Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

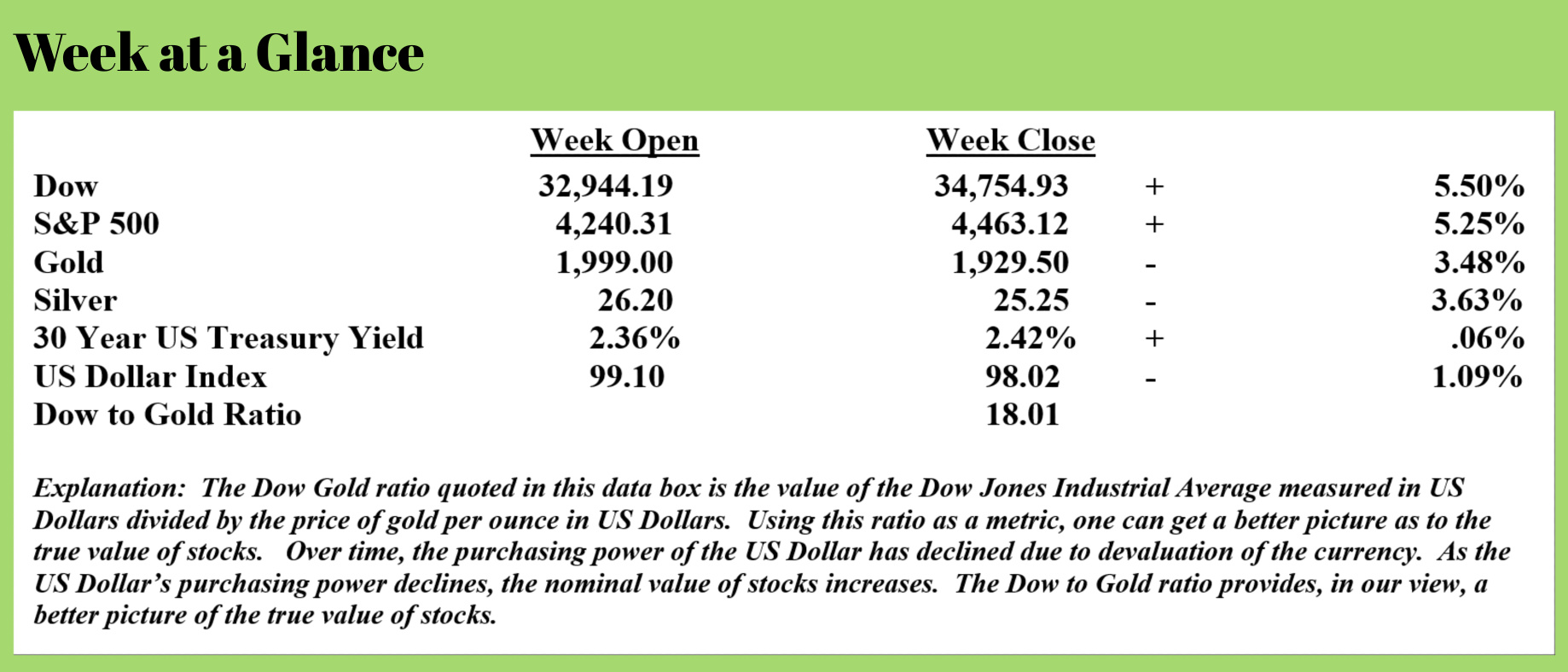

Stocks rallied and gold fell last week. At this point, I don’t view these developments as trend-changing, rather as counter-trend rallies. The Dow to Gold ratio continued to fall last week. As currency devaluation continues, this is an indicator that becomes more meaningful in my view.

At its last meeting, the Federal Reserve increased interest rates by .25%. As I have been stating, I expect Fed action to counter inflation will be more form than substance. This increase of .25% certainly fits in that category in my view.

There is more to this inflation story than meets the eye. While an increase in the currency supply leads to inflation, it also creates other undesirable side effects, particularly when the currency is the world’s reserve currency.

As long-time readers of “Portfolio Watch” know, I have often discussed the concept of a ‘crack-up boom’ put forth by Austrian economist, Ludwig von Mises. For newer readers of “Portfolio Watch”, a crack-up boom is defined as currency inflation or hyperinflation coupled with a simultaneous recession or depression.

Current monetary policy and credit expansion, if it continues, could lead to such an outcome. Arguably, we are on the fringe of such an outcome presently.

Larry Lepard, manager of the EMA GARP fund recently commented on the probability of such an outcome in light of the Russia-Ukraine situation. (Source: https://www.zerohedge.com/markets/fiat-currencies-are-going-fail-spectacularly-lawrence-lepard). Here are some excerpts from his excellent analysis piece:

What just happened in the last two weeks is enormously important and misunderstood by many investors.

The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves are nothing short of a monetary earthquake. The last comparable event was Nixon's abandonment of the gold standard in 1971.

Russia, with the backing and support of China, just told the world that it is no longer going to sell its oil, gas and wheat for Western currencies which are programmed to debase.

The West in its response just said to all countries around the world: “If you have foreign exchange reserves, held in our system, they are no longer safe if we disagree with your politics.”

It is similar to what the Canadians did when they moved to seize the bank accounts of Canadians who had demonstrated support for the truckers without due process of law.

