Weekly Market Update by Retirement Lifestyle Advocates

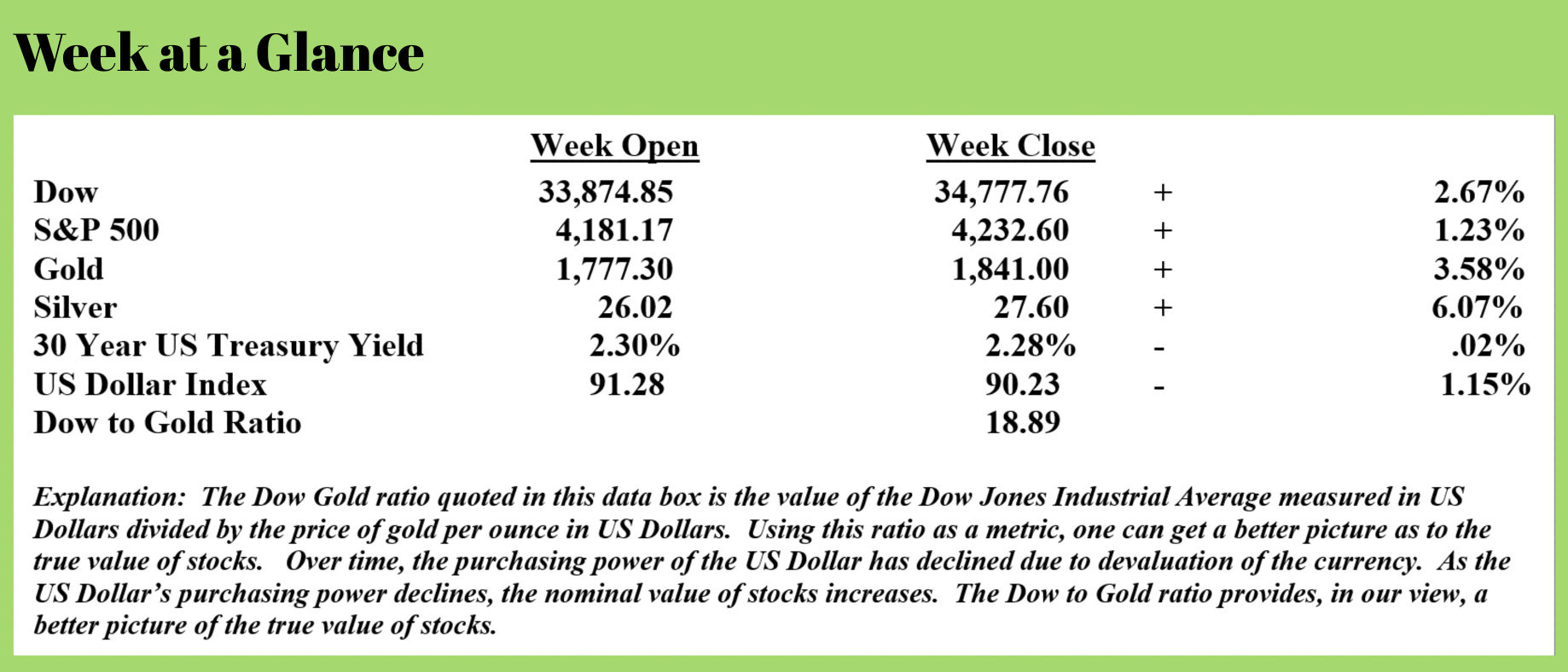

Gold and silver had big rally weeks last week as did the Dow and the S&P 500. The US Dollar Index lost more than 1%.

We are now bullish on US Treasuries by our technical indicators. Stocks remain extremely extended although technically bullish.

As I have been discussing for a very long time, the current economic policies being pursued will likely result in the realization of Thomas Jefferson’s warning to us more than 200 years ago.

If you are a new reader, Mr. Jefferson warned us that we should not allow private bankers to control the issue of our currency. Should we do so, he cautioned, first by inflation then by deflation the banks and corporations that will grow up around us will deprive the people of all property until our children wake up homeless on the very continent our fathers conquered.

In the “New Retirement Rules” class that I taught beginning in 2011, I suggested that there were two potential economic outcomes depending on what the policy of the Federal Reserve was moving ahead. We would have deflation like we saw in the 1930’s during The Great Depression or we would have inflation followed by deflation as Mr. Jefferson suggested should the Fed elect to print money.

It is now clear that we are on the latter path and the one that Mr. Jefferson warned us about.

Signs of inflation are everywhere.

In last week’s issue of “Portfolio Watch”, I discussed the statements made by Warren Buffet at the Berkshire Hathaway meeting. During his lengthy address, Mr. Buffet stated “We are seeing very substantial inflation. We are raising prices. People are raising prices to us and it's being accepted.”

That statement (and reality) flies in the face of recent statements made by Federal Reserve Chair, Jerome Powell who insisted that inflation is “transitory”. To think that the Fed has expanded the money supply by ridiculous amounts and we will have only short-lived or temporary inflation is ludicrous.

Bank of America this past week suggested something similar. The bank stated that the US will experience a “transitory hyperinflation”. (Source: https://www.zerohedge.com/economics/and-now-rents-are-soaring-too)

To some extent, that statement is accurate. History teaches us that hyperinflations are typically temporary and often last until faith in the currency is lost at which point a reset has to occur.

