Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

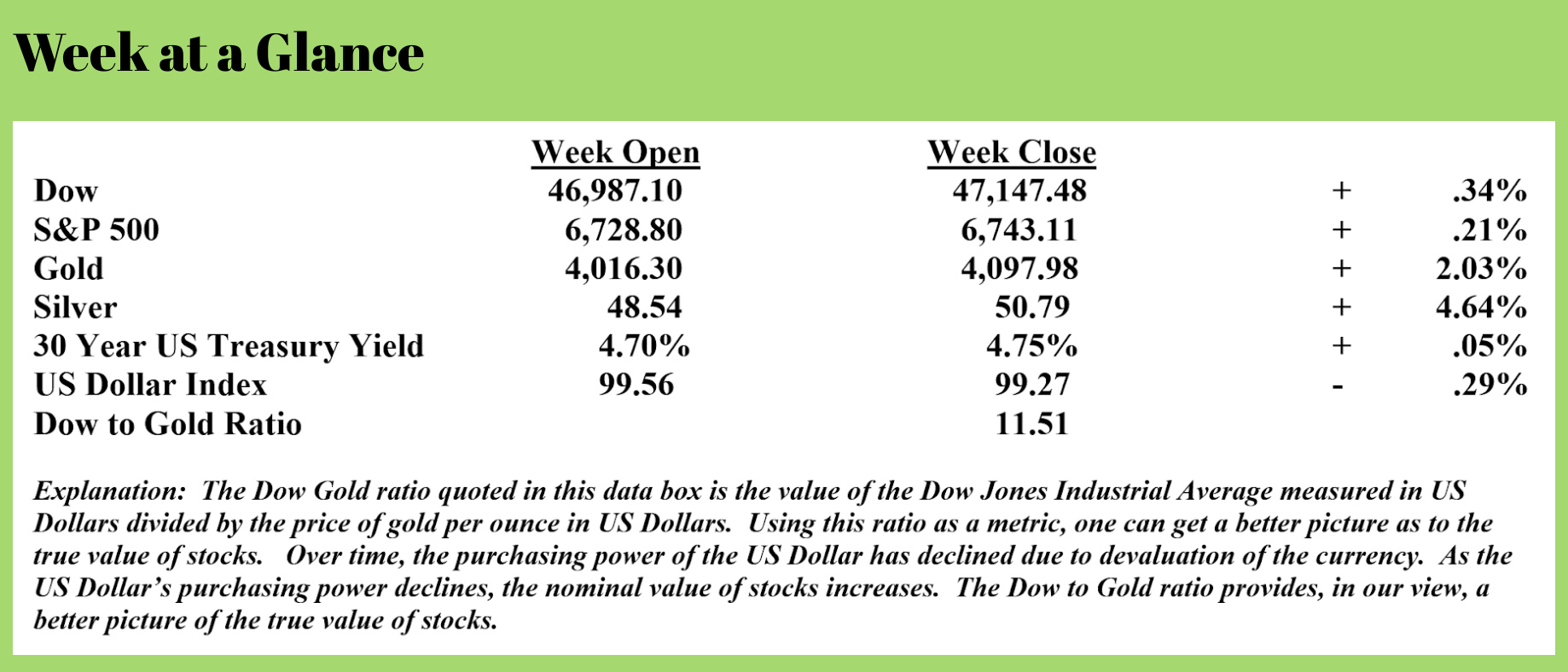

Is a 50-Year Mortgage About to Become Reality?

President Trump posted an image on social media last week that seemed to suggest that the administration is considering making a 50-year home mortgage available. I’ve reproduced that post here.

Shortly after Trump’s post, FHFA Director Bill Pulte confirmed that the administration is working on a 50-year mortgage, something that Pulte described as “a complete game changer”. (Source: https://x.com/pulte/status/1987228558226280813)

Shortly after Trump’s post, FHFA Director Bill Pulte confirmed that the administration is working on a 50-year mortgage, something that Pulte described as “a complete game changer”. (Source: https://x.com/pulte/status/1987228558226280813)

What do you think?

