Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Over the past couple of weeks, we have been discussing the possible consequences of the recent debt ceiling suspension deal. This week, I want to offer you a perspective put forth by Matthew Piepenburg. While I’ll be sharing some of the piece with you, I would encourage you to read the entire commentary – it is excellent. (Source: https://goldswitzerland.com/stories-for-children-the-us-economic-fairytale/).

Over the past couple of weeks, we have been discussing the possible consequences of the recent debt ceiling suspension deal. This week, I want to offer you a perspective put forth by Matthew Piepenburg. While I’ll be sharing some of the piece with you, I would encourage you to read the entire commentary – it is excellent. (Source: https://goldswitzerland.com/stories-for-children-the-us-economic-fairytale/).

I may appreciate the piece because it offers an opinion that I share; in the not-too-distant future, the Fed will be the ultimate buyer of most US Government debt resulting in a severe stagflationary environment.

When Humpty Dumpty fell off the wall and took a big fall, “all the king’s horses and all the king’s men could not put Humpty-Dumpty together again.”

I see a similar fate for the US debt egg, whose cracks are just about, well… everywhere.

The first obvious (but media ignored) signs of this breaking egg emerged in September of 2019, when the TBTF banks no longer trusted each other’s collateral and the repo markets spiked overnight, prompting Uncle Fed to be the lender of last resort to its spoiled little banking nephews.

This required hundreds and hundreds of billions in mouse-clicked liquidity.

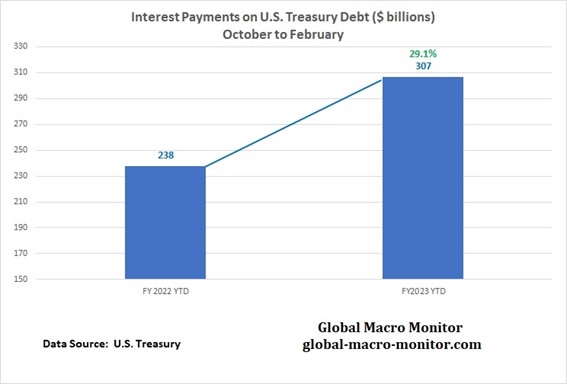

But then again, what does a billion or trillion even mean anymore to a mouse-clicker and $31+T (and growing) Public debt?

Numbers, like debts, have effectively become abstractions in what I previously described as a “banalization of debt.”

Since the repo crisis, as Uncle Sam’s twin deficits expanded at a fairytale pace alongside rising rate policies which neutered the price of sovereign bonds and hence the balance sheets and the life-cycles of regional banks, the Humpty-Dumpty US arrived at yet another climatic debt-ceiling reality-check.

As predicted, this “crisis” was “solved” by a predictable can-kicking of its debt responsibilities (and reality-checks) into a post-election-cycle.

How politically convenient.

In fact, political convenience at the expense of economic common sense or fiscal accountability is the very hallmark of our math-blind yet power-smug “representatives” in DC.

For those paying attention, however, the US not only voted past it’s $31.4T debt ceiling, it removed/suspended that ceiling all together.

This effectively allows the children in DC to borrow and spend without limit until 2025.

In short: The Humpty-Dumpty debt egg is getting fatter and fatter, and wobbling on the wall.

Having artificially “solved” (postponed) an otherwise very real/toxic debt crisis, the post-debt ceiling policy makers will now have to decide where the much-needed liquidity will come from to keep Humpty Dumpty alive, as debt (paid for with synthetic liquidity) is the only thing keeping him from a fall.

Toward this end, the question is now about how much the US Treasury is willing to “liquify” (refill) a very thirsty Treasury General Account (TGA), which has been the invisible source of funding to offset the Fed’s mid-2022 policy of so-called balance sheet “tightening”?

Whenever Powell grabs headlines for “tightening” liquidity, the TGA quietly provides more of the same behind a TGA curtain of complexity.

But now that TGA needs a re-fill of USDs to continue this charade of musical-dollar-chairs.

Stated simply, there is a great big “sucking sound” coming from the TGA, which is thirsty, very thirsty for USDs.

Should the US Treasury make a generous liquidity injection into the TGA from bank reserves, this will dry up other corners of a breaking US system equally thirsty for similar injections of USDs.

In short: This liquidity option is dangerous and unlikely.

Alternatively, however, the Fed’s Reverse Repo liquidity water-cannon could spray the TGA with the necessary liquidity (USDs) to buy more of Uncle Sam’s IOUs and thus buy the TGA’s borrow-and-spend system more time rather than solutions.

