Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Did you see the recent Social Security trustee’s report?

You can find the entire 277-page document here: https://www.ssa.gov/oact/TR/2024/tr2024.pdf

The report states that the Social Security Trust Fund is expected to be depleted in 2033. That’s just nine years away!

James Hickman, writing for “Schiff Sovereign,” had this to say about the recently releases report (Source: https://www.schiffsovereign.com/trends/social-security-will-run-out-of-money-in-nine-years-150811/):

Social Security’s annual trust fund report was released yesterday… and, no surprise, the report states very clearly that trust fund balances “are projected to become depleted during 2033.”

Allow me to repeat that: Social Security’s most important trust fund will run out of money in nine years.

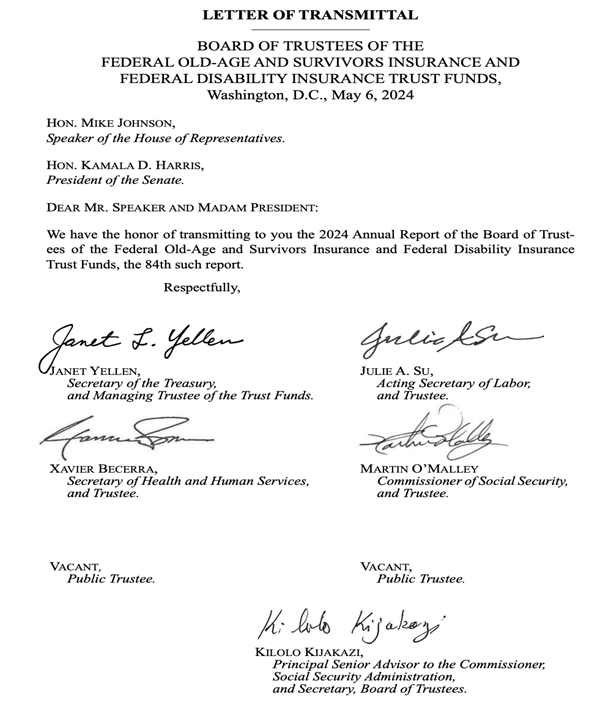

This is a fact, not some wild conspiracy theory; remember that the annual report is signed by top government officials, including the United States Secretaries of the Treasury, Labor, and Health and Human Services… so the projection is about as official as it can get.

Hickman is right on target. I’ve republished the cover page of the official report here.

Notice that Treasury Secretary Janet Yellen’s signature is on the first page of the report, along with the signatures of the Acting Secretary of Labor and the Secretary of Health and Human Services.

Hickman makes the following additional observations about the annual report:

But if you dive into the report, you quickly notice that even such a grim forecast may, in fact, be too optimistic.

But if you dive into the report, you quickly notice that even such a grim forecast may, in fact, be too optimistic.

Many of the key economic assumptions that they make in the report are wildly inaccurate. They assume, for example, that US fertility rate will be as high as 2.1 (i.e. 2.1 children born per woman). But, in reality, the US fertility rate has been falling for decades, and just hit another all-time low of 1.6 last year.

They’re also way off on other assumptions– like economic productivity. They assume (rather optimistically) that productivity growth will average 2%. Last year it was just 1.3%. And in 2022 productivity actually shrank by 1.9%.

They’re also way off-base in their assumptions about inflation, unemployment, and more.

Plus, just like the Congressional Budget Office’s long-term projections about the US economy, the Social Security trustees don’t account for any kind of future emergency, pandemic, recession, depression, war, financial crisis, or debt crisis.

The really ironic part is that the trustees’ assumptions fail to consider the future economic impact of Social Security going bankrupt.

Think about it– when Social Security’s trust funds suddenly run out of money, it’s going to trigger a major crisis in the United States. Clearly this will be disruptive and throw off their rosy economic assumptions. But they don’t account for this either.

Bottom line, Social Security’s demise is, at best, nine years away. And probably sooner.

