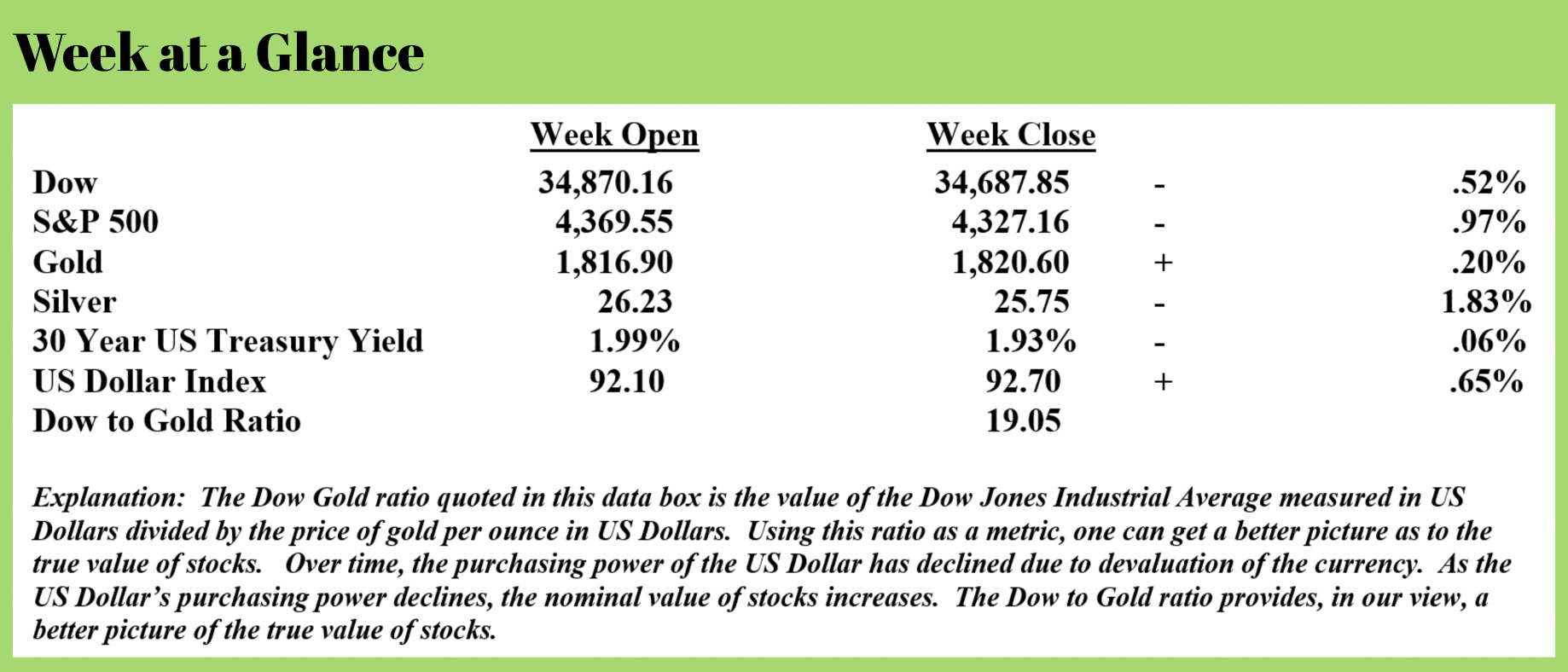

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Fed leadership and some politicians have insisted that inflation is transitory or temporary and that once the economy fully reopens, things will return to a more ‘normal’ state as far as inflation is concerned.

They may now be changing their tune a little or at least hedging their bets. Treasury Secretary, Janet Yellen said last week that Americans can expect more inflation than was indicated initially. (Source: https://www.cnbc.com/2021/07/15/yellen-sees-several-more-months-of-rapid-inflation-worries-about-impact-on-home-buyers.html0) (emphasis added):

Treasury Secretary Janet Yellen cautioned Thursday that prices could continue to rise for several more months, though she expects the recent startling inflation run to ease over time.

In a CNBC interview, the Cabinet official added that she worries about the problems inflation could pose for lower-income families looking to buy homes at a time when real estate values are surging.

“We will have several more months of rapid inflation,” Yellen told Sara Eisen during a “Closing Bell” interview. “So I’m not saying that this is a one-month phenomenon. But I think over the medium term, we’ll see inflation decline back toward normal levels. But, of course, we have to keep a careful eye on it.”

