Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

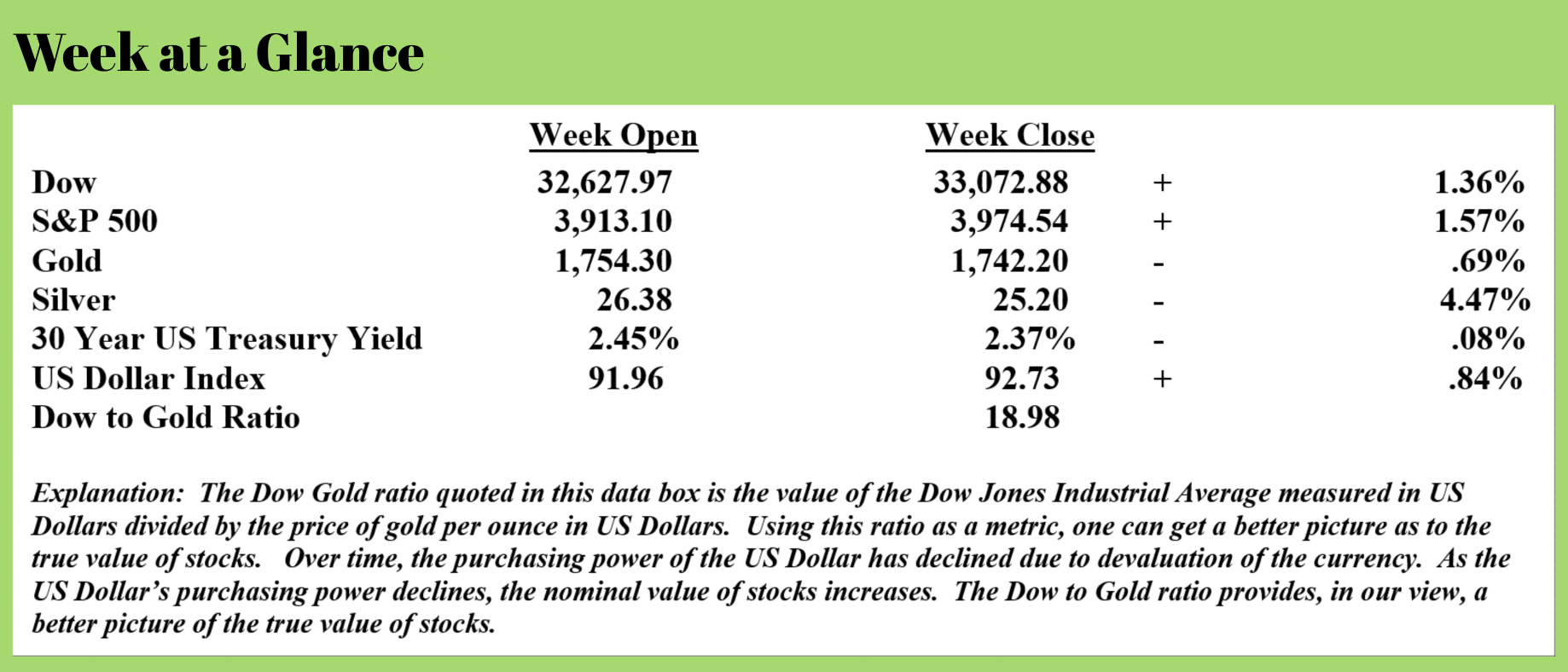

Stocks remain in an uptrend although the NASDAQ and emerging market stocks gave us a bearish signal this month. Short-term bear market trends in US Treasuries, gold, and the volatility index are extended meaning a reversal in these trends could occur at any time.

All of the sectors we track in our Sector Rotation portfolio are bullish for the month of April.

Despite the fact that precious metals had a negative week and even though my proprietary analysis has both gold and silver in a technical downtrend, the fundamentals for precious metals are strong, arguably extremely strong.

Let’s begin with statistics from the COMEX market, where gold and silvery futures are traded. The month of March is typically a pretty quiet month from the COMEX market but this March that is not the case.

This from Samuel Briggs via Kinesis Money (emphasis added):

Historically, the March contract presents very little volume or open interest. However, as the month draws to a close, we are observing huge delivery requests on the Gold Futures (GC) market. With only a few trading sessions remaining before March contracts expire, there are more than 29 tonnes of gold standing for delivery.

In terms of March silver delivery contracts, there are 11,000 open contracts representing over 1000 tonnes of physical silver. To put that into perspective, the current figure is already 300 tonnes higher than the December contract, the biggest delivery month of the year to date.

A look back at previous March contracts underlines the significant uptake in delivery obligations targeted at the COMEX.

Around the time the paper market broke, the COMEX delivered close to 2,900 March contracts. At the time, this level of delivery demand was extraordinary, with all March deliveries from 2015 to 2019 combined standing at around 800.

As the March 2021 contract closes, we’re approaching an astonishing 10,000 contracts. With the exception of last year, the March 2021 delivery orders are set to be around 25 times the average.

The demand for physical gold and silver is exploding. While this has not yet manifested itself in precious metals pricing, I believe it will be only a short time until prices rise.

