Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

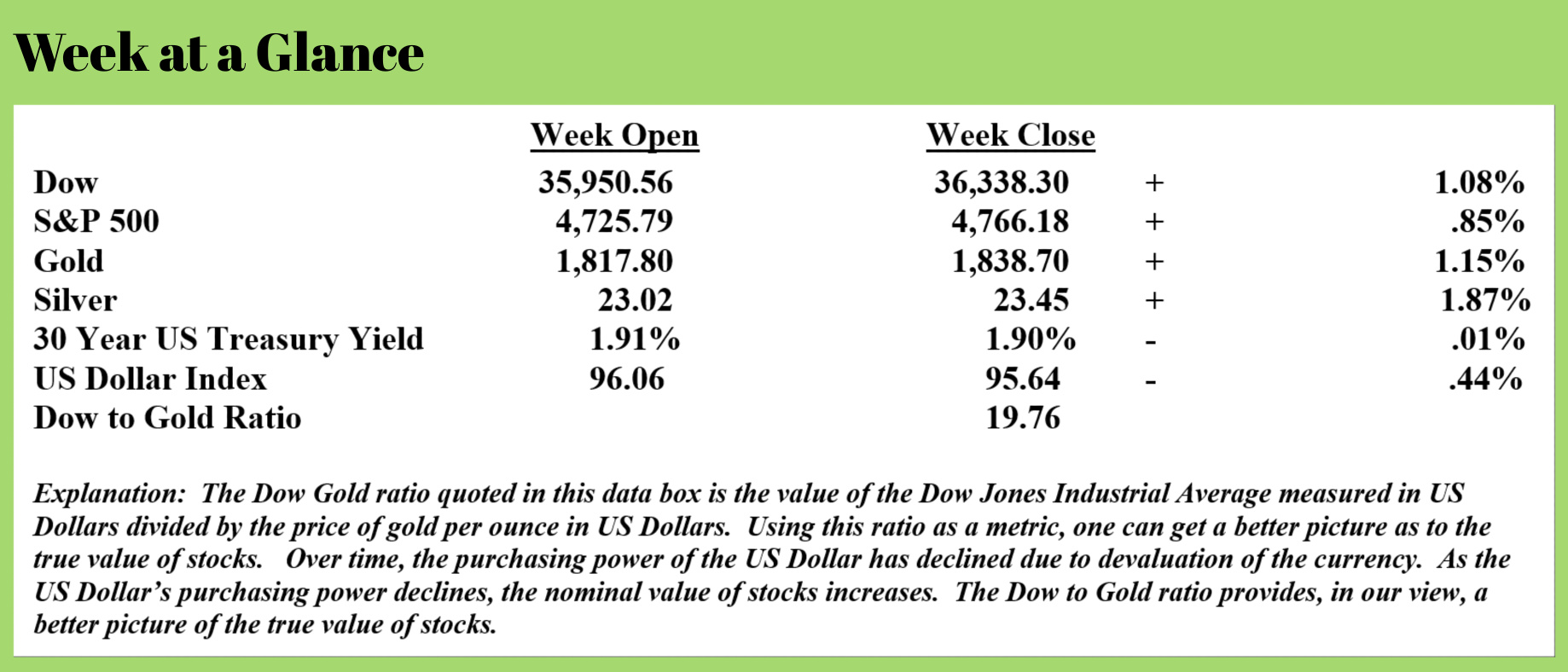

Last week, stocks touched their all-time high levels from November completing a “Santa” rally. At this point, it remains to be seen what this means. Since my long-term stock trend-following indicators are negative, I’d have to bet on a double top, which is a bearish pattern, but time will tell.

January is typically an important month in the markets. Stock performance in January often accurately forecasts stock performance for the year. I will continue to monitor and comment.

On the topic of stocks, commentator Harris Kupperman compared some stocks in the current market to a Ponzi scheme. There are many publicly traded companies that have never made a profit that continue to exist via capital raises from investors. Obviously, you don’t need to be a seasoned, savvy market analyst to realize this is a game that is only temporary.

