Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

In the June issue of the “You May Not Know Report,” a written newsletter delivered monthly to clients of our firm, I outline the Fed’s two policy options moving ahead.

Both options will produce a difficult economic and investing outcome for retirees and aspiring retirees. And, both options require an investor prepare for an outcome that is out of the realm of normalcy.

Here are some excerpts from the piece:

After a decade and a half of easy money policies ostensibly to stimulate the economy, the realities of these policies are now coming to light.

These policies, originally put forth as temporary, became permanent as the Federal Reserve went from creating $85 billion per month initially to trillions about ten years later to attempt to prop up a weak economy that was further devastated by economic shutdowns.

Now, over the past year plus, as the Fed has been increasing interest rates to battle inflation, the economy is once again weakening.

The reality is that an economy addicted to and dependent on artificial stimulus, like any other addict, feels good when the easy money is flowing, but quickly goes into withdrawal when the stimulus is withdrawn.

This addiction analogy is a good one in that an addict requires more of the susbstance to which he is addicted to get the same feeling. An alcoholic needs more booze to get the same feeling. A drug addict requires more of the drug to get the same feeling. And, an economy addicted to easy money requires more easy money to get the same economic good feeling.

Eventually though, the addict comes to the realization that he can’t duplicate the feeling he once had no matter the quantity of the substance he is ingesting to get the feeling he craves.

The economy works exactly the same way, it takes more easy money to create each subsequent bubble and at a certain point, the economic bubble cannot be reproduced.

That may be where we now find ourselves.

After the last Fed meeting, Chairman Jerome Powell stated that future increases in interest rates would be dependent on the data.

Reading between the lines, it seems that Mr. Powell and his cohorts at the Fed may be setting the stage for a policy pause and then a reversal.

In my view, this has been the highest probability outcome since the Fed announced a policy of tightening.

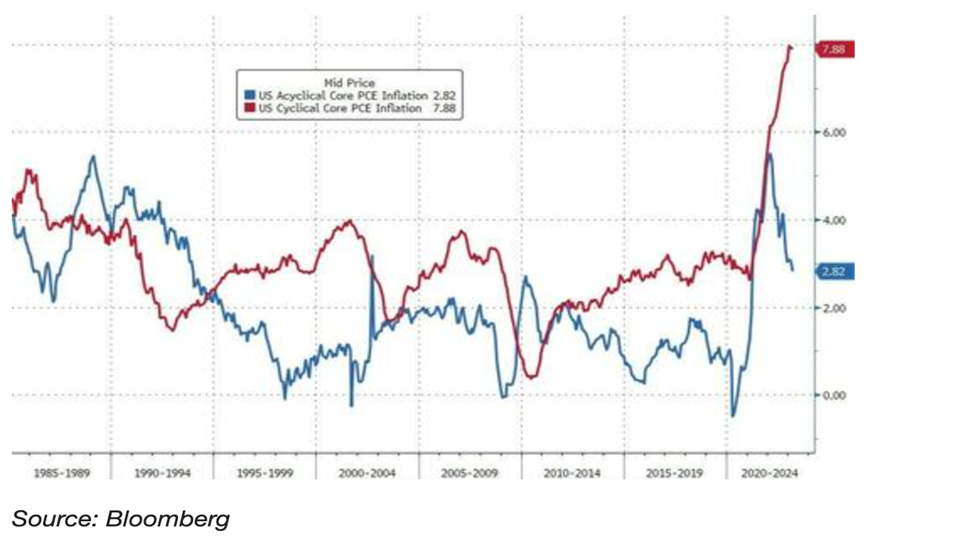

Interesting that this possible policy pause or reversal comes at a time when inflation is not even close to being contained. This was confirmed with the most recent PCE inflation report. This from “Zero Hedge”:

One of The Fed's favorite inflation indicators - Core PCE Deflator - disappointed the doves, printing hotter than expected (headline and core both +0.4% MoM vs +0.3% MoM exp), pushing the YoY inflation signals higher...

