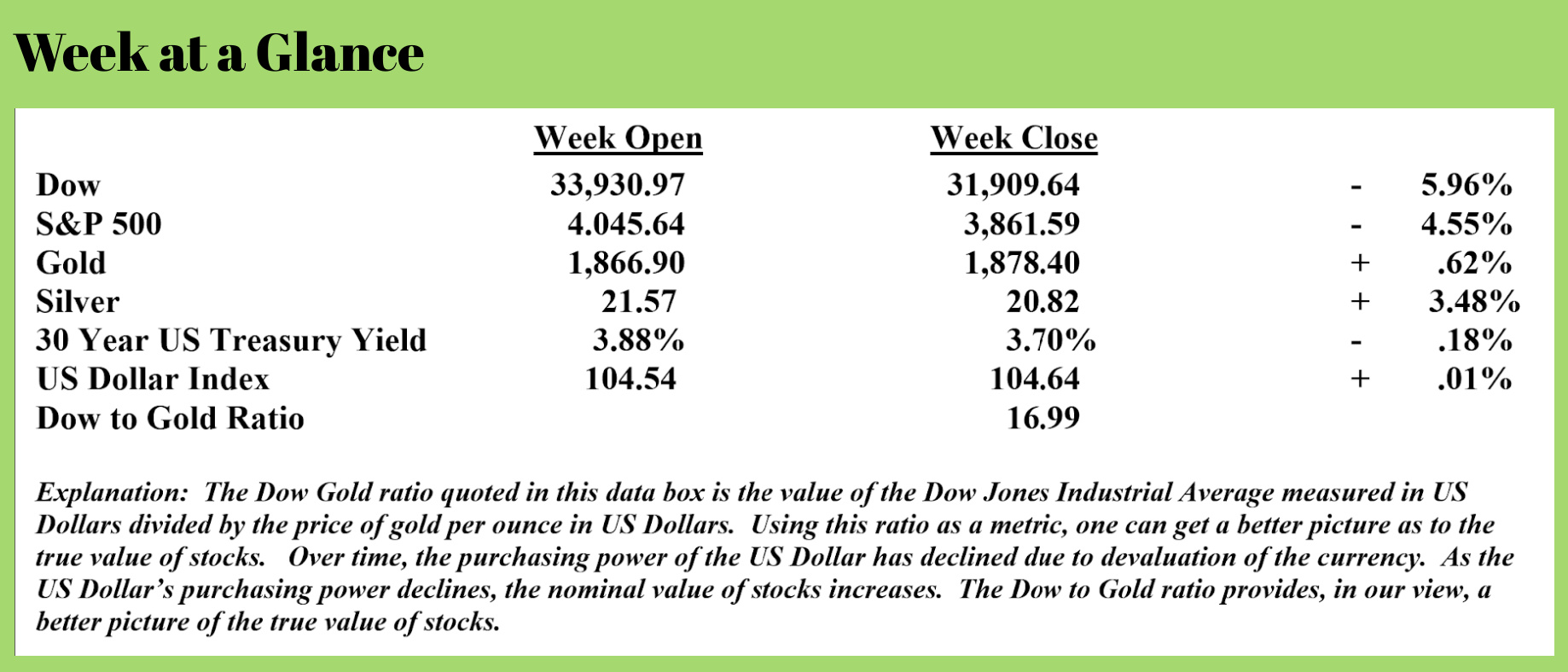

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

As I discuss in my New Retirement Rules Class, ever since 1971, the US Dollar has been debt rather than an asset.

On August 15, 1971, President Richard Nixon eliminated the link between the US Dollar and gold, making the US Dollar a fiat currency.

Since that date, US Dollars have been loaned into existence. The lower a bank’s reserve requirement and the more borrowing that occurs, the more US Dollars are created. Of course, as longer-term readers of this weekly publication know, after the financial crisis, when interest rates were reduced to zero, lending did not accelerate. It was at that point that the Federal Reserve began a ‘temporary’ program of quantitative easing or currency creation.

Since that time, worldwide debt has increased from about $100 trillion to about $300 trillion.

Since banks have debt as assets, I have been talking about the strong likelihood of banks failing as excessive debt goes unpaid.

This pattern of bank failures as asset price bubbles caused by currency creation has existed for much of history.

It happened during the financial crisis.

Many of you probably remember Henry Paulsen, the Treasury Secretary at the time, getting on television and stating that unless he got $700 billion from congress immediately, the financial system as we knew it would fail.

