Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Good news for procrastinators last week from the Internal Revenue Service. You now have an extra month to get your taxes filed. The US Department of the Treasury and the IRS have extended the filing deadline until May 17.

While the events I will be writing about today have not been widely covered by the mainstream media, there are a couple of seemingly subtle changes set to take place that could well be the catalyst for a stock market decline.

First, interest rates are rising.

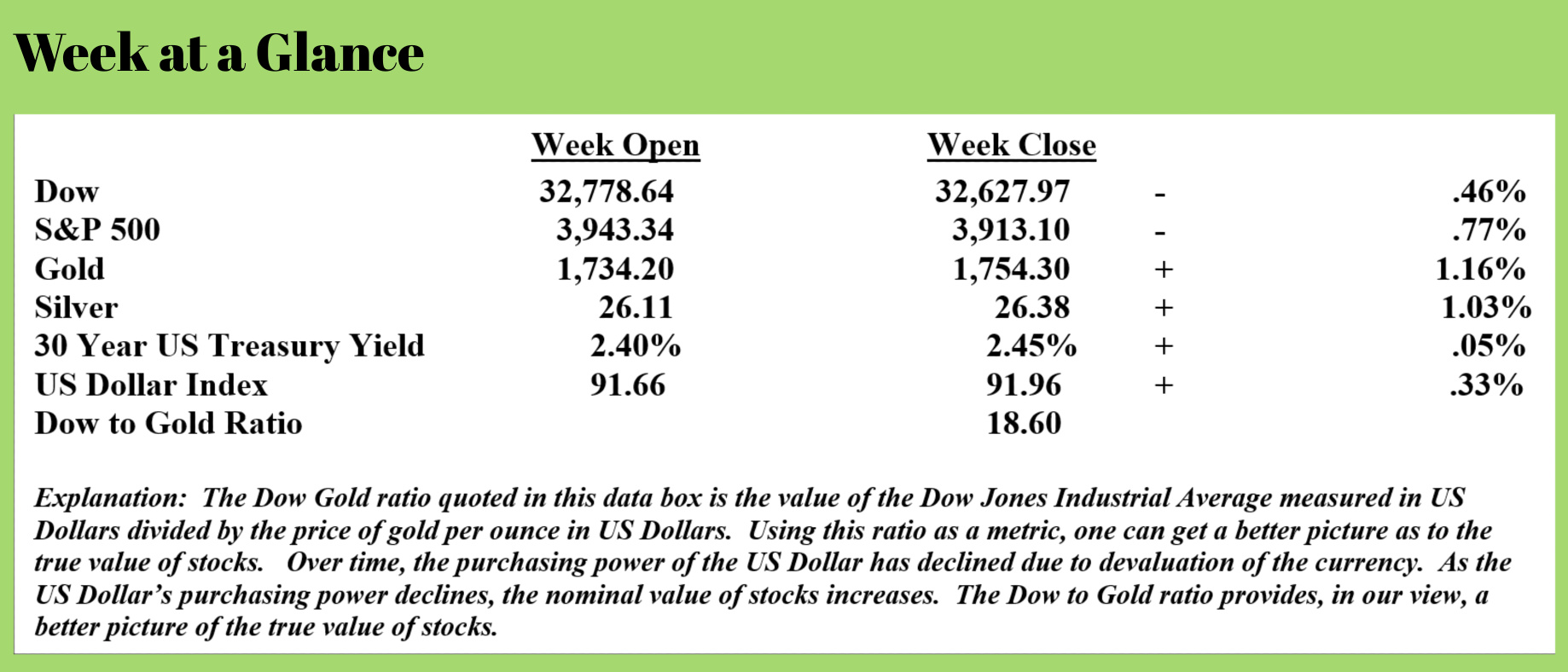

The yield on the 30-year US Treasury Bond is now at 2.45%. In March of 2020, just one year ago, the yield on the 30-year Treasury Bond dipped below 1%. That’s an eye-popping increase in just one year.

Given that the dividend yield on the S&P 500 is about 1.5%, there is now significantly more yield in the long Treasury bond than in stocks. Investors who moved from more conservative investments to stocks because stocks offered a better yield may now see fit to move out of stocks, which are wildly overvalued when using the Buffet Indicator (market capitalization to GDP) as the measure, back to more conservative bonds.

Second, the Federal Reserve is planning to let an important bank capital rule expire at the end of March.

One year ago, the Fed relaxed the capital rules for big banks. The supplemental leverage rule was relaxed last year when banks’ balance sheets literally exploded.

The supplemental leverage rule has banks calculating how much equity they must hold in relation to the bank’s total leverage exposure.

The rule change one year ago allowed banks to exclude US Treasuries and deposits held at the Federal Reserve from the calculation. Now those assets must be included in the calculation again at the end of this month.

The bottom line is this: many banks may find themselves in a position to have to sell US Treasuries and reducing or turning away deposits.

JP Morgan’s CFO, Jennifer Peipszak, stated on a conference call recently that if the rule reverts back to the prior rule, the bank may be forced to turn away deposits.

How might the bank do that?

By reducing interest rates or even imposing negative interest rates.

Negative interest rates would likely be bullish for metals as a zero yield on a historically reliable inflation hedge would be preferable to a negative yield in fiat currency.

