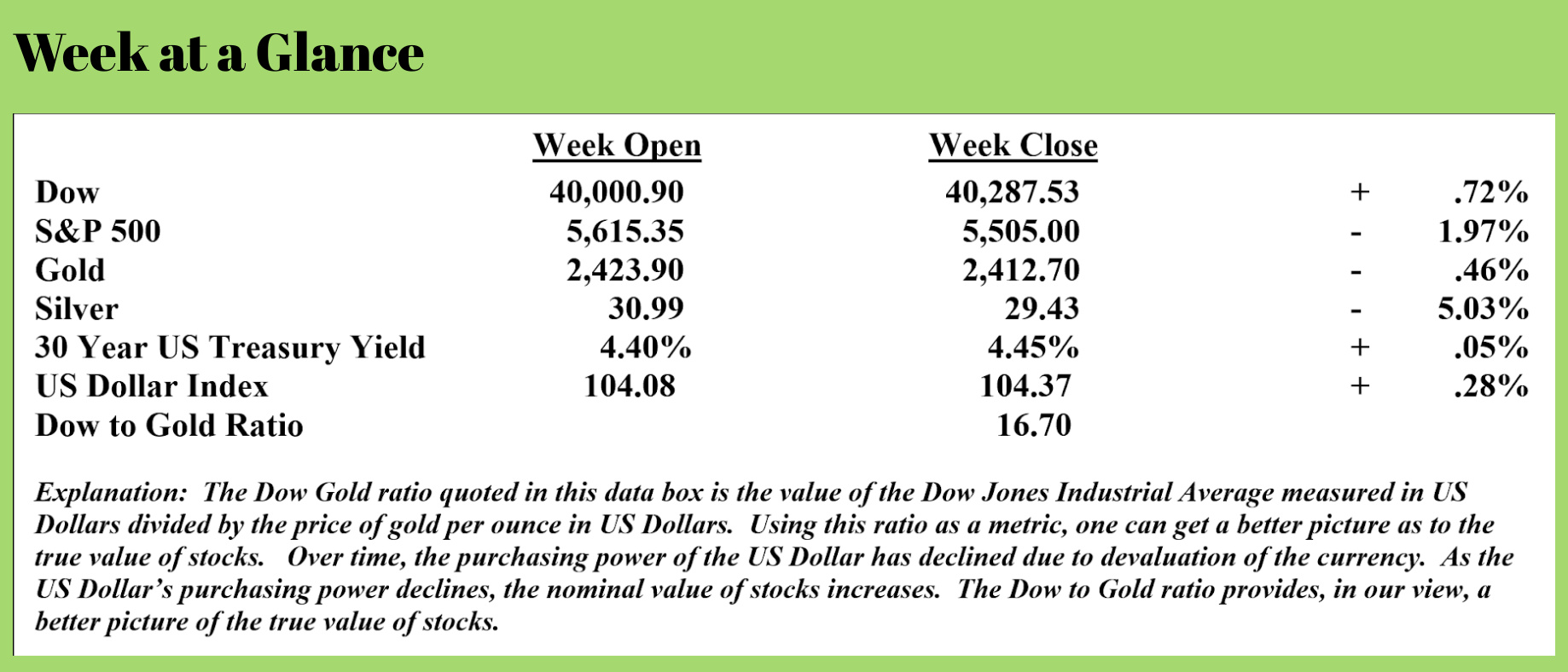

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

If there is one word that sums up the biggest threat to the economy, it’s debt. Both private sector debt and government debt will play a role in what could be the coming perfect financial storm.

US Government debt is simply out-of-control. The national debt of the United States stands at about $35 trillion. That’s a number that is nearly impossible to get one’s arms around but let me attempt to put it in perspective.

According to the National Debt Clock, to fully retire the debt, every American citizen would have to write a check for $103,565. But not all Americans are in a position to write a check for that amount.

For discussion’s sake, let’s narrow the math to include only American taxpayers in the calculation; we’ll exclude Americans who do not pay income taxes. The national debt spread only over US taxpayers would have each taxpayer writing a check for $266,953 to wipe out the debt.

The national debt has already grown to an unmanageable level. The harsh reality is it can never be paid. Please don’t shoot the messenger here; I reached this conclusion by doing 4th-grade math (at least it was 4th-grade math when I was in school).

The $35 trillion national debt of the United States is more than the total economies of China, Japan, Germany and the UK combined1.

Let’s look at this another way.

If you spent $1 million every day since the birth of Christ, you would not yet have spent $1 trillion.

If you line up dollar bills end-to-end, you could go to the moon and back about 203 times with $1 trillion. You could wrap those dollar bills around the earth approximately 3,893 times.

A trillion seconds is about 32,000 years.

Now take those mind-boggling examples and multiply by 35 and you begin to understand the magnitude of the national debt problem.

But the fiscal problems of the United States don’t stop there.

