Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

While the yield on US Treasuries fell last week as the bond rally extended, there is growing discontent around the globe with the US Dollar as a reserve currency.

From a currency standpoint, 2023 was a very active year.

The Japanese central bank, with its aggressive bond-buying program has caused a major decline in the Yen when compared to other fiat currencies. The Yen, relative to the US Dollar has taken quite a beating.

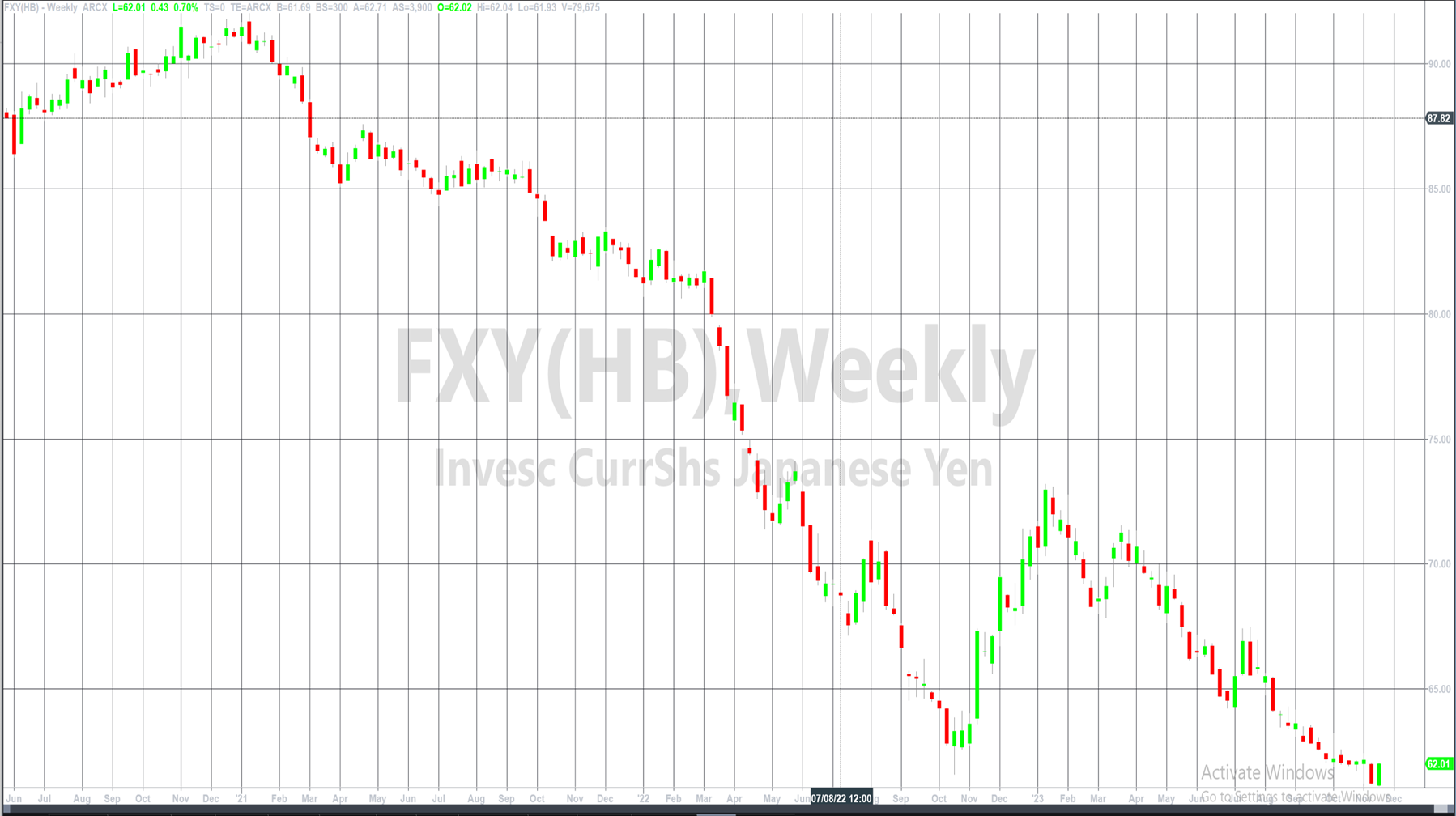

The chart (right) is of an exchange-traded fund that tracks the purchasing power of the Yen versus the US Dollar.

The chart (right) is of an exchange-traded fund that tracks the purchasing power of the Yen versus the US Dollar.

Notice that since the beginning of calendar year 2021, the Yen has lost nearly 50% of its purchasing power compared to the US Dollar.

Keep in mind that over that same time frame, the purchasing power of the US Dollar has also declined. The Yen, relative to the US Dollar, has lost purchasing power 50% faster.

As noted above, the US Dollar has also lost purchasing power during 2023.

The BRICS countries (Brazil, Russia, India, China, and South Africa) openly stated at their summit in August of 2023 that one of the coalition’s long-term objectives is to develop an alternative to the US Dollar for use in international trade.

While this has yet to occur, the BRICS coalition did add six countries at their 2023 summit, with the oil-producing countries of Saudi Arabia, the United Arab Emirates, and Iran among them.

These countries will officially become part of BRICS in January 2024.

With the addition of Saudi Arabia, United Arab Emirates, and Iran to the coalition, BRICS now has about half the world’s oil production as members. As a result, look for the US Dollar to continue to lose international favor as we move into calendar year 2024.