Good idea? Or, not so great?

Count me in the latter category. In my view, when one crunches the numbers, this is a bad idea, unless you own a bank or a mortgage company. And it accomplishes very little.

Let’s look at the numbers.

As I am writing this, according to Bankrate, the average 30-year mortgage interest rate for a new home purchase in the United States is 6.35% (Source: https://www.bankrate.com/mortgages). The average 15-year mortgage interest rate for a new home purchase is 5.72%, or .63% lower than the interest rate on a 30-year mortgage.

One would have to assume that the interest rate on a 50-year mortgage, if such a thing were to become reality, would be higher than the interest rate on a 30-year mortgage. For discussion’s sake, let’s assume the same spread even though the loan term would be 20 years longer rather than 15 years longer. That would put the 50-year mortgage rate at 6.98%.

Now, let’s compare payments on a $400,000 mortgage (a $500,000 home purchase with 20% down). Here are the payments:

15-Year Mortgage $3,315 monthly

30-Year Mortgage $2,489 monthly

50-Year Mortgage $2,401 monthly

Based on those reasonable assumptions, a 50-year mortgage saves $88 per month when compared to a 30-year mortgage. Makes a reasonable person ask, ‘What’s the point?’

The real difference is in the interest paid. Assuming no early payments, here is the interest paid on each mortgage in total:

15-Year Mortgage $ 196,739

30-Year Mortgage $ 496,019

50-Year Mortgage $1,040,379

Given the numbers, why would any rational person utilize a 50-year mortgage? There is only one reasonable answer – they wouldn’t.

So, why is this idea being proposed?

So, why is this idea being proposed?

Let me be clear. I have no inside information. But I think this chart of housing prices adjusted for inflation going back to 1890 tells the story. (Source: https://www.profstonge.com/p/trump-unveils-the-50-year-mortgage)

Housing prices are clearly in a bubble, as I have been discussing here for some time. Could this be an attempt to keep the bubble inflated for a while longer?

If it is, it’s highly unlikely to succeed.

US Government Debt Financing Resembles a Paycheck Loan

Have you seen the paycheck loan business signs in less-than-desirable neighborhoods?

These are businesses that will loan you money until your next paycheck at exorbitant interest rates. While the interest rate paid by the US Government for short-term debt financing is still quite reasonable, the time frames over which lenders are willing to loan the US Government money are getting shorter.

Wolf Richter recently published statistics from the last US Government debt auction (Source: https://wolfstreet.com/2025/11/14/government-sold-694-billion-of-treasuries-this-week-debt-hits-38-1-trillion-treasury-yields-rise-further-shift-to-t-bills-has-begun/).

The US Government sold $694 billion worth of Treasuries last week as the national debt hit $38.2 trillion. Of the $694 billion in Treasuries sold, $549 billion had maturities of 4 weeks to 52 weeks.

That means that nearly 80% of the debt that the US Government had to finance or refinance last week was for less than one year!

There was $28.9 billion of US Government debt financed over 30 years, which is about 4% of the total debt financed or refinanced.

Ten-year notes sold last week totaled $48.5 billion. That’s about 7% of total debt financed or refinanced.

Three-year notes sold totaled $67 billion, or about 10% of the total debt financed and refinanced.

Taking these numbers together, about 90% of all debt financed or refinanced by the US Government was for three years or less, and 80% was for one year or less.

Like a snowball rolling downhill, these numbers will get a lot bigger and do so a lot faster. In a year’s time or less, 80% of this debt will once again need to be refinanced in addition to the financing needed to fund the new deficit spending.

It’s no wonder the largest central bank reserve assets worldwide are now gold.

RLA Radio

The RLA radio program this week features an interview that I did with Mr. Mark Jeftovic, publisher of “The Bitcoin Capitalist”. Mark and I chat about the recent pullback in cryptocurrency and what it might mean for investors. The program is posted and available now by clicking on the Podcast tab at the top of this page.

Quote of the Week

“Here’s something to think about: How come you never see a headline like ‘Psychic Wins Lottery’?” -Jay Leno

Comments