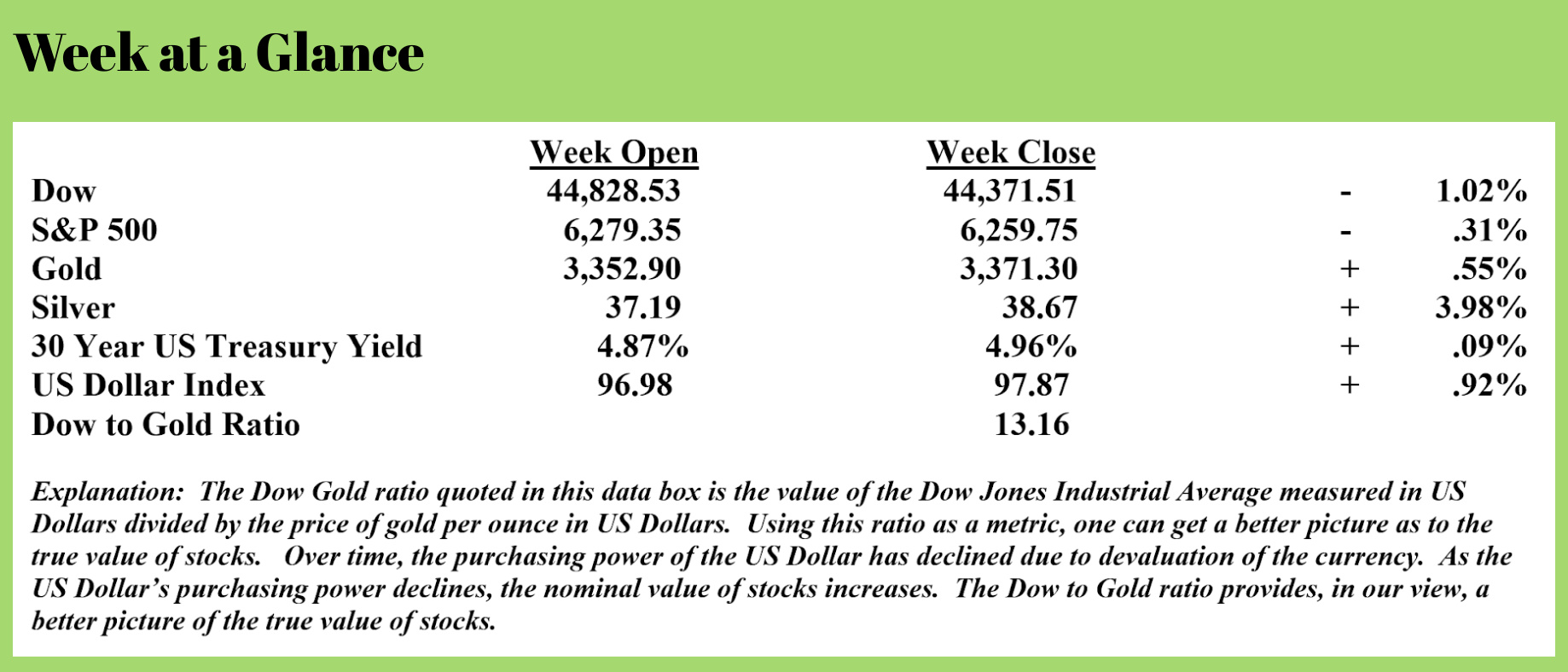

Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

“Silver Breaks Out”

Earlier this year, when the gold-to-silver ratio exceeded 100, I suggested that silver may be poised to outperform gold over the next twelve to twenty-four months. For reference, historically speaking, the gold-to-silver ratio has been about 50. (You can log in to www.RetirementLifestyleAdvocates.com and see the recommendation that I made by viewing the January 27, 2025, “Headline Roundup” newscast. If you don’t yet have a login to access the free resources on that site, you can go to the site and create a login at no cost. There are many free resources available there.)

Based on last week’s price action, silver’s breakout looks like it’s here. There are a couple of fundamental reasons to be bullish about silver’s prospects moving ahead.

First, there is a deficit between industrial demand and mining output. Manufacturing processes that use silver consume more silver than mining companies are currently producing, to the tune of about 200 million ounces each year.

Second, worldwide debt has reached an all-time high, and the recent tax legislation passed by Washington politicians and signed into law ensures that the US government will operate with deficits for as far as the eye can see. At some point, given the massive levels of spending, the Federal Reserve will have to resort to more easy-money policies that will fuel inflation. As a result, precious metals, including silver, will probably be a good place to store wealth.

The chart below shows silver’s price action last week. I expect much higher silver prices moving ahead.

Three Choices; None Good

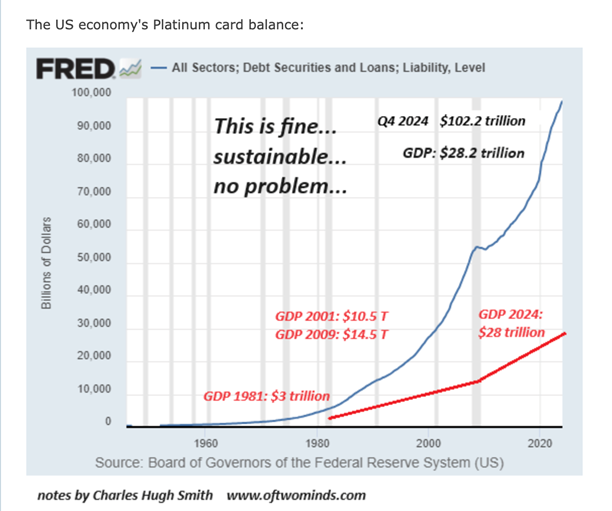

Past RLA Radio guest, Mr. Charles Hugh Smith, wrote a piece with that title last week. (Source: www.oftwominds.com/blog.html)

In the piece, Mr. Smith outlines the debt predicament in which we now find ourselves. He provides ample evidence of the massive debt problem we face by showing charts illustrating current US Government debt, overall US debt, student loan debt, and expenditures for Medicare and Medicaid. All the charts are parabolic in nature, like the one republished here of overall US debt.

debt.

He correctly notes that there are only three options at this point to deal with the debt.

One, run up the debt to the point that no one would be dumb enough to loan us more money, and then default on the debt. Smith suggests that since the wealthy own the debt, receive an income stream from the debt, and are highly influential in policy decisions, this option can likely be eliminated.

Two, inflate the debt away. In essence, this is borrowing dollars and paying back dimes. This approach can work for a while, but eventually the system collapses.

Three, scrap all the programs contributing to the growing debt problem, like defense spending, Social Security, Medicare, Medicaid, and higher education, and start over, spending only what we can afford. This is the equivalent of giving up smoking by going cold turkey.

Smith adds that not making a choice is a ‘greased slide to collapse’.

As I have often stated here in this publication, the level of debt that exists in the world presently is unpayable, and the rate at which new debt is being added is unsustainable. The question moving ahead is not if there will be a debt-fueled deflationary reset; rather, the question is when the debt-fueled deflationary reset will occur.

Presently, by default, we are pursuing option two, but at some future point, when we reach the debt tipping point, option three will be forced upon us.

Have you positioned your finances to allow you to survive, perhaps even prosper, when these eventualities emerge?

RLA Radio

The RLA radio program this week features an interview that I conducted with Mr. Karl Deninger of market-ticker.org. Karl and I talk about the real cause of obscene medical costs and the health of the US economy. You can listen to the interview now by clicking on the "Podcast" tab at the top of this page.

Quote of the Week

“The first time I see a jogger smiling, I’ll consider it.”

-Joan Rivers

Comments