Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

“GENIUS Act Becomes Law”

Last week, President Trump signed the GENIIUS Act into law. GENIUS is an acronym for Guiding and Establishing National Innovation for U.S. Stablecoins.

Under the new law, banks, credit unions, and fintechs can get licenses to issue stablecoins. If you’re not familiar, a stablecoin is a cryptocurrency that is linked to something else, commonly the US Dollar.

A stablecoin linked to another asset, like the US Dollar, may not experience the same level of volatility as a cryptocurrency without such a link. For example, the granddaddy of all cryptocurrencies, Bitcoin, can experience wild price fluctuations. Over the past year, the price of one Bitcoin in US Dollars has ranged from about $50,000 to $120,000.

The GENIUS Act mandates that licensed issuers of stablecoins need to have at least one US Dollar in reserves for every one dollar of issued coin. Issuers of stablecoin will now be subject to regulatory scrutiny as well to ensure that reserves held by stablecoin issuers are held in acceptable vehicles like US Treasuries.

So, how will the GENIUS Act affect you? While time will tell the full story, here are some of my thoughts.

Since stablecoins allow for easy payments instantaneously anywhere on the planet without the need for a bank account, this law will create competition for banks, which explains the fast reaction by banks to get in on the stablecoin movement. Both Bank of America and JP Morgan Chase are launching stablecoins targeted at consumers.

There will also likely be some discounts from retailers for customers paying in stablecoin. Since the retailer doesn’t pay a credit card discount on transactions using stablecoin, many retailers may offer to kick back some of the discount to retail shoppers.

The bad news about this bill?

Many stablecoins will be linked to the US Dollar, which is being avoided when possible by much of the rest of the world, BRICS (Brazil, Russia, India, China, South Africa) countries in particular.

In my view, some stablecoins may offer advantages for use in commerce, but precious metals and other tangible assets will offer a much better vehicle to use when storing wealth.

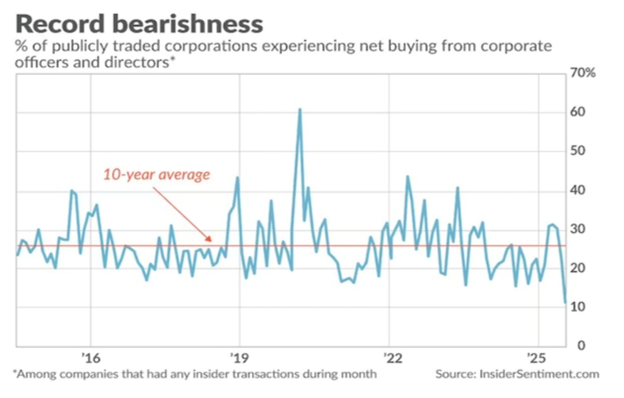

Hulbert: Corporate Insiders Extremely Bearish

Financial journalist Mark Hulbert noted this past week that corporate insiders are more bearish than ever.

Financial journalist Mark Hulbert noted this past week that corporate insiders are more bearish than ever.

Note from the chart on this page (Source: https://thefelderreport.com/2025/07/19/corporate-insiders-have-never-been-more-bearish/) that going back in time more than 10 years, there has never been more insider selling than is occurring presently. That means that corporate insiders, the people ‘in the know’ are selling on a net basis.

As Jeremy Grantham said last week (same source as above), “Don’t be conned into being super optimistic by the industry that makes money from overconfidence. Look around for signs of crazy bubble behavior, which we have seen as splendidly in these last several years as we have ever seen in history.”

If you aren’t familiar with Grantham, he is a British investor and the chief investment strategist of GMO, LLC. He recently advocated that investors should “sell everything now”. (Source: https://www.msn.com/en-us/money/topstocks/sell-everything-now-jeremy-grantham-s-final-warning/vi-AA1IlNHE)

Debt Will Cause Deflation in Real Terms

This is a topic on which I have been commenting for a very long time. Since every currency in the world today is debt (including stablecoins linked to fiat currencies), when debt reaches levels that are simply unpayable, deflation will be the economic outcome.

While I have reported in the past about the high level of delinquencies relating to credit card debt and mortgage debt, automobile debt is also suffering high levels of delinquency.

Auto loan delinquencies just hit a level that exceeds any quarter during a recession on record. The first quarter of 2025 saw 1.4% of borrowers at least 60 days past due on payments. That data is from the credit reporting agency TransUnion.

Those numbers are up 5 basis points from one year ago and now exceed the peak level seen during the Great Financial Crisis in calendar year 2009.

While the 1.4% number may sound low, it’s the highest auto loan delinquency rate in more than 15 years. The average auto loan balance is up more than 16% year-over-year, insurance costs have risen more than 54% since 2020, and maintenance costs are up more than 30% over the same time frame. (Source: https://citizenwatchreport.com/auto-loan-delinquencies-hit-record-high-trump-signs-2-5b-surveillance-bill-facial-recognition-plate-readers-24-7-tracking/#google_vignette)

When looking at the number of auto loans 90 days or more delinquent, the percentage rises to 2.9%. That’s about one in thirty-three loans that are more than 90 days past due. Total automobile debt now stands at more than $1.6 trillion.

History teaches us that currency creation, like we have seen since the time of the financial crisis, leads to inflation followed by deflation in real terms.

Does your current investing strategy protect you from this emerging trend and put you in a position to potentially prosper?

RLA Radio

The RLA radio program this week features an interview that I conducted with Mr. Mark Jeftovic, publisher of “The Bitcoin Capitalist”. This interview is especially timely given that the GENIUS Act (as noted above) is now law. You can listen to the interview now by clicking on the "Podcast" tab at the top of this page.

Quote of the Week

“Drive-in banks were established so most of the cars today could see their real owners.” - E. Joseph Crossman

Comments