As significant as this development likely is for the price of gold and silver, there is another recent development that will likely be bullish for the metals as well. World political leaders and central bankers are now openly discussing the fact that they are moving toward digital currencies.

For a long time, I have opined that as far as currencies are concerned there will have to be a reset. A reset can be proactive or reactive. A proactive reset is a planned, intentional reset while a reactive reset has the policymakers picking up the pieces after hyperinflation destroys the currency.

On the surface, it seems that we are headed toward a reactive reset. While spending at the Federal level last year was wildly out of control, Federal spending this year makes last year look thrifty and frugal as hard as that may be to believe.

Less than two weeks after the $1.9 trillion stimulus package became law, there is now talk of another $3 trillion spending package for infrastructure. While the first bill didn’t actually have the majority of the spending go for stimulus and the proposed infrastructure bill doesn’t have most of the money go for infrastructure, that is not my point.

My point is that there is no money to pay for any of this.

100% of the money spent will have to be created out of thin air. What’s troubling is the amount that will need to be created. Going into this year, the projected federal government operating deficit was projected at $2.3 trillion. The $1.9 trillion that the recently passed stimulus package will add to that total bringing the possible deficit to $4.2 trillion. A $3 trillion spending package on top of that gets the deficit to more than $7 trillion. Eye-popping no matter your political leanings.

A little more than 15 years ago, $7 trillion was the total national debt; now it may well be the operating deficit.

A savvy observer might look at this situation and ask himself or herself why the politicians and policymakers are spending so much. Are they ignorant of the inflation risk? Don’t they know that creating massive amounts of new currency literally out of thin air will have to create inflation or hyperinflation at some future point?

Given that nearly 80% of Americans are now concerned that inflation or hyperinflation is a real risk (Source: https://www.zerohedge.com/economics/77-americans-are-worried-about-soaring-inflation), one has to assume that the politicians and policymakers are keenly aware of the inflation risk.

Which begs the question, why are they pursuing these policies?

Could it be that they are intentionally setting up a reset?

I have to wonder. Nothing else makes sense. As Arthur Conan Doyle stated, once you’ve eliminated the impossible, you are left with the truth.

Is it possible that the politicians and policymakers don’t know that huge amounts of money creation creates inflation?

Not a chance.

So, we are left questioning why they are pursuing these policies.

Let me give you something to ponder and consider for yourself. Could it be that policymakers and politicians are pursuing these policies to accelerate the point at which the reset happens? Could it be that there will be a proactive, intentional reset that looks reactive?

Consider the recent statements of Treasury Secretary Janet Yellen (former Federal Reserve Chair) and current Federal Reserve Chair, Jerome Powell. Both have openly and enthusiastically endorsed the idea of a Digital US Dollar recently.

This from Stefan Gleason (emphasis added) (Source: https://www.moneymetals.com/news/2021/03/02/the-great-reset-is-coming-for-the-currency-002235):

As the Great Reset proceeds from globalist think tanks and technology billionaires to allied media elites, governments, schools, and Woke corporations, what will be “reset” next?

Supporters of the World Economic Forum’s all-encompassing Great Reset agenda are eyeing BIG changes for the global monetary system.

Plans that might once have been dismissed as pure speculation or conspiracy theories are now being openly pushed by people who occupy the highest levels of power.

President Joe Biden’s economic policies were grafted directly from the “build back better" language of the Great Reset’s authors.

Biden’s agenda for the economy is now being spearheaded by Treasury Secretary Janet Yellen. The former Federal Reserve chair has taken a particular interest in stamping out cryptocurrencies and expanding the reach of the International Monetary Fund (IMF) – which could ultimately be the issuer of a new global digital currency.

In principle, Yellen and her global central planning cohorts support the digitization of money. In fact, they are enthusiastic about the prospects for replacing circulating paper cash with digital tokens.

They just want to make sure those digits are issued and controlled by governments and central banks.

Last Thursday, Yellen told the G20 the United States would back a new issuance of the IMF’s international reserve asset, known as a Special Drawing Right (SDR).

SDRs were last issued in 2009, in part to address liquidity concerns, in part to build a precedent for something bigger down the road.

In 2011, the IMF issued its first blueprint for replacing the U.S. dollar as the world’s reserve currency with a global SDR regime.

Federal Reserve Chairman, Jerome Powell also openly stated that a digital currency is a very high priority for the central bank.

In testimony before Congress, Powell recently stated that a digital dollar “is a high priority for us”.

Is it possible that all this spending and money creation could move us closer to a reset?

Might that reset involve digital currency?

I would not be surprised.

But, history teaches us that fiat currencies always fail. It won’t matter if the fiat currency is digital or paper.

A reactive or proactive reset that has the currency moving digital cannot be successful long term unless there is a solid link between the currency and gold or silver. Anything less will be a short-lived solution.

`The radio program this week features an interview with Murray Gunn, head of Global Research at Elliot Wave International.

Murray and I talk about what Elliot Wave is and what the analysis system is telling him about the markets presently.

I get Murray’s outlook for stocks, bonds, and other markets.

The interview is now available on the YourRLA app or by clicking on the "Podcast" tab at the top of this page.

“A positive attitude may not solve all your problems but it will annoy enough people to make it worth the effort.”

-Herm Albright