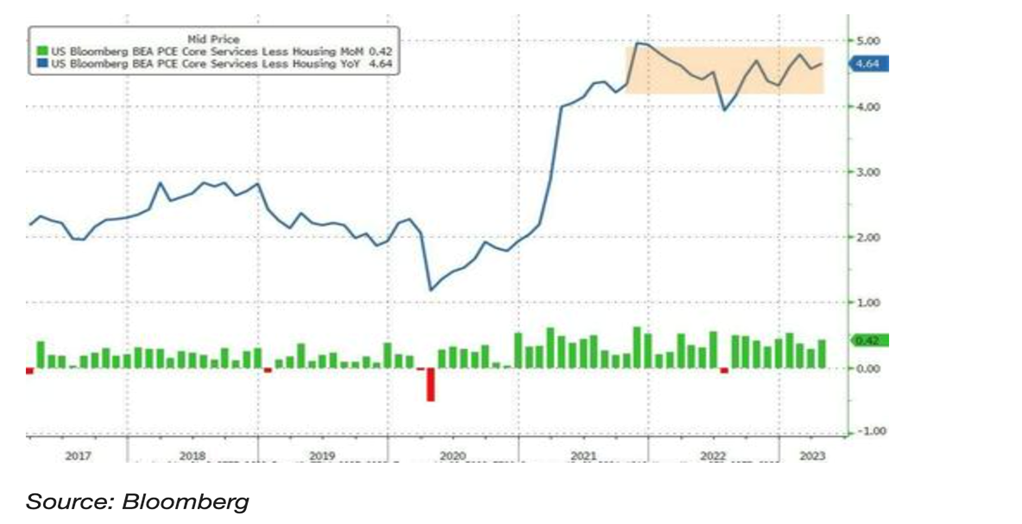

Even more focused, is the Fed's view on Services inflation ex-Shelter, and the PCE-equivalent shows that is very much stuck at high levels...

Core inflation is at the highest level since 1985, yet the Fed may be taking a pause or reversing policy. Does that make sense if the goal is to get inflation under control?

Of course not.

Will the Fed continue with interest rate increases as a result of this new data?

Maybe. We’ll have to wait and see.

No matter what the Fed does near-term, the long-term outlook remains clear with only two possible outcomes.

The Fed, as I have noted previously, is between the proverbial rock and a hard place. If the central bank continues to increase interest rates, the already weak economy get weaker.

On the other hand, if the Fed reverses policy and begins to pursue easy money policies once again, the inflation monster gets bigger and scarier.

Two options. Both bad.

Perhaps the Fed will decide to sacrifice the purchasing power of the US Dollar to attempt to prop up a sick economy?

The economy is getting weaker from my perspective. I believe that when the economic data is ultimately revised, it will show that we are now in a recession.

U.S. corporations are now filing for bankruptcy at the fastest pace in 13 years. This from “Zero Hedge’:

One would not know it from looking at the S&P which just hit a 2023 high, but there is a bit of a bankruptcy crisis sweeping the US where companies are filing for bankruptcy at the fastest pace in 13 years, in a clear sign of a tightening credit squeeze as interest rates rise and financial markets have locked out all but the strongest borrowers.

The increase is most visible among large companies, where there were 236 bankruptcy filings in the first four months of this year, more than double 2022 levels, and the fastest YTD pace since 2010 according to S&P Global Market Intelligence.

Several large recognizable companies with hundreds or thousands of workers have filed for bankruptcy protection in recent weeks, including Bed Bath & Beyond and Vice Media, although their financial troubles predated the recent economic turmoil.

The bankruptcies did not slow down in May, when just the past week saw eight companies with more than $500 million in liabilities file for Chapter 11 bankruptcy, including five in a single 24-hour stretch last week, making this the busiest week for Chapter 11 filings so far this year. In 2022 the monthly average was just over three filings.

While it is too early to know for sure, I’m betting the Fed ultimately reverses course in an attempt to prop up the economy and continue to fuel inflation. Ultimately, as history teaches us, this inflation will cede to deflation.

If you’ve not already done so, prepare.

The radio program this week features an interview with the founder of the Financial Survival Network, Mr. Kerry Lutz.

Kerry is a very bright economic commentator who does his homework. My interview with him is loaded with accurate analogies about the current economic and investing climate.

You can listen to the show now by clicking on the Podcast tab at the top of this page.

“I believe in equality for everyone – except reporters and photographers.”

-Mahatma Gandhi

Comments