Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

This week, I want to offer some market analysis.

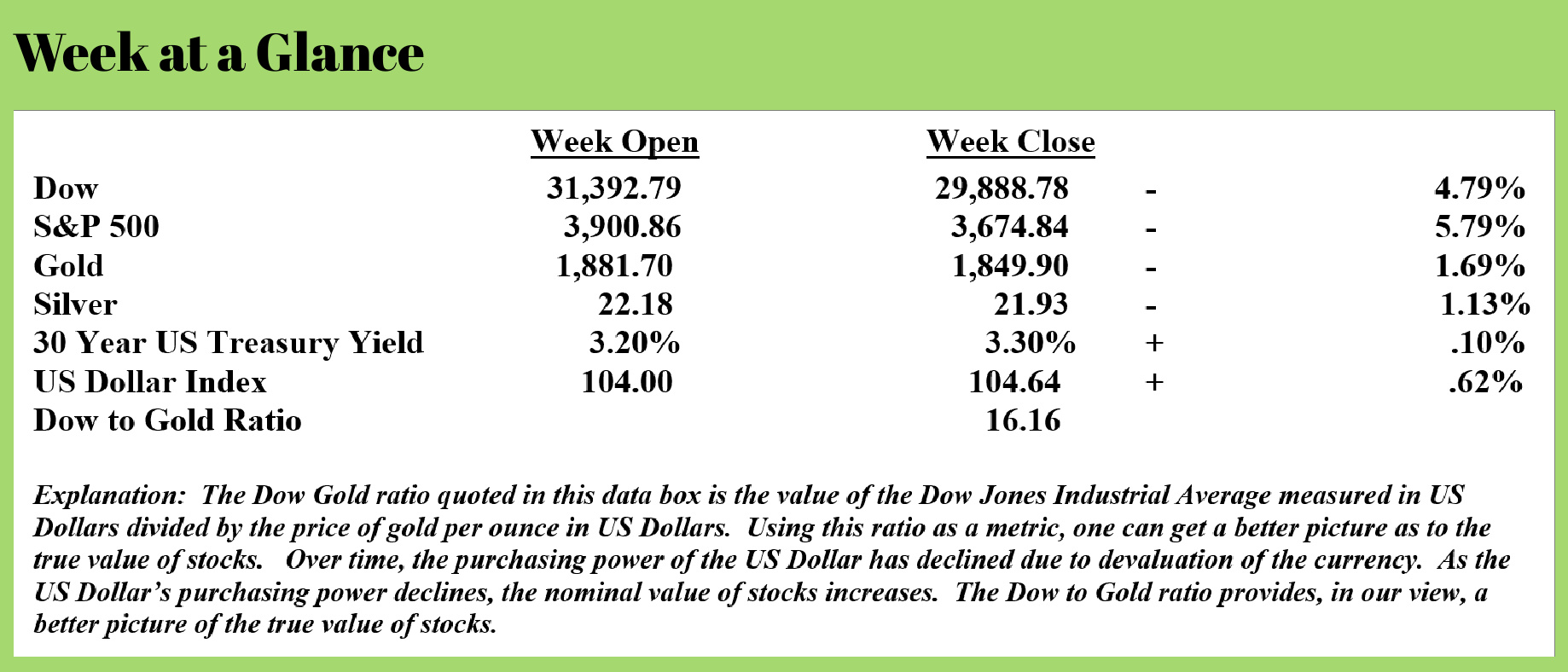

Last week stocks fell hard, US Treasuries declined as did gold and silver.

One of the money management strategies that has proven itself over time was developed by Harry Browne who began publishing a financial newsletter in the 1970s and authored many best-selling books up through the 1990s. The strategy was dubbed “Permanent Portfolio” by Browne and it had the investment objective of getting absolute returns (not losing money) while keeping pace with inflation.

When one examines the hypothetical performance of such a portfolio going all the way back to 1971 when the US Dollar became a fiat currency, the track record is very sound with 7 years of slightly negative returns and 44 years of positive returns.

This year, at the present time, this strategy is struggling as all asset classes are down or flat mid-way through the year.

Let’s begin by taking a look at stocks.

I’ll use the Standard and Poor’s 500 for the analysis. The chart below is of an exchange-traded fund that has the investment objective of tracking the S&P 500 index.

Notice on the right hand side of the chart, I have drawn a blue trend line that begins at the end of calendar year 2021 and continues to the present time.

Notice also, how far below the trendline the current price is.

Also on the chart, on either side of the green and red price bars (each bar is one week of price activity with the green bars representing the weeks that the ETF price went up and the red bars representing weeks the ETF price went down), you’ll see a blue line (on the top side of the price action) and a red line (on the bottom side of the price action). Those lines are the Bollinger Band indicator.

When prices reach outside the Bollinger Band, either on the top side or the bottom side, it often represents a price extreme and the price reverts to the mean.

Finally, if you notice on this weekly price chart that last week’s price action ‘gapped down’ leaving a space in the chart between the prior week’s price action and last week’s. Often, gaps on a chart are closed.

For these reasons, I would not be surprised to see a rally in stocks this next week although there is another market axiom that advises to ‘never try to catch a falling knife’. It’s sage advice.

If you are a trader, you are best to trade with the trend and wait for a good opportunity to do so.

Long-term, as noted in my mid-year market forecast published this month, I look for more downside in stocks. I also expect the Fed to reverse course sometime soon and continue with easing.

That brings me to precious metals.

Gold and silver have not reacted the way one might expect of late with the high levels of inflation that exist.

The chart is a chart of an exchange-traded fund that tracks the price of gold.

Notice from the chart that the weekly price chart is forming a bullish ‘cup and handle’ pattern with the handle about to be completed.

I expect that the uptrend in gold will resume by year-end and silver will follow suit.

US Treasuries have also been a poor performer this year.

This chart is a chart of an exchange traded fund that tracks the price of US Treasuries. Keep in mind that as bond prices fall, bond yields rise.

The trend line on the chart is clearly down since the beginning of 2020. A down trend over that time frame is not surprising given that the Fed expanded its balance sheet by trillions over that same time frame.

Now, as is the case with stocks, it would appear that bond prices are oversold and may be ready for a rebound. The Bollinger Bands on the weekly price chart seem to indicate that as does the MACD indicator at the bottom of the chart.

To summarize, both stocks and bonds are extremely oversold here and a rebound would not be surprising although the primary trend of both stocks and bonds remain down.

Gold and silver are forming a bullish pattern that may see prices rise by year-end.

I expect that Browne’s permanent portfolio will continue to outperform the stock market as it has year-to-date and I expect some recovery in returns from here.

This week’s radio program and podcast is a ‘best of’ program featuring an interview with the publisher of the Brookville Capital Intelligence Report, Mr. Simon Popple. If you haven't had a chance to listen yet, click the "Podcast" tab above to listen now.

“The government is good at one thing. It knows how to break your legs and then hand you a crutch and say, “See, if it weren’t for the government, you wouldn’t be able to walk.”

-Harry Browne