Weekly Market Update by Retirement Lifestyle Advocates

The Fed has a problem, and a big problem at that.

Looking at the facts and data (after sifting your way through much of the data that is manipulated to make things appear better than they really are), it’s clear that the current, strong economic headwinds that are now appearing are largely of the Fed’s own making.

Let’s start with the extremely difficult business environment. “Newsweek”, which is not a publication known for its conservative-leaning posture, recently reported on a survey of small business owners in the United States. Here is an excerpt from that article (Source: https://www.msn.com/en-us/money/markets/thousands-of-businesses-warn-theyre-at-risk-of-closing/ar-BB1mAl5A?ocid=BingNewsSerp):

In a new report from RedBalloon and PublicSquare, nearly half of the 80,000 small businesses surveyed said they "definitely" or "probably" will not survive another four years with Biden.

"There is nothing I can afford to do in addition to what I'm already doing. If things don't change, I'll be finished," one business owner said in the report.

Already, businesses are making moves to preserve their cash flows. Four in 10 now said they are delaying paying bills, while a whopping seven in 10 have put all staffing plans on hold, the survey found.

"It's been a difficult three years for America's small businesses," Michael Seifert, PublicSquare CEO, said in the report. "While many inside the Beltway may feel like things are good, that isn't translating to Main Street America—the frontlines of our small business economy."

From the financial crisis in 2008 to 2022, the Fed not only kept interest rates artificially low at zero, but the central bank also created about $5 trillion out of thin air.

Not surprisingly, a period of prosperity emerged. Or, more accurately stated, a prosperity illusion. Now, however, with a return to more ‘normal’ interest rates, the prosperity mirage is fading, and a whopping 70% of small businesses are not hiring while an eye-popping 40% can’t keep up with their bills.

The experience of these small business owners now that interest rates are back to a more customary level from a historical perspective tells us that the economy was never truly healthy despite the fact that it seemed prosperity was everywhere. Instead, it was an economy on currency creation life support, requiring ever-increasing quantities of newly created currency to keep the party going.

Then, as predicted, the currency creation saw the inevitable outcome emerge – consumer price inflation, something with which we are all familiar over the past few years. Despite the Federal Reserve increasing interest rates to attempt to control inflation, it remains a problem.

While interest rates will likely have to be increased to get inflation under control and will likely need to be held at higher levels for a long period of time to achieve the Fed’s inflation objective, doing so will inflict more harm on an economy that requires artificially favorable conditions to continue to function.

Therein is the Fed’s conundrum.

And it’s a problem of their own policy.

Take the real estate market, for example. US home sales fell in April (Source: https://www.msn.com/en-us/money/realestate/housing-supply-hits-highest-level-since-october-2021-but-home-sales-dip/ar-BB1mRbX6?ocid=windirect&cvid=39c84ed9a8fe4203960c2b7907539144&ei=16). The “MSN” article reported that sales of previously owned homes fell by 1.9% in April to an annual rate of 4.14 million. Wall Street was forecasting an annual pace of 4.21 million.

Sales of existing homes have almost fallen to levels last seen during the Great Financial Crisis of 2008. But that’s only part of the story. As sales of existing homes have fallen, the median price of existing home sales has risen. This from the article referenced above:

The median price for an existing home in April rose 5.7% to $407,600, as compared with the year before. That’s the highest price recorded for the month of April.

The jump in home prices was the biggest since October 2022.

The number of home sales is declining, and prices are rising, at least according to the April data, the most recent month for which data is available. On the surface, that doesn’t seem to make any sense. So, what gives?

It’s a straightforward explanation, really.

Mortgage rates are much higher than they were just a couple of years ago. There are millions of Americans who financed or refinanced their homes when mortgage interest rates were at historic lows. These Americans are essentially locked into their current home. If they were to sell their current home and buy a new home, the mortgage on the new home would carry a much higher interest rate, resulting in a much higher payment, comparatively speaking.

As a result, these homeowners are now staying put since they have no other choice given current economic conditions. That means that there are fewer Americans selling their homes, and higher interest rates are causing far fewer Americans to buy homes.

This won’t change unless interest rates fall significantly, but reducing interest rates further fuels the inflation problem.

The Fed is painted into the proverbial corner.

