Weekly Market Update by Retirement Lifestyle Advocates

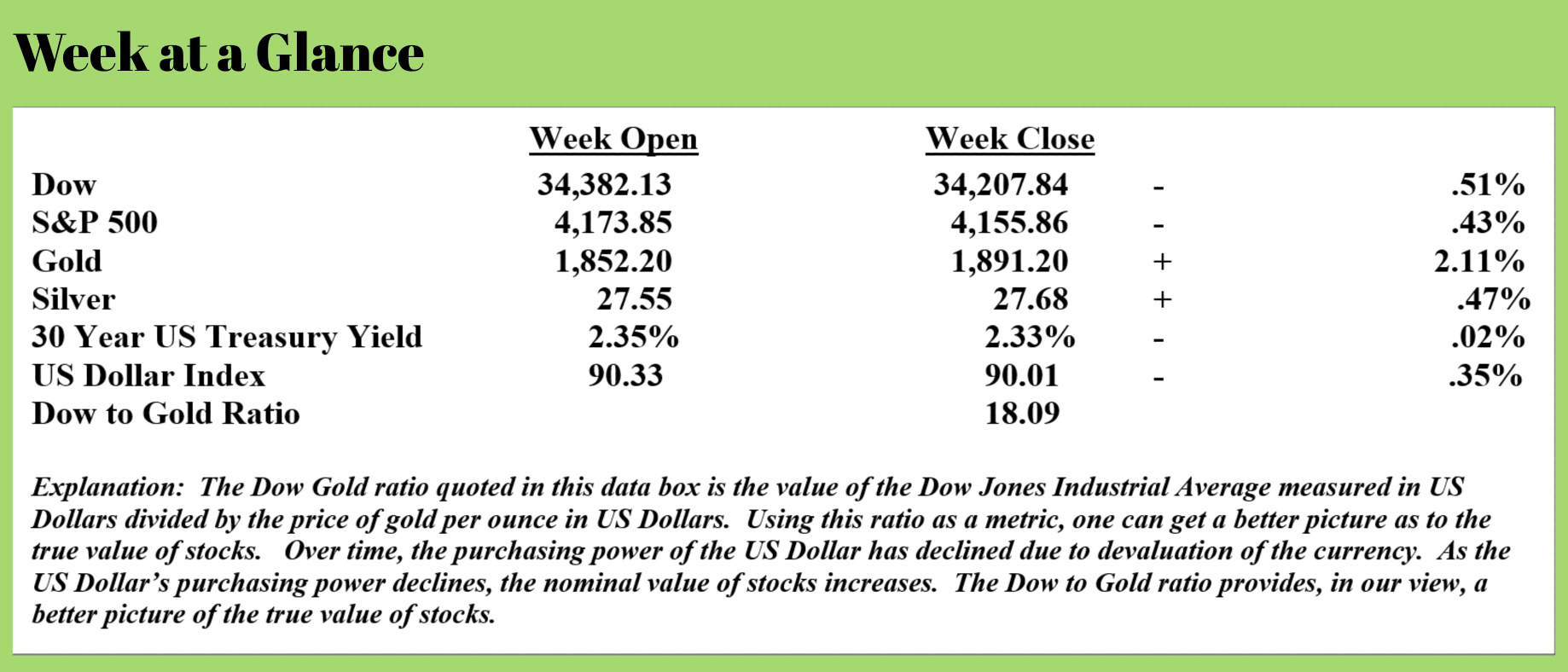

Over the past couple of weeks, I observed that from my analysis stocks looked extended and could be poised for a correction. I also noted that gold and silver were beginning to appear more bullish.

At least in the short term, it seems that these trends are still intact. US Treasuries are still technically bullish by my measure as well.

The big news this past week was the pounding that Bitcoin took. The leading cryptocurrency has fallen from about $59,000 on May 9 to $30,000 on May 19; a decline of nearly 50% in 10 days.

The decline coincided with calls from government officials for a crackdown on the use of Bitcoin and other crypto-currencies. This from CNBC (Source: https://www.cnbc.com/2021/05/21/bitcoin-falls-after-china-calls-for-crackdown-on-bitcoin-mining-and-trading-behavior.html) (emphasis added):

Bitcoin’s price tumbled Friday following an intensified call from Chinese authorities to crack down on mining and trading of the cryptocurrency.

Chinese Vice Premier Liu He and the State Council said in a statement that tighter regulation is needed to protect the financial system.

The statement, released late Friday in China, said it is necessary to “crackdown on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field.”

China’s tough talk comes just a day after U.S. officials pledged to get tough on those using bitcoin to conduct “illegal activity broadly including tax evasion.” The Treasury Department said it will require reporting on crypto transfers of more than $10,000, just as with cash.

Concerns in China centered on a number of issues. Much of bitcoin mining is done there by computers that use massive amounts of energy to solve complex math problems to unlock the cryptocurrency.

Authorities around the world have expressed worries over how bitcoin and its counterparts are used in illicit ways.