For many years, I have been suggesting a two-bucket approach to managing assets with one bucket invested to protect assets when the deflation part of the cycle hits and another to hedge from what is now inevitable inflation.

Just this past week, reliable news sources reported on the ever-increasing levels of inflation now hitting the economy as a result of the Fed’s money printing. And now, with talk of another $4 trillion stimulus package heating up, more money creation to fund more spending is probably on the horizon.

At the risk of being too political for this publication, in which I try to focus on economic and investing issues, there are actually politicians (in both parties) who are calling the proposed $4 trillion stimulus package an ‘investment’ not an expense.

That is pure rhetoric and not based in fact. In order to make an investment, you need to have money to make the investment.

As we all know, the government has no money, and the current levels of debt and unfunded liabilities simply cannot be funded by any kind of tax increases. As I’ve discussed in the past, 100% of household wealth in the US could be confiscated via a 100% wealth tax and the financial house of the US would still not be in order.

The reality is this. Current policies being pursued by the Fed will result in a tax on savers and investors.

Not in the form of a physical tax, but rather an inflation tax that sees the purchasing power of investments and savings diminish.

As I’ve been noting here each week, it seems that the inflation part of the cycle is now upon us. What we’ve been discussing as theory for the past several years is now transforming into an ugly reality.

Rents are increasing significantly. This will adversely affect the lower-income workers who typically rent and don’t own their homes.

This from “Zero Hedge” (Source: https://www.zerohedge.com/economics/and-now-rents-are-soaring-too):

On Thursday, American Homes 4 Rent, which owns 54,000 houses, increased rents 11% on vacant properties in April, the company reported in a statement:

. .. Continued to experience record demand with a Same-Home portfolio Average Occupied Days Percentage of 97.3% in the first quarter of 2021, while achieving 10.0% rental rate growth on new leases, which accelerated further in April to an Average Occupied Days Percentage in the high 97% range while achieving over 11% rental rate growth on new leases.

Invitation Homes, the largest landlord in the industry, also boosted rents by a similar amount, an executive said on a recent conference call. Or, as Bloomberg puts it, record occupancy rates are emboldening single-family landlords to hike rents aggressively, testing the limits of booming demand for suburban rentals.

While soaring housing costs had put homeownership out of reach for most Americans, rents had been relatively tame for much of 2020. But in recent months, rents have also soared as vaccines fuel optimism about a rebound from the pandemic, and a reversal in the city-to-suburbs exodus. The increases, as Bloomberg so eloquently puts it, "may add to concerns about inflation pressures." Mmmk.

“Companies are trying to figure out how hard they can push before they start losing people,” said Jeffrey Langbaum, an analyst at Bloomberg Intelligence. “And they seem to be of the opinion they can push as far as they want.”

The article states that “Bloomberg” eloquently stated that increasing rents ‘may add to concerns about inflation pressures’. I’d suggest it’s evidence of inflation.

There are many other examples of ‘inflation pressures’. One of these examples, food, also disproportionately affects lower-income households. Michael Snyder commented this past week (Source: http://theeconomiccollapseblog.com/what-will-you-do-when-inflation-forces-u-s-households-to-spend-40-percent-of-their-incomes-on-food/)

Did you know that the price of corn has risen 142 percent in the last 12 months? Of course, corn is used in hundreds of different products we buy at the grocery store, and so everyone is going to feel the pain of this price increase. But it isn’t just the price of corn that is going crazy. We are seeing food prices shoot up dramatically all across the industry, and experts are warning that this is just the very beginning. So if you think that food prices are bad now, just wait, because they are going to get a whole lot worse.

Typically, Americans spend approximately 10 percent of their disposable personal incomes on food. The following comes directly from the USDA website…

In 2019, Americans spent an average of 9.5 percent of their disposable personal incomes on food—divided between food at home (4.9 percent) and food away from home (4.6 percent). Between 1960 and 1998, the average share of disposable personal income spent on total food by Americans, on average, fell from 17.0 to 10.1 percent, driven by a declining share of income spent on food at home.

Needless to say, the poorest Americans spend more of their incomes on food than the richest Americans.

According to the USDA, the poorest households spent an average of 36 percent of their disposable personal incomes on food in 2019…

Needless to say, the final numbers for 2020 will be quite a bit higher, and many believe that eventually, the percentage of disposable personal income that the average U.S. household spends on food will reach 40 percent.

That would mean that many poor households would end up spending well over 50 percent of their personal disposable incomes just on food.

As benevolent and perhaps even as well-intentioned as stimulus to help those who have been harmed financially over the past year sounds, the fact that money has to be created out of thin air to fund stimulus payments ultimately ends up hurting those that were supposed to be helped.

Stagflation is here. The economy is contracting, and prices are rising. If you have not yet seriously investigated how the two-bucket approach to managing assets might help you navigate what lies ahead, I would urge you to do so.

And I would do so soon.

The radio program this week features an interview with one of the hardest working market analysts in the business, Dr. Robert McHugh.

I get Dr. McHugh’s forecasts for all the markets we track and ask him how your IRA or 401(k) might be affected.

He discusses a very important technical indicator called the “Hindenberg Omen” and what it may mean for stocks moving ahead.

The program is available to listen to now by clicking on the "Podcast" tab at the top of this page.

“Democracy means that anyone can grow up to be president, and anyone who doesn’t grow up can be vice-president.”

-Johnny Carson