Weekly Market Update by Retirement Lifestyle Advocates

One of the points in the “New Retirement Rules Book”, last updated in 2016, was that an economy that had accumulated far more debt than was sustainable would eventually experience a deflationary climate as debt was purged from the system.

Prior to that deflationary environment emerging, I suggested that depending on the policies pursued by the Federal Reserve, we could see inflation prior to deflation.

Since that book was published, the Federal Reserve, the central bank of the United States, has created trillions in new currency. The result of that reckless policy is now evident – accelerating inflation in all areas of the economy but perhaps now most evident at the gas station and the grocery store.

The Federal Reserve is now trying to engineer a soft economic landing. That simply means the central bank wants to get inflation under control while avoiding a recession.

In my view, a snowman has a better chance of surviving from now until the 4th of July.

In my conversations with many radio show listeners and New Retirement Rules class attendees, I find that there is confusion around the terms ‘inflation’ and ‘deflation’.

Inflation is technically defined as an increase in the currency supply and deflation is defined as a decline or contraction in the currency supply.

Increases in consumer prices are a symptom of inflation.

In a deflationary environment, currency disappears from the financial system as debts go unpaid and stock values and real estate values plummet.

It’s somewhat ironic that inflation can set off deflation. But history teaches us that it happens time and time again.

In Weimar, Germany, after the infamous hyperinflation destroyed the currency, deflation set in and an economic environment emerged that allowed a fringe political leader like Adolph Hitler to rise to power.

Due to the monetary policies of the Federal Reserve, we are now experiencing inflation but we will not avoid a painful deflationary environment.

As I’ve discussed in the past, this is due to one major reason – the currency system that we are presently using and have been utilizing since 1971.

Prior to 1971, the US Dollar was backed by gold.

In 1944, after World War II and the deflationary period of the 1930s, an international agreement made the US Dollar the world’s reserve currency. At that time, the United States had more than 20,000 tons of gold reserves making the rest of the world comfortable that the US would be able to make good on her promise to redeem US Dollars for gold at a rate of $35 per ounce.

It took about 25 years for the US to back out of this agreement. In 1971, the US gold reserves were reduced to 8000 tons and President Nixon eliminated the link between the US Dollar and gold. Since that time, US Dollars have been loaned into existence.

Many of you reading this know that back story extremely well.

Since all world currencies are debt today, when debt levels reach unsustainable heights and debt goes unpaid, the currency supply contracts and deflation sets in.