I believe this change could also lead to many banks selling US Treasuries thereby further driving up interest rates. If interest rates rise further, bonds now become more attractive to conservative investors as noted above which could lead to an exodus by many investors from stocks.

“The Wall Street Journal” had this to say on the topic last week:

“The Federal Reserve said it was ending a year-long reprieve that had eased capital requirements for big banks, disappointing Wall Street firms that had lobbied for an extension.

Friday’s decision means banks will lose the temporary ability to exclude Treasurys and deposits held at the central bank from the lender’s so-called supplemental leverage ratio. The ratio measures capital – funds that banks raise from investors, earn from profits, and use to absorb losses – as a percentage of loans and other assets. Without the exclusion, Treasurys and deposits count as assets. That will likely force banks to hold more capital or reduce their holdings of those assets, both of which could ripple through markets.”

I suggest proceeding with caution.

Now for a little politics.

Progressives in Washington are plotting on how to get the $15 minimum wage placed in the next ‘must pass’ bill. This from “Just the News” (Source: https://justthenews.com/government/congress/progressive-dems-suggest-tying-15-minimum-wage-hike-including-tipped-workers):

Progressive House Democrats are rapidly searching for ways to revive the $15 minimum wage increase after a stinging loss in the passage of President Biden's $1.9 trillion coronavirus stimulus law.

Members of the Congressional Progressive Caucus want the $15 minimum wage hike to apply to all workers, including those who receive tips such as restaurant servers.

The Senate Parliamentarian ruled that a minimum wage increase could not be tied to Biden's American Rescue Plan, which the Democrats moved through Congress using the budget reconciliation tool to allow it to pass without GOP votes.

Progressive Democratic House members said that setback won't stop them from advocating for the minimum wage hike to pass before the end of this year.

Interestingly, both Wal-Mart and Costco recently boosted the pay of employees without a minimum wage law. Patrick Carroll, writing for the Foundation for Economic Education, explains:

Imagine you’re an employee at Walmart. Maybe you’re a single mom working to pay the bills or a teenager looking to get work experience. This past year has been rough for you and your colleagues, but you’ve all persevered and pushed through despite the difficult circumstances.

Now imagine that you walk into work one day and find out that you’re getting a raise, even though you didn’t ask for one. This was what roughly 425,000 Walmart employees experienced in February.

Walmart’s average hourly wage used to be $14 per hour back in January 2020, but with these new raises, they plan to boost that average to over $15 per hour. This move comes on the heels of increasing demand for household goods due to COVID-19, especially through online orders.

But Walmart isn’t the only large employer handing out raises. On February 25, Costco announced it would be raising wages for its lowest-paid hourly workers, setting a new company-wide minimum of $16 per hour.

“It takes a lot of time to interview and find employees,” CEO Craig Jelinek said when asked about the wage hike. “We want people to stay with us.”

Conspicuously absent from these raises is any change in federal minimum wage law.

While a federal $15 minimum wage was originally in President Biden’s $1.9 trillion stimulus proposal, a Senate official recently ruled that this inclusion didn’t comply with Senate budget rules, making it unlikely to pass anytime soon.

So if the federal minimum wage hasn’t gone up and likely won’t be going up anytime soon, just what exactly is driving these wage hikes?

The answer, in a word, is competition.

“Walmart has been competing with Amazon and others for warehouse workers and other staff that are handling a surge in online orders during the pandemic,” the Wall Street Journal reports.

Notably, Amazon raised its minimum pay to $15 per hour back in 2018, and both they and Walmart gave out substantial bonuses in 2020. Target also established a minimum hourly pay of $15 last year, so it’s clear that this is becoming an industry-wide trend.

To understand how competition for labor leads to higher wages, consider a typical hourly Walmart worker. Every time they work, they produce a certain amount of value for Walmart. The value they produce can vary substantially depending on the work they do and the tools and equipment they have access to, but let’s assume that for every hour they work, they bring in $17 of additional revenue for Walmart (economists call this the worker’s marginal revenue productivity).

Now, if Walmart is only paying them $14 per hour, then Walmart gets a profit of $3 per hour. However, this profit margin creates an opportunity for Amazon. Amazon could outbid Walmart by offering them $15 per hour, and still make a profit, albeit a smaller one. So, Walmart would need to raise their worker’s wages to avoid losing them to Amazon.

A worker’s marginal revenue productivity can also go up, which would put upward pressure on their wages.

If you have not been watching the weekly “Headline Roundup” webinar live on Mondays at Noon Eastern, I’d encourage you to download the YourRLA app by visiting the app store and searching for YourRLA.

The app can be downloaded for free and gives you access to our educational resources. This week on the “Headline Roundup” webinar, I make the case for a strong, upward move in silver this year.

If you own silver or have been thinking about buying silver, check out the information on the webinar.

The radio program this week features an interview with Brien Lundin, publisher of “Gold Newsletter” and host of the New Orleans Investment Conference”.

Brien and I discuss his forecast for the markets and what he is telling his subscribers at the present time.

The interview is now available by clicking here or on the "Podcast" tab at the top of this page.

“Take a rest. A field that has rested yields a bountiful crop.”

-Ovid