Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The December “You May Not Know Report”, to hit the mailboxes of clients and subscribers in a couple of weeks or so, is a forecast issue titled “Capitalizing on Uncertainty”. There is certainly no shortage of uncertainty at the present time. This week, we’ll give you a brief preview of the December paper-and-ink newsletter.

We have long been warning of the impact of monster levels of money creation by the Federal Reserve. History teaches us that putting private bankers in charge of monetary policy never ends well.

If you’re a banker, the current central banking system is a great deal. You create money out of thin air, you loan it out, get it back with interest.

Savers, investors, and the middle and lower classes suffer as a result of this policy. Savers and investors can’t get a decent yield on their investments safely and wages don’t keep pace with the real rate of inflation.

Government bureaucrats manipulate the reported inflation rate using methodologies like substitution, hedonics and weighting. Going into the calendar year 2021, the official, reported inflation rate is 1.3%. If you’re a Social Security recipient, that’s the cost of living adjustment that you will receive.

Anyone who buys everyday essentials knows that the actual rate of inflation is much higher than the reported rate.

This week’s radio guest, Ed Butowsky, explained.

Ed is the creator of The Chapwood Index, a private inflation measure. The Chapwood Index measures the real inflation rate logically. The Index has a team of volunteers in 50 different metropolitan areas in the US. Every 6 months, team members go out and price check 500 items that everyday Americans buy; items like movie tickets, oil changes, food items, take out pizzas, and haircuts.

Depending on the part of the country in which one lives, this exercise concludes that the real inflation rate is closer to 8% to 13 % annually.

For purposes of this discussion, let’s use 10% as an average round number.

If the real annual inflation rate is 10% and a Social Security recipient gets a cost of living adjustment of 1.3%, that’s a disparity of more than 8%. Let’s look at the impact of that difference over time.

Say a visit to the doctor is $100. If it increases in cost at an annual rate of 10%, in just ten years, the doctor visit will cost $259. Assuming the doctor’s patient collects Social Security of $2,000 per month and sees an annual increase in benefits over ten years of 2%, at the end of the same ten-year time frame, the patient’s income from Social Security will be $2,438.

To summarize, at the beginning of the ten-year time frame, the doctor visit consumed 5% of monthly income from Social Security. At the end of the ten-year time frame, the doctor’s visit consumes between 10% and 11% of Social Security monthly income.

The same discussion could take place when examining the pay of a worker.

According to the Social Security Administration’s own data, the median net income in the United States in 2019 was $34,248.45. Ten years prior in 2010, the median net income was $26,363.55. That’s an annual increase in median annual income of just under 3%.

When comparing that level of increase in wages to the real inflation rate as measured by The Chapwood Index, one discovers a similar, significant decline in real purchasing power.

These examples make the point that it is monetary policies put forth by the private central bankers that are largely responsible for the wealth gap. The ongoing social unrest mentioned previously has, at least in some part, come about because of this wealth gap.

In the words of past radio program guest, Gerald Celente, “when people have nothing left to lose, they lose it.”

Now, as we move into 2021, ironically, the same private central bankers who have expanded the fiat money supply by 65% in 2020 are talking out of both sides of their mouths.

On the one hand, the Fed has very clearly signaled to Congress that it will support more stimulus. What that means in plain English is that if Congress wants to spend it, the Fed will print it.

On the other hand, the Fed is now warning about the dangers of excess money creation. The Fed’s message seems to change based on the audience.

“Forbes” reported9 (as well as many other media) that Federal Reserve Chair Jerome Powell openly stated that more stimulus is needed.

Here is a bit from the article explaining Powell’s rationale for more stimulus (emphasis added):

…..unlike the lending tools the Fed has to prop up markets, direct spending from Congress can be used to target specific groups that need income assistance during the crisis, Powell said during a virtual event for the Bay Area Council Business Hall of Fame.

During a press briefing earlier this month, Powell said that for some Americans, “direct fiscal support” is a much better option than a loan backed by the Fed that the borrower may have trouble repaying.

You read that correctly.

The Federal Reserve Chairman is openly advocating for ‘helicopter money’ that would go directly from the printing press to the Americans that congress deems worthy.

Yet, at the same time, some members of the Federal Reserve Board are signaling that this mammoth level of money creation will have to stop. This10 from “Zero Hedge:

Now, central bankers - dumb career academics as some of them may be - are not all idiots, and they clearly understand that what they are doing is merely buying time while in the process making a massive bubble even bigger, so much so that when the next crash comes, it could mean the end of fiat currency and western capitalism as we know it, especially if central banks lose what little credibility they have.

It may also explain why, amid the generally cheerful commentary in today's FOMC Minutes, according to which FOMC "participants saw the ongoing careful consideration of potential next steps for enhancing the Committee's guidance for its asset purchases as appropriate", there were two distinct warnings that the Fed's $120BN in monthly QE could lead to catastrophic consequences.

Of course, the Fed would never use alarmist language like that. Instead what the minutes did say was subdued, but just as alarming, to wit:

- Several participants noted the possibility that there may be limits to the amount of additional accommodation that could be provided through increases in the Federal Reserve's asset holdings in light of the low level of longer-term yields, and they expressed concerns that a significant expansion in asset holdings could have unintended consequences.

