Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

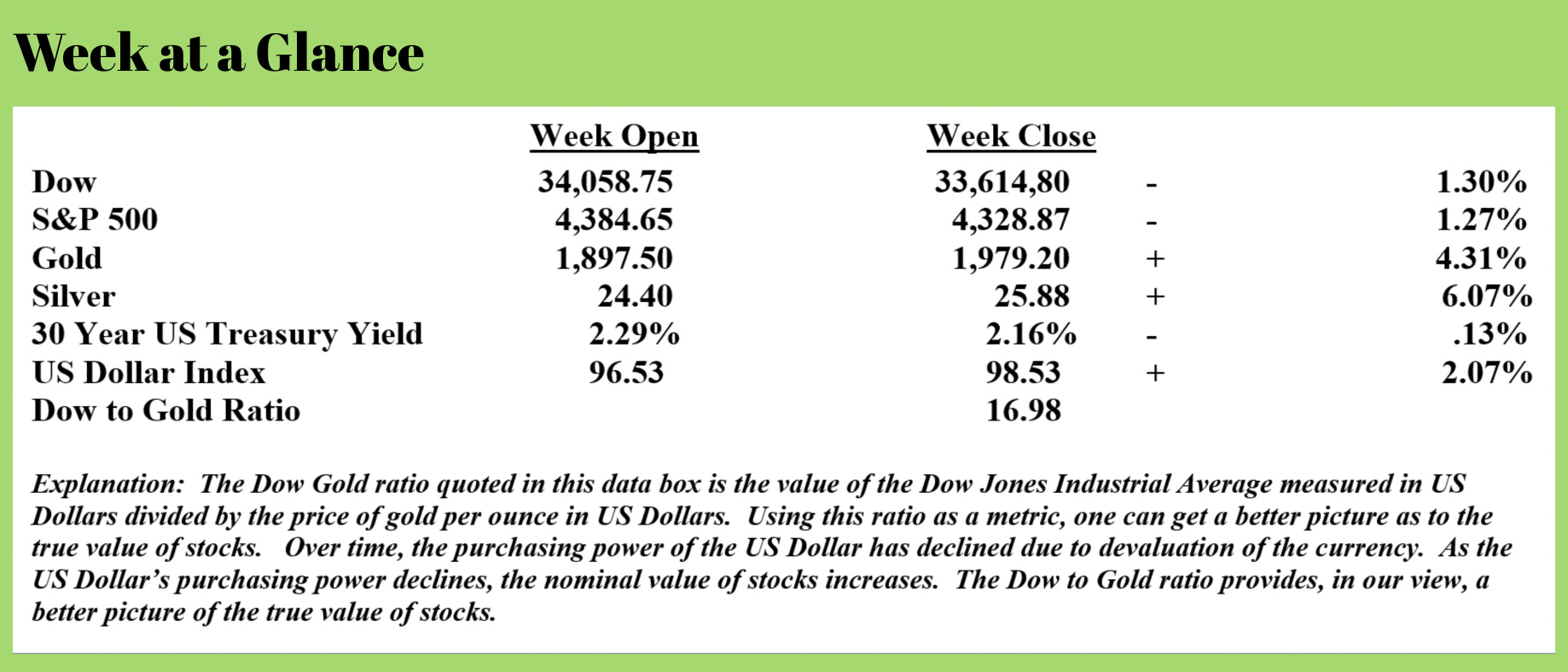

Stocks continued their decline last week as metals rallied strongly. While many analysts blame the rising geopolitical tensions for the decline in stocks and the rise in gold and silver prices, the reality is that stocks went into calendar year 2022 extremely overvalued, and metals were undervalued in light of the massive currency creation that has been taking place over the past couple of years.

Moving ahead, I expect more upside for metals as central banks around the world continue to create currency despite their talk to the contrary. Past guest on my radio program, Mr. Alasdair Macleod put it this way in his excellent article this week (Source: https://www.goldmoney.com/research/goldmoney-insights/when-normality-is-exposed-as-a-ponzi) (emphasis added):

Today, this is the situation with the whole fiat hypothesis. It has been going in its current form since 1971, when President Nixon took the dollar off from the Bretton Woods fig leaf of a gold standard. With a few ups and downs since now we have all bought into the dollar-based fiat Ponzi. Everyone committed to it not only “sincerely wants to be rich” but believes we can be without having to work for it.

Since the 1980s the currency Ponzi was bankrolled by the expansion of bank credit aimed at consumers and their housing until the Lehman crisis. Since then, it has been financed by central bank QE, credit expansion, and the odd helicopter drop. Today, in the wake of covid lockdowns central banks are scrambling to keep the illusion alive by printing currency even more aggressively while screwing down interest rates and bond yields.

Meanwhile, the political class has become complacent. For them, their central banks will continue to fund the state’s excess spending while maintaining monetary and financial stability. And one can easily imagine that in dealing with matters of state, central banks are no longer consulted; their support is simply assumed.

The Federal Reserve and other world central banks that are now indirectly monetizing deficit spending cannot end loose monetary policies until government spending is reined in; an event that is highly improbable at this time.

We are living in an interesting time, to say the least. Stocks and bonds are in a bubble. Regardless of the reason given for the decline in stocks by the pundits, overvalued assets eventually return to their real value.