Congress complied, and the banks got their bailout.

From a historical perspective, a bailout is not normal or typical. For most of history, when banks fail, there is a ‘bail in.’ Banks are bailed out by the bank’s depositors, who lose some or all of the money they have in the bank.

A bail-in was the solution for failed banks in 1933 when President Roosevelt declared a bank holiday, relieving banks of any responsibility to repay depositors.

While it is too early to tell, the most recent bank failure involving Silicon Valley Bank will likely see many depositors lose their deposits. Looks like at least a partial bail-in might be happening.

In case you haven’t yet heard, Silicon Valley Bank, the 18th largest in the country, failed last week. This from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/record-bank-run-drained-quarter-or-42-billion-svbs-deposits-hours-leaving-it-negative-1bn):

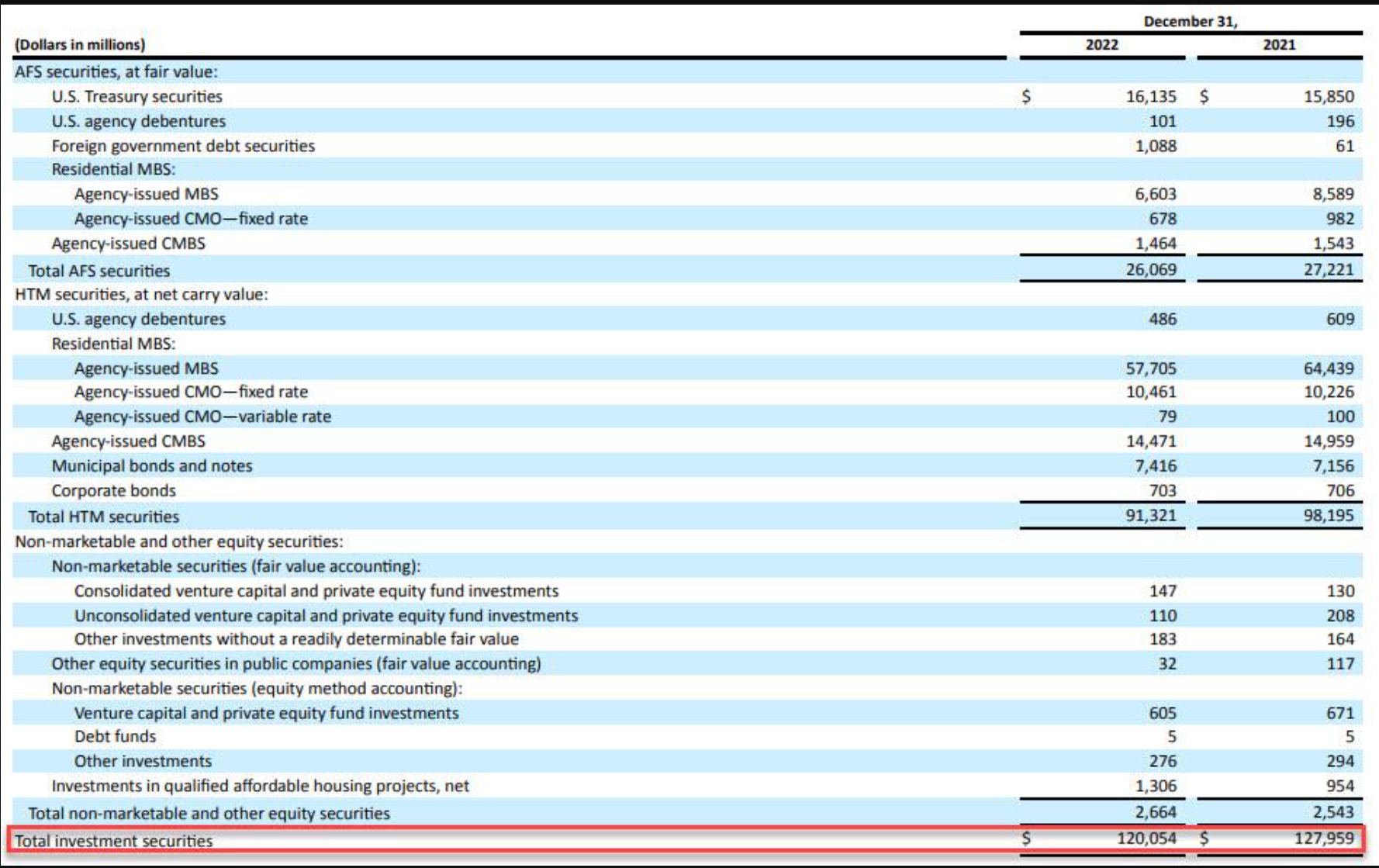

For those who slept through yesterday, here is what you missed and why the US banking system is suffering its worst crisis since 2020. Silicon Valley Bank, aka SIVB, the 18th largest bank in the US with $212 billion in assets of which $120 billion are securities (of which most or $57.7BN are Held to Maturity (HTM) Mortgage Backed Securities and another $10.5BN are CMO, while $26BN are Available for Sale, more on that later )...

... funded by over $173 billion in deposits (of which $151.5 billion are uninsured), has long been viewed as the bank at the heart of the US startup industry due to its singular focus on venture-capital firms. In many ways it echoes the issues we saw at Silvergate, which banked crypto firms almost exclusively.

The big question, of course, is what happened in the past 24 hours to not only snuff the bank's proposed equity offering, but to push the bank into insolvency.

We got the answer just a few moments after that tweet, when the California Department of Financial Protection and Innovation reported that shortly after the Bank announced a loss of approximately $1.8 billion from a sale of investments and was conducting a capital raise (which we now know failed), and despite the bank being in sound financial condition prior to March 9, 2023, "investors and depositors reacted by initiating withdrawals of $42 billion in deposits from the Bank on March 9, 2023, causing a run on the Bank."

As a result of this furious drain, as of the close of business on Thursday, March 9, "the bank had a negative cash balance of approximately $958 million."

At this point, despite attempts from the Bank, with the assistance of regulators, "to transfer collateral from various sources, the Bank did not meet its cash letter with the Federal Reserve. The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due, and the bank is now insolvent."

Some context: as a reminder, SIVB had $173 billion in deposits as of Dec 31., which means that in just a few hours a historic bank run drained a quarter of the bank's funding!

