now by clicking on the "Podcast" tab at the top of this page.

“Our lives begin to end the day we become silent about things that matter.”

-Martin Luther King, Jr.