Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

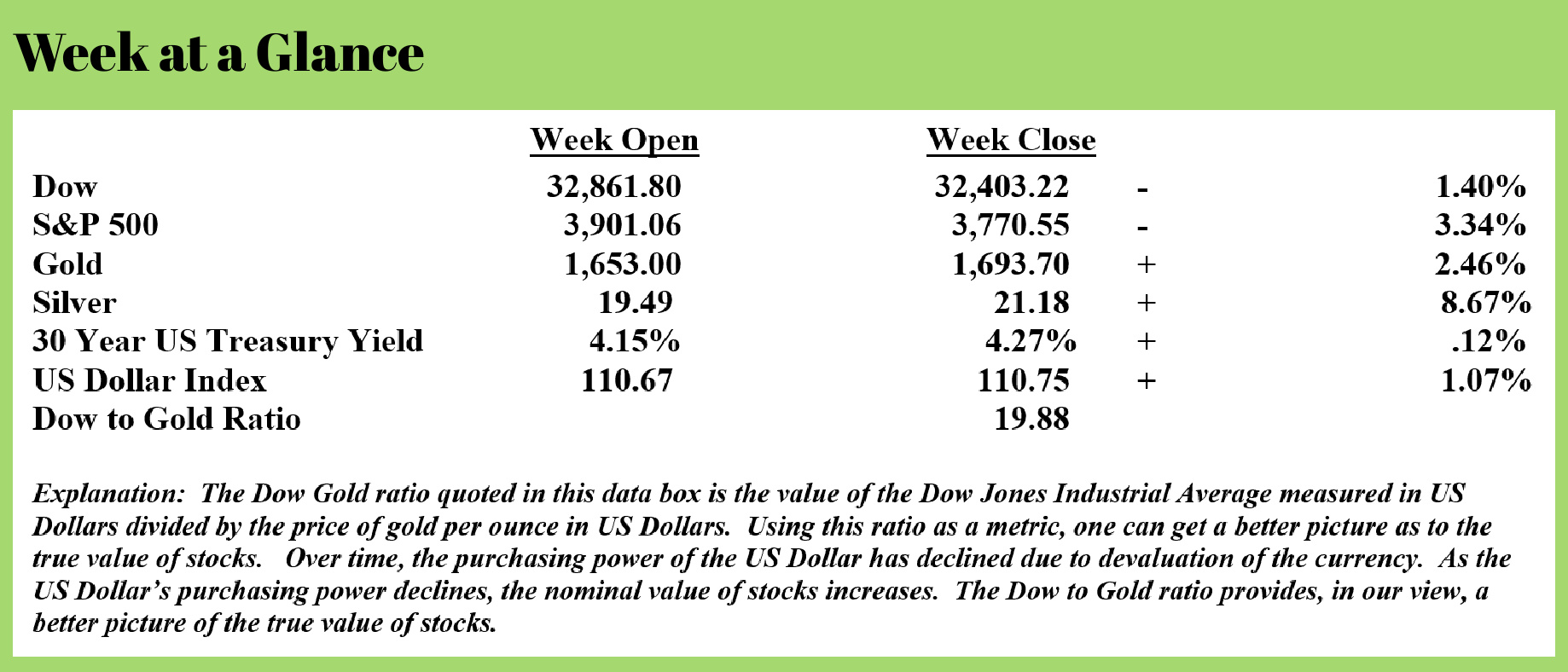

Precious metals rallied last week, notably silver which advanced 8.67%.

Over the course of this year, the disparity in pricing between the paper or “spot” price of precious metals has widened. Put another way, the “premium over spot” at which physical precious metals sell has increased in calendar year 2022.

For example, the spot price of an ounce of silver is now just over $21 after last week’s big rally. But you won’t be able to buy an ounce of physical silver at a price that is anywhere near the spot price.

While physical silver has always sold at a premium to the spot price, those premiums have now dramatically increased.

Here are some approximate examples of actual physical silver prices as of this writing (NOTE: prices can change quickly in this market and there is no guarantee that these prices are valid at the time this issue is distributed):

100-ounce silver bar $2,525 (Approximate premium to spot $4)

1-ounce silver bar $28.40 (Approximate premium to spot $7)

1-oz Maple Leaf $32 (Approximate premium to spot $11)

1-oz American Eagle $39 (Approximate premium to spot $18)

As you can see, the silver market has a spot price that is not at all representative of the physical market for silver.

This week, I thought it might be interesting to look at why this disparity exists and what has caused it to widen recently.

Silver futures contracts are traded on the COMEX, a commodity exchange. An investor can buy a silver futures contract that controls 5,000 ounces of the metal. An investor who thinks that the price of silver is going to rise, might buy a silver futures contract with a specific maturity date.

When that maturity date arrives, an investor can sell the contract for a profit or take delivery of the 5000 ounces of silver that the investor controls with the silver futures contract. Historically, investors took the profits on a profitable futures trade in cash, but more and more investors of late are taking delivery of the silver.

This developing trend is changing the dynamics of this market. The COMEX market has always been highly leveraged, with a small amount of physical silver backing the futures contracts that are traded.

Now, with the increasing number of traders who are electing to take delivery of the silver when their contracts reach the settlement date, COMEX silver inventories are running low. As of this writing, according to COMEX, there are 34 million ounces of silver in their vaults. (Source: https://www.silverdoctors.com/silver/silver-news/silver-price-to-3000-per-ounce-physical-will-be-gone-from-warehouses-in-less-than-two-months/)

That total is the lowest number of silver ounces in the COMEX vaults since June 20, 2017. Open interest is now 229% of all vaulted silver. If you are not familiar with the term open interest, it is the total outstanding contracts that have not been settled.

