Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

In my books, “New Retirement Rules” and “Revenue Sourcing,” I forecast an environment of inflation followed by deflation. The first version of the “New Retirement Rules” book was written nine years ago.

I made this forecast not because I am a trained economist with unique insights into our economic future but rather by applying some common sense to the state of world finance at the time.

While the timing of this inflation followed by deflation cycle is difficult, even impossible to predict; the outcome is, in my view, inevitable.

I say this for two reasons.

One, common sense dictates that if there is too much debt to be paid, it won’t all be paid. This was the case 9 years ago and remains the case today. In the years that have elapsed since I made that forecast, both private sector debt and the debt of the federal government have continued to rocket higher.

Cutting through the news clutter that includes pontifications of a soft economic landing and declarations of a resilient American consumer, the fact remains that debt accumulation has a limit. So does currency creation from thin air, a.k.a. ‘quantitative easing.’

In the words of the late economist Herbert Stein, ‘if something cannot go on forever, it will stop.’

How’s that for a little common sense?

Ironically, recent inflation has driven up private sector debt levels as many consumers, struggling to make ends meet, have relied on credit cards to purchase essentials.

Now, however, there are growing signs that the consumer is reaching the end of the proverbial rope.

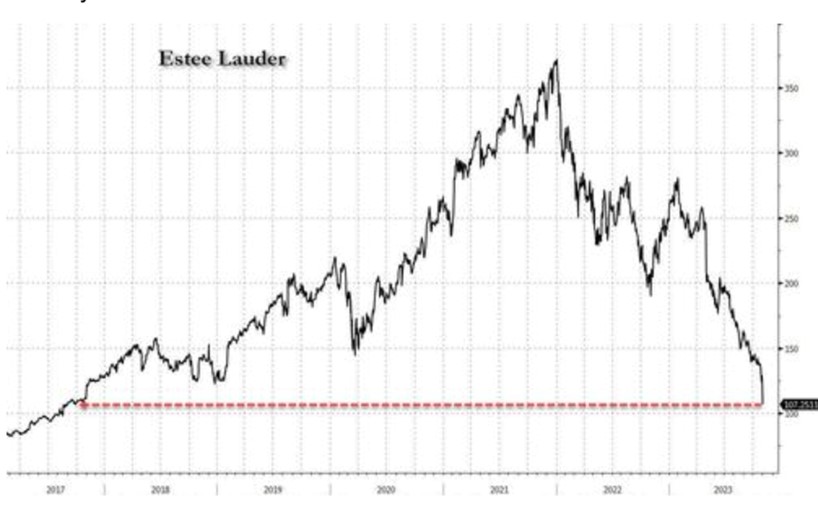

Estee Lauder, the beauty products company, has seen its stock plummet in 2023, losing half its value this year alone.

Estee Lauder, the beauty products company, has seen its stock plummet in 2023, losing half its value this year alone.

The chart on this page (from “Zero Hedge”) illustrates the performance of Estee Lauder stock.

The company expects sales to fall by about 11% in the current quarter as compared to the same quarter one year ago.

The CEO of Target, Brian Cornell, recently noted that the retailer’s customers are also cutting back. MSN reported on Cornell’s comments (Source: https://www.msn.com/en-us/money/companies/target-ceo-on-consumer-spending-theyre-buying-less-stuff/ar-AA1jlAUk):

Target CEO Brian Cornell weighed in Thursday on spending behavior that the retailer has observed among its customers, saying they have been "buying less stuff."

"They’re managing that budget really carefully, and it’s certainly pressuring discretionary spending. They’re buying less stuff, even within food and beverage," Cornell, who has led the Minnesota-based retailer since 2014, said during a CNBC interview.

He added that when looking at retail spending, one can "just look at the top line and say a really healthy consumer, and they are spending."

Retail sales unexpectedly rose 0.7% in September, according to the latest data from the U.S. Department of Commerce.

Nonetheless, shoppers have been "tightening up" how much they’re buying units-wise for food and beverages in recent quarters.

Cornell added that Target has "seen seven consecutive quarters of both dollars and units declining" in discretionary categories, noting people are buying less clothing, home goods, and toys.

As past RLA radio guests, Mr. Peter Schiff, recently commented, retail sales numbers increasing doesn’t mean that consumers are buying more; it means that they are spending more for the items that they HAVE to buy.

As many American consumers are struggling to meet living expenses, the debt of the US Government is growing faster than has ever been seen historically.

The Federal Reserve, the central bank of the United States, has been increasing interest rates ostensibly to get inflation under control. As interest rates have risen, bank assets have declined in value.

Let me give you an example using long-term US Treasuries as an example. A bank holding long-term US Treasuries for the past 3 ½ years would have seen those assets lose about 50% in value.

Let me give you an example using long-term US Treasuries as an example. A bank holding long-term US Treasuries for the past 3 ½ years would have seen those assets lose about 50% in value.

Think about that for a moment. A ‘safe’ investment in long-term US Treasuries would have seen a decline in value of half, as the chart of an exchange-traded fund that tracks the price action of a long-term US Treasury shows.

The blue trendline drawn from the top, middle of the chart toward the bottom right of the chart begins when US Treasuries peaked at the end of March 2020. Since that time, peak to trough, US Treasuries have fallen 54%!

Since many banks have US Treasuries as assets, this makes many banks financially stressed and others fundamentally insolvent.

In my view, this will have to lead to more currency creation as central bankers try to keep the deflationary debt collapse at bay.

That will, in turn, feed inflation, and the cycle will continue until it can’t continue.

The country of Japan may be telling us where we are ultimately headed with these disastrous policies.

The Japanese central bank was intervening in the bond market whenever interest rates exceeded 1%.

Plainly stated, if interest rates went over 1%, the central bank would create currency and buy bonds to drive the yield back down.

It seemed to work for a while anyway.

Now, however, this loose money policy is catching up with the Yen as a currency.

This from “Market Watch” (Source: https://www.marketwatch.com/story/the-yen-tumbles-toward-33-year-low-is-it-the-bank-of-japans-fault-e139511e):

The Japanese currency fell sharply Tuesday, on track for its weakest close versus the U.S. dollar in 33 years, after the Bank of Japan took another baby step toward abandoning its controversial policy of yield-curve control.

The BOJ, at its policy meeting, effectively loosened its cap on long-term bond yields, saying that its previous 1% limit on the 10-year Japanese government bond would now serve as a “reference point.”

In an effort to prop up the currency, the Japanese central bank is now easing up on its prior policy.

It will be too little too late.

If you have not yet put a plan in place to help protect you from the coming inflation followed by deflation cycle, time may be running short to do so.

The radio program this week features an interview that I conducted with renowned cycles analyst, Dr. Charles Nenner.

I chat with Dr. Nenner about how be developed cycles analysis and what he sees moving ahead for inflation, stock markets, bond markets, and precious metals.

It’s an information-packed program that you can listen to now by clicking the "Podcast" tab at the top of this page, or you can find it on most podcast sources.

“99% of failures come from people who make excuses.”

-George Washington

Comments