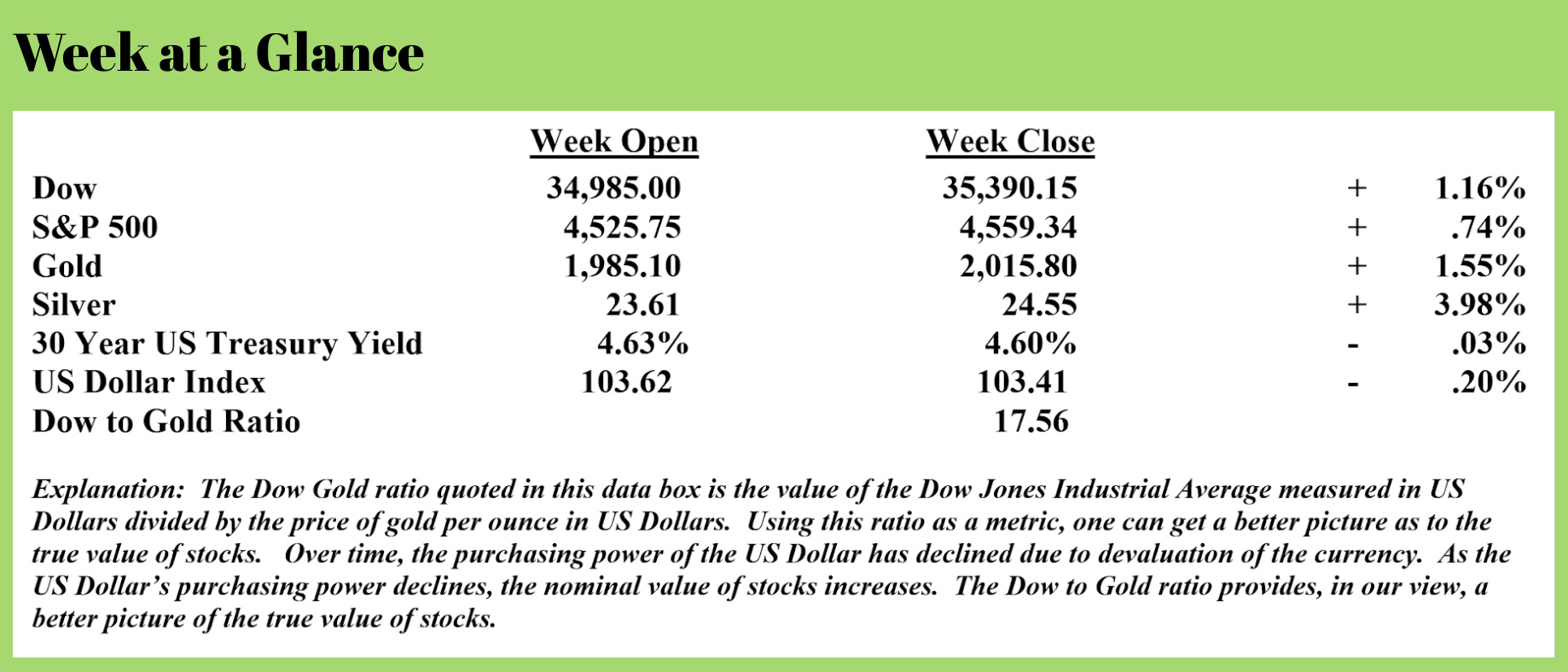

Weekly Market Update by Retirement Lifestyle Advocates

While over the past few weeks, interest rates on US Treasuries have fallen, sparking hopes of a rally after an absolutely dismal 3+ years, the fundamentals of the finances of the US Government are not what bond rallies are made of.