The stock and bond bubbles have been created by the fiat currency bubble. Or, as Mr. Macleod describes it, the fiat currency Ponzi scheme. Mr. Macleod also points out that this fiat currency Ponzi scheme may be about to be exposed. Here is another excerpt from his terrific article (which I would encourage you to read in its entirety by clicking the link to the article above):

Now we face an aggressive Russia. In the West, it is unwisely assumed that America, the EU, UK, and their allies can just shut Russia down by isolating it from international financing facilities. By denying access to Western currencies at the central bank level, they believe that the Russian economy will be ruined rapidly. The rouble is rubble and prices are rising. ATMs are empty and bank runs are everywhere. Putin will be forced to give in in a matter of days, or a week or two at the outside.

Putin has responded most alarmingly by announcing the mobilization of his nuclear capability, threatening to liquidate Ukrainians and/or his Western enemies. We can only assume that won’t happen because if it does, including Putin we are all dead anyway. Instead, escalation to world war levels should be more seriously considered as being financial and economic in nature. Last weekend we saw the first financial salvos being fired by the West: sanctions against prominent Russians, withdrawal of SWIFT access for Russian banks, and cutting off Russia’s central bank from access to its currency reserves.

The risk, which is barely understood even by central bankers let alone the politicians, is that Russia has the power to reverse the flows that keep the West’s currency Ponzi alive. In this article, we look at the situation on the ground, estimate how the financial war is likely to evolve, and how the fifty-one-year fiat Ponzi we are complacently accustomed to is likely to finally collapse.

Mr. Macleod points out that the sanctions being imposed on Russia have not been thoroughly considered and will probably serve to continue the devaluation of the US Dollar.

It appears that SWIFT payments and currency transfers from the Russian Central Bank’s accounts with other central banks will be permitted only for oil and gas payments. The message to Putin is “we are going to do all we can to make your life impossible, but we expect you to continue to supply us with oil and gas”. This only makes sense if the financial sanctions being put in place rapidly bring Russia to its knees, making Putin desperate for the revenue from energy exports.

What is not clear is how Russia can spend the dollars and euros earned from energy exports if payments for imported goods and services are prohibited. If that is really the case, then foreign currency is valueless in Russian hands. The thinking behind these sanctions does not, therefore, make sense. But in practice, SWIFT does not really matter, because there are alternative means of settlement communications between banks. What matters more is guidance for Western banks from their regulators, forcing them not to accept payments from Russian sources. And that is also bound to threaten oil and gas-related transfers. “If in doubt, chuck it out…”

Furthermore, it isn’t clear why Russia needs more dollars and euros anyway. Western leaders and the financial media merely assume that the Russian kleptocracy relies on foreign currencies. This is not true. The Russian economy is reasonably healthy and stable. Income tax is a flat 13%, business regulation is light, public-sector debt is less than 20% of GDP, and the banking system is considerably healthier overall than that of its neighbors. Libertarians in the West can only dream of these conditions. The loss of all oil and gas revenue is about the only thing which would hurt Russia, but that has been exempted in the sanctions. Anyway, depending on the exchange rate, Russia’s break-even oil price is said to be below $45, less than half the current level. Or put another way, Russia can more than halve its total oil exports at current prices and still get by. The margins on natural gas are probably similar.

SWIFT is an acronym for Society for Worldwide Interbank Financial Telecommunications. It is a messaging system that banks use to securely send and receive information like money transfer instructions. Russia has been cut off from the SWIFT system with the exception of payments for gas and oil. The question that Mr. Macleod raises is an important one – how does it benefit Russia to export oil and gas and take Dollars and Euros as payment if they can’t spend the Dollars and Euros?

Russia will likely respond to the sanctions in a way that will be unfavorable to consumers in the west. It will likely accelerate inflation which is already causing pain. One more excerpt from Mr. Macleod’s piece:

In any event, Russia still has China as a major market for its energy and commodities. By switching extra supplies to China, China would simply cut back on its imports from the rest of the world. Admittedly, the pipeline network to China cannot handle oil and gas volumes on the European scale, but any revenue shortfall can be made up to a degree by additional sales of other commodities.

Therefore, while obviously painful, the sanctions against Russia are unlikely to undermine its entire economy. But Russia’s response might.

Putin will have calculated that with continuing commodity sales to China and other Asian states within the Shanghai Cooperation Organisation (which represents roughly half the world’s population) that they can squeeze Europe on energy supplies for as long as it takes. European nations will have found their economies are in a vice-like grip that threatens to get even tighter. Pepe Escobar’s tweet above refers.

But as Escobar suggests, even if that is not enough, being cut off from spending or selling euros for goods and settling through SWIFT, Russia would be reasonable to request payment in gold because there would be no point in accumulating valueless Western fiat currencies. The Central bank of Russia could then exchange some of the gold for roubles to supply the economy’s need for currency as necessary without undermining its purchasing power, adding the balance to its gold reserves. This would be edging towards a de facto gold standard, which could have the merit of stabilizing the rouble and putting it beyond the reach of foreign attacks. Russia’s gold strategy and its consequences are discussed more fully below.

Ironically, the Russian sanctions may move the world closer to a gold standard. China and India, two major trading partners of Russia, have noteworthy gold holdings.

Looking at the recent performance of precious metals, it seems that much of the world may understand this.

If you are not participating in the weekly “Headline Roundup” webinars, they happen live each Monday at Noon Eastern time. Feel free to give the office a call at 1-866-921-3613 to get an e-mail link to the weekly broadcast, or click here to register. When you register, you'll get a reminder email each week.

This week’s radio program and podcast features an interview with John Rubino, co-author of “The Money Bubble” that predicted much of what we are now seeing. John also manages the highly popular dollarcollapse.com website. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Good times make weak people. Weak people make lousy times. Lousy times make strong people. Strong people make great times.”

-Anthony Robbins