Saudi Arabia, earlier in 2023, made the decision to abandon US Dollar exclusivity in her oil exports. Throughout 2023, Saudi Arabia has begun to accept other currencies as payment to her for her oil.

All these changes are sudden and dramatic as far as currencies are concerned with the US Dollar losing favor.

As one might expect, this is now having an effect on the US Government bond market. “The Wall Street Journal” reported last week (Source: https://www.wsj.com/finance/investing/where-have-all-the-foreign-buyers-gone-for-u-s-treasury-debt-3db75625):

Foreigners no longer have an insatiable appetite for U.S. government debt. That’s bad news for Washington.

The U.S. Treasury market is in the midst of major supply and demand changes. The Federal Reserve is shedding its portfolio at a rate of about $60 billion a month. Overseas buyers who were once important sources of demand—China and Japan in particular—have become less reliable lately.

Meanwhile, supply has exploded. The U.S. Treasury has issued a net $2 trillion in new debt this year, a record when excluding the pandemic borrowing spree of 2020.

“U.S. issuance is way up, and foreign demand hasn’t gone up,” said Brad Setser, senior fellow at the Council on Foreign Relations. “And in some key categories—notably Japan and China—they don’t seem likely to be net buyers going forward.”

Earlier this month, a U.S. Treasury auction of 30-year bonds was met with tepid demand, spooking markets broadly as investors feared more supply-demand disruptions to come. A group of Wall Street executives that advise the U.S. Treasury, known as the Treasury Borrowing Advisory Committee, recently flagged waning demand from two big-time buyers: banks and foreigners.

Over the medium term, the committee said it expects “demand from banks and foreign investors to be more limited.”

In response to recent demand weakness, Treasury has shifted to issuing shorter-term bonds that are in higher demand, helping to restore market stability. The yield on the U.S. 10-year note, which shot above 5% in October, is now at around 4.4%.

Foreigners, including private investors and central banks, now own about 30% of all outstanding U.S. Treasury securities, down from roughly 43% a decade ago, according to data from the Securities Industry and Financial Markets Association.

Overseas investors sold a net $2.4 billion in long-term Treasurys in September, bringing their holdings to $6.5 trillion, according to data from the U.S. Treasury released Thursday. On a rolling 12-month basis, which helps to smooth out volatility in monthly data, the pace of foreign buying has eased to around $300 billion in recent months from levels above $400 billion for much of last year, according to data from the Council on Foreign Relations that also adjusts for changes in valuation.

The makeup of overseas demand has shifted. European investors bought $214 billion in Treasurys over the past 12 months, according to Goldman Sachs data. Latin America and the Middle East, flush with oil profits, also added to holdings. That has helped offset a $182 billion decline in holdings from Japan and China.

For some overseas investors such as David Coombs, head of multi-asset investments at U.K. investment manager Rathbones, U.S. government bonds remain an investment too good to pass up.

Coombs has been buying U.S. Treasurys lately for the first time in 15 years, drawn in by the rise in yields and the chance to compound those returns with exposure to the dollar. Treasurys now make up 9% of his portfolio, even larger than his holding of U.K. bonds and nearly half of his total fixed-income assets.

Here’s the point.

Even at much higher interest rates, demand for long-term US Government bonds, to quote the article, is tepid.

The only way the US Government attracts more foreign investors is to further increase the interest paid on the debt so it is more in line with the risk an investor is taking when loaning money to the US Government longer-term.

As the article states, the US Government has been focusing more on offering bonds that have shorter durations to maturity.

Perhaps we can conclude from this that foreign investors are a lot more comfortable loaning the US Government money for a short time frame rather than a longer time frame.

When looking at the math, who can blame them?

It’s only a matter of time before there is a default.

Don’t get me wrong. I don’t think the US Government will tell all her creditors that they won’t be paid. I believe the Federal Reserve will step in and be the buyer of last resort, creating new currency to buy US Treasuries from banks who buy them from the US Government.

If you’re not familiar with the math, let me share it with you.

The current official national debt is just under $34 trillion.

As I have previously reported, there is more than $7 trillion in short-term debt that is rolling over in the next 12 months.

Assuming a 5% interest rate on $34 trillion in debt, the interest-carrying costs to service the debt are $1.7 trillion.

When looking at total US tax revenues and pulling out payroll taxes that are earmarked to fund Social Security and Medicare, that is the majority of tax revenues!

And, that math does not take into account having to continue to fund deficit spending, which could, in my view, easily exceed the $2 trillion operating deficit last year given that the economy is slowing and 2024 is an election year.

It’s easy to fathom the collective group of politicians in Washington throwing some stimulus money at the electorate to attempt to buy some votes.

As crazy as currency changes were in 2023, it’s highly likely that 2024 will see even more significant changes.

If you haven’t already added some precious metals to your portfolio, now is the time to consider it.

The radio program this week features a ‘best-of” interview that I conducted with the publisher of “The Bitcoin Capitalist,” Mr. Mark Jeftovic. Mark and I discuss Bitcoin, precious metals, and how the proposed central bank digital currencies might affect crypto-currencies.

If you haven't already had the opportunity to listen, you can listen now by clicking on the "Podcast" tab at the top of this page.

“Unthinking respect for authority is the greatest enemy of the truth.”

-Albert Einstein

Comments