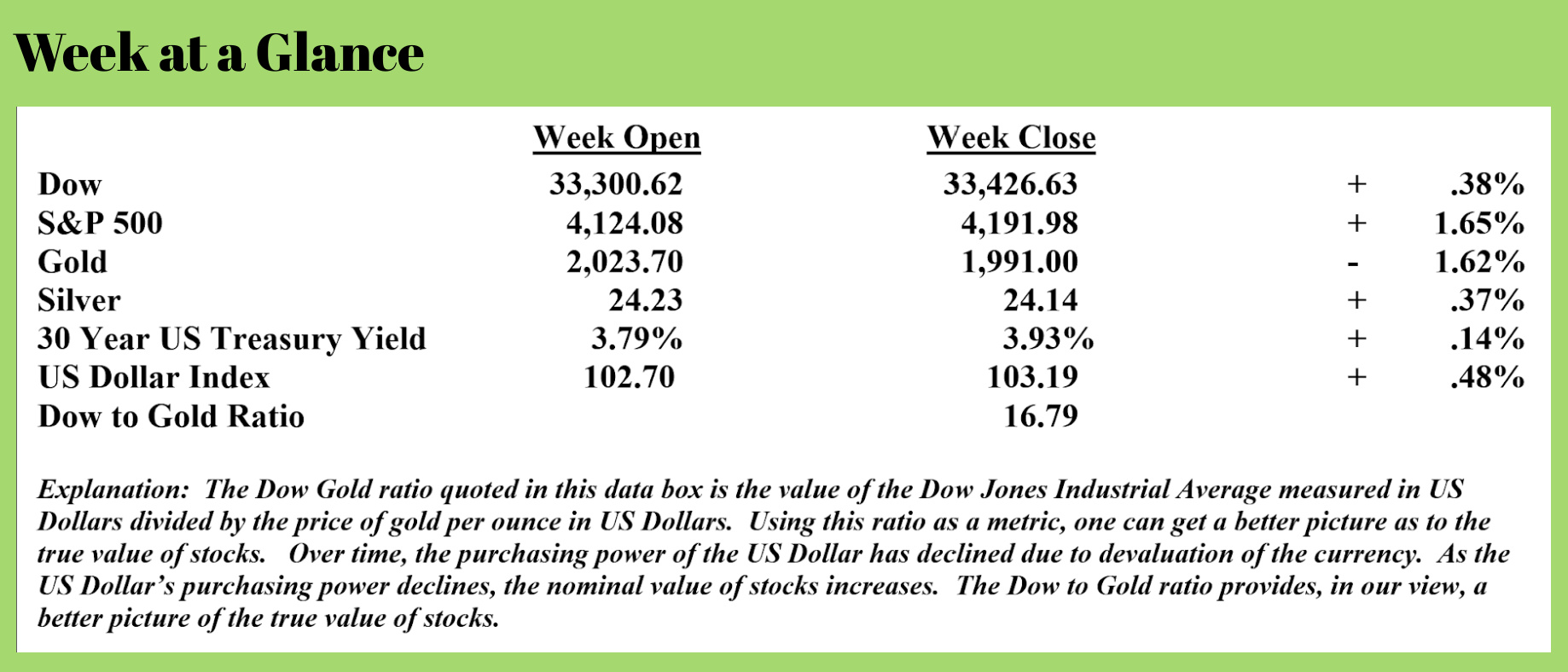

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

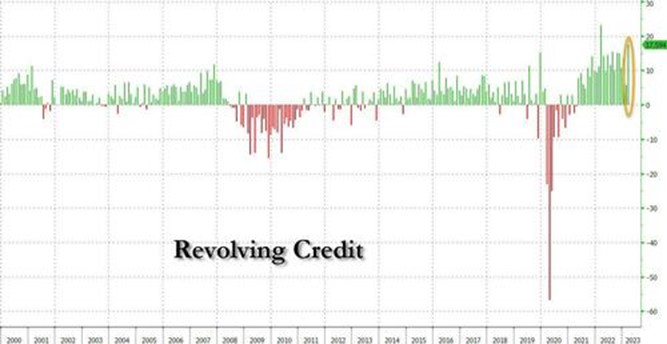

Previously, I have written about increasing debt levels in the country among those in the private sector. In short, private sector debt levels have been increasing; specifically, credit card debt has been rising very quickly.

