Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Will 2024 be the year that the US Dollar takes the big hit?

We’ll have to wait and see, but past RLA Radio guest Mr. Peter Schiff thinks so, and I agree. In a recent piece, Schiff suggested that the US Dollar could be in for a tough year for three reasons.

Here is a bit from Schiff’s piece (Source: https://schiffgold.com/peters-podcast/2024-could-be-horrible-for-the-dollar/):

1. The Fed wants to boost Biden’s reelection.

The Fed is deeply influenced by political dynamics, and with the 2024 presidential election around the corner, it’s already maneuvering to align with the political incumbent.

“I think that the Fed is going to be doing everything it can to try to reelect Biden or whoever may run if Biden does not… The Fed chairman always wants to play ball with whichever Administration is in power.”

This has less to do with blatant political bias and more to do with self-preservation.

The President plays a decisive role in appointing the Fed chair. Given this, Jerome Powell is incentivized to prioritize monetary policies that could boost a Biden reelection. And that’s exactly what we’re seeing.

The Fed already announced considerably lower interest rates in 2024 through 2025, strategically timed for this year’s US election.

Peter predicts that the Fed will continue its dovish, inflationary policies through the end of this election year.

I certainly think this is the case and have stated so in these pages previously.

But there is another reason, too.

There’s not much choice. The cost to service the massive Federal Government debt is skyrocketing. Debt levels are rising along with interest rates.

A “Zero Hedge” piece recently commented (Source: https://www.zerohedge.com/markets/us-debt-hits-record-34001-trillion):

... but since there is no way to reverse the catastrophic outcome, there is no point in even talking about it. At best, one may only prepare for the inevitable hyperinflationary outcome, which would be good news to what is now over $1 trillion in interest expense: after all, someone has to devalue the currency all that interest is payable in.

