Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

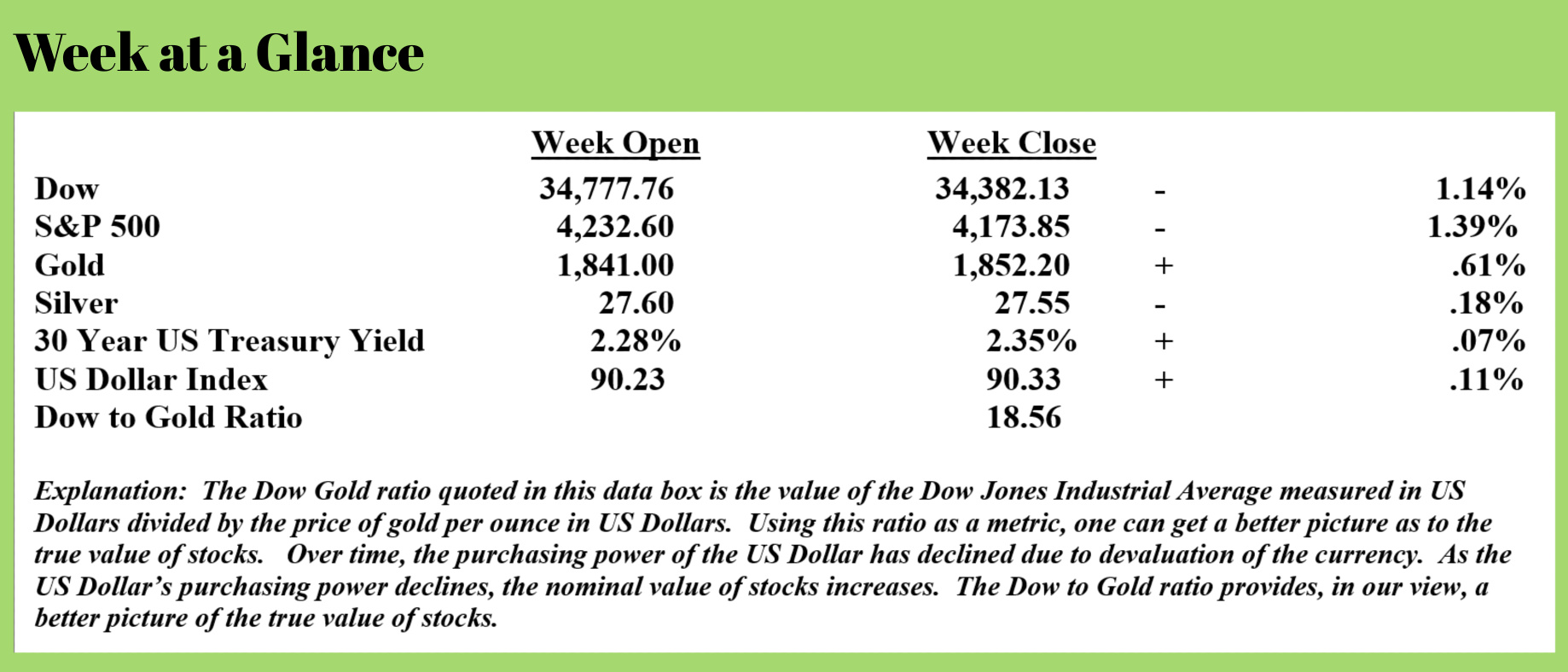

As noted last week, stocks looked extended. Stocks look even more extended this week. Gold and silver are beginning to look more bullish and despite a bad week for US Treasuries, we remain technically bullish on the long bond for now.

As I have been warning for a long time, the Fed’s money creation policies are now leading to inflation. The Fed is insisting that the inflation we are now seeing is transitory and will settle down once the economy returns to a more normal status. I have my doubts if current monetary policy continues as it now seems it will.

The most commonly used measure of inflation the Consumer Price Index has risen significantly over the past several months. This from “Wolf Street” (Source: https://wolfstreet.com/2021/05/12/its-getting-serious-dollars-purchasing-power-plunges-most-since-2007-but-its-a-lot-worse-than-it-appears/) (emphasis added):

Fed officials, economists “surprised” by a surge in CPI inflation, but we’ve seen it for months, including “scary-crazy” inflation in some corners.