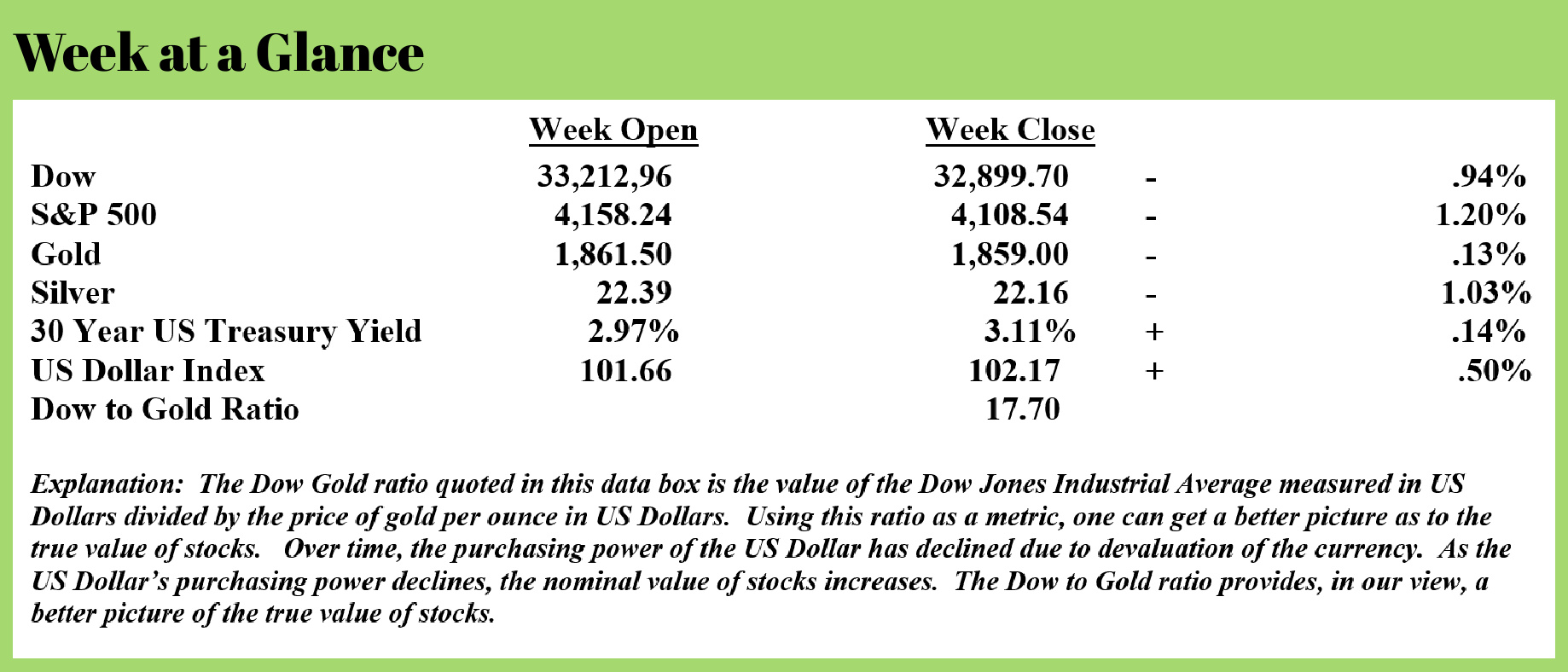

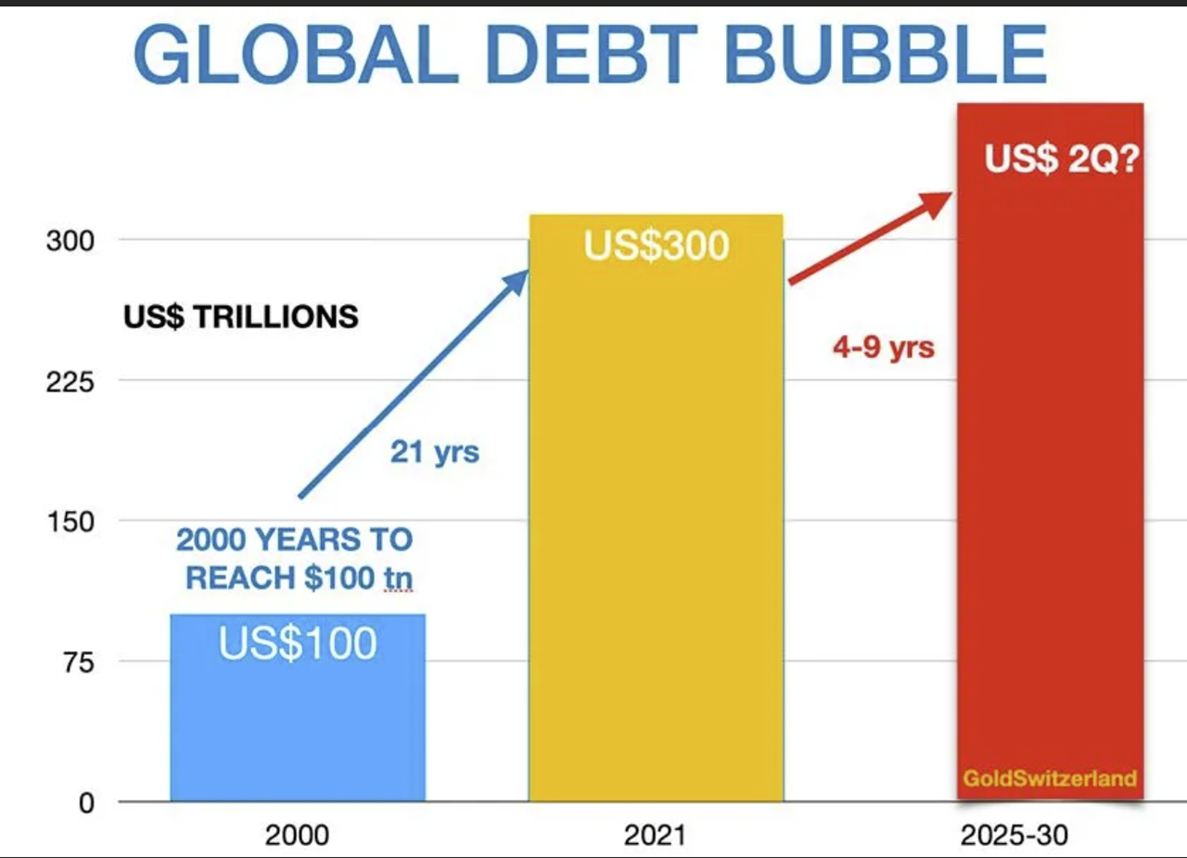

Note from the chart on this page from Gold Switzerland (Source: https://www.gold-eagle.com/sites/default/files/images2020/evg081821-5.jpg) that worldwide debt levels now stand at $300 trillion.

Note from the chart on this page from Gold Switzerland (Source: https://www.gold-eagle.com/sites/default/files/images2020/evg081821-5.jpg) that worldwide debt levels now stand at $300 trillion.

