Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

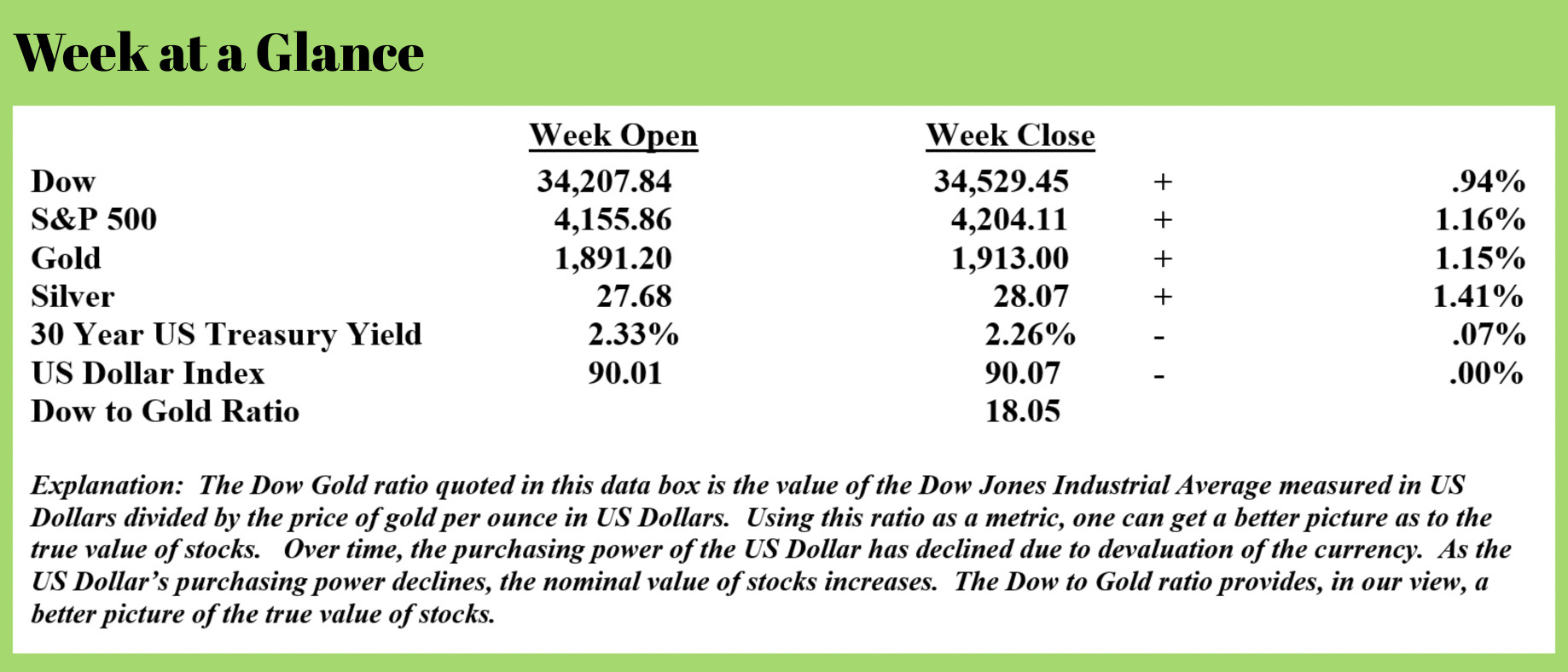

Stocks rallied last week interrupting what looked like a possible set-up for a correction. Despite the rally, stocks are extended here.

Gold and silver continued their respective rallies as did US Treasuries.

As inflation is heating up worldwide, there is growing interest in protecting oneself from the loss in purchasing power that comes with higher levels of inflation.

Russia recently passed legislation to allow the country’s sovereign wealth fund to invest in gold. This from “Zero Hedge” (Source: https://www.zerohedge.com/commodities/russia-lines-new-gold-buying-through-its-sovereign-wealth-fund) (emphasis added):

In a significant and strategic development for monetary metals, the Government of the Russian Federation has just introduced legislation which will allow Russia’s giant National Wealth Fund (NWF) to invest in gold and other precious metals. The NWF is Russia’s de facto sovereign wealth fund, and has assets of US$185 billion.

Introduced as a resolution to the procedures for managing the investments of the National Wealth Fund and signed off by the Russian prime minister Mikhail Mishustin on Friday 21 May, the changes will allow the National Wealth Fund to buy and hold gold and other precious metals with the Russian central bank, the Bank of Russia.

In a note accompanying the gold announcement, the Russian government refers to gold as a traditional protective asset, and says that the move to add gold will introduce more diversification into NWF’s investment allocation, while promoting overall safety and profitability for the fund.

Up until now, the National Wealth Fund, through its 2008 investment management decree has been allowed to allocate funds to all main financial asset classes, such as foreign exchange, debt securities of foreign states, debt securities of international financial organizations, managed investment funds, equities, Russian development bank projects, and domestic bank deposits. The latest amendment now adds gold and precious metals to that list.

As the NWF soon will begin to buy and hold gold as part of its investment remit, it will be interesting to watch the NWF’s asset allocation reports, which can be found in the statistics section of the NWF pages of the Russian Ministry of Finance website here.

If this recent news about the NWF investing in gold look familiar, that’s because it is. Back in November 2020, the Russian government proposed a plan to allow the NWF to buy and hold gold, at the time introducing draft legislation for that purpose. It is this draft legislation which has now been signed into law on 21 May by Prime Minister Mikhail Mishustin.

