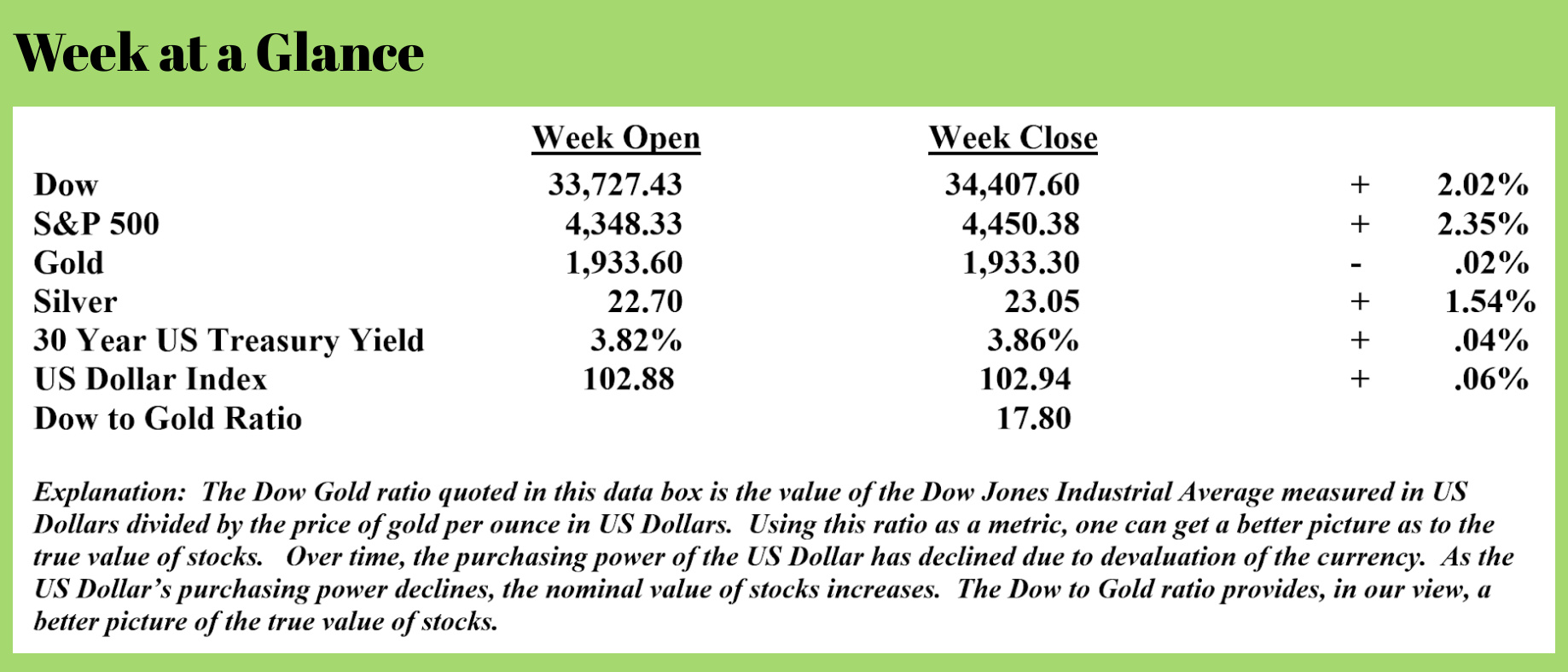

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

I have long held that the current investing environment has been artificial for more than the last decade. Higher stock and real estate prices have been fueled by currency creation and debt accumulation.

It now seems that we may be close to the reversal that I have been forecasting. While I fully expect the Federal Reserve to pull out all the stops and attempt to keep the bubble inflated, it remains to be seen if they will or if they will be successful should they once again opt for currency creation on a large scale.

In this week’s “Portfolio Watch,” I want to zero in on real estate. While the median home sale price is falling, there is another little-discussed factor that will probably be a big drag on real estate prices moving ahead.

What am I talking about?