As someone who has been around markets and analyzed them for a while, what we are presently seeing in markets is eerily reminiscent of market behavior and stock valuations as the tech stock bubble of about 20 years ago peaked. Except this time around, the collective behavior of market participants is even more erratic and more irrational.

I think back 20 years to a company called pets.com. The company was in the business of selling pet supplies online. The company launched its business with a Super Bowl commercial featuring a white sock puppet.

Pets.com raised $82.5 million in an initial public offering, selling its stock for $11 per share. Nine months later, having never turned a profit, the company declared bankruptcy as its share price plummeted to 11 cents.

As Yogi Berra famously proclaimed, it’s déjà vu all over again.

Here is a bit of what Mr. Kupperman had to say on the topic last week (Source: https://wolfstreet.com/2021/12/26/the-problem-with-ponzis/)

Over the past few years, I’ve been highly critical of the Ponzi Sector. This is a whole grouping of companies that has no ability or desire to ever become profitable. Instead, these businesses have focused on rapid revenue growth because the stock market has rewarded them for this growth—especially if there are no profits. In reality, stock promotion is the core business of the Ponzi Sector—it allows the companies to raise capital and fund unprofitable growth, while insiders dump stock at insane valuations. Now, as the Ponzi Sector equities go into free-fall, a problem has emerged.

Let’s look at Peloton, the overpriced clothes rack with a built-in iPad. We just witnessed the best possible 6-quarter environment that the company will ever experience. The whole world was locked down, gyms were closed, and work was canceled. People literally sat at home, bored out of their wits, armed with massive government stimulus checks, fixated on buying products. Despite every possible tailwind, Peloton lost $189 million in the year ended June 2021. As the stimmies wore off, losses exploded to $376 million in the most recent quarter. If this business cannot make money in this perfect environment, what is the operating environment where it earns money?

Investors will say that the goal at Peloton is to lose money on the hardware and make it back on the subscription product. Sure, I can see how investors may fixate on the growing subscription business, but this is a fad fitness business, churn will be high and accelerating now that gyms have re-opened. The expected monthly annuity will underperform, and marketing will always be necessary to bring in more customers.

If you cut SG&A and marketing to a level where the annuity business revenue stays constant, this thing probably still loses globs of money or at best ekes out a small profit. Could you put this into run-off and harvest some residual value from the current membership base? Of course, you can, but that residual value is a tiny fraction of the current valuation. Instead, management is fixated on continuing the Ponzi Sector model of subsidizing consumers to grow revenue.

Unfortunately, the market psychology is changing and the whole Ponzi Sector is melting down—just look at the ARK Innovation ETF [ARKK], which is a well-curated basket of the largest listed Ponzi Schemes. As inflation accelerates, the market is losing patience with unprofitable growth that never seems to inflect.

The ARK Innovation ETF contains many technology and innovation stocks that have negative earnings. Two examples are Teladoc and Zillow.

We’ve gone over this in the past, but it’s worth a refresher here. Ponzi Schemes are inherently unstable. They’re either inflating or detonating. They cannot exist in a state of equilibrium. Once past the peak, they tend to unravel rapidly, as many participants know it’s a Ponzi Scheme and dump when the shares stop rising. The collapse is then accelerated by corporate action.

When a Ponzi is appreciating, stock option exercises can fund the business. Once below the exercise price, there are no cash inflows from options. Instead, you need to issue equity to fund the business. Except, there’s a shrinking pool of investors who will buy into financing at a value-destructive company.

You see, investors want to believe that there won’t be another financing in a few quarters. They’ll want spending to be reined in. They’ll want a path to profitability.