Based on the current spending trajectory, within 4 to 9 years, global debt could reach $2 quadrillion!

That is an increase of more than 600%!

At some point, debt levels collapse under their own weight, and deflation sets in.

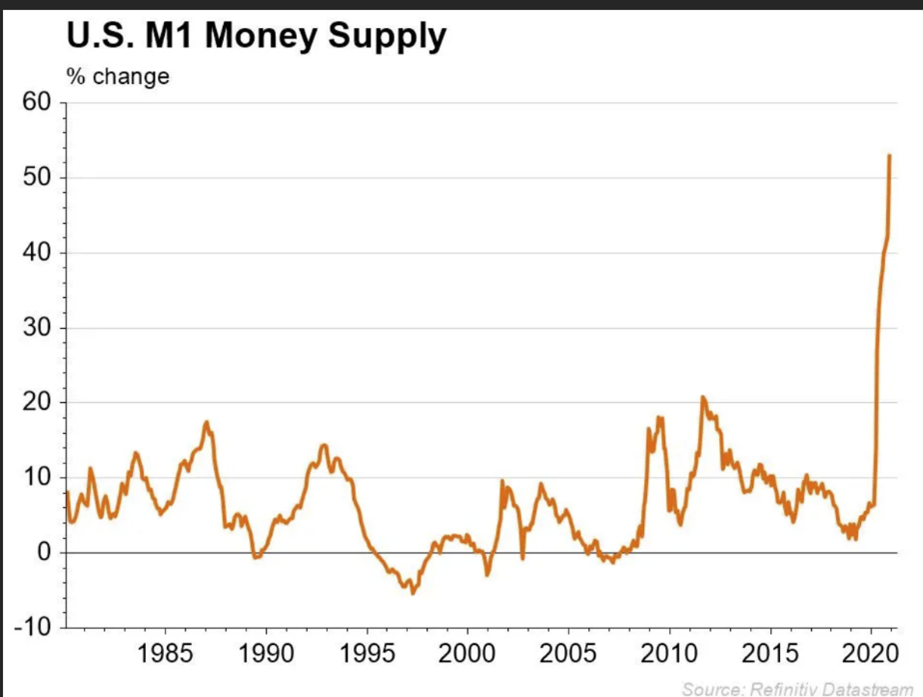

The Federal Reserve and other world central banks are trying to avoid this deflationary outcome by creating currency.