Rapidly increasing levels of credit card debt had me concluding that Americans were increasingly dealing with rapidly rising consumer prices by resorting to accumulating debt on their credit cards.

Now, at least according to one recent survey, that is exactly what has been happening. This from “Zero Hedge” citing a “Bloomberg” article (Source: https://www.zerohedge.com/markets/battered-inflation-90-million-americans-struggle-paying-bills-credit-card-usage-spikes):

A large swath of American consumers are facing financial hardship as they grapple with elevated living costs, record-high credit card use, and two years of negative real wage growth. This perfect storm could decimate financially fragile households in the next downturn.

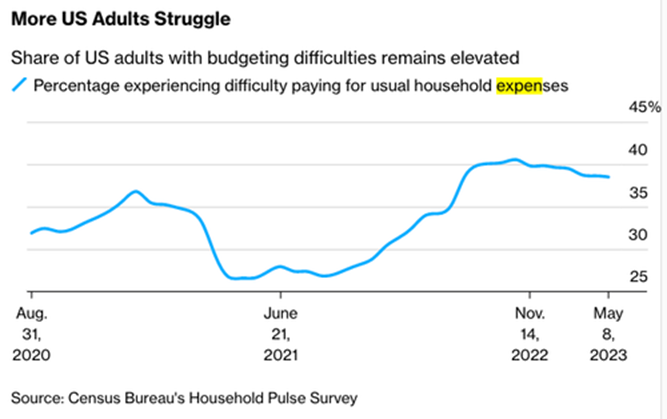

As many as 89.1 million American adults (or about 38.5%) were found to experience some form of difficulty in covering expenses between April 26 and May 8, according to Bloomberg, citing new data from the Household Pulse Survey. This is up from 34.4% in 2022 and 26.7% during the same period in 2021.

The rising trend is alarming but not surprising. Consumers have been battered by two years of negative real wage growth.

As wages fail to outpace the cost of living, many consumers have burned through savings and resorted to credit cards. The latest revolving credit data shows consumers appear to be 'strong,' but that's only because they use their plastic cards more than ever to survive.

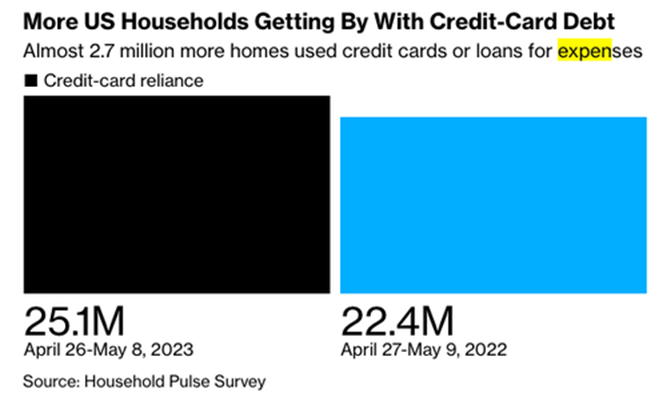

Compared with the same period last year, the survey found 2.7 million more households were relying on credit cards to cover expenses.

Consumers have record card debt and ultra-low savings rates and are paying some of the highest borrowing costs in a generation (the average interest rate on cards now exceeds 20%). This debt is becoming insurmountable for some as delinquencies rise.

And what we have now is new debit and credit card data published by the Bank of America Institute that shows not just spending slowdown for lower-income consumers but also the upper-income cohort is finally starting to crack.

Increasing delinquencies on credit card debt and auto debt are now the new normal. (See “Bloomberg” https://www.bloomberg.com/news/articles/2023-05-15/us-households-show-signs-of-stress-new-delinquencies-rise#xj4y7vzkg).

As reported here last week, the Fed may now be poised to reverse course at some point in the near future and once again engage in easy money policies in an attempt to prop up the economy. When the Fed first began tightening, this was my forecast, and I fully expect that this will be the case and perhaps sooner than many expect.

Of course, this will feed inflation and only make the eventual debt fallout worse.

If you are not yet using the Revenue Sourcing planning method that incorporates strategies for surviving an inflationary followed by a deflationary period, I would strongly encourage you to consider it.

This week's radio program features an interview with economist, author, and demographic researcher Mr. Harry Dent. Mr. Dent provides his forecast for stocks and real estate as well as his assessment of the current economy. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“The wisest men follow their own direction.”

-Euripides

Comments