Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Does the name “Michael Burry” ring a bell with you?

Mr. Burry is a physician by training but while in his medical residency training, he became obsessed with financial investing. He didn’t finish his residency, instead, he left the medical profession to start a hedge fund.

He quickly developed a reputation for his ability to pick stocks based on value; much in the same vein as Warren Buffet and Buffet’s mentor, Benjamin Graham.

Burry’s hedge fund Scion Capital finished 2001 up 55% while the S&P 500 declined 11.8% during the same year. Burry got these returns shorting internet stocks.

The next year, 2002, saw the S&P 500 fall 22.1%, yet Burry was up again, finishing the year + 16%. In 2003, the overall stock market turned around rallying 28.69%, but Burry beat the market again, his fund reported gains of 50%.

In 2005, Burry’s hedge fund began to focus on the sub-prime mortgage market. Burry had been studying mortgage lending practices in 2003 and felt that the housing bubble could blow up by no later than 2007.

He shorted the housing market and ended up realizing huge profits for himself and his investors, $2.1 billion to be exact. (If you are not familiar with a short trade, when taking the short side of an investment, an investor makes profits as an investment declines in value.)

In 2008, Burry closed his fund and decided to focus on investing his own portfolio.

Burry reopened his hedge fund in 2013 and is now famously short Tesla stock, expecting the company’s share price to fall.

Burry’s track record is stellar; he has consistently outperformed the stock market over his career.

That’s what makes his most recent comments so interesting.

This from “Business Insider” (Source: https://www.msn.com/en-us/money/savingandinvesting/big-short-investor-michael-burry-is-back-on-twitter-and-warning-of-the-biggest-market-bubble-in-history/ar-AAL4jnO) (emphasis added):

Michael Burry on Tuesday warned of the biggest market bubble in history, suggesting that his concerns about rampant speculation only grew during his 10-week hiatus from Twitter.

"People always ask me what is going on in the markets," the investor tweeted. "It is simple. Greatest Speculative Bubble of All Time in All Things. By two orders of magnitude. #FlyingPigs360."

The hashtag was likely a reference to a famous saying in investing: "Bulls make money, bears make money, but pigs get slaughtered." Burry has repeatedly told investors that they're being too greedy, speculating wildly, shouldering too much risk, and chasing unrealistic returns.

And this from “Zero Hedge” on Burry (Source: https://www.zerohedge.com/markets/michael-big-short-burry-greatest-bubble-all-time-all-things-two-orders-magnitude):

Earlier this year, none other than Michael 'Big Short' Burry confirmed BofA's greatest fears, as he picked up on the theme of Weimar Germany and specifically its hyperinflation, as the blueprint for what comes next in a lengthy tweetstorm cribbing generously from Parsson's seminal work, warning that (Note: Parsson’s refers to Jens O Parsson who wrote “Dying of Money: Lessons of the Great German and American Inflations”)

"The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket."

And then the Parsson quotes from the book tweeted by Burry:

"The life of the inflation in its ripening stage was a paradox which had its own unmistakable characteristics. One was the great wealth, at least of those favored by the boom. Many great fortunes sprang up overnight...The cities, had an aimless and wanton youth"

"Prices in Germany were steady, and both business and the stock market were booming. The exchange rate of the mark against the dollar and other currencies actually rose for a time, and the mark was momentarily the strongest currency in the world" on inflation's eve.

"Side by side with the wealth were the pockets of poverty. Greater numbers of people remained on the outside of the easy money, looking in but not able to enter. The crime rate soared."

"Accounts of the time tell of a progressive demoralization which crept over the common people, compounded of their weariness with the breakneck pace, to no visible purpose, and their fears from watching their own precarious positions slip while others grew so conspicuously rich."

"Almost any kind of business could make money. Business failures and bankruptcies became few. The boom suspended the normal processes of natural selection by which the nonessential and ineffective otherwise would have been culled out."

"Speculation alone, while adding nothing to Germany's wealth, became one of its largest activities. The fever to join in turning a quick mark infected nearly all classes..Everyone from the elevator operator up was playing the market."

"The volumes of turnover in securities on the Berlin Bourse became so high that the financial industry could not keep up with the paperwork...and the Bourse was obliged to close several days a week to work off the backlog" #robinhooddown

"All the marks that existed in the world in the summer of 1922 were not worth enough, by November of 1923, to buy a single newspaper or a tram ticket. That was the spectacular part of the collapse, but most of the real loss in money wealth had been suffered much earlier."

"Throughout these years the structure was quietly building itself up for the blow. Germany's #inflationcycle ran not for a year but for nine years, representing eight years of gestation and only one year of #collapse."

Burry then concluded his tweetstorm by writing:

The above was "written in 1974 re: 1914-1923" and then makes the ominous extrapolation that "2010-2021: Gestation" adding that "when dollars might as well be falling from the sky...management teams get creative and ultimately take more risk.. paying out debt-financed dividends to investors or investing in risky growth opportunities has beaten a frugal mentality hands down."

Seems that extrapolation may now be reality. Dollars now are almost literally falling out of the sky.

I agree with Dr. Burry’s assessment that the current bubble is unlike any bubble we’ve seen in our lifetimes.

