Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The Federal Reserve recently increased interest rates to a 22-year high. Federal Reserve Chair Jerome Powell, in his remarks during a press conference after the interest rate hike announcement was made, noted a couple of interesting things.

One, he noted that the Fed is no longer forecasting a recession.

Two, he noted that banks are not aggressively tightening credit standards.

It is my view that Mr. Powell will be wrong on the recession comment and is already incorrect when it comes to banks tightening credit standards.

Before I get into my reasoning, let’s take a look at an excerpt from a “Market Watch” article discussing the Fed Chair’s presser. (Source: : https://www.marketwatch.com/story/fed-no-longer-sees-a-recession-and-other-things-we-learned-from-powells-press-conference-ef98d718)\

The Federal Reserve on Wednesday raised its benchmark interest rate to a range of 5.25% to 5.5%, the highest level in 22 years, in order to combat “elevated” inflation.

With financial markets and economists widely expecting that rate move, the focus was on Fed Chair Jerome Powell’s one-hour session with reporters, which followed.

Here are the four key takeaways from Powell’s presser: (Editor’s note: only two takeaways from the article here)

Fed staff is no longer forecasting a recession

During the press conference, Powell made news by saying the Fed staff is now forecasting a “noticeable slowdown” rather than a recession. The reason for the shift, Powell said, is that the staff has seen the recent resiliency in the economic data.

Powell said he also thinks the Fed can bring inflation down “without the kind of really significant downturn.”

Ordinarily, we would have had to wait until Aug. 16, when the Fed releases a summary of its two-day meeting, to get a read on the staff’s economic forecast.

“They’re putting a soft landing back on the table,” said Gus Faucher, chief economist of PNC Financial Services Group.

Banks are not aggressively tightening lending standards

Ever since Silicon Valley Bank collapsed in March, economists have been worried that other banks would pull back on lending and raise loan standards. So far, there has been a steady reduction in lending but no dramatic moves. The Fed keeps an eye on loan standards in quarterly surveys with bank officers.

The latest report is due next week, but Powell gave us a sneak preview, saying that lending conditions are tighter but not in an alarming manner. “I would just say it is broadly consistent with what you’d expect. You’ve got lending conditions tight and getting a little tighter,” he said.

Let’s discuss the probability of recession first.

At the time of the Great Financial Crisis, worldwide debt stood at about $100 trillion. Now, it stands at $305 trillion.

The easy money policies pursued by the Federal Reserve and other world central banks over the past 15 years have only served to dangerously increase debt levels.

As aspiring retirees who have attended by New Retirement Rules Class know, ever since 1971, currency is debt, largely loaned into existence. When currency is created from thin air, debt levels increase.

Eventually, when debt levels reach unsustainable levels, a deflationary recession or depression is the inevitable result.

There are signs that we may be on the verge of entering a deflationary period. For the first time in the last sixty years, the M2 money supply contracted. Alarmingly, it contracted at a rate not seen since 1929 on the eve of the Great Depression.

Not only do I believe Mr. Powell’s forecast of a ‘soft landing’ to be more of wish than reality, I also believe that the US may already be in a recession.

Mr. Powell also stated that banks are not aggressively tightening lending standards.

One look at the data seems to contradict Mr. Powell’s assertion, although the word ‘aggressively’ does leave some room for interpretation.

Past guest on the RLA Radio program, Mish Shedlock, had this to say on the topic, citing recent lending data. This from his piece (Source: https://mishtalk.com/economics/noose-tightens-on-consumer-credit-auto-loan-rejections-hit-record-high/):

The more you think you really need a loan, the less likely you are to get one, especially auto loans.

The New York Fed Credit Access Survey report comes out every four months. The June report shows a significant tightening of credit standards by lenders and less demand for loans by consumers.

June SCE Credit Access Survey Key Findings

- The application rate for any kind of credit over the past twelve months declined to 40.3 percent from 40.9 percent in February, its lowest reading since October 2020. Application rates declined to 11.9 percent for auto loans and 12.5 percent for credit card limit requests, but increased to 24.8 percent for credit cards, 6.5 percent for mortgages, and 5.3 percent for mortgage refinances.

- The overall rejection rate for credit applicants increased to 21.8 percent, the highest level since June 2018. The increase was broad-based across age groups and highest among those with credit scores below 680.

- The rejection rate for auto loans increased to 14.2 percent from 9.1 percent in February, a new series high. It increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5 percent, 30.7 percent, 13.2 percent, and 20.8 percent, respectively.

- The proportion of respondents reporting that they are likely to apply for one or more types of credit over the next twelve months rose to 26.4 percent from 26.1 percent in February.

- The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 30.7 percent for auto loans, 32.8 percent for credit cards, 42.4 percent for credit limit increase requests, 46.1 percent for mortgages, and 29.6 percent for mortgage refinance applications. The readings for auto loans, mortgages, and credit card limit increase requests are all new series highs.

Don’t let the information contained in the last bullet point go unnoticed.

30.7% of all auto loan applications are rejected. That’s about one in three. In my book, that’s aggressively tightening credit standards.

32.8% of all new credit card applications are rejected. Again, about one in three. Seems aggressive to me.

42.4% of requests to increase credit limits were turned down.

46.1% of mortgage applications were rejected. THAT IS NEARLY HALF!

These are all-time highs. This is credit-tightening at a very aggressive level.

And, given the debt levels that I noted above, look for this tightening of credit to continue.

It’s important to remember that this credit tightening is occurring at the same time as the demand for loans is falling.

With rising interest rates, many consumers dreaming of a new ride or some new digs to call home are simply not even trying. Interest costs are just too high.

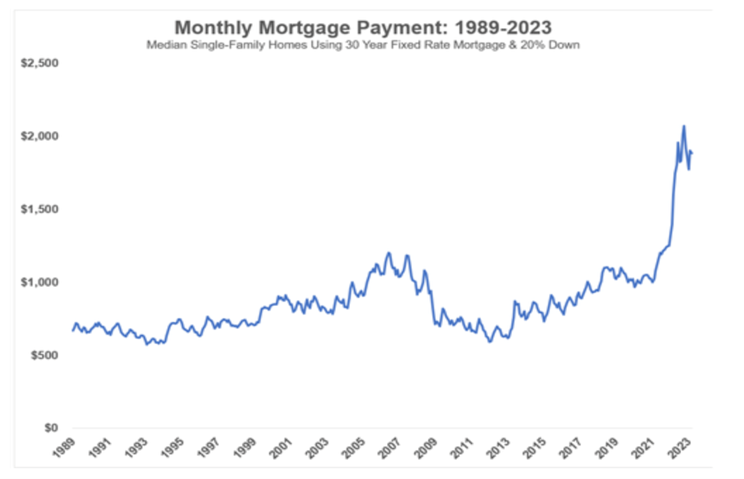

Take a look at this chart illustrating the mortgage payment on a median home going back to 1989.

Take a look at this chart illustrating the mortgage payment on a median home going back to 1989.

The monthly mortgage payment on a median home has about doubled in the last two years.

That, along with tightening credit, is moving us quickly toward recession. And probably a deep one, in my view.

Let me again remind you that if you are not using the Revenue Sourcingä planning process in your personal financial situation, it may be time to take a closer look.

The radio program this week features an interview with the Head of Global Research at Goldmoney, Mr. Alasdair MacLeod.

I talked with Alasdair about how the soon-to-be-revealed BRICS gold-backed currency might be structured and how you may be affected.

You can listen to the interview now by clicking on the "Podcast" tab at the top of this page.

“I once wanted to be an atheist, but I gave up. They have no holidays.”

-Henny Youngman

Comments