The Consumer Price Index jumped 0.8% in April from March, after having jumped 0.6% in March from February – both the sharpest month-to-month jumps since 2009 – and after having jumped 0.4% in February, according to the Bureau of Labor Statistics today. For the three months combined, CPI has jumped by 1.7%, or by 7.0% “annualized.” So that’s what we’re looking at: 7% CPI inflation and accelerating.

Consumer price inflation is the politically correct way of saying the consumer dollar – everything denominated in dollars for consumers, such as their labor – is losing purchasing power. And the purchasing power of the “consumer dollar” plunged by 1.1% in April from March, or 12% “annualized,” according to BLS data. From record low to record low. Over the past three months, the purchasing power of the consumer dollars has plunged by 2.1%, the biggest three-month drop since 2007. “Annualized,” over those three months, the purchasing power of the dollar dropped at an annual rate of 8.4%.

As I have noted in the past, the Consumer Price Index is not really an accurate assessment of the true inflation rate. Over the years, the CPI has been manipulated to make the reported level of inflation appear more favorable.

Economist John Williams of ShadowStats.com and The Chapwood Index are both private inflation measures that, in the view of many, including me, provide far more accurate pictures of the real inflation rate.

Mr. Williams, using the inflation rate calculation methodology used pre-1980, now calculates the actual inflation rate to be approaching 13%. That is 1970’s style inflation.

What is different presently is the response of the Federal Reserve to the inflationary environment. In the 1970’s and presently, the cause of inflation lies at the feet of the Fed. In 1980, responding to the high level of inflation, the Fed increased interest rates to more than 20%. Inflation was subdued.

Presently, the Fed is taking the opposite approach vowing ultra-low interest rates and more money creation. Why is the Fed taking an approach that is obviously reckless?

The answer is simple; the Fed must now monetize government spending. Interest on the national debt which is now approaching $30 trillion is already consuming a large portion of the operating budget. An increase in interest rates bankrupts the government (or makes the bankruptcy obvious). So, the Fed has elected to continue to pursue the policy that has caused the inflationary problem. Likely pursuing the policy until the inflation gets so out of control that it causes the price reset the Fed is trying so hard to avoid.

Government finances have deteriorated substantially since last year. Deficit levels are up more than 30% from the same time frame last year. Creditors are not lined up to buy US Government debt so the Fed becomes the buyer of last resort using newly printed currency to purchase US Government debt.

Ironically, in light of the increase in prices in food, lumber, fuel, and other items, gold and silver have moved higher but not to the extent one might have expected. Frank Holmes, CEO of US Global Investors addressed this issue last week stating that central banks around the world are stabilizing prices of precious metals. Holmes stated, “The threat of gold exploding would basically say they have lost control, and I really think there is some type of stabilization if you want to call it.”

That begs the question, how would a central bank go about ‘stabilizing’ or manipulating the price of gold and/or silver. Craig Hemke of “Sprott Money News” explains (Source: https://www.silverdoctors.com/gold/gold-news/bullion-bank-pump-n-dump/) (emphasis added):

Though we’ve seen this trick countless times over the years, it never gets less frustrating. However, with a summer rally pending, this latest Bank effort might be instructive.

Speaking of countless, I have no idea how many times I’ve written about this topic. Ten? Twenty? It’s impossible to say and, unfortunately, the fraud of the current pricing scheme continues. At any rate, you might review this post from April 2017 as it explains in greater detail the specifics of this latest smash, which we’ll discuss in detail today.

Here is your most recent example of this tried-and-true, Bank price manipulation technique.

Over the last three days—Thursday, May 6; Friday, May 7; Monday, May 10—some of the most fundamentally bullish news of the year hit the COMEX gold market. Inflation is soaring. Real interest rates are plunging. Wages are increasing and stagflation is pending. All of this combined to surge Speculator interest in COMEX gold. Hedge funds, institutions, and traders all sought COMEX gold price exposure, and the price rose $55 over those three days.