- A few participants expressed concern that maintaining the current pace of agency MBS purchases could contribute to potential valuation pressures in housing markets.

What this means translated into simple English, is that the Fed itself is starting to have doubts that its shotgun approach of stimulating the markets, or rather "the economy" as they call it, may be reaching its limits and that the next major expansion in QE could have "unintended consequences", i.e., a market crash. And just as bad, they also concede that just the current $40BN in MBS purchases could lead to another repeat of the housing bubble of 2006/2007... and its inevitable bursting.

The Fed has put itself into a tough place.

If it stops the easy money policies, a crash will likely follow. That crash could and likely would affect stocks, bonds, and housing. The alternative is to continue to print money which will cause its own set of problems down the road. As the “Zero Hedge” piece points out, should money printing continue, the next crash could threaten the very existence of fiat currencies.

We expect that the printing will continue.

We reach this conclusion for one straightforward reason – in the eyes of a central banker a crash later is better than a crash now.

As we have been discussing for a long time, owning tangible assets in a portfolio makes sense moving ahead.

For many investors, this means precious metals. While the amount of metals that is advisable to own varies according to the personal financial situation of each person, up to 20% of one’s portfolio in precious metals may make sense.

As we develop, monitor, and research investment strategies on both strategic and tactical investments, we like holding some silver as a tactical investment.

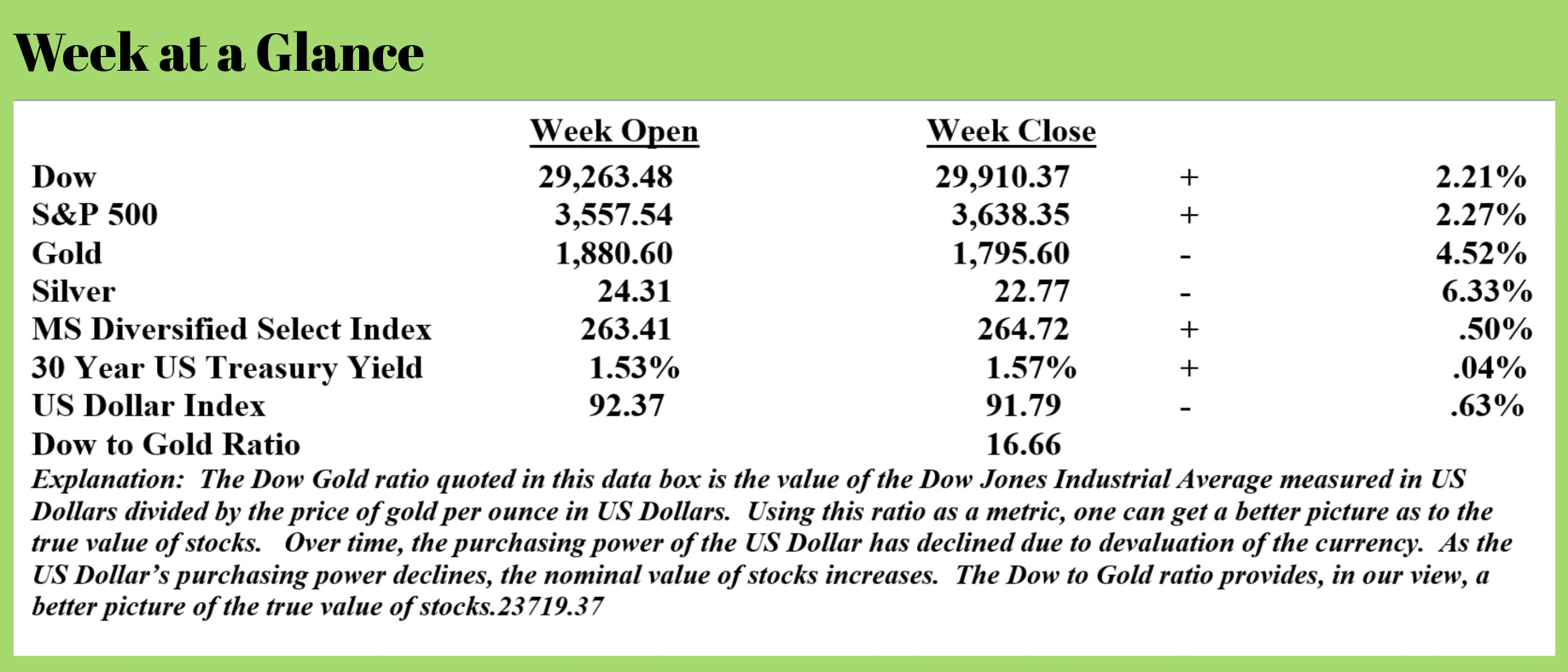

We reiterate this position from last week’s “Portfolio Watch” as silver has pulled back, even more, this week.

At this point, we view pullbacks as additional accumulation opportunities.

As noted above, this week’s radio program features an interview with Chapwood Index founder, Ed Butowski. We talk with Ed about his index and what the real inflation rate is.

The interview is now available on the podcast which you can access through the RLA app.

If you don’t yet have the RLA app, you can download it by visiting www.RetirementLifestyleAdvocates.com.

The RLA app gives you free access to all our resources.

“Always read stuff that will make you look good if you die in the middle of it.”

- P.J. O’Rourke