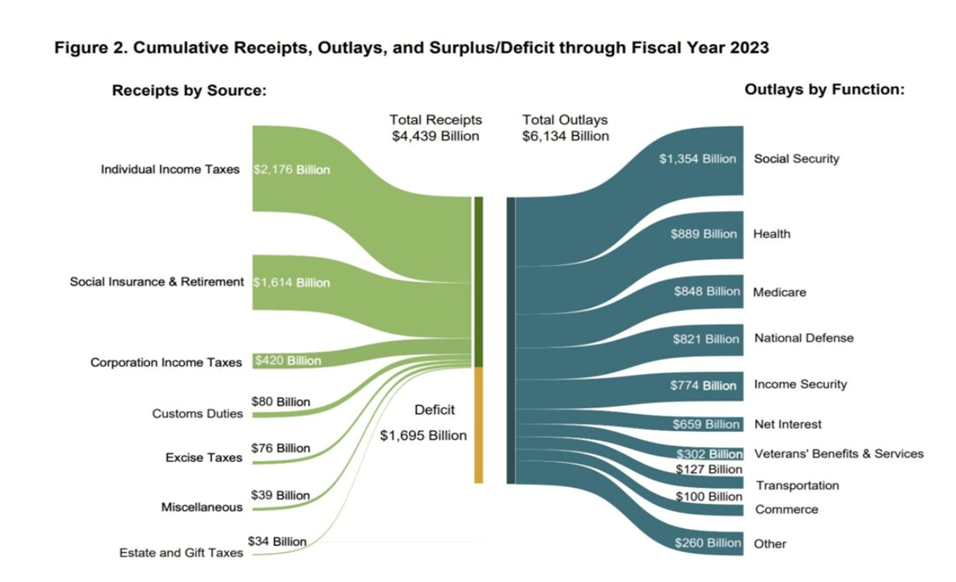

Doug Casey recently published a chart that illustrates US Government tax revenues and US Government spending. (Source: https://internationalman.com/articles/doug-casey-on-the-imminent-bankruptcy-of-the-us-government/)

The first thing one notices from the chart is that total receipts by the US Government are about $4.4 trillion, while expenditures are nearly $2 trillion more than that.

Notice the net interest cost on the right-hand side of the chart at $659 billion.

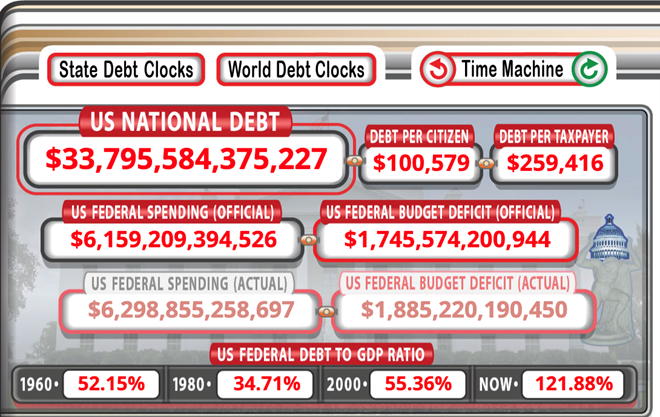

A visit to the US Debt Clock (Source: www.usdebtclock.org) shows the official US Government debt at roughly $33.8 trillion.

A little quick math has us concluding that $659 billion in net interest cost is about 1.95% of the total, official national debt.

A little quick math has us concluding that $659 billion in net interest cost is about 1.95% of the total, official national debt.

Given that as shorter-term US Government debt matures, it will be refinanced at much higher interest rates, we know that the interest-carrying cost will have to increase.

The yield on a 2-year US Treasury bill presently stands at just under 5%. $33.8 trillion x 5% equals an eventual interest-carrying cost of just under $1.7 trillion annually.

That’s more than the cost of Medicare and the national defense combined and more than Social Security by several hundred billion dollars.

If all other spending by the Washington politicians stays stagnant and there are no more stimulus packages passed into law, the deficit eventually moves from about $2 trillion to about $3 trillion!

The bottom line here is that this financial problem is so big that it can’t be solved via increasing taxes and cutting spending moves us into a deflationary depression.

So what is the solution?

Is there a solution?