The consumer price index, which measures costs for a wide range of items, increased 5.4% in June, the fastest pace in nearly 13 years. Excluding food and energy, the gauge rose 4.5%, the fastest acceleration in nearly 30 years. Prices that goods and services producers receive for their products jumped 7.3%, a record for data going back to 2010.

Also, housing prices in the nation’s largest cities climbed nearly 15% in the most recent measurements from S&P CoreLogic Case-Shiller.

All of that has added up to concern that inflationary pressures could stall the aggressive U.S. economic recovery, with the housing escalation raising fears of a bubble.

“So I don’t think we’re seeing the same kinds of danger in this that we saw in the runup to the financial crisis in 2008,” Yellen said. “It’s a very different phenomenon. But I do worry about affordability and the pressures that higher housing prices will create for families that are first-time homebuyers or have less income.”

I’d like to make a prediction – the inflation narrative will continue to change as inflation becomes increasingly, painfully obvious. The narrative has already changed from transitory to some persistent inflation. When the narrative changes again, there will be something or someone to blame other than Fed policy.

The narrative will HAVE to change; the officially reported inflation numbers are attention-getting and the officially reported numbers are a far cry from reality. This from Birch Group (Source: https://www.birchgold.com/news/thirty-year-inflation/?msid=94970&utm_source=market_update&utm_campaign=newsletter_071721&utm_medium=email):

Consumer prices increased 5.4% in June from a year earlier, the biggest monthly gain since August 2008.

That’s what Jamie Cox of Harris Financial Group meant when he told CNBC, “The headline CPI numbers have shock value, for sure.”

Yes indeed. This is the largest one-month jump since 2008. If you take the “lowest of the lowball” Core CPI measure, which ignores food and energy prices (because nobody really needs to eat, right?) the June annual inflation rate is only 4.5%, the biggest jump in 30 years.

The article called this rise “higher than expected.” That’s one way of putting it. Like saying a wreck that totals your car is “inconvenient.”

We shouldn’t worry, though! This is just transitory, just a blip of supply chains and post-pandemic pressures relaxing. Remember?

Well, not everybody’s buying that anymore.

Sarah House, senior economist for Wells Fargo, said:

‘What this really shows is inflation pressures remain more acute than appreciated and are going to be with us for a longer period. We are seeing areas where there’s going to be ongoing inflation pressure even after we get past some of those acute price hikes in a handful of sectors.’

“More acute than expected” means, higher than the Fed said.

“For a longer period” means, longer than the Fed said.

“A handful of sectors,” hmm. Let’s take a closer look at that.