So, what will happen when Social Security runs out of money?

Remember that 70 million retirees’ monthly benefits are essentially funded from three different sources.

The first source is payroll tax revenue; people currently in the labor force fork over a portion of their wages to pay Social Security benefits.

For decades, payroll tax revenue exceeded the total benefits that Social Security paid. And this surplus was invested into a special trust fund, which now totals trillions of dollars.

And that’s the second source of funding for the program: investment income from the trust fund, while the third source is the trust fund itself.

Again, for most of Social Security’s history, the trust fund was growing, and its investment income was compounding year after year.

But starting in 2021, Social Security’s annual costs have exceeded combined payroll tax revenue and investment income. So, in order to make ends meet, the program had to start dipping into its trust fund.

The fund’s reserves are now falling. And, again, by 2033, the trust fund will be fully depleted. This also means that there will be no more investment income… leaving payroll tax revenue as the sole source to fund Social Security.

Once this happens, the report states that retirees will have to suffer an immediate, substantial cut (roughly 25%) to their promised benefits. And most likely this cut will continue to become worse over time.

The time to take action on Social Security is long overdue.

Yet, the majority of the politicians in Washington are not doing anything except insist that Social Security will not be cut or changed depending on which politician you want to listen to.

After the recent report was released, the Biden Administration released a report stating that “Social Security remains strong.” (Read it here on the website of the White House: https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/06/statement-from-president-joe-biden-on-the-social-security-and-medicare-trustees-reports/)

Not sure what report Biden was reading, but it couldn’t have been this one.

If you click on the link above and read the statement from the White House, Biden is proposing making Social Security stronger by making the wealthy pay “their fair share”.

The only problem with that solution is it’s not a solution at all – it’s rhetoric.

The current annual outlay for Social Security is just about $1.4 trillion per year. In 9 years, there will be enough Social Security tax revenues to pay 75% of promised benefits under the rosiest of assumptions.

That will be a shortfall of $350 billion per year. Adding that shortfall to interest on the debt that will reach $1.6 trillion annually by the end of this year, continued deficit spending that will have increased to pay for higher interest costs and shortfalls in other programs (Medicare for one) that are underfunded and we quickly run out of enough wealthy people to cover even a small portion of these growing fiscal problems. For example, confiscating 100% of the wealth of billionaires doesn’t even solve the deficit problem for a year and a half.

Hickman suggests that even the “Wall Street Journal” which purports to be a conservative publication, is shrugging off the seriousness of this problem:

Even the Wall Street Journal, which is supposed to be a conservative-leaning paper, published an article this morning to say that Social Security’s rapidly depleting trust funds are no big deal… because Congress can always just “choose” to continue funding the program.

Uh… with what money? The budget deficit is already $2 trillion per year. So, if Congress “chooses” to continue paying out 100% of Social Security benefits after 2033, it will all be funded with more debt.

The Journal then suggests that such spending “could also mean the U.S. deficit continues to grow at a pace economists find alarming, potentially weighing on the performance of the economy.”

Could? Potentially? In what reality does a multi-trillion-dollar deficit and a fully depleted Social Security trust fund NOT weigh on the US economy?

It’s astonishing how few people want to acknowledge the reality. Social Security will run out of money. Benefits are at risk. And the only way to ‘save’ the program is more debt… which means more inflation, more risk to the dollar’s global reserve status, and more consequences down the road.

How will this problem be solved?

Short-term, I expect that Hickman will be correct. More debt accumulation funded through currency creation, a.k.a. quantitative easing, would be my forecast.

This is just another reason to use the “Revenue Sourcing” planning process when planning your retirement income.

This week’s radio program features an interview that I did with economic and political commentator and author Mr. Karl Denninger.

Be sure to check out the interview now by clicking on the "Podcast' tab at the top of this page.

“Thinking is the hardest work there is, which is probably why so few people engage in it.”

-Henry Ford

Comments