The chart shows the expansion of the currency supply.

Notice the currency created by the Federal Reserve has been literally off the charts in an attempt to avoid this deflationary outcome which is inevitable in my view.

Notice the currency created by the Federal Reserve has been literally off the charts in an attempt to avoid this deflationary outcome which is inevitable in my view.

History tells us this policy will not work.

There cannot be an economic ‘soft landing’ in my view.

And, it seems the economic data is starting to bear this out.

Michael Snyder, wrote a piece last week in which he cited much of this data. (Source: http://theeconomiccollapseblog.com/here-are-11-statistics-that-show-how-u-s-consumers-are-faring-in-this-rapidly-deteriorating-economy/)

-According to a Harvard CAPS/Harris Poll that was recently conducted, 56 percent of Americans say that their financial situations are getting worse, and only 20 percent of Americans say that their financial situations are improving.

-Another new survey has just discovered that 66 percent of Americans “have avoided social events because they’ve felt embarrassed or uncomfortable” about their financial situations.

-The housing bubble appears to be bursting. At this point, sales of new single-family homes are falling at a very frightening pace…

Sales of new single-family houses in April plunged by 16.6% from March and by 26.9% from a year ago, to a seasonally adjusted annual rate of 591,000 houses, the lowest since lockdown April 2020, according to the Census Bureau today. Sales of new houses are registered when contracts are signed, not when deals close, and can serve as an early indicator of the overall housing market.

(Editor’s note: I’ve been warning of an inevitable correction in real estate prices)

-After breaking the all-time national record in March, the average price of a gallon of gasoline in the United States has gone 42 cents above the old record and is now sitting at $4.59.

-The average age of a car on U.S. roads has reached an all-time record high of 12.2 years. Many Americans continue to delay replacing their current vehicles because new vehicles have become so unaffordable.

-Millions of American families are struggling with rapidly rising food prices…

The index for food away from home increased 7.2% over the last year, the Labor Department reported earlier this month. Food prices were up 9.4% in April from the same time last year — the biggest jump since April 1981, the Bureau of Labor Statistics recently reported. And grocery store prices increased 10.8% for the year ended in April.

-U.S. natural gas futures just crossed the nine-dollar threshold – the highest level that we have seen since the financial crisis of 2008. That means that much higher energy costs are on the way for U.S. consumers.

-Multiple Fed surveys are showing that manufacturing activity in the U.S. is really slowing down…

The slowdown in manufacturing activity on display in reports from the Federal Reserve banks of New York and Philadelphia was confirmed by a survey from the Richmond Fed indicating that factory activity contracted in the mid-Atlantic region in May. The Fifth District Survey of Manufacturing Activity index dropped 23 points from a positive reading of 14 in April to a minus nine, the lowest reading since May 2020, when much of the economy was still reeling from the onset of the pandemic and lockdowns.

-Zero Hedge is reporting extremely depressing news about U.S. macro data: “Other than April 2020 – when the entire economy was closed – May’s serial disappointment in US Macro data is the worst since Lehman”

-Thanks to plunging stock prices, approximately 20 trillion dollars in household net worth has been “wiped out” so far this year.

-A new CBS News/YouGov survey has found that 74 percent of Americans believe that things are going badly in this country and that 51 percent of Americans actually believe that Joe Biden is “incompetent”.

In my view, we are likely seeing the beginning of the transition from inflation to deflation.

Are you ready?

This week’s radio program and podcast features an interview with technical analyst Dr. Robert McHugh.

I get Dr. McHugh’s current assessment of all markets. If you are not familiar with his work, Dr. McHugh is one of the hardest working analysts I’ve ever had the pleasure of interviewing.

You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Employ thy time well if thou meanest to get leisure.”

-Benjamin Franklin