Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

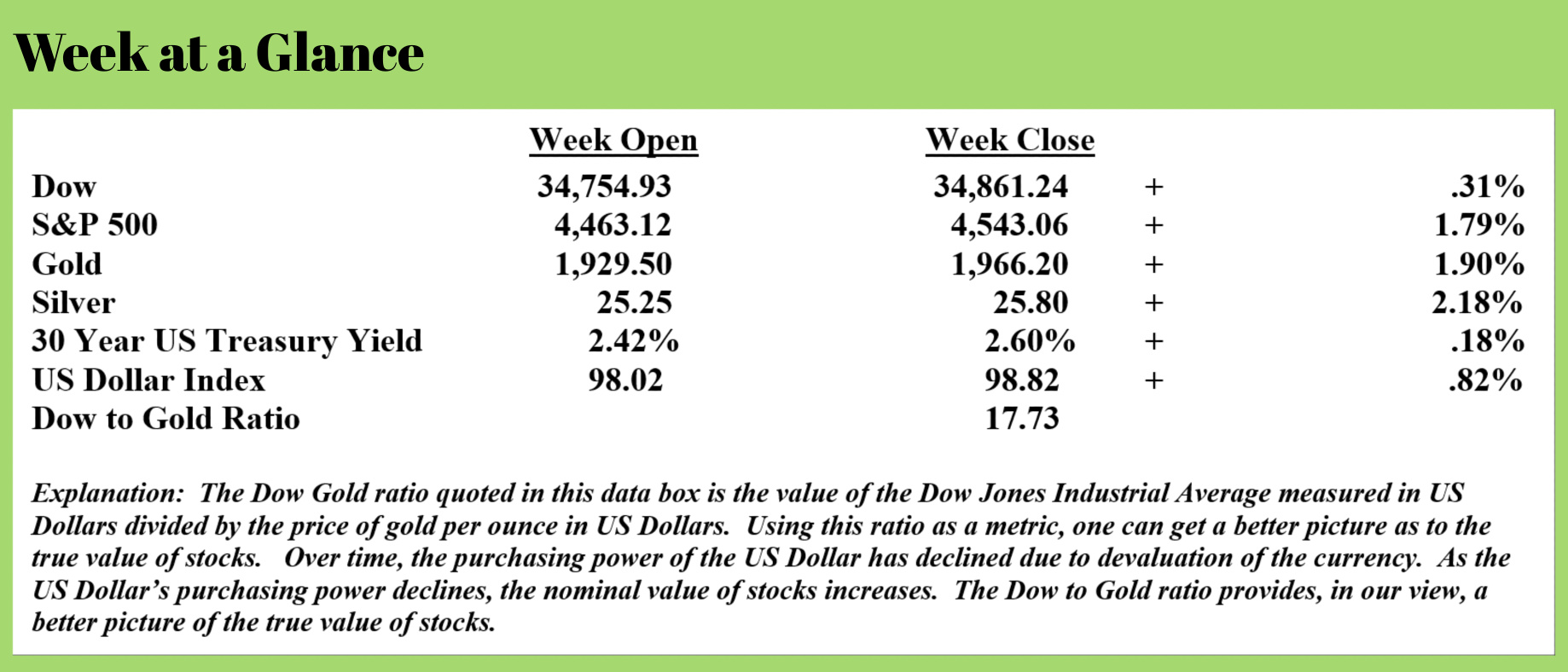

As noted last week, I view the current rally in stocks as a counter-trend with the primary trend being down. The Dow to gold ratio continued to fall. Ultimately, I expect this ratio to reach two or perhaps even one.

For new readers, the Dow to gold ratio is calculated by taking the value of the Dow and dividing it by the price of gold per ounce. The Dow is measured in US Dollars, a rapidly changing metric as the US Dollar continues to devalue.

When the Dow is measured in gold, which is a constant metric, one gets a clearer picture as to the actual value of stocks. At the tech stock bubble peak, the Dow to gold ratio was well over 40. At the close of the last big inflationary cycle in the US in 1980, the Dow to Gold ratio was one. I expect that as the present economic climate evolves, we will ultimately see a similar ratio.

Of course, world central banks will do everything they can to keep this ratio as constant as possible, but over the long term, economic laws will have to prevail. History teaches us that it is never possible to print your way to prosperity.

Thomas Paine, a hero at the time of the Revolutionary War but later much maligned over his views said, “Money is money and paper currency is paper. All the invention of man cannot make them otherwise.”

It may be wise to keep the perspective of Mr. Paine as we move forward. There are now 90 world central banks that have issued a central bank digital currency or are experimenting with them.