Fed policy, along with Russian sanctions that have backfired, has also contributed to the growing de-dollarization movement around the globe.

The BRICS countries have long stated that the coalition intends to create a currency for use in international trade in place of the US Dollar. Recently, the group announced plans to use a blockchain-based system for payments to settle trade (Source: https://www.foxbusiness.com/money/russia-china-team-up-against-us-dollar-planned-blockchain-payment-system).

The BRICS bloc of countries, led by China and Russia, are moving ahead with their efforts to move away from the U.S. dollar with an announcement that they plan to create a payment system based on blockchain.

"We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain," Ushakov said.

"The main thing is to make sure it is convenient for governments, common people, and businesses, as well as cost-effective and free of politics," he said.

The announcement did not go into detail as to what types of blockchain the countries plan on using, although Ushakov reaffirmed the group's goal to increase the role of BRICS in the international monetary and financial system this year.

In the 2023 Johannesburg Declaration, BRICS leaders agreed to increase settlements in national currencies and strengthen correspondent banking networks to secure international transactions.

He said the payment system’s major aim is to decrease the BRICS nations’ dependence on the U.S. dollar and to develop the Contingent Reserve Arrangement (CRA), an agreement among the BRICS' central banks for mutual support during a sudden currency crisis. The CRA is generally seen as a competitor to the International Monetary Fund (IMF).

He said the payment system’s major aim is to decrease the BRICS nations’ dependence on the U.S. dollar and to develop the Contingent Reserve Arrangement (CRA), an agreement among the BRICS' central banks for mutual support during a sudden currency crisis. The CRA is generally seen as a competitor to the International Monetary Fund (IMF).

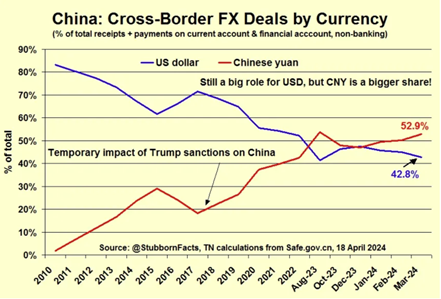

China is gradually, yet steadily moving away from the US Dollar in international trade. Check out this chart (Source: https://rubino.substack.com/p/de-dollarization-the-trend-continues):

Notice from the chart that China now has about 53% of its trade conducted in its own currency as compared to about 43% of its trade that is settled in US Dollars. Just six years ago, about 20% of China’s trade was settled in her own currency, while about 70% was conducted in US Dollars.

That’s a huge swing in a short period of time.

With this rather fast move away from the US Dollar, China has less use for US Treasuries.

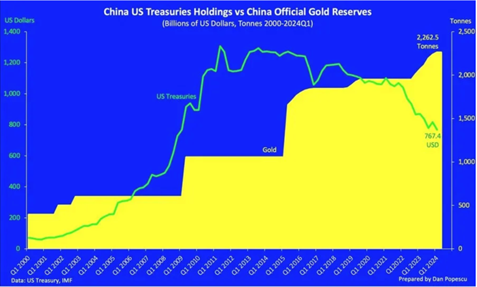

The latest data from the US Treasury Department shows that China sold a record amount of US government debt in the first quarter of 2024 (Source: https://swentr.site/business/597933-china-us-securities-sell-off/). China sold $53.3 billion in US Treasuries and agency bonds during the first quarter of the year.

If you’re wondering what the country is doing with the sales proceeds look no further than the chart on this page that illustrates China’s gold holdings and holdings of US Treasuries. (Source: https://rubino.substack.com/p/de-dollarization-the-trend-continues)

If you’re wondering what the country is doing with the sales proceeds look no further than the chart on this page that illustrates China’s gold holdings and holdings of US Treasuries. (Source: https://rubino.substack.com/p/de-dollarization-the-trend-continues)

It seems that China knows the Fed has no good options, too. The country is swapping her US Treasuries for gold.

This week’s radio program features a ‘best of’ interview that I did with author and investor Jim Rogers. I caught up with Jim from his Singapore offices and picked his brain on where he is investing presently and what he sees in the near future, economically speaking.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page.

“The more the government intervenes to delay the market’s adjustment, the longer and more grueling the depression will be, and the more difficult will be the road to complete recovery.”

-Murray Rothbard

Comments