Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

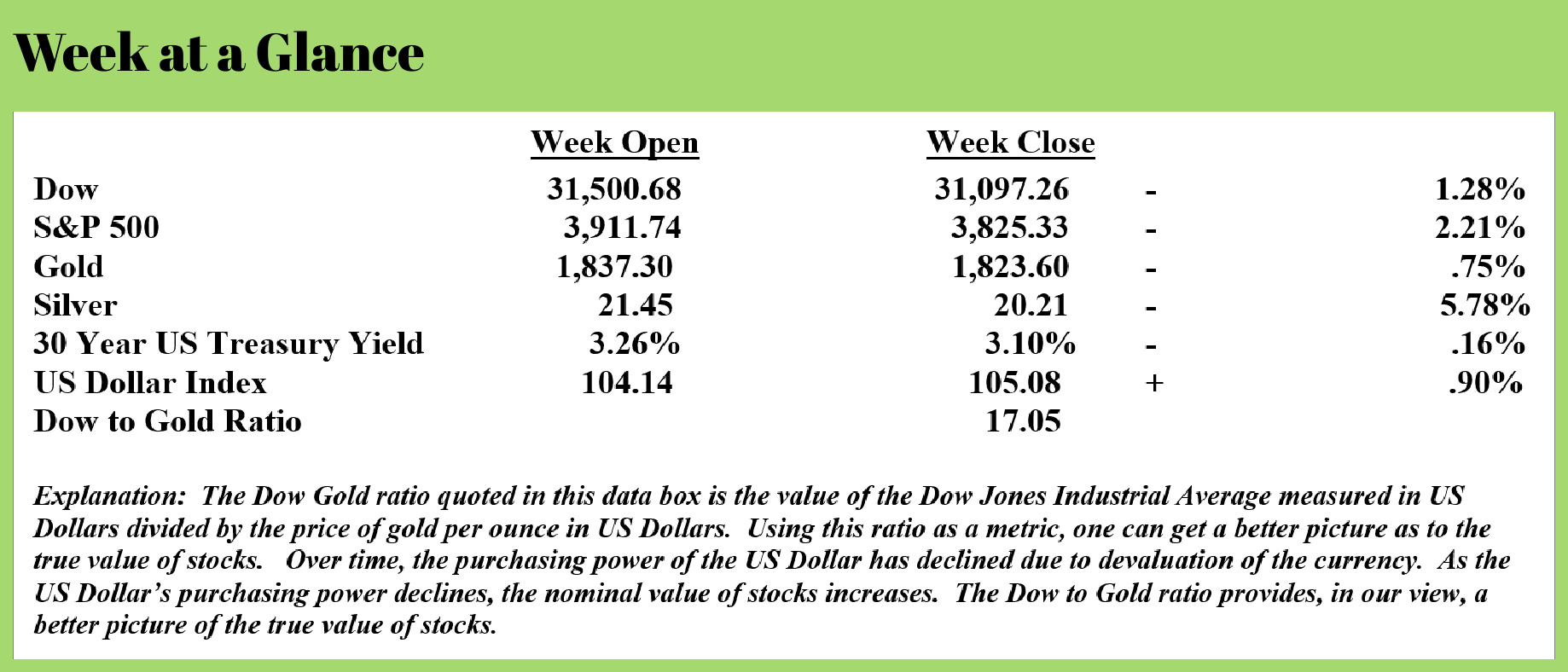

US Treasuries rallied slightly last week as stocks, and precious metals fell.

Since the beginning of 2022, I have been commenting that I believed the US economy was in recession. As many of you know, after economic data is initially reported, it is often revised multiple times.

This time is no exception to the revision rule. This from CNN (Source: https://www.cnn.com/2022/06/29/economy/gdp-first-quarter-final/index.html):

The US economy shrank at a slightly faster rate than previously estimated during the first quarter, the Bureau of Economic Analysis said Wednesday.

With one quarter of negative economic growth in the books, the data adds to fears that a recession may be looming.

Real gross domestic product declined at an annualized rate of 1.6% from January to March, according to the BEA's third and final revisions for the quarter.

Previously, the advance estimate released in April showed a contraction of 1.4%. Last month, that was revised to a decrease of 1.5%.

The Atlanta Fed just reported (Source: https://menafn.com/1104470550/GDP-of-Atlanta-Fed-shows-that-US-economy-already-in-recession) that the estimated growth for the second quarter will also be negative:

The United States economy is already in a recession, according to data from the Federal Reserve Bank of Atlanta's gross domestic product (GDP) model released on Friday.

In a declaration, Atlanta Fed stated that "the GDPNow model estimate for real GDP growth, seasonally adjusted annual rate, in the second quarter of 2022 is -2.1 percent on July 1, down from -1.0 percent on June 30."

The number is lower than the 0.3 percent growth anticipated announced on June 27; the next report will be issued on July 7, it was added. On the other hand, Real gross private domestic investment growth decreased to -15.2 percent from -13.2 percent, according to the bank, whereas real personal usage expenditures growth fell to 0.8 percent from 1.7 percent.

According to the Commerce Department's third and final reading on Wednesday, the sharp decrease in data suggests that the largest economy in the world, which shrunk by 1.6 percent in the first quarter of the current year, may see a contraction in the months of April and June of the current year.

