Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

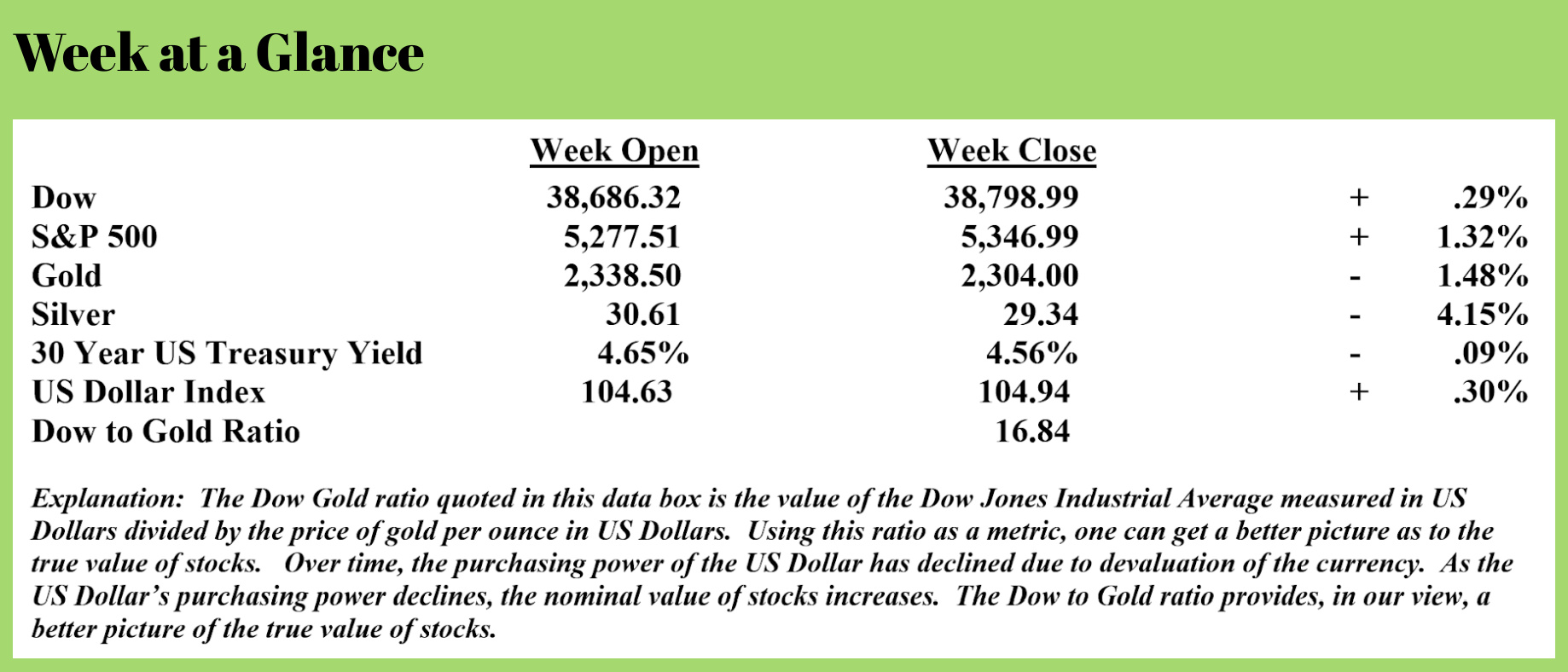

Many times here in “Portfolio Watch” and during my “Headline Roundup” newscast that happens every Monday at Noon Eastern (call the office if you’d like an invite to participate live. It’s free), I’ve discussed that one of the side effects of currency creation a.k.a. quantitative easing, is the expansion of the wealth gap.

The wealthy in the population have assets. In an inflationary environment fueled by currency creation, those assets serve as an inflation hedge, rising in nominal price just like household essentials increase in price.

While the wealthy have an inflation hedge via the assets that they own, those without assets who may be living paycheck-to-paycheck struggle as inflation continues to rage. That, in essence, is why the wealth gap exists and widens as currency creation continues.

Case in point, one of my team members sent me a link to an article about the percentage of the Michigan population living in poverty. Since our primary business office is located in Grand Rapids, Michigan, this article is especially relevant to where we live and do business.

Here is a bit from the piece (Source: https://www.woodtv.com/news/kalamazoo-county/how-many-in-your-county-are-in-poverty-or-struggling-financially/):

The amount of Michigan residents who are above the poverty line but are struggling financially is growing, a new report found.

The report, released on May 22 by Michigan Association of United Ways in partnership with United For ALICE, Consumers Energy Foundation and local United Ways throughout the state, works to capture a snapshot of how economic conditions are impacting individual people using data from 2022.

It goes beyond looking at only those living below the poverty rate, also looking at households who are ALICE: Asset Limited, Income Constrained, Employed. These are people who are working hard to make ends meet and are still struggling financially, but typically don’t qualify for local, state or federal assistance.

“These are individuals across our communities that are working sometimes two, three jobs,” Natalie O’Hagan, senior director of strategy and culture for United Way of South Central Michigan, explained. “They’re living paycheck to paycheck, so they’re under some pretty strong financial constraints.”

They aren’t thriving, they’re in survival mode.

The amount of Michigan households living under the poverty line has remained steady at around 13%, according to the report. The number of ALICE households living above the poverty line increased by close to 89,000 from 2021 to 2022, now representing 28% of Michigan households.

In total, 41% of Michigan households — close to 1.7 million — are below the ALICE threshold, meaning they’re either an ALICE household or below poverty line.