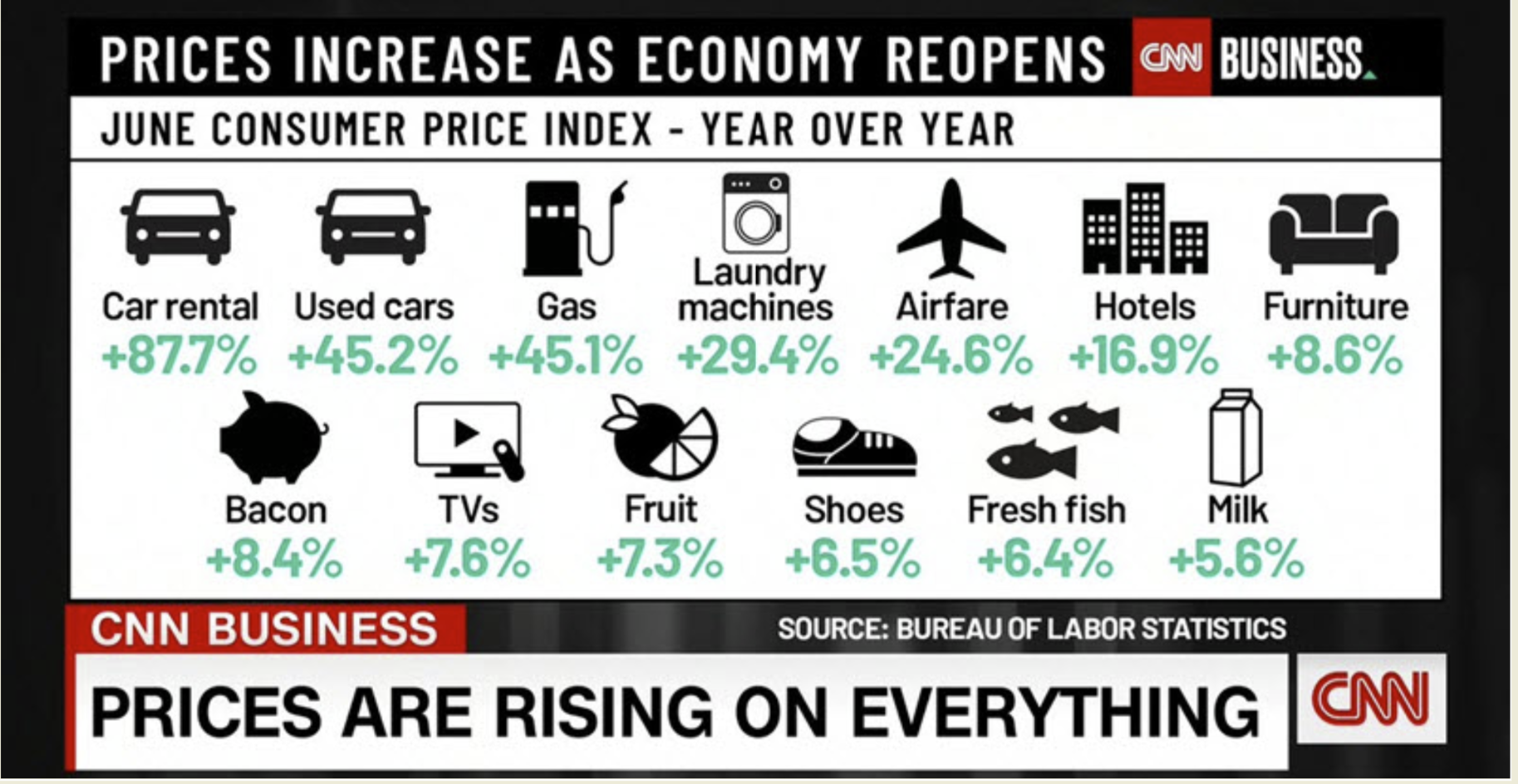

Here’s a CNN snapshot of the current inflation situation. It’s incomplete but more realistic than the vague numbers we discussed previously.

Ms. House’s “handful of sectors” turned into these thirteen specific price categories, according to CNN.

Ms. House’s “handful of sectors” turned into these thirteen specific price categories, according to CNN.

Admittedly, there is a bit of cherry-picking going on. Overall, food prices have increased 2.4% year over year, so if you don’t eat bacon or fruit or fresh fish or drink milk, your grocery bill hasn’t gone up quite as much.

Although this number didn’t make it onto CNN’s graphic, a New York Fed survey anticipates:

- +9.4% healthcare prices

- +6.2% housing prices

- +9.7% rent payments

It’s really difficult to look at these numbers and understand how they all add up to an overall inflation rate of 5.4%… Still, personal inflation rates are idiosyncratic. If you eat bacon and fruit every day, you’re going to pay more for groceries than people who only eat canned beans and ramen. If you work in transportation, the huge increase in gas prices are probably your major concern.

Your individual situation dictates just how much you’re hurting from inflation. Generally speaking, though, these price rises affect the entire nation.

Inflation affects everyone.

Inflation is just another tax.

The current crop of policymakers are following the actions of many policymakers at various times historically. When debt levels get high enough and can no longer be addressed via tax increases, only two options remain – cut spending or print currency.

When a currency is created and inflation results, goods, and services cost more for everyone. This additional cost for goods and services is a tax that disproportionately affects the poor; those that currency creation was ostensibly going to help.

The numbers bear that out.

I’m excited to report that this week’s RLA radio program features an interview with Mr. Jim Rogers, the international investor, and author.

Jim was the co-founder of the wildly successful Quantum Fund.

I caught up with Jim by ZOOM from his offices in Singapore. He is a true gentleman and a very bright investor. I ask him where he is investing presently and what advice he would offer our listeners.

You won’t want to miss the interview.

You can listen to the show now by clicking on the "Podcast" tab at the top of the page. You'll also find the weekly “Headline Roundup” webinar by clicking on the "Blog" and then "YPW Live Webinar". If you don’t yet own the app, just go to the app store on your phone and search for “YOURRLA”. You can download the app for free and get access to all of our free resources.

“Success is the ability to go from one failure to another with no loss of enthusiasm.”

-Winston Churchill