In the past, the banks were buyers of these IOUs, but we all know how well that worked for them in 2023…

So, once again, and amidst all this deliberate DC confusion, the simple question remains: Who will buy the IOUs (Treasury Bills) needed to keep Humpty Dumpty alive?

The US Treasury’s bank reserves? The Fed’s Reverse Repo Program? The UST-weary banks? The Money Market Funds?

To see through this maze more clearly, one must always look at the bond market, however “boring.”

If the Fed keeps raising rates and tightening its balance sheet, those T-Bills needed to keep Humpty Dumpty on the wall will fall in price and hence rise in yields, becoming far more expensive for Uncle Sam to repay?

This is a problem.

But perhaps far more important, and far less discussed or understood, is Yellen’s preference to issue IOUs to refill the TGA from the short end of the duration spectrum (i.e., short-term T-Bills) rather than longer-term UST bonds.

But would it not be cheaper for Uncle Sam to issue longer-term bonds at lower yields (interest expense) to continue his debt orgy of extend and pretend?

In short: What the heck is going on behind the scenes of Yellen’s Treasury Department?

Yellen, many argue, is still under the illusion that the UST market in general, and the US T-Bill market in particular, is the safest, most loved and hence most liquid IOU in the world.

Yellen, many argue, is still under the illusion that the UST market in general, and the US T-Bill market in particular, is the safest, most loved and hence most liquid IOU in the world.

But even Yellen can not have ignored the simple fact that a post-sanction world of weaponized dollars is dumping (rather than buying) those IOUs and stacking gold instead…

Perhaps Yellen is now desperately aware that to keep the debt Humpty Dumpty egg alive, she’ll now have to issue more and more “yield-sexy” (but harder-to-repay) T-Bills to buy time in a debt-soaked nation that is running out of time?

But far more ominously, perhaps Yellen is slowly coming to a sober conclusion which the markets and mathematical realists understood long before the fork-tongued policy makers, namely: Uncle Sam’s debt cancer is simply too fatal to cure with longer-duration bonds—or at some point, any bonds at all.

For now, a desperate Yellen has no choice but the last resort of issuing more of the sacred yet more expensive T-Bills to keep the yield-curve from inverting to levels so grotesque that the sound of Humpty Dumpty’s fall would echo through eternity.

But the question still remains: Who will buy these T-Bills/IOUs at levels (trillion-dollar) necessary to cushion Humpty-Dumpty’s fall?

My opinion, and for now, it is only an opinion (one based on flow probabilities, the math of interest expense Realpolitik, the reality of UST-weary banks and the historical lessons of nations over their skis in debt) is that the ultimate buyer of Uncle Sam’s debt will be the Fed itself.

In short, and as warned since quantitative tightening began in earnest in 2022, I still see an unavoidable and inevitable pivot to either open QE or hidden repo/reverse repo QE once Powell’s “higher-for-longer” efforts to become Volcker-reborn are won at the expense of Humpty Dumpty’s demise.

Stated otherwise: Once the tightening and rate hiking breaks the national economy into a dis-inflationary or even deflationary spiral, the thirst for more mouse-clicked and inflationary trillions will be obvious.

This thirst will force the system into a stagflationary “solution” of more fake, debased money in which the currency is sacrificed to save an otherwise unworthy, rigged and broken “system.”

I’ll say it again: In the end, the last bubble to “pop” is always the currency.

It’s no secret that gold is insurance for currencies already dying.

Regardless of the USD’s relative (but ever-weakening) strength/hegemony, its (and other currencies’) inherent purchasing power when measured against gold has fallen by greater than 98% since Nixon closed the gold window in 1971.

Many can, will and do anxiously track and ask about the daily gold price, a price, which, is ironically measured in increasingly worthless fiat currencies.

This price fixation is especially true (and understandable) of speculators and traders.

But we are gold investors and wealth preservers. As such, our perspective, bias and convictions are comfortably patient and far-sighted.

We feel that measuring gold, as well as one’s own wealth, in such fiat fantasy is a dangerous and consensus-driven habit, and thus we measure wealth in ounces and grams not euros, dollars, pesos etc.

Gold, unlike the various US bonds discussed above, are of infinite duration and finite supply.

This so-called “pet rock” (of which central banks just bought over 1100 tons in 2022) serves as a constant as the USD races and scatters about the repo, Eurodollar and derivative markets in a complex, and often sexy madness which hides the fact that it is just a player in a familiar and losing game in which all fiat money reverts to its zero mean.

This week's radio program is a ‘best of’ program featuring an interview with author Simon Popple. If you haven't yet had the chance to hear the show, click on the "Podcast" tab at the top of this page to listen now.

“To punish me for my contempt of authority, fate made me an authority myself.”

-Albert Einstein

Comments