Not a good one, but Mr. Casey makes six suggestions.

I thought I would share them with you to give you an idea as to the magnitude of the problem.

1. Allow the collapse of all bankrupt entities. No bailouts, subsidies, or guarantees for banks, insurers, corporations, or anything.

There will be plenty in the coming years. Bailout money is always wasted. Most of the real wealth now owned by the bankrupt entities will still exist.

It will simply change ownership. But that’s not nearly enough. At this point, it would be a half-measure, a 3-foot rope over a 12-foot gap. If you allow the collapse of unprofitable enterprises without changing the conditions that created the problem, recovery is going to be even harder. So…

2. Deregulate. Contrary to what almost everyone thinks, the main purpose of regulation is not to protect consumers but to entrench the current order. Regulation prevents new institutions from arising quickly and cheaply.

Does the Department of Agriculture really need 100,000 employees to regulate fewer than two million farms in the US? Abolish it.

Has the Department of Energy, created in 1977 to somehow solve a temporary crisis, done anything of value with its 110,000 employees and contractors and $32 billion annual budget? Abolish it.

How about the terminally corrupt Bureau of Indian Affairs, which has outlived whatever usefulness it might have had by 100 years. Abolish it.

The FTC, SEC, FCC, FAA, DOT, HHS, HUD, Labor, Commerce, and many more, serve little or no useful public purpose. Eliminate them, and the entire economy would blossom – except for the parasitical lobbying and legal trades. There are hundreds of agencies like these. Most aren’t just useless. They’re actively destructive.

3. Abolish the Fed. This is the actual engine of inflation. Money is just a medium of exchange and a store of value; you don’t need a central bank to have money. In fact, central banks are always destructive. They benefit only the cronies who get their money first.

What would we use as money? It doesn’t matter as long as it’s a commodity that can’t be created out of thin air. Gold is the obvious choice. Bitcoin may turn out to be excellent.

The whole idea of a central bank is a swindle. Massive bailouts and optional wars can’t be done without it.

4. Cut taxes by 50%… to start. The economy would boom. The money won’t be needed with all the agencies gone. Certainly not if the next two points are followed.

5. Default on the national debt. I realize this is a shocker unless you recall that the debt will never be paid anyway. Why should the next several generations have to pay for the stupidity of their parents?

A default sounds dishonorable—and it is in civil society. But government is different. It hasn’t been “We the People” for a long time; it’s now a self-dealing behemoth run by cronies. It’s like a building with a rotten foundation—better to bring it down with a controlled demolition than wait for it fall unpredictably.

Governments default all the time, though most defaults are subtle, through inflation. In an outright default, however, the only people who get hurt are those who lent money to an institution that can only repay them by stealing money from others. They should be punished.

6. Disentangle and disengage. The entanglements the US needs to escape prominently include the UN and NATO. Spending could easily be cut 50%. The US combat troops now in over 100 foreign countries can come home. They’re not “defending” anything but local collaborators while picking up bad habits and antagonizing the locals. Spending on the military and its sport wars significantly adds to the economy’s problems.

While some readers may consider Mr. Casey’s views to be extreme, they put the size of the problem in perspective.

And he makes some great points.

We should all be able to agree that the Department of Agriculture doesn’t need 100,000 employees to regulate 2 million farms.

And perhaps most of us can agree that having US troops in more than 100 countries around the world is a bit excessive.

The US debt default will eventually arrive. Probably not an outright default but an inflationary default as newly created, hugely devalued currency is used to pay off old creditors. We are only debating the ‘when,’ not the ‘what.’

Got gold?

The radio program this week features a ‘best-of” interview that I conducted with cycles analyst Dr. Charles Nenner.

If you have not yet listened to the podcast, you can listen now by clicking on the "Podcast" tab at the top of this page or find it posted and available today on most podcast sources.

George Washington on the importance of leadership:

“A pack of jackasses led by a lion is superior to a pack of lions led by a jackass.”

Comments