Both of these political moves are blatant advertisements for what I call "non state controlled money without counterparty risk", like gold and bitcoin. If governments can weaponize their money when they do not like what you are doing, what is the natural defense?

The US Dollar has been the reserve currency of the world since WW II and the Bretton Woods agreement. This has given the US an enormous advantage and subsidy from the rest of the world because everyone else needs to produce goods and services to obtain dollars and the US can simply produce dollars at no cost by printing them.

Putin is now cast in the role of Charles de Gaulle who complained about the "exorbitant privilege" of the US with its dollar hegemony. As we all know, de Gaulle demanded gold in exchange for France's US dollar FX surpluses and this outflow forced Nixon to close the gold window.

Recall that post this event, gold went from $35 per ounce to $800 per ounce (23x). Russia's move will lead to a similar move in favor of gold. Putin could see that the US fiscal and monetary situation was becoming untenable and he decided to use this to create an existential threat to the US and the world financial system.

He undoubtedly knows that the West has artificially suppressed the price of gold and that is why he has been building his gold reserves steadily for the past 20 years.

Putin just shot "King Dollar" in the head.

We can see it in the financial markets, as the price of everything commodity-related is going up relentlessly in dollar terms.

Russia is long commodities, long gold, and doesn't need fiat currency. His debt to GDP ratio is low and taxes are low. If the world financial markets collapse on a relative basis, the position of Russia will be improved significantly. This is what I believe he is playing for. If investors do not recognize this, they will be caught wrong footed as I believe many are today.

The implications for investors are quite clear. None of us own enough gold, real assets or commodities. Fiat currencies are going to fail spectacularly, and soon, in my opinion.

In the April issue of the “You May Not Know Report”, I report on another potential development that, should it occur, will be another blow to diminishing US Dollar dominance. “The Wall Street Journal” ran a story (Source: https://www.wsj.com/articles/saudi-arabia-considers-accepting-yuan-instead-of-dollars-for-chinese-oil-sales-11647351541) reporting that Saudi Arabia is now in serious discussions with China to price the kingdom’s oil sales or at least part of the oil sales in the Chinese currency. Here is an excerpt:

Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

The Saudis are angry over the U.S.’s lack of support for their intervention in the Yemen civil war, and over the Biden administration’s attempt to strike a deal with Iran over its nuclear program. Saudi officials have said they were shocked by the precipitous U.S. withdrawal from Afghanistan last year.

China buys more than 25% of the oil that Saudi Arabia exports. If priced in yuan, those sales would boost the standing of China’s currency. The Saudis are also considering including yuan-denominated futures contracts, known as the petroyuan, in the pricing model of Saudi Arabian Oil Co., known as Aramco.

As I discuss in detail in the April “You May Not Know Report”, since 1974, all of the oil exports of Saudi Arabia have been priced in US Dollars. Should that change, it will be more bad news for the US Dollar and more inflation as there will be another reason not to inventory US Dollars by other countries around the world.

Of course, none of these developments is at all surprising or shocking. History teaches us that fiat currency systems have a 100% failure rate. We are not debating the ‘what’, we are only debating the ‘when’.

In the meantime, we will probably continue to see accelerating inflation or hyperinflation which will be coupled with an economic slowdown as von Mises described the ‘crack up boom’.

There is growing evidence that we are now in a recession or, at the very least, moving toward one. The Federal Reserve Bank of Atlanta recently revised 1st quarter growth projections to 0%. This from “Seeking Alpha” published prior to the Fed’s ¼ point rate hike (Source: https://seekingalpha.com/article/4492503-stagflation-warning-atlanta-fed-cuts-q1-gdp-projection-to-zero_):

On Tuesday, the Atlanta Fed cut its GDP estimate for the first quarter of 2022 to zero.

Just a few days ago, the estimate was for 0.6% growth. That was down from 1.3% just a few days before that.

This is not an encouraging trend.

Keep in mind, Atlanta Fed GDP estimates tend to start high and then fall as the quarter progresses. We’re still early in the quarter.

Just a few weeks ago, a collapse in economic growth seemed impossible. We’re coming off 7% GDP growth in Q4, capping off the fastest growth year on record.

But here we are.

Stagflation is defined as little to no economic growth coupled with high inflation.

And here we are.

This puts the Federal Reserve in a nasty spot. The central bank would typically respond to an economic contraction with rate cuts and quantitative easing. But the Fed is supposed to be tightening monetary policy to deal with surging inflation.

In the book “New Retirement Rules”, I wrote about the two potential economic paths that were before us. Inflation followed by deflation or we would go direct to deflation. The latter could only happen if the Fed ceased easy money policies.

The Fed did not cease easy money policies but instead, doubled down on them. The inflation followed by deflation that I wrote about, now looks a lot like a ‘crack-up boom’.

This week’s radio program and podcast features an interview with market analyst, Michael Oliver, founder of Momentum Structural Analysis.

I get Mr. Oliver’s take on markets and ask him what he is now advising his clients. It’s a very informative interview with a very bright analyst. You can listen to the interview now by clicking on the "Podcast" tab at the top of this page.

“Famous people are deceptive. Deep down they are just like regular people. Like Larry King. We’ve been friends for forty years. He’s one of the few guys I know who is really famous. One minute he’s talking to the President on his cell phone and the next minute he’s saying to me, ‘Do you think we ought to give the waiter another dollar?’”

-Don Rickles