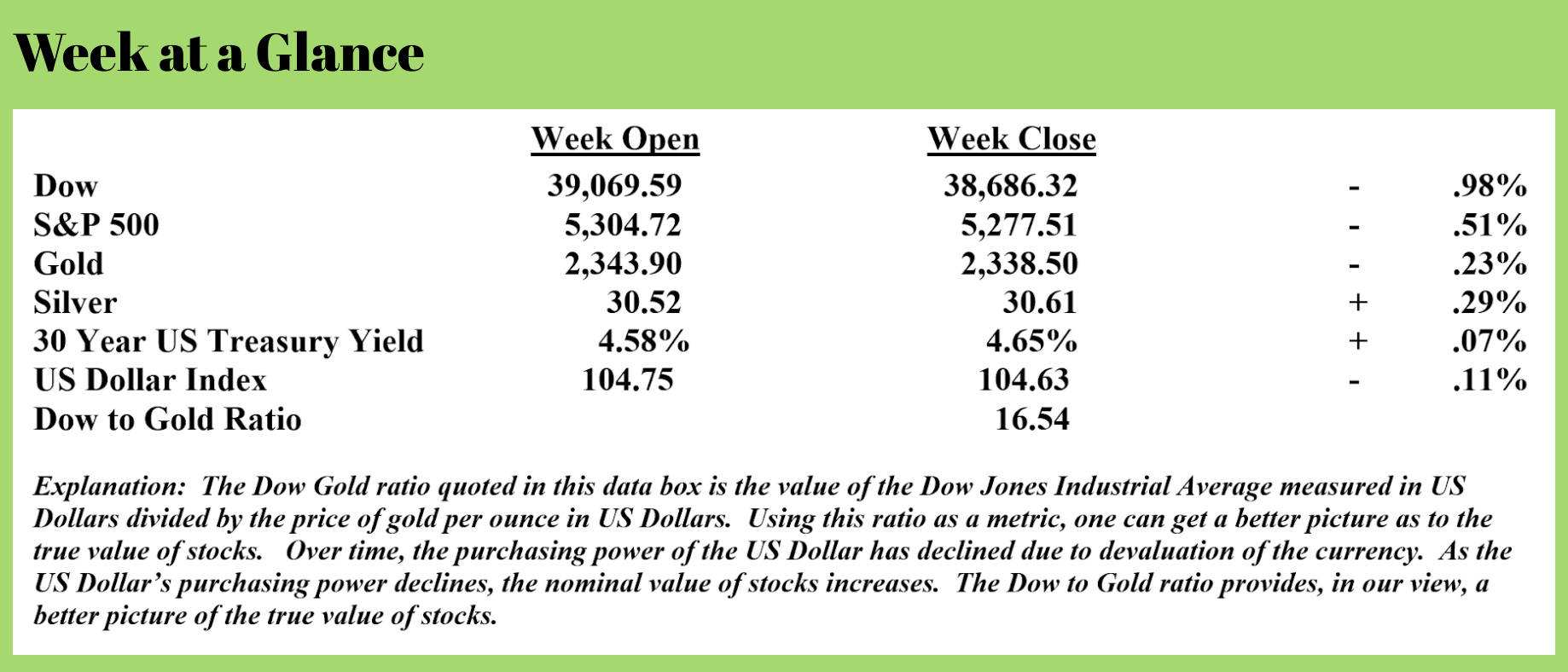

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

As I have been suggesting for a long time, I believe we are headed for an economic climate of stagflation. Stagflation is best defined as a contracting economy combined with rising consumer prices. Simply put, it’s pure misery for most Americans with limited financial means.

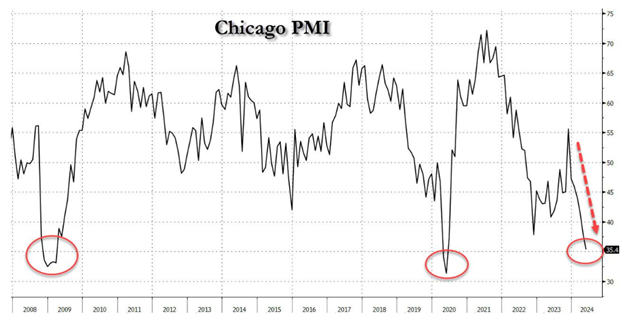

The recent Chicago Purchasing Manager’s Index came in with very dismal numbers that seem to indicate the forecast of stagflation is on target.

If you’re not familiar with the Chicago Purchasing Manager’s Index, or PMI, it is used to determine the health of the manufacturing sector in the Chicago region. A reading of more than 50 tells us that manufacturing is expanding, while a reading under 50 indicates a contraction in the manufacturing sector. (Source: https://www.investing.com/economic-calendar/chicago-pmi-38)

The most recent PMI reading implies the economy is not just slumping; we are headed for a very deep recession. This from a “Zero Hedge” article on the topic (Source: https://www.zerohedge.com/economics/chicago-pmi-unexpectedly-craters-depression-levels):

After unexpectedly slumping last month to 37.9, the Chicago PMI index cratered even more unexpectedly in May, when it defied hopes of a rebound to 41.5, and instead tumbled even more, sliding to a cycle low of 35.4 which was not only below the lowest estimate, but was staggeringly low. To get a sense of just how low, the last two times it printed here was during the peak of the covid and global financial crises (see chart below from article)...