But that doesn’t tell the whole story.

Over those same three days, the market-making Banks created and added a total of 45,858 new COMEX gold contracts. The deep-pocketed Banks took the short side of these contracts and sold them to the aforementioned Speculators, who took the long side of the trade.

So let’s first stop here and ponder just how far price might have risen without these additional contracts diluting the available supply. Yes, a $55 rally is nice, but how far might price have risen if sellers of existing contracts were needed to be found in order to meet the Spec demand? $105? $155? It’s impossible to say.

But next, let’s think about the scam and fraud of all this. The Banks created “gold” from nothing and sold it to Speculators who bought this “gold” by only putting 15% down (margin). No physical gold ever changed hands, and no physical gold entered the COMEX warehouses as collateral for the new shorts. Instead it’s just one side making a bet against the other, and one side has monopolistic control of the “market” and the too-big-to-fail deep pockets needed to guard against margin calls.

The result is what we’ve seen literally hundreds of times before. Price spikes. The Banks control the rally through new contract issuance, and total open interest rises. Price is capped. Buying exhaustion follows. Banks initiate a price raid. Price plunges as jittery Specs begin to liquidate. Banks use Spec selling to buy back and cover the shorts they had created on the run up, and total open interest declines.

And you wonder how and why the Bank proprietary trading desks post a profit month after month.

Next, let’s stop to consider the size and scope of this massive scam.

Due to their infinitely deep pockets and their monopolistic role as “market makers”, The Banks can simply create contracts on COMEX—and they do so in the size mentioned above. And how many ounces of digital derivative “gold” are willed into existence through the creation of 45,858 contracts? At 100 ounces per contract, that’s 4,585,800 ounces. Stated another way, that’s 142.6 METRIC TONNES! That’s more than the official reserves of Sweden or South Africa and over 5% of total global annual mine supply. That’s also about 1/3 of the entire, current stock of gold in the COMEX vaults that’s marked as “registered”.

The Shills, Apologists, and Charlatans would have you believe that the altruistic Bullion Banks are simply acting as conduits for the mining companies to hedge and forward sell their production. Hmmm. Do you really think that there was a sudden rush by Barrick or Kirkland Lake or Newmont to dump ALL of their projected 2021 production as soon as the COMEX gold price broke out and rallied on the most fundamentally positive news of the year? Give me a break!

So, The Banks did it again. No surprise there. But here’s the point of this post…

How might what we just observed be a warning of what to expect this summer?

The key component to last summer’s rally to new all-time highs was a lack of Bank shorting. Whether this was due to the March 2020 collapse in confidence is hard to say. What we do know, however, is that for some reason The Banks were reluctant to play their usual games.

So did we just get our first hint that The Banks will not willfully allow a repeat of last year? Are they instead going to fight us every step of the way in the usual three-steps-forward-and-two-steps-back pattern? Time will tell, but the past four days are definitely not encouraging.

But let’s end this week on a positive note that IS encouraging…

The seven-month consolidation in COMEX gold prices ended with the double bottom at $1680 in March. Price has since broken higher—and through several layers of significant resistance—and the only remaining hurdle is the 200-day moving average, currently near $1865.

Leading the charge is a surge of fundamentally bullish factors such as plunging real interest rates, dovish Fed policy, and surging inflation. The next target for price remains $2000 by sometime in early July—regardless of the Bank interference, we are sure to encounter every step of the way.

Ultimately, I believe the fundamentals will take over and increasing inflation will lead to much higher, nominal gold and silver prices. Given the current situation, if you don’t have 20% of your portfolio in PHYSICAL metals, I would encourage you to seriously consider it. If you want to have a conversation about this and the best way to go about it, feel free to give my office a call at 1-866-921-3613.

The radio program this week features an interview with the publisher of the Brookville Capital Intelligence Report, Mr. Simon Popple.

We get Mr. Popple’s take on various markets.

The program is now available here by clicking on the Podcast tab at the top of this page.

“I hope someday to have so much of what the world calls a success, that people will ask me, “What’s your secret?” and I will tell them, “I just get up again when I fall down.”

-Paul Harvey