What this means is that if about 40% of open contracts stand for silver delivery, the vaulted silver supply will be exhausted.

This fact, coupled with the fact that the Fed now may be signaling the ‘pivot’ or policy reversal that I have been predicting, could be very bullish for silver as the year winds down and 2023 arrives.

While Fed Chair Jerome Powell’s comments after last week’s Fed meeting were solidly hawkish, there are other Fed members who are suggesting the Fed may be going too far with its rate hikes.

Fred Imbert reported on Mr. Powell’s statement after the Fed meeting last week (Source: https://www.cnbc.com/2022/11/02/real-time-updates-of-big-fed-rate-hike-and-jerome-powells-news-conference.html)

While the Fed statement gave a softer tone welcomed by the marker, Chair Powell presented a different tone in his press conference, indicating that investors are getting ahead of themselves and thoughts about a potential pause would be “very premature.”

“Chairman Powell made it clear that his bias is to err on the side of over-tightening rather than under-tightening in order to avoid the risk of inflation becoming entrenched,” said Yung-Yu Ma, chief investment strategist, BMO Wealth Management. “At the end of the day, it’s going to come down to inflation and labor market data in the coming months and quarters. The Fed’s outlook may be less one-sided, but reaffirming its bias to fight hard against inflation – and the 2% inflation target – is likely to remain a market headwind until inflation conditions improve.”

The reality is that Mr. Powell is talking tough, but other Fed members are not. Reuters (Source: https://www.reuters.com/markets/us/st-louis-fed-says-will-think-differently-about-involvement-private-events-2022-10-20/) reported that San Francisco Federal Reserve Bank President, Mary Daly, may be having second thoughts about the Fed’s currently tough monetary policy:

The U.S. central bank should avoid putting the economy into an "unforced downturn" by raising interest rates too sharply, and it's time to start talking about slowing the pace of the hikes in borrowing costs, San Francisco Federal Reserve President Mary Daly said on Friday.

The Fed is widely expected to raise its benchmark overnight interest rate by three-quarters of a percentage point for a fourth consecutive time at a Nov. 1-2 policy meeting, as the central bank battles the highest inflation in 40 years.

The aggressive policy tightening has lifted that rate from the near-zero level in March to the current 3.00%-3.25% range.

"We might find ourselves, and the markets have certainly priced this in, with another 75-basis-point increase," Daly said at a meeting of the University of California, Berkeley's Fisher Center for Real Estate & Urban Economics' Policy Advisory Board in Monterey, California. "But I would really recommend people don't take that away and think, well it's 75 forever."

Fed projections released last month show most of its policymakers believe the federal funds rate will need to rise to between 4.5% and 5% next year to start bringing inflation down toward the central bank's 2% goal. Those projections are still "reasonable," Daly said, adding that she's pinned them to her wall to remind herself of where the rate will end up.

"I hear a lot of concern right now that we are just going to go for broke. But that's actually not how we, I think about policy at all," Daly said.

With rates near the neutral level, where economic activity is neither constrained nor stimulated, Daly said the Fed is moving to a second phase in policy tightening that should be "thoughtful" and "incredibly data-dependent."

These statements by Ms. Daly may indicate a softening of monetary policy moving ahead into next year.

While the article states that many Fed policymakers believe that the Fed Funds rate will need to rise to between 4.5% and 5% to get inflation under control, I don’t think that interest rates at that level will get inflation under control. As I have stated many times, I believe it will take real positive interest rates to get inflation under control meaning interest rates will have to be higher than the real inflation rate.

5% is a way from that target.

At a future point (probably soon), there will be enough political pressure on the Fed to cause the Fed to reverse course on monetary policy. That, coupled with the COMEX market conditions discussed above may be enough to catapult silver and gold much higher.

In the interim, Fed policy is hurting the economy, long been reliant on stimulus to function.

And, as the economy weakens, inflation continues to take its toll on mower income and middle-class Americans. The Nationwide Retirement Institute® recently conducted a survey (Source: https://news.nationwide.com/101722-americans-making-tradeoffs-to-pay-health-care-costs/) that found economic conditions are forcing many American households to make difficult decisions.

The survey found that over the past 12 months, two in five American households received goods or food from a food bank and 17% of Americans stopped buying healthier organic foods due to the higher prices.

One in five Americans surveyed stated that they had skipped meals or didn’t buy groceries due to high inflation. 14% of Americans have put off seeing a healthcare specialist, 10% have skipped taking prescribed medication and 11% have procrastinated on their annual physicals. 20% of Americans have cancelled or postponed plans to see a mental health professional.

The radio program and podcast this week features an interview with John Rubino, founder of dollaarcollapse.com. I talk to John about fed policy now and moving ahead as well as the two options the Fed has and the end game for each option.

John always has terrific perspective and insight and this interview is no exception. You can listen to the show now by clicking on the "Podcast" tab above.

As I noted last week, I once had the pleasure of meeting Pat Paulsen, the comedian who ran a satirical campaign for President each presidential election cycle from 1968 to 1996.

“All the problems we face in the United States today can be traced to the unenlightened immigration policy on the part of the American Indian.”

“No taxes. Let’s just tip the government 15% if they do a good job.”

-Pat Paulsen

Comments