Social Security and Medicare are woefully underfunded. According to a recent report by the US Treasury, these programs are underfunded by more than $173 trillion. To put that number in perspective, $173 trillion dwarfs the gross domestic product (total economic output) of the entire planet. In 2023, total world gross domestic product was $104.5 trillion.

The $173 trillion number, adjusted for inflation, is nearly as much as our government has spent on everything since the Constitution was written in 1787.

If we add the official national debt to the unfunded liabilities of Social Security and Medicare, we arrive at a number of about $200 trillion. And, we haven’t included the unfunded liabilities of other government programs including Medicaid. I’ve seen estimates of the US total fiscal gap being more than $250 trillion!

According to the Federal Reserve, US households and non-profit organizations have a net worth of $161 trillion. The Federal Reserve tells us that corporations, excluding financial corporations, have a net worth of about $60 trillion. That’s a total net worth of $221 trillion. That means 100% of the wealth of households, non-profits, and non-financial corporations could be confiscated with a 100% wealth tax, and we still come up short.

As far as financial corporations are concerned, it’s not reasonable to expect that any assets could be put toward this losing cause. Despite Dodd-Frank, which was implemented to prevent future bank failures after the financial crisis, the notional value of derivatives has skyrocketed. Derivatives are basically side bets between banks where one bank insures another bank against portfolio fluctuations, typically fluctuations in interest rates. Total worldwide derivative exposure stands at about $1.5 quadrillion. That is an unfathomable number.

As a quick side note, one of the authors of Dodd-Frank, former Congressman Barney Frank, was on the Board of Directors of Signature Bank, one of the banks that recently failed and had to be bailed out6.

The bottom line is this.

The US Government has too much debt and too many unfunded liabilities to possibly pay. It won’t be long before the proverbial rooster will come home to roost.

As big a problem as government debt and unfunded liabilities are, this economic perfect storm has another component, record private sector debt.

The easy money and accommodative policies of the Federal Reserve have allowed private sector debt to balloon to levels that are also simply unmanageable and unpayable.

Presently, US private sector debt is about 220% of gross domestic product. That means for every dollar the economy produces, there is the private-sector debt of about $2.20. Let me put that in context for you.

The Great Depression of the 1930’s was arguably caused by debt excesses and led to the worst deflationary environment of the last 100 years, saw private sector debt at about 140 percent of the economy. That’s $1.40 in private-sector debt for every $1 of economic output.

The Great Depression of the 1930’s was arguably caused by debt excesses and led to the worst deflationary environment of the last 100 years, saw private sector debt at about 140 percent of the economy. That’s $1.40 in private-sector debt for every $1 of economic output.

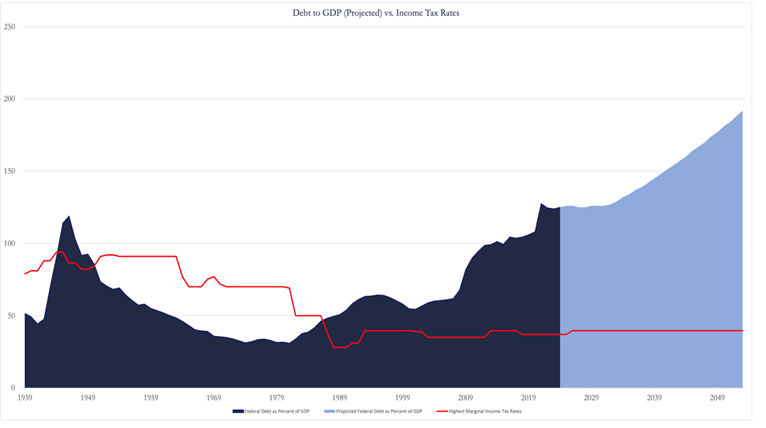

Alarmingly, private sector debt today is more than 50% higher when measured as a percentage of economic output than it was at the onset of the Great Depression. That one fact alone should make you extremely concerned, but when coupled with this next fact, it should put you on high alert. In 1929, US Government debt was about 17% of economic output or gross domestic product. Today, government debt is about 130% of economic output, as seen on the chart, which graphs US Government debt to gross domestic product along with top tax rates in effect at the time.

Let’s stop there and do some math. In 1929, prior to the onset of the worst deflationary period in the last 100 years, private sector debt was about 140% of gross domestic product, and US Government debt was about 17% of GDP. That’s a total debt of 157% of the economy. Presently, total public and private debt totals 350% of the economy. That’s well over twice the debt that existed in 1929 when a painful deflationary period materialized.

This week’s RLA radio program features an interview that I conducted with Dr. A Gary Shilling, publisher of “Insight” newsletter. Gary and I discuss the probablity of a US recession as well as his forecast for stocks and commodities.

The radio program is posted now and is available by clicking on the "Podcast" tab. The weekly Headline Roundup newscast is also posted there. If you haven’t yet done so, check out the free resources available on the website.

“After eating an entire bull, a mountain lion felt so good he started roaring. He kept it up until a hunter came along and shot him. The moral: when you’re full of bull, keep your mouth shut.”

-Will Rogers

Comments