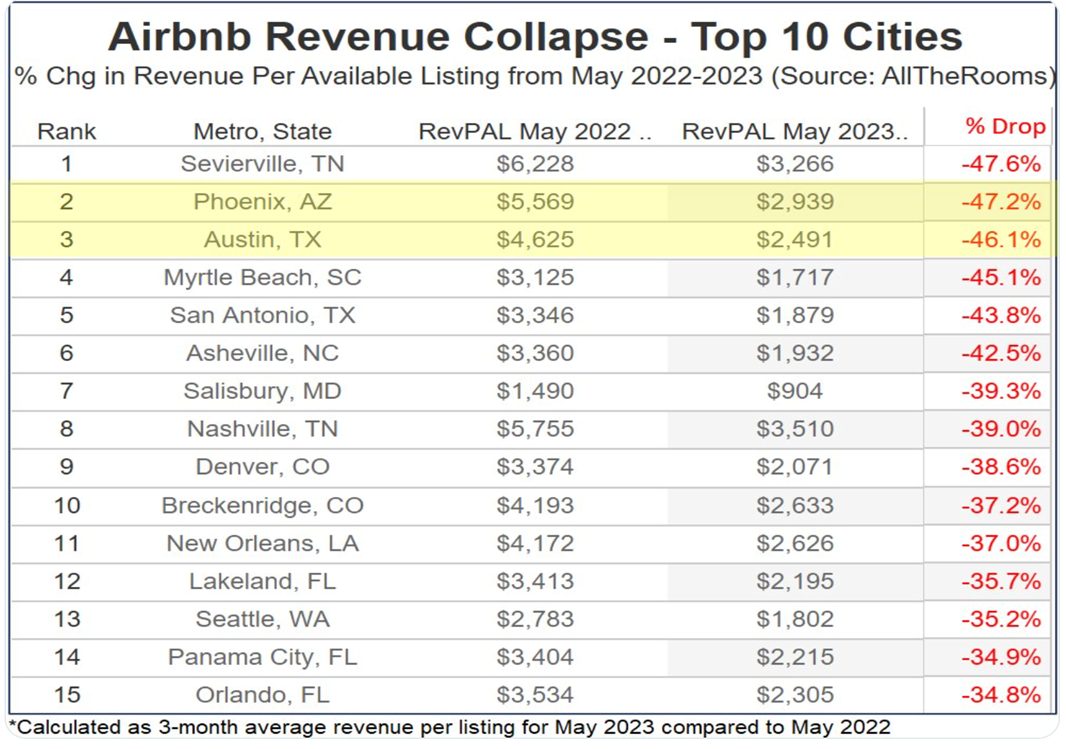

The considerable oversupply of Airbnb rentals and the enormous falling revenues on these rentals. This revenue cliff could lead to a lot of distressed selling on a lot of properties. Nick Gerli published an article outlining how big a problem this actually is. (Source: https://threadreaderapp.com/thread/1673774695693385728.html)

The Airbnb collapse is real.

Revenues are down nearly 50% in cities like Phoenix and Austin.

Watch out for a wave of forced selling from Airbnb owners later this year in the areas hit hardest by the revenue collapse.

What’s scary for the US housing market is just how many Airbnb’s there are.

Data from “All The Rooms” shows 1 million Airbnb/VRBO rentals.

Compared to only 570,000 homes for sale.

Creates huge home price downside if struggling Airbnb owners elect to sell.

Ground zero for this Airbnb collapse is a city like Phoenix.

Where the number of short-term rentals (18,000) is more than double the number of for sale listings (8,000).

Mix the huge Airbnb supply with revenues down -50% and you get a cocktail for massive forced selling.

Another area with huge exposure is Eastern Tennessee. Particularly a vacation town called Sieverville in the Smoky Mountains.

In this county there’s 10 times as many Airbnb’s as homes listed for sale while the revenue per owner is down 50%.

Another area to watch out for is Central Texas. Data from “All The Rooms” shows that Airbnb revenues are down 40-50% across most of the area, particularly in Austin, San Antonio, and Uvalde.

Another are that is getting smoked by the Airbnb crash is the Pacific Northwest and the mountain region. States like Montana, Idaho, and Oregon.

Fewer people playing out their Yellowstone fantasies and way more supply equals a 40% decline in revenues per listing.

Reading between the lines, it’s probably safe to conclude that this is another ‘bubble effect.’ The supply of Airbnb rentals is higher, while demand is declining. One can’t deny how persistent inflation has affected the discretionary income of many American households. A recent survey by the Federal Reserve confirms this. (Source: https://www.foxbusiness.com/economy/inflation-pummeled-us-household-finances-fed-survey)

Historically high inflation took a notable toll on Americans' finances last year, when rising prices outpaced wage gains and chewed into household budgets, according to newly released Federal Reserve data.

The central bank's 2022 Survey of Household Economics and Decision Making (SHED) report released Monday, which was fielded from October 2021 through November 1, 2022, found the share of U.S. adults who reported they were worse off financially than a year earlier jumped from 20% to 35% – the highest level since the question was first asked nearly a decade ago.

"Overall financial well-being declined markedly," according to the report, which found 73% of respondents said they were doing at least OK financially last year, a drop of five points from the year prior.

The share of adults who reported spending less than their income in the month before the survey fell below pre-pandemic levels, while the share of Americans who reported their credit card debt increased rose.

The Fed said, "inflation affected people's spending and saving choices in several different ways," pointing out that nearly two-thirds of adults stopped using a product or used less because of higher prices, 64% switched to a cheaper alternative, and more than half (51%) of Americans reduced their savings due to their budgets being squeezed.

Less discretionary income means not as much money for vacations which causes demand for Airbnb and VRBO rentals fall.

Gerli suggests that many Airbnb owners may attempt to convert their properties into longer-term rentals.

Some Airbnb owners might elect to do a long-term rental in their properties instead. But the problem with that is that there has already been a huge surge in long-term rentals hitting the market, with vacant rentals like Nashville exploding over the last year.

Gerli notes that since the end of 2021, vacancies in Nashville rentals have about doubled, moving from 4.1% to 8% presently.

So, if Airbnb owners ‘pivot’ to long-term rentals, they’ll likely crash that market as well.

Especially in dense urban areas which is where the majority of Airbnb’s are located.

I think ‘newbie’ Airbnb owners who bought over the last 1-2 years with a mortgage are in trouble.

They got in at a high price. And have a high monthly payment and little margin for error. They could become some of the first to sell later in 2023 when the season ends.

This is yet another headwind for the real estate market.

If you are thinking about selling real estate, it may be a good time to consider making a move. On the other hand, if you are thinking about buying, in my opinion, there is a good chance that better buying opportunities may lie ahead.

I will close this week the same way as I did last week.

There will have to be a reactive reset at some point.

The eternal truth is that you can’t borrow or print your way to prosperity.

The recent prosperity we’ve seen in the economy is the result of deficit spending, currency creation, and debt accumulation, which means it hasn’t been prosperity at all – it’s been a prosperity illusion.

I use the word illusion intentionally.

Webster defines illusion as something that deceives by producing a false or misleading impression of reality.

That perfectly describes the current economic environment and investing climate.

The radio program this week features an interview with Dr. Charles Nenner, a cycles analyst with a terrific track record. I chat with Charles about what his cycles analysis is telling him, and I get his forecast for stocks, gold, US Treasuries, and the US Dollar.

You can listen to the program now by clicking on the "Podcast" tab at the top of this page.

“Never spend your money before you have it.”

-Thomas Jefferson

Comments