Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

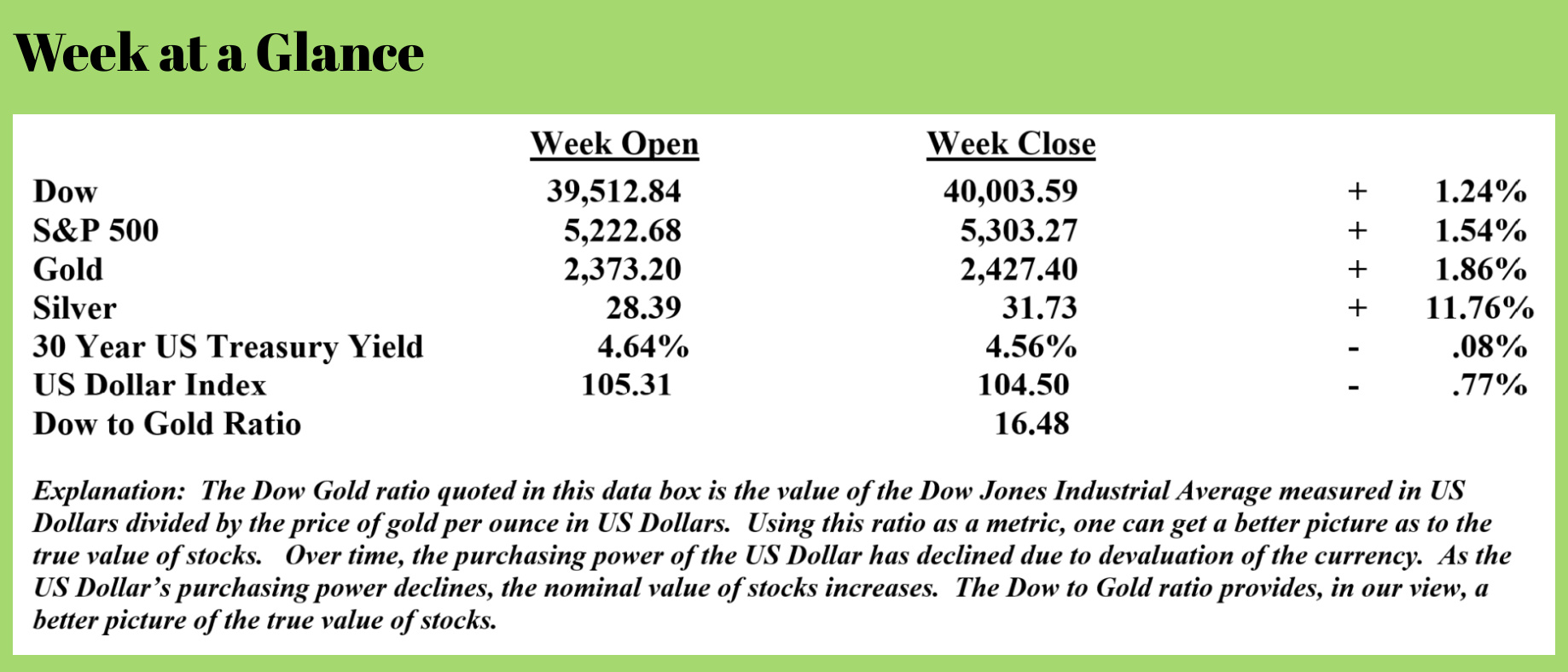

Are we now witnessing the beginning of another decline in the US Dollar?

I think it’s possible that you and I now have a front-row seat to the next big move down in the dollar.

There are those that measure the strength of the US Dollar using the dollar index ($DXY). But, as I’ve discussed previously, that is a poor metric to use. The dollar index measures the purchasing power of the US Dollar in relative terms, not absolute terms. The index measures the purchasing power of the US Dollar compared to the purchasing power of the fiat currencies of the six major trading partners of the United States. And the index is weighted which means it’s largely a measure of the purchasing power of the US Dollar versus the Euro.

To get an accurate picture of the purchasing power of the US Dollar, one needs to look at the price performance of real, tangible assets in US Dollars. Stuff that can’t be printed, like gold, silver, and other goods with intrinsic value.

When one looks at the purchasing power of the US Dollar from that perspective, it seems that the US Dollar had a very bad week.

Stocks rallied, gold rallied, silver rallied, copper rallied, the Dow cracked the north side of 40,000, the S&P 500 rallied, and the NASDAQ rallied.

What do all these asset classes have in common?

What do all these asset classes have in common?

They are priced in US Dollars.

Let’s look at last week’s price action beginning with silver.

The chart (right) is a weekly price chart of silver going back about 25 years.

Notice that silver prices peaked in the early part of 2011 and were in a technical decline until recently (note the blue downtrend line I’ve drawn on the silver price chart).

Notice the recent breakout to the topside of the downtrend line. From a technical perspective, it’s convincing.

