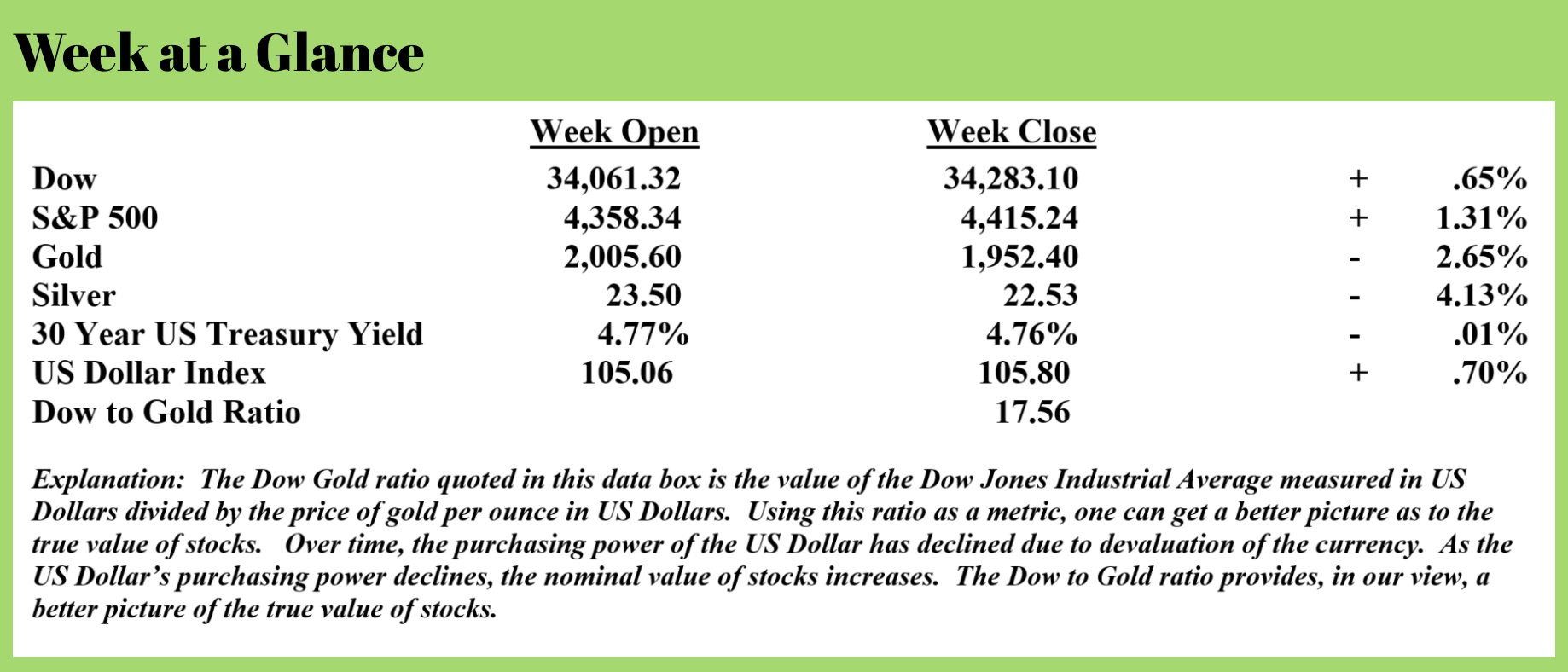

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Last week, here in “Portfolio Watch,” I provided evidence that we are in the inflation followed by the deflation cycle that I forecasted in my 2011 book “Economic Consequences.” At this point in time, there is evidence of both.

First, events this past week point to the Federal Reserve will have to reverse course on the tough inflation talk.

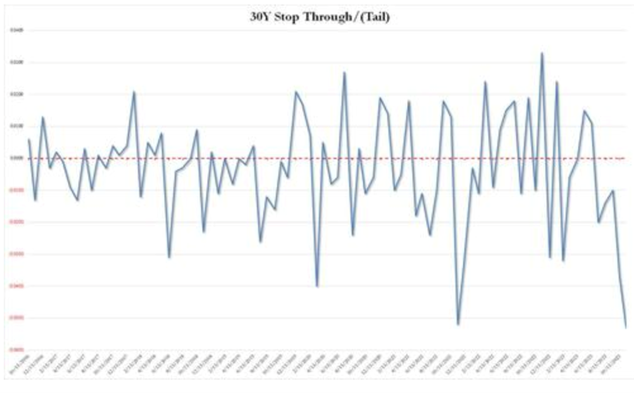

The recent US Government bond auction was a complete disaster. Seems that foreign investors are not lining up to loan the US Government more money even at today’s much higher interest rates. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/stocks-tumble-yield-surge-after-catastrophic-30y-auction-stops-biggest-tail-record-foreign):

Complete disaster.

That's the only way one can describe today's 30Y auction, which many expected could be challenging after a mediocre 3Y and a subpar 10Y auction earlier this year, but nobody expected... this.

The bond priced at a high yield of 4.769%, which was below last month's 4.837%, and just shy of the April 2010 high. But more importantly, it tailed the When Issued by a whopping 5.3bps, which was... well... terrible, because as shown in the chart, this was the biggest tail on record (going back to 2016).

The bid to cover was just as bad: at 2.236 it was the lowest since Dec 2021.

The internals were even worse as foreign bidders (Indirects) tumbled from 65.1% to 60.1%, the lowest since Nov 2021, and with Directs taking down only 15.2%, banks (Dealers) were forced to step up and take the balance, or a whopping 24.7%, double the recent average of 12.7%, and the highest since Nov 2021.

This is a big warning flag because every time we have seen a surge in Dealer takedowns, some sort of Fed intervention - QE or otherwise - has usually followed, and we doubt this time will be different.