Except, when you cut spending, growth collapses, yet the business will still be nowhere near profitable. When it was growing fast, it was easy to claim you were the next Amazon and profits don’t matter. When you’re not growing, or even shrinking, what exactly is your justification for losing money? It’s a typical death-spiral conundrum. Burn capital to show profitless growth, or cut spending and show smaller losses while the business shrinks.

Returning to Peloton, I get that there’s a loyal customer base and I’m absolutely convinced that there’s a residual business here on the subscription side. However, it’s likely to be a few hundred million of shrinking annual cash flow per year. Put a mid-single-digit multiple on that and what do you have? Exactly!! The stock could drop 90% and still be overvalued.

As a result, no one wants them to shrink towards profitability. Instead, investors are demanding that Peloton use the proceeds of down-round financings to incinerate capital, trying to outgrow the problem. Except, they likely cannot outgrow the problem as everyone who wanted a Peloton has one by now. Spending on growth will have diminishing returns. Yet, what choice do they have, besides losing more per unit and hoping to make it up in volume?

I remember seeing a similar problem in 2000 and into 2002 as internet companies tried to continue their prior growth, buying banner ads, convinced that if they could just show revenue growth, eventually the shares would recover, allowing them to issue more shares and fund more unprofitable revenue. As investors grew tired of this, the down rounds were more drastic, until the companies ran out of suckers and the businesses were wound up.

The same will happen to everyone in the Ponzi Sector. First, they’ll try and out-grow the problem by throwing equity capital at it, then they’ll resort to cost cuts, which will send revenue growth negative, which will make it even harder to raise capital and fund losses. Once investor psychology changes and no longer rewards profitless market share growth, the feedback loop only accelerates the problems for these companies.

The most recent capital raise by Peloton at $46, is indicative of how painful this will be. The shares are now at $39 and everyone who bought at $46 is underwater. Do you think they’ll step up as aggressively for the next down-round?

What if the whole Ponzi Sector is doing down-rounds at the same time? Will there be enough suckers to fund all of these Ponzis? They’ll all need someone to cough up more capital in a few quarters.

Now, I’m not saying Peloton has done anything illegal or immoral. I singled it out because it doesn’t seem to fit the model in most people’s minds of a Ponzi, yet it is. Many of the most successful Ponzi Sector stalwarts have been well-loved consumer products, led by people who genuinely believe they’re improving the world. Investors rewarded them for growing fast, so they did. Now, patience is running thin. Especially when investors are losing money on multiple Ponzi Sector investments simultaneously. Logic says that Peloton cannot grow into profits, it needs to shrink its way there, but that’s going to be a nasty and highly dilutive journey.

At the outset of this week’s “Portfolio Watch”, I compared the current stock market conditions to the stock market conditions that existed 20 years ago at the time of the tech stock bubble.

Longer-term readers of this publication know that I often use Warren Buffet’s favorite stock market valuation measure when looking at stock valuations. It’s the market capitalization to gross domestic product ratio which takes the value of all stocks and divides it by economic output.

The chart below uses the Wilshire 5000, a broad stock market index in the analysis. Notice from the chart that in 2000, at the tech stock bubble peak that we have been discussing the market cap to GDP was about 150%.

That simply meant that the total value of stocks was about 150% of the total economic output.

At the time, that level of stock valuation was a historic high given that the average valuation of stocks over time had been about 65% of the total economic output.

Fast forward to the present. Stock valuations are now more than 200% of economic output or about three times the long-term historic average.

While there may be some additional upside in stocks, for many investors the downside risk far outweighs the reward potential.

This week’s radio program features a “best of” interview with Alasdair Macleod, Head of Research at Goldmoney.

I get Mr. Macleod’s updated inflation forecast. If you missed the recent interview with Alasdair Macleod, you can listen now by clicking on the "Podcast" tab at the tp of this page.

“The more specific you are about your resolution, the better your chance of sticking with it. Don’t just say, “I want to lose weight.” Say, “When my arm jiggles, I want it to look less like a pelican’s throat-pouch choking down a bass.”

-Colin Nissan