In another sign the economy is slowing, Amazon, the giant online retailer, announced the company is cancelling or delaying plans to build 16 more warehouses this year. (Source: https://www.zerohedge.com/markets/amazon-cancels-or-delays-plans-least-16-warehouses-year)

After spending billions doubling the size of its fulfillment network during the pandemic, Amazon finds itself in a perilous position.

In the first quarter of 2022, the e-commerce giant reported a $3.8 billion net loss after raking in an $8.1 billion profit in Q1 2021. That includes $6 billion in added costs — the bulk of which can be traced back to that same fulfillment network.

Amazon CFO Brian Olsavsky said the company chose to expand its warehouse network based on “the high end of a very volatile demand outlook.” So far this year, though, it has shut down or delayed plans for at least 16 scheduled facilities.

“We currently have some excess capacity in the network that we need to grow into,” Olsavsky told investors on Amazon’s Q1 2022 earnings call. “So, we’ve brought down our build expectations. Note again that many of the build decisions were made 18 to 24 months ago, so there are limitations on what we can adjust midyear.”

There are only politicians and members of the Federal Reserve Board who are suggesting that we will not see a recession based on the research that I have done. If history teaches us anything about the prognostications of politicians and policymakers it is that they are attempts to control or direct the narrative rather than being legitimate forecasts.

This from New York Federal Reserve Bank President John Williams (Source: https://www.cnbc.com/2022/06/28/new-york-fed-president-john-williams-says-a-us-recession-is-not-his-base-case.html):

New York Federal Reserve President John Williams said Tuesday he expects the U.S. economy to avoid recession even as he sees the need for significantly higher interest rates to control inflation.

“A recession is not my base case right now,” Williams told CNBC’s Steve Liesman during a live “Squawk Box” interview. “I think the economy is strong. Clearly financial conditions have tightened and I’m expecting growth to slow this year quite a bit relative to what we had last year.”

Quantifying that, he said he could see gross domestic product gains reduced to about 1% to 1.5% for the year, a far cry from the 5.7% in 2021 that was the fastest pace since 1984.

“But that’s not a recession,” Williams noted. “It’s a slowdown that we need to see in the economy to really reduce the inflationary pressures that we have and bring inflation down.”

The most commonly followed inflation indicator shows prices increased 8.6% from a year ago in May, the highest level since 1981. A measure the Fed prefers runs lower, but is still well above the central bank’s 2% target.

In response, the Fed has enacted three interest rate increases this year totaling about 1.5 percentage points. Recent projections from the rate-setting Federal Open Market Committee indicate that more are on the way.

Williams said it’s likely that the federal funds rate, which banks charge each other for overnight borrowing but which sets a benchmark for many consumer debt instruments, could rise to 3%-3.5% from its current target range of 1.5%-1.75%.

He said “we’re far from where we need to be” on rates.

“My own baseline projection is we do need to get into somewhat restrictive territory next year given the high inflation, the need to bring inflation down and really to achieve our goals,” Williams said. “But that projection is about a year from now. Of course, we need to be data dependent.”

While some may think that Mr. Williams’ forecast of a soft economic landing, getting inflation subdued while avoiding recession, is possible, I am not among them. Particularly when the current ‘data’ being published by the Atlanta Fed squarely contradicts Mr. Williams’ statements.

Bottom line as far as I’m concerned is that the Fed will ultimately reverse course and once again engage in easing to try to prop up the economy. Of course, such action will be at the expense of the US Dollar. And consumer prices.

This perspective from Schiff Gold (Source: https://schiffgold.com/commentaries/rick-rule-fed-will-chicken-out-on-inflation-fight/):

Well-known investment advisor Rick Rule said the Fed will chicken out on its inflation fight.

Rule runs Rule Investment Media and formerly served as the president and CEO of Sprott US Holdings Inc. In a recent interview, Rule said that the Fed could get inflation under control with significantly tighter monetary policy for a sustained period of time. But he said he doesn’t think the central bank has the wherewithal to follow through when the economy starts to crash.

I think they’ll chicken out. If we had a period of real interest rates it would certainly cure inflation, but it wouldn’t cure inflation until it did amazing damage to various balance sheets.”

Rule has warned that the Fed won’t have the fortitude to fight inflation before. In an interview with MoneyWise earlier this year, he said, “I do not believe that the broad equities market will handle multiple rate hikes.”

Inflation has run hot for months. During the June FOMC meeting, the Fed raised interest rates 75 basis points for the first time since 1994.

Ron Paul has made similar statements, recently noting the Fed rate hikes have only raised rates to the level they were before the pandemic.

The Federal Reserve cannot increase rates to anywhere near the level they would be in a free market because doing so would increase interest payments to unsustainable levels for debt-ridden consumers, businesses, and the federal government.”

Jerome Powell continues to insist that the central bank can tame inflation while bringing the economy to a “soft landing,” but this promise seems dubious at best.

As noted, I expect the Fed to reverse course in the near future and once again pursue easy money policies.

This week’s radio program and podcast features an interview with John Rubino. I get John’s take on this topic as well as where the financial markets might go from here. Listen now by clicking on the "Podcast" tab at the top of this page.

“Books ……are like lobster shells. We surround ourself with ‘em, then we grow out of ‘em and leave ‘em behind as evidence of our earlier stages of development.”

-Dorothy L. Savers