As long-time readers and radio show listeners know, silver has been my favorite asset class for a couple of years. I strongly believe that we will see new highs in the silver market in the relatively near future, given fiat currency weakness and industrial demand for silver that exceeds the mining supply.

I also expect that silver will outperform gold since the price of silver in US Dollars relative to the price of gold in US Dollars is historically low.

I also expect that silver will outperform gold since the price of silver in US Dollars relative to the price of gold in US Dollars is historically low.

That opinion aside, the price of gold also reached new highs last week, as noted on the weekly price chart of an exchange-traded fund that tracks the price of gold.

The same observation is made when looking at a price chart of copper, as seen here on the weekly price chart of an exchange-traded fund that tracks the price of copper.

The same observation is made when looking at a price chart of copper, as seen here on the weekly price chart of an exchange-traded fund that tracks the price of copper.

Interestingly, stocks, an asset class that often moves inversely to metals, experienced similar price action last week.

Both the Standard and Poor’s 500 and the Dow Jones Industrial Average also made new highs last week.

This chart is a chart of the Dow Jones Industrial Average (again, a weekly price chart).

This chart is a chart of the Dow Jones Industrial Average (again, a weekly price chart).

Notice from the chart that the Dow, priced in US Dollars, also made new highs the same week as the metals discussed above.

An observer sees that the price action of the Standard and Poor’s 500 follows suit.

Along with the Dow, the S&P 500 also made new highs last week, as noted on the chart.

Interesting price action, isn’t it?

Interesting price action, isn’t it?

In my three decades plus in the financial industry, I cannot recall another time when all these markets made new highs nearly simultaneously.

The only conclusion I can realistically reach is that the US Dollar, in which all these asset classes are priced, is being devalued more quickly.

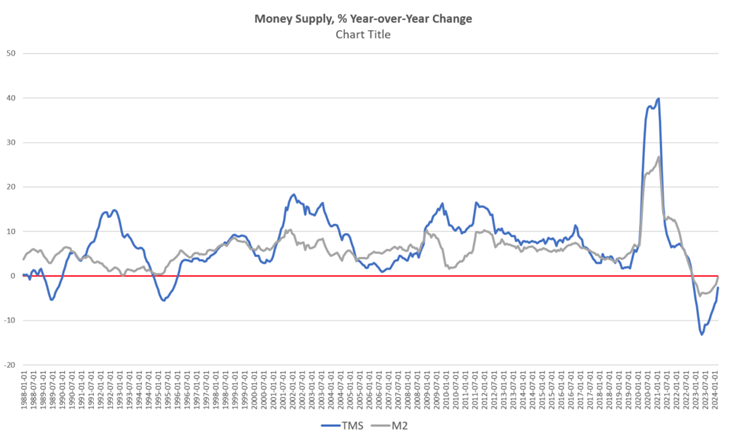

An article published last week on “Mises Wire” (Source: https://mises.org/mises-wire/money-supply-growing-again-and-fed-wants-it-way) confirms that this may indeed be the case. In the article, author Ryan McMaken had this to say (emphasis added):

Money-supply growth fell year over year again in March, but March’s decline was the smallest money-supply drop recorded in sixteen months. Moreover, the money supply in March grew—month over month—by the highest rate in two years. The current trend in money-supply growth suggests a continued turnaround from more than a year of historically large contractions in the money supply. As of March, the money supply appears to be in a period of stabilization. The money supply is still flat or down on a year-over-year basis, but there is clear growth over the past several months.

The chart below is taken from the article written by McMaken. Notice that after significant declines in the money supply from early 2021 through mid-2023, the money supply is now growing again.

Growth in the money supply fuels price inflation, including in assets like stocks and metals and anything else priced in US Dollars. McMaken puts it this way in his article:

Growth in the money supply fuels price inflation, including in assets like stocks and metals and anything else priced in US Dollars. McMaken puts it this way in his article:

Those dramatic drops in the money supply appear to be over for the time being. Indeed, when we look at month-to-month changes in the money supply, we find that the money supply increased 0.98 percent from February to March. That’s the largest growth rate since March 2022. In month-to-month measures, money supply growth has been positive during seven of the last ten months, further suggesting that the new trend in money supply is either flat or returning to sustained upward growth.

The bottom line, as I’ve previously stated, is that the Federal Reserve, the nation’s central bank, is painted into a corner. The central bank can attack inflation or attack the problem of higher interest rates making US borrowing costs in an era of out-of-control deficits unaffordable. Trying to solve one problem exacerbates the other.

It seems the Fed, as I have previously suggested, maybe throwing in the towel on inflation, given there is not enough demand for US Treasuries to keep up with ever-increasing deficit spending that needs to be financed.

This week’s radio program features an interview that I did with author and investor Jim Rogers. I caught up with Jim from his Singapore offices and picked his brain on where he is investing presently and what he sees in the near future, economically speaking.

Be sure to check out the interview now by clicking on the "Podcast" at the top of this page.

“The natural tendency of government, once in charge of money, is to inflate and destroy the value of the currency.”

-Murray Rothbard

Comments