... which seems to suggest that, at least according to Chicago-based purchasing managers, the economy is in a depression.

Looking at the report we find the following:

Looking at the report we find the following:

- Business barometer fell at a faster pace; signaling contraction

- New orders fell at a faster pace; signaling contraction

- Employment fell at a faster pace; signaling contraction

- Inventories fell at a faster pace; signaling contraction

- Supplier deliveries fell at a slower pace; signaling contraction

- Production fell at a slower pace; signaling contraction

- Order backlogs fell at a faster pace; signaling contraction

Did nothing rise? One thing did:

- Prices paid rose at a slower pace; signaling expansion

So we have not just a depression, but a stagflationary depression in which everything else is going to hell, except prices: they keep on rising.

New orders, employment, inventories, supplier deliveries, production, and order backlogs all contracted. Only prices rose.

That’s bad news for the economy moving ahead. Key economic indicators are turning VERY negative while consumer prices continue to rise.

It’s my view that these trends are just getting started.

I’m reminded of the lucid, reasoned statement made on the topic of inflation by Austrian economist Ludwig von Mises, who said, “The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

Clearly, this is the case. A past guest on my radio program, Mr. Alasdair MacLeod, who is Head of Research at Goldmoney, wrote about this last week, noting that economic growth presently in the U.S. is essentially a growth illusion. When one subtracts government deficit spending from the economic output calculation, it is quick and easy to conclude that the private economy is contracting, confirming the data just reported by the PMI numbers. Here is a bit from Alasdair’s piece (Source: https://www.goldmoney.com/research/think-inflation-is-done-think-again):

Margaret Thatcher said something on the lines that socialism fails when it runs out of other people’s money. We appear to have reached that point. Rapacious tax policies are now reducing their yield. We are now sliding down the after-end of the Laffer curve. The economic force which drives any economy is being strangled by the burden of government.

(Note: The Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, and there is an optimum percentage rate of taxation somewhere in the middle that results in maximum government tax revenue.)

Consequently, with mandated welfare and other expenses increasing, hope that economic growth will reduce budget deficits are misplaced. Estimates for budget deficits in nearly all high-tax jurisdictions will turn out to be overly optimistic. This has important implications for inflation which are currently being ignored by everyone from governments, central banks, and down to investors.

Take the situation in the USA. As recently as February, the Congressional Budget Office forecast a budget deficit of $1,507 billion for the current fiscal year. Yet, in the first six months, the deficit was already $1,100 billion, according to the US Treasury’s own figures. But this fails to explain the pace of borrowing. According to the US Debt Clock, US national debt is $34.77 trillion today, an increase of $1,600 billion this fiscal year so far. At this rate it will be $2.4 trillion by end-September, nearly a trillion over the CBO estimate. It represents 9% of GDP, raw unproductive credit driving GDP higher and creating an illusion of a strong economy.

I suspect the budget deficit could turn out to be even worse, partly because it is a presidential election year, partly because the debt ceiling is not in place until January 2025, and partly because the productive economy is already in recession. This last assumption is based on simple arithmetic. If, according to the Bureau of Labor Statistics GDP grew by 4.5% in the year to last March, allowing for a budget deficit injection of 9% means the private sector actually contracted by 4.5%.

A rough and ready calculation perhaps, but it is important to understand that not only is the expansion of non-productive government debt concealing the true economic situation, but is is also debasing the currency. And currency debasement becomes reflected in higher prices. In other words, the inflation of CPI is not over.

There you have it, another logical explanation backing up the stagflation forecast. It also confirms what von Mises concluded - that inflation is a policy.

As I have also often stated, one of the best inflation hedges is to own precious metals. Seems that as this stagflation forecast moves closer to full-blown stagflation reality, there is more attention on precious metals.

The State of Louisiana just reaffirmed gold and silver as money. This from “Money Metals” (Source: https://www.moneymetals.com/news/2024/05/31/louisiana-reaffirms-gold-and-silver-as-legal-tender-003227):

Louisiana Gov. Jeff Landry has signed a new law reaffirming gold and silver as legal tender, making a symbolic statement in favor of sound money principles.

Senate Bill 232, sponsored by Sen. Mark Abraham, marks the sixth pro-sound money bill passed by a state this year, underscoring a growing national trend.

Louisiana’s sound money bill simply affirms that “any gold or silver coin, specie, or bullion” issued by the United States government is considered legal tender whenever voluntarily agreed upon by both parties to a contract. The measure enjoyed popular support, receiving only one “no” vote on the floor throughout the Louisiana House and Senate.

In other precious metals news, the country of India, also a member of the anti-dollar BRICS alliance, recently repatriated 100 tons of gold, moving the metal more than 4000 miles from storage vaults in the U.K. (Source: https://www.moneymetals.com/news/2024/05/31/india-brings-100-tons-of-gold-home-for-safe-keeping-003225)

In addition, the Indian central bank has been adding to its gold reserves.

This week’s radio program features an interview that I did with the author and founder of the Brownstone Institute, Mr. Jeffrey Tucker. In the interview, Jeffrey makes some comments regarding the COVID pandemic and the ensuing vaccines, which, while accurate, have violated the censorship rules on YouTube. But you can listen to our conversation now by clicking on the "Podcast" tab at the top of this page.

“The Supreme Court has ruled that they cannot have a nativity scene in Washington DC. This was not for religious reasons. They couldn’t find three wise men and a virgin.”

-Jay Leno

Comments