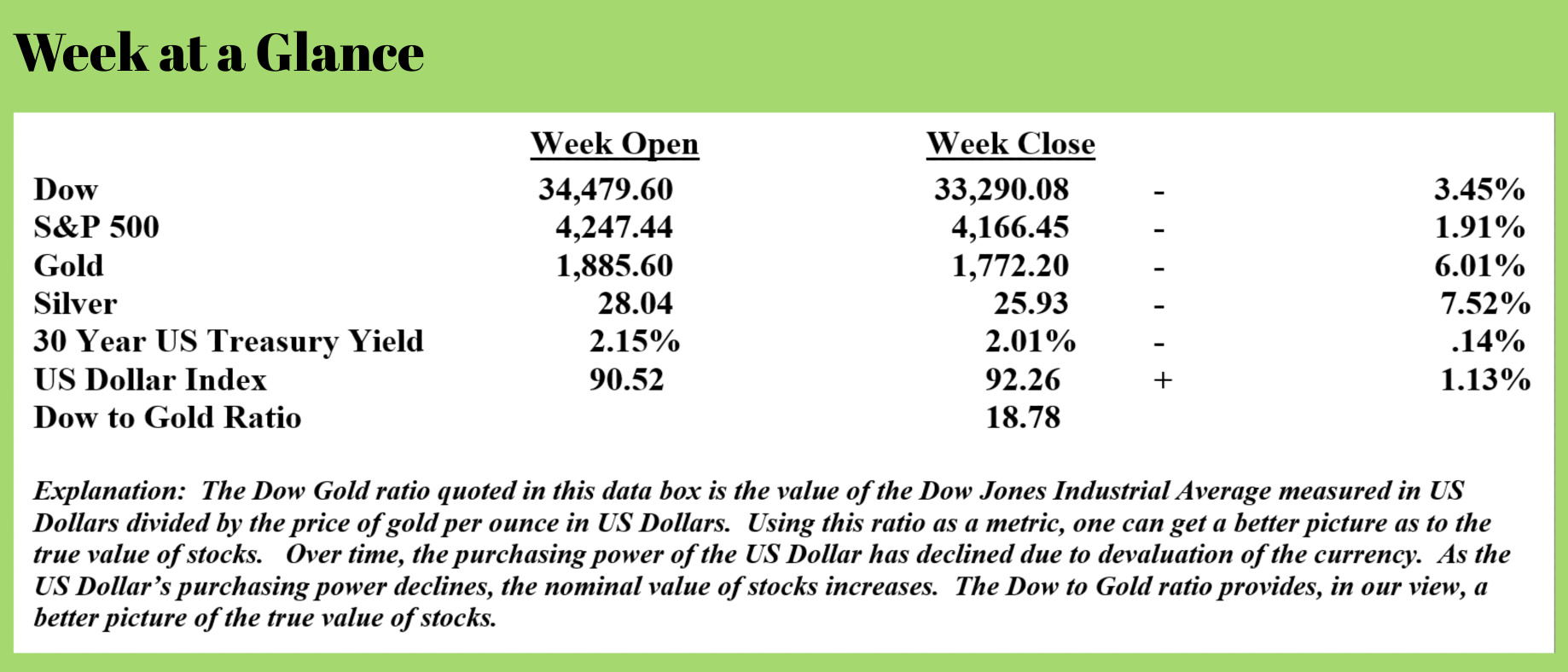

That said, last week’s stock market action may be indicative of that bubble beginning to burst. Stocks finished solidly down last week as did metals.

What may be confusing about last week’s market action at first glance is the big decline in the price of gold and silver. Given all the money creation taking place and members of the Federal Reserve Board acknowledging that inflation may be a concern, after all, one might expect to see the price of metals rally.

A little digging into the gold and silver markets might reveal the answer. Consider this from Dave Kranzler (Source: https://www.silverdoctors.com/gold/gold-news/blatant-price-manipulation-comex-gold-trading-was-form-vs-substance/) (emphasis added)

The sell-off today in the gold and silver market was unadulterated, blatant price manipulation confined to just the CME paper gold trading arena using Comex paper gold contracts, as soon as the FOMC policy statement was released at 2 p.m. NY Time. Note that the only commodity market in the world that is open at this time is the CME/Comex. Market “depth” is thin at this time of day. The paper gold price was further hit another $20 right after the NYSE closed, when liquidity is as its lowest.

The price action above starting with the initial price slam when the FOMC policy statement was released occurred in a pure paper derivative trading venue. There was not any physical gold bought or sold. The buyers of the contracts were the banks covering their massive short positions. Unfortunately and by design, we won’t get to see what affect today’s trading had on the COT report structure until a week from Friday because the cut-off day for the Friday COT report is Tuesday. This is, in and of itself is bull, because the CME knows Comex trader positions in real-time.

Furthermore, what type of “rational” market participant looking to sell a significant amount of any asset or securities, would indiscriminately unload large quantities onto the market in a short period of time, rather than attempting to maximize sale proceeds by feeding the item being sold more slowly over an extended period?

For those readers wishing to learn more about this topic, visit these links and check out the history of price intervention/manipulation in the gold market.

http://gata.org/files/GoldWeekAfricaConfSlides1.pdf

http://gata.org/files/GoldWeekAfricaConfSlides2.pdf

This week’s RLA radio program features an interview with the founder of Momentum Structural Analysis, Mr. Michael Oliver.

Mr. Oliver performs technical analysis on markets while adjusting for the diminished purchasing power of the US Dollar. His work is fascinating and during the interview, Michael reveals what he is advising his clients at this point in time.

The program is available now by clicking on the "Podcast" tab at the top of this page.

“The Washington Bullets are changing their name. They don’t want their team to be associated with crime. From now on they’ll just be known as “The Bullets”.

-Jay Leno