This is an excerpt from a piece (Source: https://www.nakedcapitalism.com/2022/03/the-world-quietly-took-another-step-toward-embracing-central-bank-digital-currencies.html) penned by Nick Corbishley (emphasis added):

Given how much is at stake, this financial revolution is among the most important questions today’s societies could possibly grapple with. It should be under discussion in every parliament of every land, and every dinner table in every country in the world.

Around 90 central banks are either in the process of experimenting with or are already piloting central bank digital currencies (CBDCs). In a world of just over 190 countries that is a large contingent, but given they include the European Central Bank (ECB) which alone represents 19 Euro Area economies, the actual number of economies involved is well over 100. They include all G20 economies and together represent more than 90% of global GDP.

Three CBDCs have already gone fully live in the past two years: the so-called DCash in the Eastern Caribbean, the Sand Dollar in the Bahamas and the eNaira in Nigeria. The International Monetary Fund, the world’s most powerful supranational financial institution, has been lending its expertise in the roll out of CBDCs. In a recent speech the Fund’s President Kristalina Georgieva lauded the potential benefits (on which more later) of CBDCs while heaping praise on the “ingenuity” of the central banks busily trying to conjure them into existence.

Also firmly on board is the world’s largest asset manager, BlackRock, which helps many of the world’s largest central banks, including the Federal Reserve and the ECB, manage their assets while obviously keeping all potential conflicts of interests at bay. The fund was the largest beneficiary of the Federal Reserve’s bailout of exchange-traded funds during the market rout of Spring 2020.

In his latest letter to investors, the CEO of BlackRock, Larry Fink, said the Ukrainian conflict has the potential to accelerate the development of digital currencies across the world.

“The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades As a result, a large-scale reorientation of supply chains will inherently be inflationary…

“The war will prompt countries to re-evaluate their currency dependencies. Even before the war, several governments were looking to play a more active role in digital currencies and define the regulatory frameworks under which they operate…

A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption. Digital currencies can also help bring down costs of cross-border payments, for example when expatriate workers send earnings back to their families.”

On Tuesday (March 22), the Bank for International Settlements published the findings of a study it had conducted with four central banks — the Reserve Bank of Australia, Bank Negara Malaysia, the Monetary Authority of Singapore, and the South African Reserve Bank — into the practical challenges of executing cross-border payments between different central bank digital currencies. The report concludes that while major hurdles still remain, financial institutions could use CBDCs issued by participating central banks to transact directly with each other on a shared platform:

The Bank for International Settlements (BIS) Innovation Hub, the Reserve Bank of Australia, Bank Negara Malaysia, the Monetary Authority of Singapore, and the South African Reserve Bank today announced the completion of prototypes for a common platform enabling international settlements using multiple central bank digital currencies (mCBDCs).

Led by the Innovation Hub’s Singapore Centre, Project Dunbar proved that financial institutions could use CBDCs issued by participating central banks to transact directly with each other on a shared platform. This has the potential to reduce reliance on intermediaries and, correspondingly, the costs and time taken to process cross-border transactions.

The project was organized along three workstreams: one focusing on high-level functional requirements and design, and two concurrent technical streams that developed prototypes on different technological platforms (Corda and Partior).

The project identified three critical questions: which entities should be allowed to hold and transact with CBDCs issued on the platform? How could the flow of cross-border payments be simplified while respecting regulatory differences across jurisdictions? What governance arrangements could give countries sufficient comfort to share critical national infrastructure such as a payments system?

The project proposed practical solutions for addressing these issues, which were validated through the development of prototypes that demonstrated the technical viability of shared multi-CBDC platforms for international settlements.

The findings of the experimental CBDC program could assist in the adoption of CBDC international settlement for G-20 nations, though given the rising geopolitical fissures in the so-called “international rules based order”, it is far from clear which countries would be willing to engage with one another in such a way.

China has already launched its own digital yuan and is piloting its use in more than a dozen cities and regions. It has also been experimenting with its cross-border functionality. This has ignited fears in the West that that U.S. “financial leadership” is under threat — fears that have been magnified by the way US and EU sanctions against Russia, particularly the confiscation of a large chunk of Russia’s foreign currency reserves have backfired, encouraging not just Russia but many countries on the planet to seek out an alternative cross-border payments system.

At the same time, the U.S. is determined to continue playing a leading role in the new global financial architecture. To that end, it has cobbled together a tentative consortium of “seven of the largest Western-aligned central banks, led in practice by the U.S. Federal Reserve and the European Central Bank… aimed at creating a system of ‘interoperable’ CBDCs,” reports Washington DC-based blogger and analyst NS Lyons in the article, Just Say No to CBDCs.