Many ALICE households are working important jobs, O’Hagan said, adding that the worker at your kid’s day care may be considered ALICE. The report found that 49% of fast food, counter workers and cooks are below the ALICE threshold, as are 47% of cashiers and 46% of waiters and waitresses.

In health care, 52% of personal care aides are living below the ALICE threshold — a recent report from the Michigan Health Council expects a shortage of more than 170,000 openings for home health and personal care aides within the next decade — as are 41% of nursing assistants.

“These are really hardworking individuals,” O’Hagan said. “But because of a lot of different factors, they’re really struggling.”

The report looks at the cost of living and a typical budget, factoring in the cost of things like housing, transportation, food and child care. The state’s housing crisis and childcare crisis are very prevalent, she explained, as families are struggling to find safe, affordable childcare and available, affordable housing.

Wages simply aren’t keeping up with the cost of living, she said.

“Things cost more. Right now you go to the grocery store, groceries are more expensive, that resonates for everybody,” she said.

In United Way of South Central Michigan’s region, which includes Kalamazoo County and Calhoun County, a family of four would need to be making a full-time hourly wage of $37.97, or $6,329 every month, to cover its basic needs, the report said. A single adult would need to make a full-time hourly wage of $14.27.

The acronym ALICE, with the “A” and the “L” meaning “asset limited,” makes my point.

On the other hand, as more asset limited families struggle with inflation, there have been 600,000 new millionaires created in the United States over the last year.

This from “CNBC” (Source: https://www.cnbc.com/2024/06/07/us-millionaire-population.html):

The U.S. far outpaced the rest of the world in minting millionaires last year, adding 600,000 new millionaires and powering record fortunes at the top, according to a new study.

America’s millionaire population grew 7.3% in 2023 to 7.5 million people, according to a report from Capgemini. Their combined fortunes grew to $26.1 trillion, up 7% from 2022. Capgemini defines millionaires as those with investible assets of $1 million or more not including primary residence, collectibles or consumer durables.

While interest rates remain higher, the stock rebound at the end of 2023 combined with trillions of dollars in government spending and stimulus continues to power the U.S. wealth machine.

The fortunes at the very top of the wealth ladder are growing fastest. The number of Americans worth $30 million or more grew 7.5% in 2023, to 100,000, while their fortunes surged to $7.4 trillion.

Globally, ultra-high net worth individuals account for 1% of the millionaire population but now hold 34% of its total wealth, showing the increasing concentration of wealth even among the wealthy.

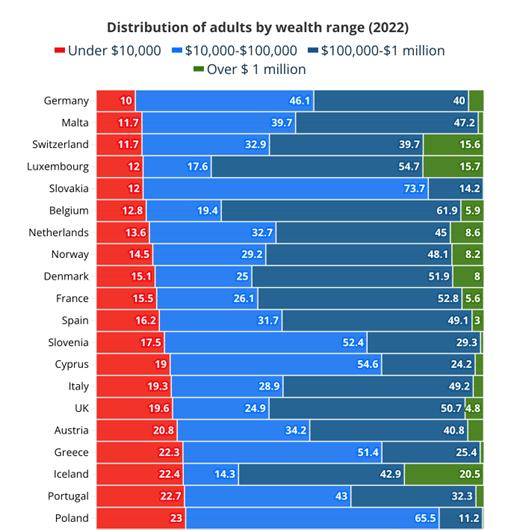

The wealth gap is not just a United States’ phenomenon. It exists everywhere that currency creation has been utilized. Here is an excerpt from a piece published on “Euro News” about the wealth gap widening in Europe. (Source: https://www.euronews.com/business/2024/06/04/the-wealth-of-nations-the-widening-gap-between-rich-and-poor-in-europe)

Inequality has emerged as a major concern among EU citizens. According to the 2021 Eurobarometer survey, ensuring equality of opportunities was ranked as the top priority for the EU's economic and social advancement. The most pressing issues for citizens are equal opportunities and access to the labour market, fair working conditions, and access to quality health care.

Inequality has emerged as a major concern among EU citizens. According to the 2021 Eurobarometer survey, ensuring equality of opportunities was ranked as the top priority for the EU's economic and social advancement. The most pressing issues for citizens are equal opportunities and access to the labour market, fair working conditions, and access to quality health care.

Credit Suisse and UBS's Global Wealth Report 2023 showed that wealth inequality is apparent not only within countries but also between the nations across Europe. The report measures wealth per adult in European countries in both mean and median terms, highlighting the economic disparities.

Net worth or “wealth” is defined as the value of financial assets plus real assets (principally housing) that households own, minus their debts.

Switzerland and Luxembourg lead the rankings, with the highest mean wealth per adult at €650,737 and €556,458 respectively, making them the richest countries in Europe. These figures underscore the financial robustness of these countries, which may be attributed to their strong banking sectors, high levels of income, and favourable economic policies.

Iceland, Denmark, and Norway also show remarkable wealth figures, with mean wealth per adult standing at €473,210, €389,320, and €365,943, respectively. These Nordic countries are known for their high standards of living and extensive social welfare systems.

This week’s RLA radio program features an interview that I did with Mr. Alasdair Macleod. Mr. MacLeod is the head of research at Goldmoney.

Alasdair and I discuss his recent article in which he suggests the United States’ real economy is already in recession when taking government deficit spending into account and we also discuss the future of world fiat currencies, including the US Dollar.

The radio program is posted on this site and is available now by clicking on the "Podcast" tab at the top of this page. The weekly Headline Roundup newscast is also posted here. If you haven’t yet done so, check out the free resources available here now.

“Once upon a time, government budgets were balanced, our money was sound, our streets were safe, and taxes imposed by all levels of government took less than 10% of our income.”

-Harry Browne

Comments