But not everyone got out in time obviously, there is a long line of depositors who are over the $250,000 FDIC insured limit (in fact only somewhere between 3 and 7% of total deposits are insured).

The article goes on, listing MANY companies and organizations that had uninsured deposits in the bank.

Here’s the reality of the fractionalized banking system. Banks are required to maintain minimum reserves that are a percentage of deposits. That minimum reserve requirement currently stands at 10%.

As the article excerpt above points out, the run on Silicon Valley Bank had depositors demanding withdrawals of $42 billion on total approximate assets (as of December 31, 2022) of $173 billion.

That’s a little more than 24% of deposits.

This bank had a relatively high amount of liquidity, given the minimum required level of reserves. Yet, despite that relatively high level of liquidity, the bank run consumed all the liquidity and then some, making the bank insolvent.

“Business Insider” tells of the predicament of a winery owner who is dealing with the bank failure. (Source: https://www.businessinsider.com/silicon-valley-bank-collapse-wine-industry-napa-valley-cade-surprise-2023-3?utm_campaign=tech-sf&utm_medium=social&utm_source=facebook):

Conover said CADE has a "large loan" and mortgage with SVB on four wineries and five vineyards. And as of Saturday, the company's checking account "is locked up."

"I've never been through this before," Conover said. The only similar crisis he could recall was during the 2008 recession.

Here is a business owner with debt outstanding to the bank with a checking account that is locked up and not accessible.

While it will take some time to see how this is sorted out, for the time being, this business owner has a problem – outstanding loans requiring payments and a once-liquid checking account that is now illiquid.

There are a few lessons here.

One, as noted at the beginning of this piece, if there is too much debt to be paid, it won’t be paid. Since banks have debt as assets, when debt goes unpaid, banks become insolvent.

Two, under the fractionalized banking system, because reserves are only a portion of deposits, nearly any bank that experiences a bank run of large enough magnitude can become insolvent.

Three, it’s probably prudent to know the safety ratings of your bank, keep deposits under the $250,000 insurance threshold (if possible), and diversify holdings among multiple banks.

The radio program this week features an interview with Murray Gunn of Elliott Wave International.

I chat with Murray about his forecast for inflation, interest rates, and stocks. We also discuss how social mood influences financial markets. I found it to be a fascinating conversation.

“Success usually comes to those who are too busy to be looking for it.”

-Henry David Thoreau

Comments