But what are CBDCs? How will they work? What purposes could they serve? How might they affect the general populations of the countries where they are introduced? To answer the first two questions, here’s an excerpt from “Just Say No to CBDCs“:

You might assume that you are already using “digital currency” regularly if you rarely use physical cash anymore and instead buy almost everything with a credit card or a digital payment app. In truth, the process of moving money from A to B is vastly more complicated than that. It involves a tangle of payment processors, banks, financial clearinghouses, and, if your money is crossing borders, international communication and exchange systems, such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT). The money itself doesn’t move anywhere fast, so each intermediary institution must assume risks to fulfill your transaction by accepting promises, sending transfers, verifying receipt of funds, and so on. Many fees get collected along the way for such services.

A CBDC system would be radically simplified. A customer would open an account directly with a country’s central bank, and the central bank would issue (create) digital money in the account. Crucially, this makes the money a direct liability of the Fed, rather than of a private bank. Using a simple smartphone app or other tools, the customer can then initiate direct transactions between Fed accounts. The digital money is deleted in one account and recreated in another instantaneously. Moving money across borders no longer requires something as complex as SWIFT or wire transfers, and currencies can be exchanged instantly as long as friendly central banks have agreements to do so. No promises or trust are necessary; every transaction is permanently recorded on a digital cryptographic ledger in real time—a bit like Bitcoin, but exquisitely centralized rather than distributed.

In his article, Corbishley points out the four primary ways that a central bank-issued digital currency could affect our lives.

One, central banks will have more power over our payment behavior. Another way to phrase this is that central banks will have more control. Agustin Cartens, general manager of the Bank of International Settlements, stated this intention in 2020 at a Summit hosted by the International Monetary Fund when he said, “We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control over the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

A digital currency gives the central bank complete control over money. There is no financial privacy and should the government, not like the behavior of an individual, freezing assets is easy.

Two, our spending could be programmed. NS Lyons, referenced above, had this to say on this topic. “The Fed could directly subtract taxes and fees from any account, in real-time, with every transaction or paycheck, if it wished. There could be no more tax evasion; the Fed would have a complete record of every transaction made by everyone. Money laundering, terrorist financing, any other unapproved transaction would become extremely difficult. Fines, such as for speeding or jaywalking, could be levied in real-time if CBDC accounts were connected to a network of “smart city” surveillance. Nor would there be any need to mail out stimulus checks, tax refunds, or other benefits, such as universal basic income payments. Such money could just be deposited directly into accounts. But a CBDC would allow the government to operate at a much higher resolution than that if it wished. Targeted microfinance grants, added straight to the accounts of those people and businesses considered especially deserving, would be a relatively simple proposition.”

Three, negative interest rates could be imposed with no limits. In a society with no cash, there would be no limit on how negative interest rates could go.

Four, the financial exclusion could accelerate. This from Mr. Corbishley’s piece:

Even proponents of CBDCs admit that central bank digital currencies could have serious drawbacks, including further exacerbating income and wealth equality.

“The rich might be more capable than others of taking advantage of new investment opportunities and reaping most of the benefits,” says Eswar Prasadm a senior fellow at the Brookings Institute and author of The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance. “As the economically marginalized have limited digital access and lack financial literacy, some of the changes could harm as much as they could help those segments of the population.”

So, not only will the introduction of CBDCs strip global citizens of one of the last vestiges of freedom, privacy and anonymity (i.e., cash), it could also exacerbate the upward transfer of wealth and power that many societies have witnessed since the COVID-19 pandemic began.

Stepping back, it’s easy to see that increased use of cryptocurrencies, and now this intensified talk of central bank-issued digital currencies is occurring because the existing system is breaking down. Currency creation on a widespread scale is causing inflation. Accelerating inflation is causing faith in world currencies to diminish.

Central banks and governments around the world don’t want to lose the monopoly that they have on the currency. So, in response to the problems that their own policies have caused, they are looking to take even more control over the currency system.

These efforts, in the long run, will fail as well in my view. In the words of Thomas Paine, “Money is money and paper currency is paper. All the invention of man cannot make them otherwise.” While a digital currency was not a thought when Mr. Paine made his statement, Mr. Paine’s observation will still hold true in my view.

All the inventions of men will not make digital currency money. Should digital currencies become a reality worldwide (and I remain skeptical), our current economic problems of growing inflation and a widening wealth gap will worsen in my opinion. Digital currencies will just make poor monetary policies easier to implement.

This week’s radio program and podcast features an interview with long-time “Forbes” columnist and publisher of “Insight” newsletter, Dr. A. Gary Shilling. I chat with Dr. Shilling about what he is presently advising his subscribers. You can listen now by clicking on the "Podcast" tab at the top of this page.

“The beginning of wisdom is to call things by their right name.”

-Confucious