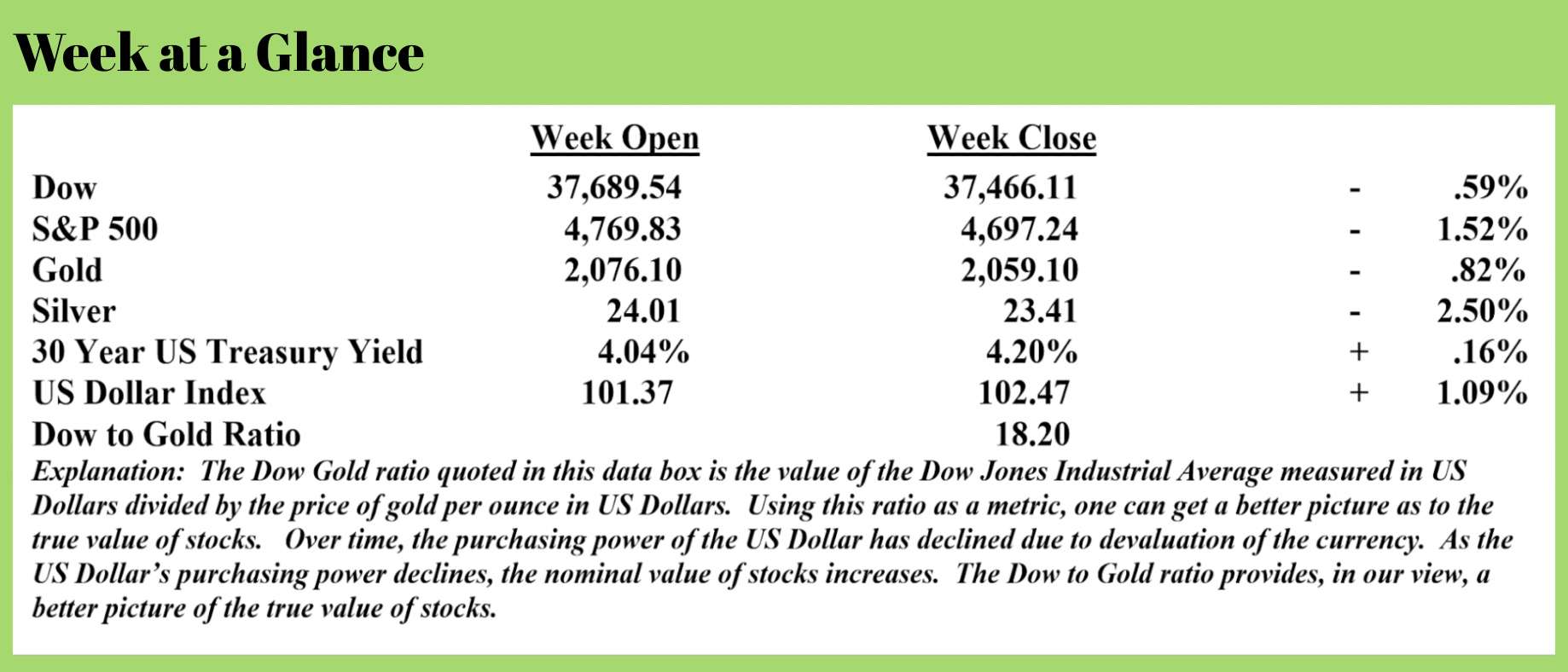

The “Zero Hedge” piece published this chart illustrating costs to service the US Government’s debt. Notice that interest costs now exceed $1 trillion per year as the official level of US Government debt is now over $34 trillion!

The “Zero Hedge” piece published this chart illustrating costs to service the US Government’s debt. Notice that interest costs now exceed $1 trillion per year as the official level of US Government debt is now over $34 trillion!

Back to Schiff’s other reasons for 2024 being a tough year for the US Dollar.

2. US Economic “Strength” Rides on Inflation

The perceived strength of the US economy is largely illusory, a facade created by inflationary policies rather than genuine economic growth.

Peter explains that higher stock market indexes and other financial indicators in 2023 reflect investor expectations of inflationary Fed stimulus rather than genuine economic progress:

“Investors are anticipating a big bond rally. That’s what they think. The Fed is going to going to go back to zero or close to it back to quantitative easing. And so they’re factoring all this in. They’re pricing this easing cycle into the markets now. They’re betting on it.”

Rather than ruin the bets of the broader economy and suffer a massive stock market collapse, the Fed would rather keep monetary policy loose. Congress, too, would prefer to maintain high budgets than risk losing reelection.

This all drives up inflation, which Peter dubs as “the only magic trick they have.”

In my New Retirement Rules Class, I intentionally use the term “prosperity illusion” to describe the US economy since the financial crisis.

Frankly, it doesn’t take a rocket scientist to figure this out. Think about it this way – if you have a credit card with no limit, allowing unlimited spending, things would seem prosperous – until the credit card was taken away.

While the US Government hasn’t lost the credit card completely, that outcome is inevitable. That’s not opinion: that’s simple, straightforward math.

Schiff’s reason three:

3. U.S. Trade Deficits Contribute

Peter links the dollar’s weakening to recent large U.S. trade deficits. A cheap dollar will mean higher commodity prices and even higher trade deficits, which in turn will undermine the dollar further.

Peter explains:

There’s no way that inflation is going to come down in an environment where the dollar is that weak because that’s going to really push up commodity prices. That’s going to push up our trade deficit… These big trade deficits are going to weigh heavily on the dollar.”

We’re entering a classic scenario where a depreciating currency contributes to domestic inflation. Trade deficits are not just a symptom of economic issues but also a causative factor in the declining value of the dollar.

As long as the U.S. continues to run these deficits, the pressure on the dollar will persist.

Schiff went on to point out that the Swiss Franc has been one beneficiary of the US Dollar’s decline:

In 2023, the Franc was up a whopping 10%:

That is a very negative sign for the dollar for 2024 and a positive sign for gold because people are buying the Swiss franc as a safe haven. Gold is an even safer haven than the Swiss franc, but the fact that the Swiss franc is gaining so much on the dollar is an indication that people are leery of the dollar.”

I believe that Schiff is correct in stating that gold is an even better dollar devaluation hedge than the Swiss franc.

Looking at gold’s price action over the past four months, one sees that 2024 could be positive for gold and negative for the US Dollar.

The chart on this page is a daily price chart of an exchange-traded fund that tracks the price of gold. Note the uptrend line on the chart.

The chart on this page is a daily price chart of an exchange-traded fund that tracks the price of gold. Note the uptrend line on the chart.

If you have not yet ‘currency diversified’ in your portfolio, now is the time for action. Feel free to request a precious metals buyer’s guide at www.PLPMetals.com.

The radio program this week features a ‘best of’ interview that I did with Dr. Robert McHugh, a brilliant technical analyst of markets. If you haven't heard the program or want to listen again, click on the "Podcast" tab at the top of this page to find the show.

“Instead of politicians, let the monkeys govern the countries; at least they will steal only the bananas.”

-Mehmet Murat Ildan

Comments