“It is necessary to maintain the smooth operation of the stock, debt, and foreign exchange markets, severely crackdown on illegal securities activities, and severely punish illegal financial activities,” the statement said.

As part of its efforts to streamline the burgeoning digital currency space, China’s central bank has been one of the first in the world to develop its own digital currency backed by the yuan. The U.S. Federal Reserve said Thursday it will soon release a paper outlining its own research into the central bank digital currency area.

I have a couple of observations and a prediction.

One, governments and central bankers around the world have severely jeopardized the future of fiat currencies via excess money creation. Trying to regulate away from cryptocurrencies is likely not as much about stopping illicit activities and more about trying to preserve weakening fiat currencies.

Two, as I wrote in 2017, cryptocurrencies will likely never be used in everyday commerce by a majority of the population because crypto’s lack something that every currency must have – stability.

In order for a currency to be widely accepted, those using the currency have to have an expectation that the currency will need to have approximately the same level of purchasing power from one week to the next. That essential currency characteristic does not exist with the current crop of cryptocurrencies.

Now for a prediction – central bank forays into the digital currency arena will ultimately fail for the same reason that cryptocurrencies will ultimately fail. There is nothing backing the currency.

Central bank digital currencies will be digital fiat currencies. Should central bank digital currencies be issued in the same massive quantities as fiat currencies are currently issued, the outcome will be the same – inflation, perhaps hyperinflation, and a loss in confidence in the currency.

There are many reasons that central banks and governments would like currencies to be 100% digital.

First, it will be far easier for negative interest rates to be imposed. If all currency resides on a computer server with no option for cash, bankers will be able to easily impose negative interest rates.

Second, if there are no transactions that take place in cash, there will be no financial privacy. Central bankers and governments are citing this reason as the primary reason that digital currencies are necessary; to crack down and expose illegal activities. The reality is should central bank digital currencies become a widespread reality, another of our individual liberties will no longer exist.

It’s unlikely in my view that we get to this point any time soon.

One, central banks are just beginning to seriously explore the idea.

Two, it is unlikely that the populace will stand for a standalone digital currency. Historically speaking, there is precedent for this. Whenever currency has evolved from hard money like gold and silver to paper bills, there has been a transition period during which the paper bills have been redeemable for the hard money.

Should central banks roll out a digital currency, a similar transition period will likely be required to get the population used to the idea. There would probably have to be a period of time where cash AND digital currency were used. Then, when the digital currency was used primarily in commerce, cash could be phased out citing the fact that no one was using cash.

Given the current level of inflation that we are witnessing, it is unlikely that there would be time to develop a digital currency and move through a transition period. And, should central bankers attempt to move through a transition period more quickly than the population would tolerate, other, alternate currencies would be developed and used by the population. These alternate currencies would almost certainly be something tangible like gold or silver.

Central bankers are trapped.

The last time we saw inflation at these levels was in the 1970’s. Federal Reserve Chair Paul Volcker prevented economic collapse and subdued inflation by raising interest rates to north of 20%. Since money is loaned into existence in our fractionalized banking system, high-interest rates meant not many borrowed and the money supply contracted.

Here’s the rub.

The Fed can’t pursue the same policy today. Should interest rates move to an even more “normal” rate of 5%, the government could not afford the interest on the debt.

The Fed has one other problem. There is no room to cut rates when the current bubble bursts.

In the early 1980’s interest rates were cut to 8%, the economy seemed to thrive. After the tech stock implosion in the early 2000’s, rates were cut from 6% to about 1%. After the financial crisis and stock meltdown from 2007 through 2009, interest rates were cut to nearly 0% and the Fed began to engage in Quantitative Easing or money creation.

Interest rates remain at near 0% presently and money creation has intensified.

When this ‘everything bubble’ bursts, the Fed cannot cut interest rates (unless they try to go negative which may be difficult with paper currency being used as noted above), their only option will be even greater money creation which will also be difficult given the current inflationary environment.

When the ‘everything bubble’ bursts, we could be at the point that there are no alternatives left except to take our lumps. I expect it to be painful.

Ultimately though, history teaches us that once we get through the downturn, we will probably move back to a sound money system because the population will demand it.

Private central banks are pursuing policies that make the wealthy even wealthier while lower-income and middle-income workers see a greater percentage of their paychecks going to cover the cost-of-living essentials.

And those that have saved and invested see the purchasing power of their nest eggs significantly eroded.

That is why I have advocated for the two-bucket approach to investing since after the financial crisis. It is now almost certain in my view that we will see inflation followed by deflation.

The radio program this week features an interview with author and economic commentator, John Rubino. Mr. Rubino co-authored “The Money Bubble” and maintains the website www.DollarCollapse.com.

During my conversation with him, we discuss the evolution of currencies and probable currency outcomes, given current monetary policies.

The program is posted on the app and on the website.

“I told my psychiatrist that everyone hates me. He told me I was being ridiculous, everyone hadn’t met me yet.”

-Rodney Dangerfield