However, nearly a year earlier in December 2019, Russia’s Finance Minister Anton Siluanov had originally raised the idea that the National Wealth Fund should invest in gold, saying at the time that he saw gold “as more sustainable in the long-term than financial assets.”

Meanwhile, the United States Mint issued a statement last week about silver (Source: https://www.facebook.com/UnitedStatesMint/) (emphasis added):

The United States Mint is committed to providing the best possible online experience to its customers. The global silver shortage has driven demand for many of our bullion and numismatic products to record heights. This level of demand is felt most acutely by the Mint during the initial product release of numismatic items. Most recently in the pre-order window for 2021 Morgan Dollar with Carson City privy mark (21XC) and New Orleans privy mark (21XD), the extraordinary volume of web traffic caused significant numbers of Mint customers to experience website anomalies that resulted in their inability to complete transactions.

In the interest of properly rectifying the situation, the Mint is postponing the pre-order windows for the remaining 2021 Morgan and Peace silver dollars that were originally scheduled for June 1 (Morgan Dollars struck at Denver (21XG) and San Francisco (21XF)) and June 7 (Morgan Dollar struck at Philadelphia (21XE) and the Peace Dollar (21XH)). While inconvenient to many, this deliberate delay will give the Mint the time necessary to obtain web traffic management tools to enhance the user experience. As the demand for silver remains greater than the supply, the reality is such that not everyone will be able to purchase a coin. However, we are confident that during the postponement, we will be able to greatly improve on our ability to deliver the utmost positive U.S. Mint experience that our customers deserve. We will announce revised pre-order launch dates as soon as possible.

Interesting that Russia has adapted her laws to allow the National Wealth Fund to buy gold and the US Mint is openly stating that demand for silver is greater than the supply. This is something we have noted recently in obtaining precious metals for clients. We have been able to find the metals but it's much more difficult.

There is a growing disparity between the spot price (paper price) of gold and silver that the price one pays (when buying) or receives (when selling) for physical metals. In the current market, with growing demand for physical metals, both purchases and sales take place above the metal’s spot price.

Despite the Federal Reserve’s insistence that inflation is ‘transitory’, the actions of investors in the precious metals markets are telling us a different story. Simply put, precious metals investors don’t believe the Fed.

And with good reason.

When current levels of inflation are adjusted for reality, using inflation calculation methodologies that were used pre-1980, one would have to conclude that we are presently at or near 1970’s inflation levels.

In 1980, as we’ve discussed previously, the Federal Reserve increased interest rates to the 20% level to get inflation under control. It worked.

Would a similar policy response today do the same thing?

It would. Inflation is an expansion of the money supply so taking action to reduce the money supply would once again get inflation under control.

So can we expect the Fed to increase interest rates soon?

There are analysts who insist the Fed will have to do so or risk a hyperinflationary outcome. There are other observers, including me, who think the Fed will keep interest rates low and continue the policy of money creation for the near future.

I believe this is the case for a couple of reasons.

First, the recently proposed budget calls for more than $6 trillion in spending, the highest ever. (Source: https://www.zerohedge.com/political/biden-unveils-6-trillion-budget-will-raise-federal-spending-highest-post-ww2-level) Federal spending would reach $8.2 trillion by 2031. The budget deficit under the proposed budget would exceed $1.8 trillion and be twice the $900 billion deficit in 2019, pre-COVID.

Massive deficits combined with a declining economy mean that the Fed will be forced to continue to monetize government spending. And, I’d bet the biggest steak in Texas that should this proposed budget become reality, the deficit is bigger than the forecasted $1.8 trillion due to overly optimistic tax revenue assumptions.

More and more analysts are predicting deflation. This from “Fox Business News” (Source: https://www.foxbusiness.com/economy/stagflation-worries-comparisons-jimmy-carter-1970s) (emphasis added):

Surging consumer prices and gasoline shortages have sparked concerns the U.S. economy could relive the nightmarish stagflation of President Jimmy Carter’s administration in the late 1970s.

Stagflation is defined as a period of inflation with declining economic output.

Strategists at Bank of America predict the stagflation narrative will begin to take hold in the second half of this year.

Second, should the Federal Reserve go full Volcker and raise interest rates to fight inflation, a deflationary collapse is a likely result with real estate and stock valuations at nosebleed levels.

The Fed is painted into the proverbial corner.

Keep printing and the outcome is stagflation.

Begin to tighten monetary policy and risk a deflationary collapse.

Neither choice is a good one but past actions by the Fed and the politicians in charge tell us that they will make the choice that kicks the can down the road a little further. That probably leads to inflation followed by deflation as Thomas Jefferson predicted two centuries ago.

The radio program this week features an interview with the Head of Research at Goldmoney, Mr. Alasdair Macleod.

During my chat with Alasdair, we discuss his recent article predicting the end of paper gold and silver markets due to pending new regulations that will affect bullion banks. If you own gold or silver or are thinking about buying some or more, don’t miss this interview.

Alasdair is one of the best researchers and scholars on the topic of currencies. I always learn something during these interviews with Mr. Macleod.

The program is available to listen to now by clicking on the "Podcast" tab at the top of the page.

“Giving money and power to government is like giving whiskey and car keys to teenage boys.”

P.J. O’Rourke