What does that mean?

A likely pivot or reversal by the Fed. While the ‘when’ may be difficult to predict, the ‘what’ is glaringly obvious. Unless the US Government operates with a balanced, or much closer to a balanced budget, there is only one option – currency creation.

Moody’s Investor Services sees the ‘what’. This past week, the rating agency downgraded the outlook for US Government debt. This from “MSN” (Source: https://www.msn.com/en-us/money/markets/moodys-cuts-us-outlook-to-negative-citing-deficits-and-political-polarization/ar-AA1jJGlf):

Moody's Investors Service on Friday lowered its ratings outlook on the United States' government to negative from stable, pointing to rising risks to the nation's fiscal strength.

The ratings agency has affirmed the long-term issuer and senior unsecured ratings of the U.S. at Aaa.

"In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues," the agency said. "Moody's expects that the US' fiscal deficits will remain very large, significantly weakening debt affordability."

Brinkmanship in Washington has also been a contributing factor, Moody's said.

"Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability," the ratings agency said.

The Treasury Department responded by staying on script. Deputy Treasury Secretary Wally Adeyemo stated, “While the statement by Moody’s maintains the United States AAA rating, we disagree with the shift to a negative outlook. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset.”

While one would expect that statement from the Deputy Treasury Secretary, a closer look into the actual economic output numbers tells a different story about the US economy. Alasdair Macleod, a past guest on the RLA Radio program, had this to say on the topic this past week (Source: https://schiffgold.com/commentaries/the-future-for-fiat/)

More realistic estimates will emphasize the debt trap danger. The deficit outturn was officially stated as $1.69 trillion, to which a further $300bn must be added back because when President Biden’s proposal to pay off student loans was rejected by the Supreme Court, the money “saved” was simply added back as a reduction in expenditure. A truer figure for the 2023 deficit was $2 trillion.

Nevertheless, at $981bn, debt interest was approaching half the total deficit. The deficit for the current fiscal year commences with interest on $33.5 trillion, of which $26.3 trillion is in public hands, and the average interest rate is not going to be the CBO’s estimate of 2.9%. Already, we see the cost of funding the $7.6 trillion of debt being refunded this year, plus the $1 trillion of existing interest costs having risen to over 5%, adding an extra $200bn on interest costs alone.

To this must be added additional interest costs for the underlying budget deficit this year. There is no knowing how high this will be. But allowance for the consequences of higher interest rates must be made, which are essentially recessionary. Much has been made of recent figures showing US GDP growing persistently, with the third quarter outturn up 4.9%, leading to the Fed’s tight monetary policy being justified. But there are fundamental errors in this way of thinking, which radically affects the budget outcome.

If we look at raw GDP figures, we see that in the 2023 fiscal year, GDP increased by just under $1.9 trillion. Including the student loan accounting trick, this is remarkably close to the $2 trillion budget deficit. While we cannot equate the two numbers absolutely, particularly when nearly half the deficit is interest expense, we should not ignore the fact that some of this interest enters the real economy, there are additional deficits from state governments, and that the rest of the deficit contributes almost entirely to GDP.

Therefore, instead of nominal GDP increasing 7.5%, private sector GDP probably increased hardly at all. But the rate of CPI inflation for the fiscal year was recorded at 3.6%, or according to Shadowstats.com, based on the original 1980-based calculation method, about 12% — take your pick. We can, therefore, say that despite the bullish growth headlines and allowing for CPI inflation, the US is already in recession.

While this is a very brief look at just some of the facts, the end result of a common sense analysis concludes that there will be more currency creation.

In the meantime, due to massive debt levels, there are already emerging signs of deflation.

Real estate prices are falling. Wolf Richter had this to say on the subject (Source: https://wolfstreet.com/2023/10/19/median-price-of-existing-homes-falls-further-peak-was-june-2022-demand-crashes-price-cuts-jump-supply-days-on-market-rise/)

The national median price of previously owned houses, condos, and co-ops fell to $394,300 in September, down by 4.7% from the peak 18 months ago, in June 2022, according to data from the National Association of Realtors (NAR) today.

June is usually the seasonal price-peak of the year, but June 2023 was below the peak in June 2022 for the first time since the Housing Bust, and prices skidded lower since then.

Used car prices are also falling; perhaps plummeting is a better description of this market. This from the Manheim Price Index (Source: https://site.manheim.com/en/services/consulting/used-vehicle-value-index.html)

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.3% in October from September. The Manheim Used Vehicle Value Index (MUVVI) dropped to 209.4, down 4.0% from a year ago.

Schwab analyst Liz Ann Sonders noted that the Manheim Index was down 18% from its peak, the largest drawdown in the history of the index. (Source: https://www.zerohedge.com/markets/used-vehicle-prices-record-largest-maximum-drawdown-history).

Seems that we are seeing evidence of both inflation and deflation, a direct result of currency creation and debt excesses.

The outcome of all this?

In my view, we will see stagflation. Inflation in consumer items (yes, even more inflation) accompanied by a contracting economy, the absent massive deficit spending by the government, would already be in recession.

Got gold?

The radio program this week features an interview that I conducted with the publisher of “The Bitcoin Capitalist,” Mr. Mark Jeftovic.

Mark and I discuss Bitcoin, precious metals, and how the proposed central bank digital currencies might affect crypto-currencies.

It’s a lively discussion. You can listen now by clicking on the "Podcast" tab at the top of this page or on your favorite Podcast channel at Your RLA.

“Lenin is said to have declared that the best way to destroy the capitalistic system was to debauch the currency. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction and does it in a manner which not one man in a million can diagnose.”

-John Meynard Keynes

Comments